22nd Century Looks Set To Finally Cash In

There are reasons to believe that the company will receive MRTP status, which enables the company to be the only company to sell and market VLN cigarettes.

While investors have already piled in, MRTP status is a company-changing event, and the odds look pretty good.

There is also slow progress in other fields, but it's all about achieving MRTP at the moment.

22nd Century (NYSEMKT:XXII) is a company that has proprietary technology to grow tobacco with basically any level of nicotine they choose. They actually produce some cigarettes (called Moonlight) with 95% less nicotine, but they can't market them without regulatory approval.

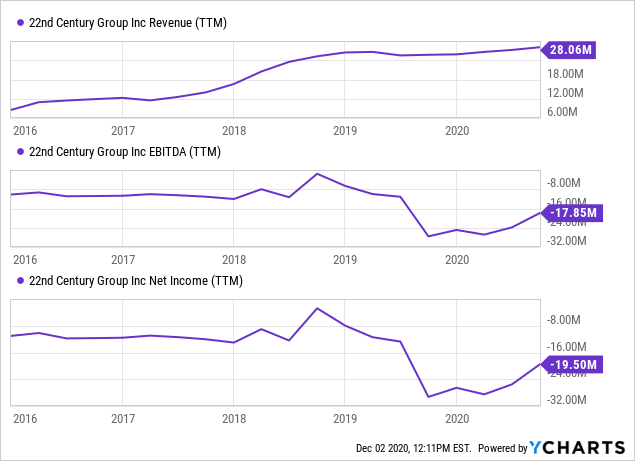

We have covered this company in the past but lost sight of it a bit because of the lack of regulatory progress which they need to be able to market their stuff. That now seems set to change. At first sight, this isn't an attractive picture:

But there are several things one should realize:

- The revenue, which is actually rising at a pretty decent rate, comes from contract manufacturing, and this isn't supposed to be their core business.

- The operational deterioration (although improving in the last two quarters) is the result of the cost of its other two businesses.

Regulatory hurdles

The company has acquired numerous IP on the tobacco plant which enables them to produce cigarettes at basically any level of nicotine. Commercially interesting are the VLN, or very low nicotine level cigarettes, containing non-addictive levels of nicotine. From the earnings deck,

The company's fortunes depend critically on two regulatory interventions:

- The company receiving MRTP (Modified Risk Tobacco Product) status for their VLN (very low nicotine) cigarettes.

- The FDA to regulate nicotine levels for all tobacco products.

In short, if the company should attain MRTP status, they will be able to market their cigarettes as low (or very low) nicotine cigarettes, so low that they cease to be addictive, and there is evidence that these can also help existing smokers to quit the habit (alone or in combination with other therapies).

Should the company receive MRTP status for their VLN cigarettes, they would be the only combustible cigarettes achieving this as the other two product applications (see link above) are for smokeless tobacco products.

This would give the company a tremendous opportunity:

- Smoking kills 7M people a year worldwide, 1,300 people a day in the US alone (compared to 128 a day for opioids); it's the leading cause of preventable disease and death.

- The CDC argues that two-thirds of smokers in the U.S. want to quit smoking, and more than half of them to attempt to quit in a given year.

- The company's market research shows that 60% of smokers indicate an intent to use VLN when shown our 95% less nicotine claim.

- Even achieving just one-quarter of 1% of the US market ($100B a year) could drive the company's market capitalization way higher (ten times is what management argued during the CC, which was held on November 5 when the stock price was $0.75, less than half the levels now).

From the earnings deck:

Why does management think achieving MRTP status is imminent?

- They have been at it for years, all in constant dialogue with the FDA revising their application and are now in the final stages.

- VLN cigarettes support the FDA's plan to implement an industry-wide reduced nicotine product standard (see below).

- The FDA authorized their PMTA application last year, which means that the FDA deems the company's VLN cigarettes appropriate for the protection of public health, a standard that all new tobacco products need to receive FDA authorization.

- Their MRTP application seeks a reduced exposure claim, not a reduced harm claim, and that should not be controversial. Reduced nicotine is objective and measurable.

Here is management (Q3CC):

We continue to feel confident in a positive outcome for several reasons. First, the FDA continues to interact with our company regarding our application, which is often not the case with applications that are bound for rejection. More broadly, the FDA has funded and continues to fund millions of dollars of research to better understand the public health benefits of our reduced nicotine-content cigarettes...To-date, the FDA has authorized only two MRTP applications; one for a smokeless tobacco product and one for a heated tobacco product. Both of these products received their authorizations approximately five to six months after the closing of their public comment period. Our public comment period closed in mid-May, a little over five months ago.

Management is so convinced that they wavered their bonuses until MRTP approval is won. They think it is going to happen this year.

They have good prospects for lining up strategic partnerships with retail chains and distributors within 90 days of achieving MRTP status, both in the US and overseas (Q3CC):

we've made product launch plans that include a national rollout of them with large well-recognized retail chains in the United States and a marketing campaign that has been designed to introduce adult smokers to the world's lowest nicotine content cigarette... Today we are in discussions with a number of independent regional and national tobacco retailers, names many of you would recognize to partner with us to bring VLN to market.

The company has an FDA-cleared production facility that can manufacture up to 1% of the US market, which, if needed, can be tripled with minimal CapEx.

The home run

MRTP status would be terrific, but it could get even better if the FDA actually executes its plan to require that all cigarettes sold in the U.S. be made minimally or non-addictive by limiting their nicotine content to just 0.5mg nicotine per gram of tobacco, which is a level already achieved by the company's VLN cigarettes.

A number of years ago, there was much excitement in the stock as then-FDA chairman Scott Gottlieb proposed this regulation of nicotine levels, but Gottlieb left, and the issue seems to have died down, although it's still the plan of the FDA. From the Q3CC:

Recently, Mitch Zeller, Director of the FDA Center for Tobacco Products, spoke at the Food and Drug Law Institute's Tobacco and Nicotine Conference. When asked, if the FDA is still considering moving ahead with its comprehensive plan for tobacco and nicotine regulation, including reducing nicotine in cigarettes to non-addictive levels, he indicated that the FDA remains absolutely committed to everything that was in that plan.

Here is what management plans to do when this gets through (Q3CC):

When the FDA mandate ultimately goes into effect, we plan to make our proprietary reduced nicotine-content tobacco and related intellectual property available to every cigarette manufacturer in the United States.

They will be helped with their recent achievement getting a broad patent, enabling the company to rapidly introduce very low nicotine trains into all variety of tobacco, which is currently in use for cigarette production in the US.

International expansion would offer a further big opportunity as the US market is $100B, the world market is an $800B market. With the FDA's MRTP designation, international regulatory hurdles would become much less as the FDA is seen as the gold standard.

They also have developed non-GMO tobacco lines which will become useful in markets where there is resistance to GMO crops.

And just in, to buttress the FDA's seriousness about regulating tobacco, the FDA, in coordination with NIDA (the National Institute on Drug Abuse) and others, has submitted an order to 22nd Century for 3.6 million variable nicotine research cigarettes. From the PR:

The Company’s research cigarettes will continue to fuel numerous independent, scientific studies to validate the enormous public health benefits identified by the FDA and others of implementing a national standard requiring all cigarettes to contain minimally or non-addictive levels of nicotine.

Cannabis

The company also acquired IP in cannabis when it entered into a worldwide license agreement with Anandia Laboratories in 2014, the latter has been acquired by Aurora Cannabis, but 22nd Century's patent situation remains unchanged.

That is, they have an exclusive sublicense in the U.S. and co-exclusive sublicense in the rest of the world for 23 patents and patent applications relating to the hemp/cannabis plant. From the earnings deck:

The company is now going to concentrate on the upstream segments. It entered a worldwide strategic research and development agreement with KeyGene last year, which (Q3CC):

is now focused on developing hemp/cannabis plants with select agronomic traits including lines with stable, ultra-high THC levels, lines with higher levels of rare cannabinoids and lines with ultra-low terpene levels for use in high-growth consumer and life science markets.

Their strategy is about developing and monetizing IP, and for this purpose, they have developed a bioinformatics platform containing all information about the cannabis genome. Here is how their strategy shapes up (earnings deck):

Management mentioned a third plant-based franchise with similarities in its genome to the cannabis plant, but these are opportunities for the future, and they couldn't be more specific (Q3CC):

Finally we have identified a third franchise that we are extremely excited about. I wanted to announce the plant line on this call, but we are still in the process of securing valuable intellectual property and pursuing strategic partnerships to support the development of this franchise. I will identify the plant line, as soon as possible as the competitive situation allows.

Q3 results

From the earnings deck:

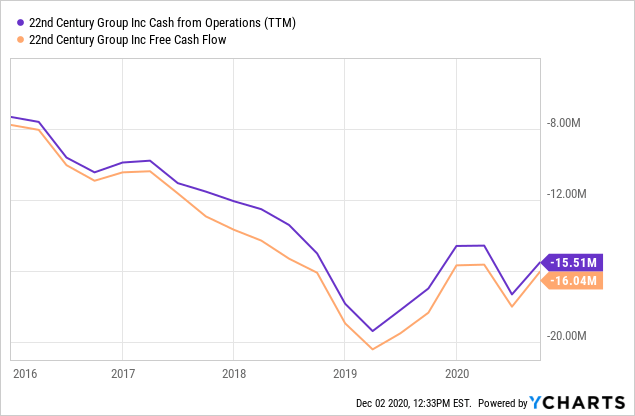

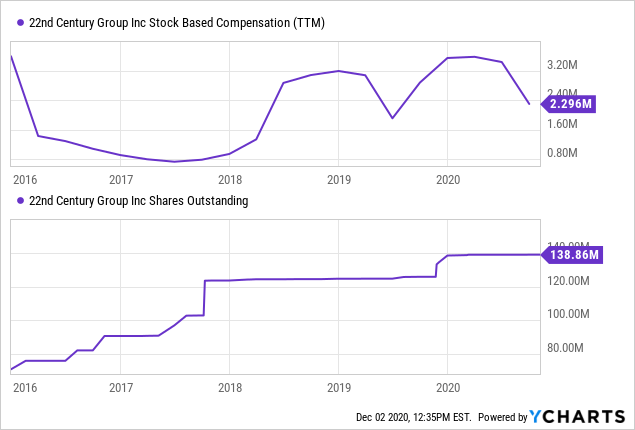

The company's revenue-generating business is contract manufacturing of cigarettes and cigars. Whilst improving, it is still making considerable losses, but we like the new CEO's frugal approach bringing the cost down. The most important metric here is cash burn.

Cash

The company loses about $16M in cash a year, and there has been some improvement in this since early 2019. Bleeding cash means that the funds have to come from elsewhere.

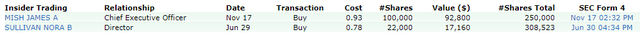

The company still had $26.8M in cash and equivalents at the end of Q3 and is not planning a raise even for the rollout of the VLN cigarette after the expected MRTP approval. There have been a couple of insider buys, from FinViz:

Conclusion

This is a binary situation; the company will either receive the MRTP status or it won't. We think it's highly likely it will, and that will be a company-changing event.

It, of course, remains to be seen how many of their VLN cigarettes they will be able to sell and how fast they can ramp up, but they do have plenty of production capacity, which can quickly ramp.

An MRTP designation will be the first stop in a global rollout, and the prospect is pretty tantalizing, we have to say. The company will be the only company able to market VLN cigarettes, which is likely to be a rather lucrative proposition.

If you are interested in similarly small, high-growth potential stocks you could join us at our marketplace service SHU Growth Portfolio, where we maintain a portfolio and a watchlist of similar stocks.

If you are interested in similarly small, high-growth potential stocks you could join us at our marketplace service SHU Growth Portfolio, where we maintain a portfolio and a watchlist of similar stocks.

We add real-time buy and sell signals on these, as well as other trading opportunities that we provide in our active chat community. We look at companies with a defensible competitive advantage and the opportunity and/or business models that have the potential to generate considerable operational leverage.

Disclosure: I am/we are long XXII. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.