Valaris: Waiting For A Rebirth

Total revenues decreased to $285.3 million in Q3 from $551.3 million in the year-ago quarter and are down 26.6% sequentially.

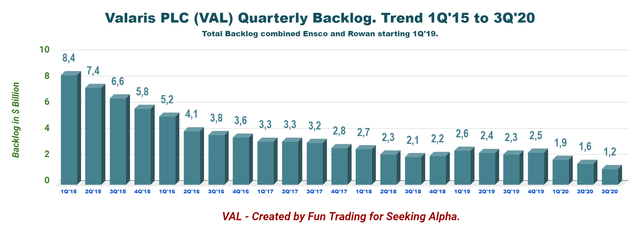

The backlog indicated by the company for 3Q'20 is now $1.2 billion. Another historical low.

It will be some time when a more balanced environment will favor the offshore drilling industry again.

Source: Shipspotting Picture: Drillship DS-16 (Rowan Resolute)

Investment Thesis

Valaris Plc (OTCPK:VALPQ) and certain of its direct and indirect subsidiaries filed on August 19, 2020, voluntary petitions for reorganization under Chapter 11 of the United States Bankruptcy Code in the Bankruptcy Court for the Southern District of Texas. The company reached an agreement with about 50% of its noteholders.

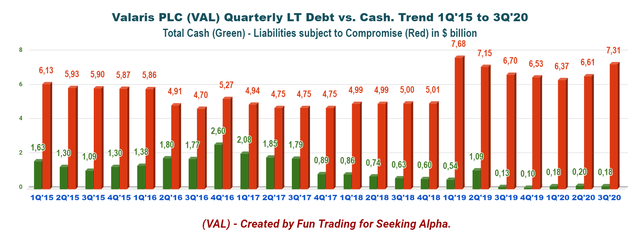

The company intends to use a DIP financing of $500 million during the restructuring period until and agreement is finalized. The debt will be exchanged for shares in a new company ("newco"), replacing the old stocks that will be canceled. The actual cash on hand was $180.4 million as of Sept. 30, 2020.

On September 25, 2020, following approval by the Bankruptcy Court, the Debtors entered into the DIP Credit Agreement, by and among the Company, as Lead Borrower, and certain wholly owned subsidiaries of the Company, as borrowers, the lenders party thereto and Wilmington Savings Fund Society, FSB, as administrative agent and security trustee, in an aggregate amount not to exceed $500.0 million (10Q)

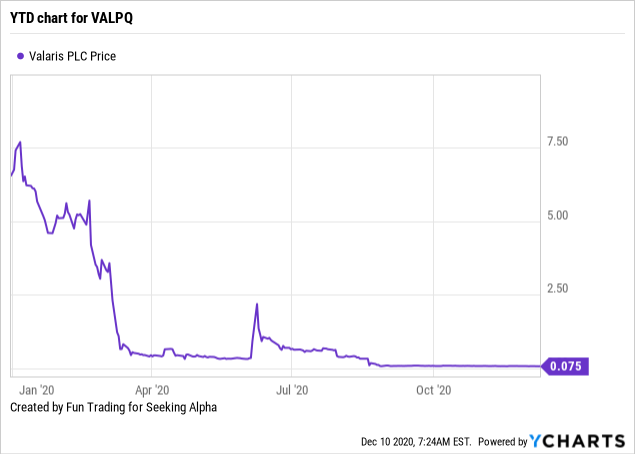

Data by YCharts

Data by YChartsThe stock is trading around $0.075 and has flat-lined based on a minimal recovery for the common shareholders. Technical analysis will not be necessary here.

The company indicated that old shareholders would get up to 0.01% of new equity and out-of-the-money warrants, which will have significance if senior noteholders get a 100% recovery. In my opinion, we can assume that the warrants offered will be worthless, judging by experience.

The investment thesis is non-existent at this stage. I think it's time to sell out and move on for the ones who are still holding the stocks, as I have suggested in my preceding articles.

However, I recommend reading this article to follow the company through those tough times and eventually invest in the new company that will emerge next year, with a better financial profile. Hopefully, the oil sector restarts a slow recovery expected in H2 2020. Furthermore, the new company will strip its rig fleet of its obsolete or redundant parts, reducing capex and increasing profitability.

Valaris PLC - 3Q'20 and Balance Sheet History: The Raw Numbers

| Valaris | 3Q'19 | 4Q'19 | 1Q'20 | 2Q'20 | 3Q'20 |

| Total Revenues in $ Million | 551.3 | 512.1 | 456.6 | 388.8 | 285.3 |

| Net Income in $ Million | -197.1 | -215.4 | -3,006.3 | -1,107.4 | -670 |

| EBITDA $ Million | 80.1 | 129.0 | -2,879.2 | -867.5 | -465.7 |

| EPS diluted in $/share | -1.00 | -1.09 | -15.19 | -5.58 | -3.36 |

| Cash from Operating Activities in $ Million | -134.1 | 150.6 | -204.4 | -176.7 | -15.3 |

| Capital Expenditures in $ Million | 39.4 | 52.8 | 36.3 | 30.8 | 15.8 |

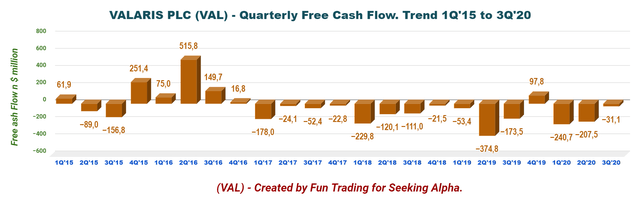

| Free Cash Flow in $ Million | -173.5 | 97.8 | -240.7 | -207.5 | -31.1 |

| Cash and Short-Term Investments $ million | 129.5 | 97.2 | 184.9 | 202.0 | 180.4 |

| Liabilities subject to compromise in $ billion | 6.17 | 6.53 | 6.37 | 6.61 | 0 |

| Shares outstanding diluted in million | 197.6 | 198.0 | 197.9 | 198.6 | 199.4 |

Note: Most of the data indicated above come from the company 10-Q filing

Trends, Charts, and Commentary: Revenues, Free Cash Flow, and Upstream Production

Note: The charts have been created by Fun Trading using the 10-Q filing and my files. More data are available to subscribers only.

1 - Quarterly Revenues of $285.3 million in 3Q'20

Total revenues decreased to $285.3 million in Q3 from $551.3 million in the year-ago quarter and are down 26.6% sequentially.

Revenue details for 3Q'20 are indicated below:

| Floaters | Jack-ups | Aro Drilling | Others | Reconciling Items | Total |

| 57.1 million | 186.8 million | 145.6 million | 41.4 million | -145.6 million | 285.3 million |

VALPQ reported a loss of $3.36 per share for the third quarter of 2020 (or a loss of $670.9 million) compared with a loss of $1.00 per share a year ago.

2 - Free Cash Flow is a loss of $31.1 million in 3Q'20

Capex has been reduced by half this quarter, which helped. However, cash from operations was negative again this quarter.

3 - Fleet status and Backlog

The backlog indicated by the company for 3Q'20 is now $1.2 billion. Another historical low, as shown in the graph below.

| Segment | Floaters | Jack-ups | Others |

| Amount in $ | 222.6 | 841.5 | 136.0 |

| Average day rate in $ | 148,968 | 88,554 | 37,017 |

| The fleet composition as of September 30, 2020. | Rigs |

| Floaters | 16 |

| Jack-ups | 36 |

| Others | 9 |

| Rigs Under Construction | 2 |

| Rigs Held for sale | 3 |

| ARO Drilling | 7 |

| TOTAL | 73 |

From Fun Trading files and 10Q.

On October 29, 2020, 10-Q filing, the company indicates:

Our backlog was $1.2 billion and $2.5 billion as of September 30, 2020 and December 31, 2019, respectively. This is inclusive of backlog from our rigs leased to ARO and managed rigs of $178.7 million and $324.3 million as of September 30, 2020 and December 31, 2019, respectively. The decrease in our backlog was due to customer contract cancellations, customer concessions and revenues realized, partially offset by the addition of backlog from new contract awards and contract extensions.

For full details, see 10-Q page 68-69. However, the company said in the 10Q:

We began marketing VALARIS 84, VALARIS 88 and VALARIS 8504 in the third quarter of 2020 and classified the rigs as held-for-sale on our September 30, 2020 condensed consolidated balance sheet. These rigs, with the exception of VALARIS 8504, were subsequently sold in October 2020.

4 - Liabilities subject to compromise and Cash on hand.

As of Sept. 30, 2020, Valaris had $581.0 million of borrowings outstanding under our revolving credit facility and $41.2 million of undrawn letters of credit.

Conclusion

The offshore drilling industry has been brought to its knees, and the only one still barely standing is Transocean (NYSE:RIG), but for how long?

It's a struggling industry that needs a profound restructuring to adapt to a new leaner paradigm or die.

The path to recovery is a long and narrow one that will probably take several years by looking at the actual dismal demand for oil vs. the vast oil supply potential.

The IEA said in November 2020 that oil demand would not recover until well into 2021.

The IEA cut its forecast for oil demand growth by 400K barrels a day to show a decline of 8.8 million barrels per day in 2020 and said:

It is far too early to know how and when vaccines will allow normal life to resume. For now, our forecasts do not anticipate a significant impact in the first half of 2021.

The IEA predicts a recovery in oil demand next year of 5.8 million barrels per day, but this is only 300,000 barrels per day higher than its forecast a month ago, even with drugmaker Pfizer's promising COVID-19 vaccine trial results.

The day rates are below what can be considered sufficient, with about $250K per day expected by Valaris in 2025. Oil operators are still cutting exploration capex to be able to pay for an overblown dividend.

However, it will be a time when a more balanced environment will favor the offshore drilling industry again, but it will take a long time.

Author's note: If you find value in this article and would like to encourage such continued efforts, please click the "Like" button below as a vote of support. Thanks!

Join my "Gold and Oil Corner" today, and discuss ideas and strategies freely in my private chat room. Click here to subscribe now.

You will have access to 57+ stocks at your fingertips with my exclusive Fun Trading's stock tracker. Do not be alone and enjoy an honest exchange with a veteran trader with more than thirty years of experience.

"It's not only moving that creates new starting points. Sometimes all it takes is a subtle shift in perspective," Kristin Armstrong.

Fun Trading has been writing since 2014, and you will have total access to his 1,988 articles and counting.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.