Osmotica: In Active Transition

Osmotica's traditional business is facing challenges.

Its UPNEEQ launch is enjoying a propitious start.

Arbaclofen's new target review date following its CRL is 12/29/20.

Osmotica is exploring all options for enhancing shareholder value, triggering Irish Takeover Rule 2.4 announcement.

I encountered Osmotica Pharmaceuticals (OSMT) on the Schwab Small Cap Growth List (as of 12/4/2020). It being the sole entrant on the list (Schwab account required for access) within my sphere of article writing interest, I decided to check it out.

I see a company just having launched a new branded product, with a pending FDA approval for a second. I can see that Osmotica indeed has a heady potential for growth, however, such growth is highly conditional. I have taken a small stake in the company for my speculative biotech portfolio.

This article focuses primarily on commercial prospects for Osmotica's two new branded therapies, one of which is still pending FDA approval. Based on my initial evaluation, I am guardedly optimistic, as I will explain. Nonetheless, I am rating the stock as Neutral until its situation clarifies.

Osmotica has a broad portfolio of therapies which are showing declining sales

Osmotica launched its IPO in 2018. In the second amendment to its registration statement (p. 1), the company characterized its core competencies as spanning:

... drug development, manufacturing and commercialization. Our specialized neurology and women's health sales teams support the ongoing commercialization of our existing promoted product portfolio as well as the launch of new products. As of June 30, 2018, we actively promoted five products: M-72 (methylphenidate hydrochloride extended-release tablets, 72 mg), Lorzone (chlorzoxazone scored tablets) and ConZip (tramadol hydrochloride extended-release capsules) in specialty neurology; and OB Complete, our family of prescription prenatal dietary supplements, and Divigel (estradiol gel, 0.1%) in women's health. We most recently launched M-72 in the second quarter of 2018, and we expect to launch Osmolex ER (amantadine extended-release tablets), which was approved by the FDA on February 16, 2018, in the second half of 2018.

It also described its portfolio of ~35 non-promoted products which provide it a cash flow to support its R&D and business development activities. It noted that several of these products enjoyed IP protection; some involved formulation and production complexities and data exclusivity protections. Further, several were manufactured in its Marietta, Georgia facility and incorporated its proprietary Osmodex drug delivery system.

Fast forward to the company's Q3 2020 earnings call. The bloom is off the rose in terms of its legacy operations. During the call, CFO Einhorn mentions Q3 2020 impairment charges of $19.5 million following its Q3 2019 impairment charges of $128.1 million.

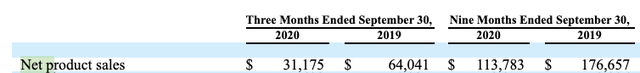

Of more concern, net sales are trending in the wrong direction. The net product sales from Osmotica's registration statement (p. 76) showed:

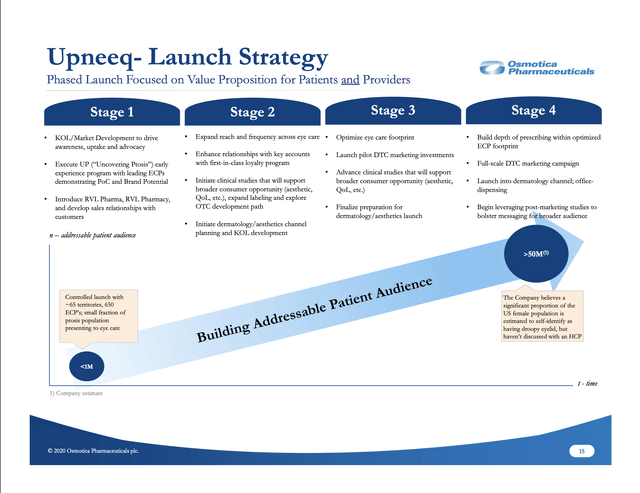

Rather than growing, net product sales reported in the call were declining as follows:

Net product sales decreased by $32.8 million to $31.2 million for the three months ended September 30, 2020 as compared to $64 million for the three months ended September 30, 2019. This decrease reflects continued price and volume erosion on our existing product portfolio stemming from additional generic competition.

As shown by the following net product sales line from its Q3 2020 10-Q (p. 6) below, this was not simply a single quarter's blip:

The following table from Osmotica's Q3 2020 10-Q (p. 12) shows a more granular view of the degradation of revenues that the company is enduring:

Now one might dismiss the situation as just another COVID-19 disruption. That would be a misreading. Osmotica's 10-Q (p. 24) likely provides a more reliable explanation as follows:

... The entrance into the market of additional competition can have a negative impact on the pricing and volume of the affected products which are outside the company’s control. In particular, methylphenidate ER tablets, venlafaxine ER tablets, or VERT, and Lorzone have experienced, and are expected to continue to experience, significant pricing and market erosion due to additional competition from other generic pharmaceutical companies. This generic pricing erosion has resulted in, and is expected to continue to result in, lower net sales, revenue and profitability from methylphenidate ER tablets, VERT and Lorzone for the remainder of 2020, and this erosion is expected to continue in subsequent years.

Accordingly, Osmotica's forward investment merit depends on its new branded initiatives, the recently approved UPNEEQ and arbaclofen extended-release (ER) tablets, which is in the on-deck circle, with an FDA action date of 12/29/20.

UPNEEQ's launch is in its early stages; so far it is showing positive promise

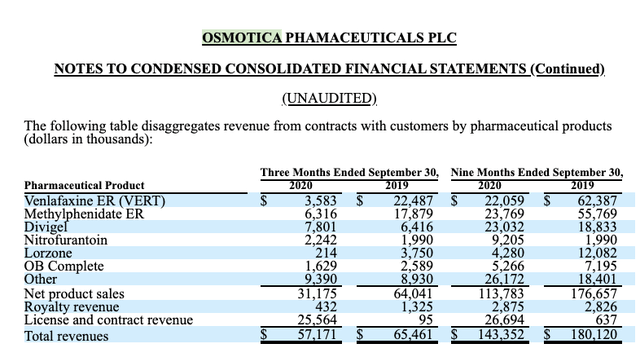

Osmotica announced FDA approval of UPNEEQ (oxymetazoline hydrochloride ophthalmic solution) in treatment of blepharoptosis (ptosis) on 07/09/20. The company described ptosis as a condition characterized by the abnormal drooping of the upper eyelid which can limit field of vision. It noted that UPNEEQ is the only FDA therapy approved for treatment of this condition.

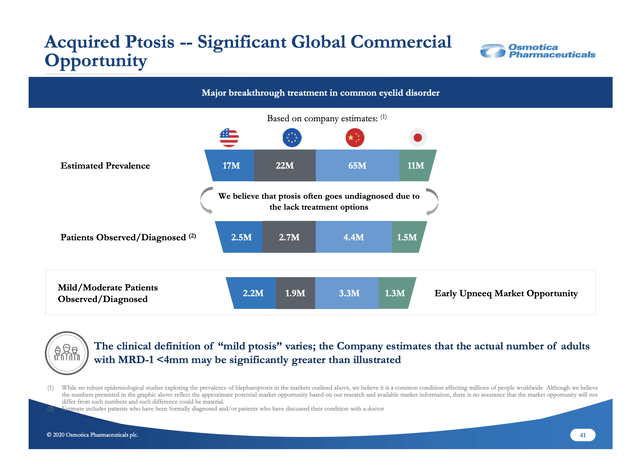

For those unfamiliar with ptosis, Osmotica's 11/2020 slide deck includes a helpful section of eight slides, Nos. 10-17, plus slide 41 in the appendix describing various aspects of this condition and the company's launch strategy. It characterizes the condition as one at the intersection of medicine and aesthetics.

The slide below gives an idea of the challenges and opportunities presented by UPNEEQ:

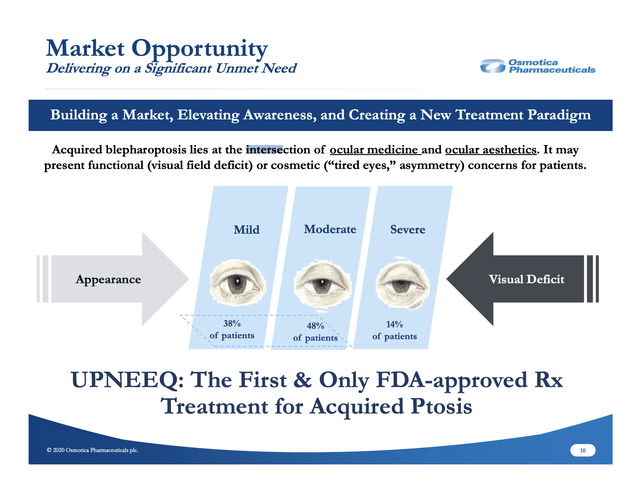

As I write, I am realizing for the first time in my life that I have severe ptosis. I can appreciate that there is likely a market here, but not one that will be easy to harvest. Osmotica's launch strategy as shown on its slide below reflects an ambitious goal:

It will be fascinating over the next few years to watch quarter by quarter as it works to build its volume. The company's initial report, as illustrated by its Q3 2020 earnings call, shows the careful attention it is giving to its strategy.

FDA approval for UPNEEQ came in 07/2020 as noted; Stage 1 of its launch began after Labor Day in accordance with its prescribed plan, as shown on the slide above. The initial reaction was reported to have exceeded expectations. CEO Markison reported that physicians had already begun writing prescriptions, with some actually trying the product on themselves.

A question from RBC Capital Markets analyst Stanicky provided interesting color on initial UPNEEQ customers. They tend to be the more severely ptotic as opposed to those less burdened by the condition. Demographically, patients have a median age of 65.

One thing for investors to remember is that outstanding percentage growth comes easy in the early stages of a launch. This phenomenon is revealed in miniature in the following from COO Schaub during Osmotica's Q3 2020 call:

... I don’t think the visibility and anchoring to things which are really just data points and not really trends at this point. But through September, and we launched right around Labor Day, coming out of the Labor Day holiday, we had about 345 practices that had also prescribed Upneeq. By the end of October, that number had grown to over 1,000. And I think similarly, overall prescriptions during those same two time periods submitted went from 637 to over 2,400. So but 4x growth in prescription volume over that 4-week period, what amounts to about 8 weeks in the launch. So obviously, some really encouraging trends or data early on. ...

Slide 41 from the slide deck appendix sets out the global ptosis treatment opportunity below:

After I wrote the foregoing, I checked out Osmotica's presentation during the virtual Jefferies London Healthcare Conference. CEO Markison spent the bulk of his time during this presentation enthusing about UPNEEQ and its market potential.

He noted that UPNEEQ's combination of therapeutic impact and tolerability make it an easy sale. Nonetheless, structuring the most commercially effective launch into the diffuse and entrepreneurial eye-care market is challenging for a small company with limited resources. It will take time to realize its full potential.

The upcoming FDA action date on arbaclofen ER offers the prospect of another branded product launch to start Osmotica's new year

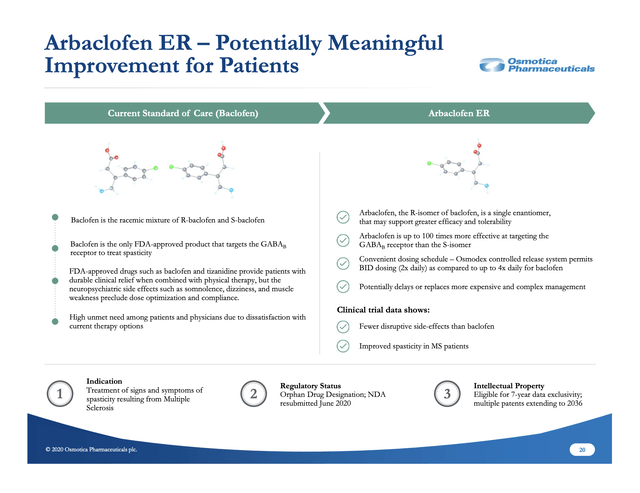

UPNEEQ is an entirely different animal from Osmotica's next potential new branded therapy, arbaclofen ER. UPNEEQ is the first treatment approved for a ptosis, a condition that is not widely recognized. Arbaclofen ER is a cousin of baclofen.

Baclofen is a widely prescribed therapy. Baclofen's label's primary use is for multiple sclerosis spasticity. It also serves as a general purpose muscle relaxer. I can vouch from personal experience for its role as an insurance company substitute for more expensive muscle relaxers.

Osmotica's arbaclofen ER is being submitted to the FDA as a superior treatment for multiple sclerosis spasticity. Back in 2015, Osmotica's corporate predecessor submitted (p. 9) an NDA for arbaclofen. Because of irregularities at clinical trial sites in Russia and Ukraine, the FDA issued a CRL. Osmotica elected to run new phase 3 trials.

The company reported mixed results from this trial in 2019 with its Q4 2018 financial report as follows:

“We completed our second Phase III clinical trial of arbaclofen ER for the treatment of spasticity in Multiple Sclerosis (MS) patients and are reporting preliminary topline results. Arbaclofen did not demonstrate superiority to placebo as measured by the CGIC (Clinical Global Impression of Change); however, a statistically significant improvement in spasticity relative to placebo was demonstrated for the TNmAS (the Total Numeric modified Ashworth Scale) for both 40mg and 80mg doses of arbaclofen. While the results of the study are mixed, we believe that the efficacy signal for the treatment of spasticity identified by the TNmAS endpoint is a positive result and the profile of arbaclofen could offer a meaningful benefit to patients who suffer from spasticity. Based on what we have seen thus far, we intend to continue toward submission of an NDA, although our timeline may now extend past 2019,” added Markison.

In fact, as we now know, the timeline has extended past 2019 to the end of 2020. As I write on 12/7/2020, Osmotica is expecting a decision in a matter of weeks, by 12/29/2020. If such decision is positive, the company will have a second launch on which to work. Will such a launch be successful? That depends on whether Osmotica can differentiate arbaclofen in treatment of MS spasticity from regular baclofen.

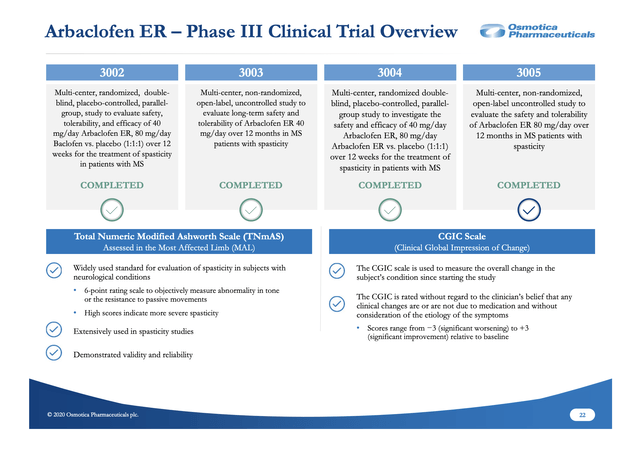

In terms of a treatment for MS spasticity, there are two potentially differentiating issues between baclofen and arbaclofen ER: (i) efficacy and (ii) safety and tolerability. Arbaclofen ER has a suite of phase 3 trials generally supporting its superiority to baclofen in both respects. These trials are listed in Osmotica's slide 22 from its 11/2020 slide deck below:

Studies 3002 (NCT01743651) and 3003 (NCT01844232) were earlier trials including sites in Russia and Ukraine. Studies 3004 (NCT03290131) and 3005 (NCT03319732) were studies started in 2017. ClinicalTrials.gov shows study 3004 was completed in 2019, while study 3005 has an estimated completion date in 2020.

Whether arbaclofen ER gets an approval or not is uncertain. Osmotica makes its best case for approval in terms of both measures (i) and (ii) above on its slide 20 below:

Given the seriousness of MS spasticity and arbaclofen's general advantages in terms of safety and tolerability, I would expect the FDA to approve arbaclofen ER. In this regard, I am more optimistic than Osmotica's management.

In response to a Q3 2020 earnings call question, CEO Markison was careful to dial back expectations; he noted that the FDA was giving it a rigorous review and was guarded as to its prospects. During a subsequent investors' conference, he suggested investors treat it as a 50:50 proposition. (25:17/31:44)

In any case, I can be optimistic because my optimism has little, if any, impact on Osmotica's stock price. So I will go forward expecting an FDA approval. If I am correct, the company's next battle will be with payers. This could be a real donnybrook. Existing MS antispasmodics such as tizandine and baclofen are quite inexpensive.

Osmotica has yet to share its arbaclofen pricing strategy. As shown on slide 19 below, spasticity can be a serious contributor to MS disability, impacting ~84% of MS patients. It causes muscles to contract and tighten, interfering with movement during the day, worsening at night and interfering with sleep:

I will not hazard a guess as to how a more effective therapy for this condition will be priced. If approved and effectively marketed, it will be a substantial contributor to the company's market value.

Osmotica is ready for a deal; how that will play out for shareholders is a conundrum

Osmotica added an impactful extra to its Q3 2020 earnings report press release as follows:

Irish Takeover Rule 2.4 Announcement of Strategic Review, including sale process

The Board of the Company today announces that it is undertaking a comprehensive review of strategic options to maximize shareholder value. The options under consideration include asset disposals, re-financings, commercialization or collaboration agreements. The review will also include the initiation of a process for the sale of the Company, which will commence shortly.

This is the sort of announcement which suggests that big doings are afoot. What this actually portends for shareholders in this case is unclear. During the Q3 2020 earnings call, CEO Markison addressed this on several occasions.

After having listened to his discussion during the final few minutes of the Jefferies conference and rereading his earnings call discussions of it, I think the CEO's discussion below best summarizes the intent:

... what really sparked all of this is we’ve seen through a fairly short time with Upneeq on the market that we believe this drug is a winner. And as you know, we’re a fairly diversified company right now. And we really want to focus on, as I’ve said earlier, clearing the runway for investing in Upneeq and growing that brand, which we think has huge upside for us and shareholders. And then should arbaclofen get approved as well by the end of the year, we’re very bullish on that product. And we just want to make sure that we’re letting folks know that we are willing to consider a lot of options in our portfolio in order to drive the best outcome for Upneeq and arbaclofen.

Conclusion

As noted in the title to this article, Osmotica is a company in transition. As such, its potential range of values is huge. As I write mid-morning on 12/8/20, its market cap is a tiny $0.367 billion.

I would urge that this disregards not just the company's UPNEEQ potential but also its arbaclofen ER possibilities. Accordingly, Osmotica appears to be an attractive investment for those who are sanguine about its UPNEEQ potential and its arbaclofen ER approval.

Yet, it would be foolish to disregard its risks. There are few tasks in business more challenging and expensive than commercializing an FDA-approved therapy that has not proven its commercial viability. I have inveighed against disregarding the hazards of such danger zone stocks in numerous articles.

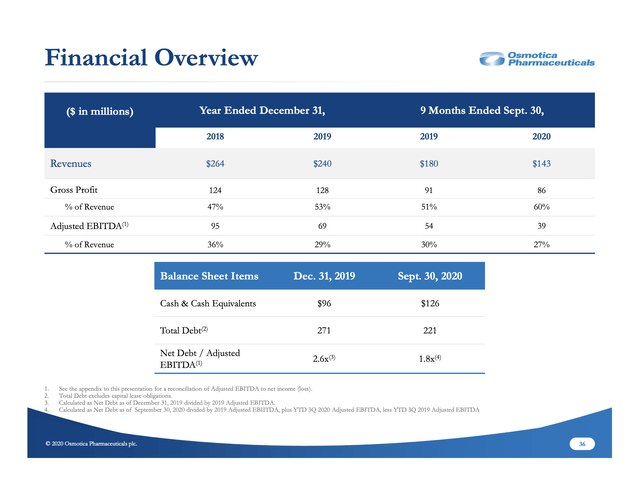

To this point, I have not discussed details on Osmotica's finances beyond the introductory section pointing to deterioration of its legacy business. Before I close, I will briefly touch on its financial overview slide below:

Osmotica's debt picture is not helpful for a company that is in the midst of a new product launch and on the brink of a second. Investors should expect an active transition for the company over the next several months with one or more of the following either baked in or likely:

- FDA decision on arbaclofen ER (baked in);

- Sale of some portion of its legacy business (likely);

- Secondary stock offering (likely).

Disclosure: I am/we are long OSMT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I may buy or sell shares in Osmotica over the next 72 hours.