Social Capital Hedosophia Holdings Corp. III Warrants: Great Opportunity

The opportunity to buy into the IPOC warrants provides a great risk/reward to investors who are willing to wait until Clover closes.

The underlying business operates in an exciting area that is large - healthcare.

The warrants prove upside if the deal closes and expire worthless if the deal does not.

Thesis

Social Capital Hedosophia Holdings Corp. III (NYSE:IPOC) is the SPAC that is merging with Clover Health in Q1 2021. I believe the warrants IPOC.W offer a compelling way to play the upside in this special situation, and that Clover Health is a target worth investing in.

I conduct a probability-weighted analysis to conclude there is a 50% upside from today's prices of about $2/share for the warrant and the stock trading at $11/share. I believe the warrant can easily be in the money - with strike prices of $11.50 and including the premium, within the next 6 months. Although they do not have the same upside as calls, I believe they are reasonably priced and, therefore, the best way to play into IPOC.

Clover Health

Chamath and Co. announced that IPOC would be merging with Clover Health in October 2020 with a proposed finalization in Q1 2020. That gives us about 3 months left for the expected close.

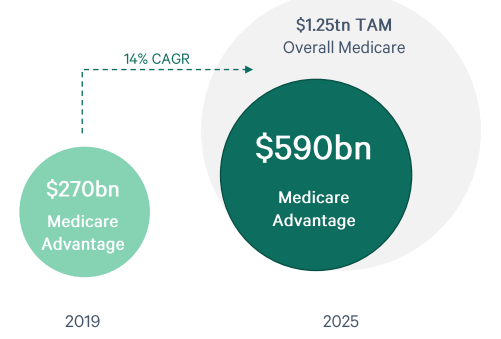

Clover operates in the healthcare Medicare Advantage space. The market has been anticipating the deal for a few months, and we can learn about the size of the market, growth, and other metrics. I believe all of these speak well for a medium-term hold in Clover Health. Looking at other recent medical IPOs in the health tech area like One Medical (NASDAQ:ONEM), we can see upside from post-merger prices as well.

Clover Assistant is a key part of the thesis here, as well as the size of the market. I believe the market opportunity and revenue growth will be the key indicators investors look at with Clover moving forward.

Source: Investor Presentation

Clover believes it can overlay data to increase its margins and build a competitive advantage. I believe this can be a true advantage over time in a field where data-first engineers are difficult to attract and retain. Clover has the right DNA to do so. Clover Assistant is the proprietary software that showcases this ability.

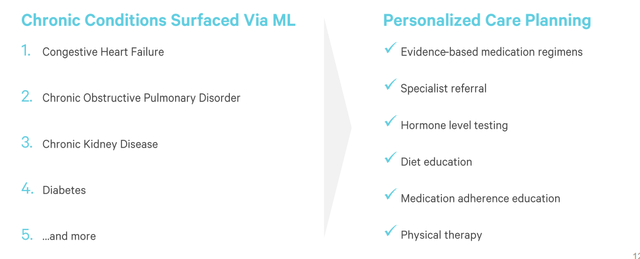

Using machine learning, Clover is able to surface various conditions to increase the quality of care and reduce the cost. Management gives an example of proactive care and chronic conditions that can be treated with Assistant. This software leads to more personalized care that the end patient appreciates. Clover closes tracks Net Promoter Score (NPS) like many other tech-forward companies.

Source: Investor Presentation

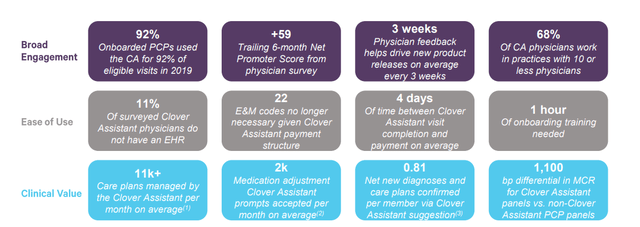

Assistant also makes the physicians' lives easier. Looking at engagement, ease of use, and clinical value as the key areas that the Assistant helps with, Clover provides an evidence-based approach to the value its software brings to various workflows.

Source: Investor Relations

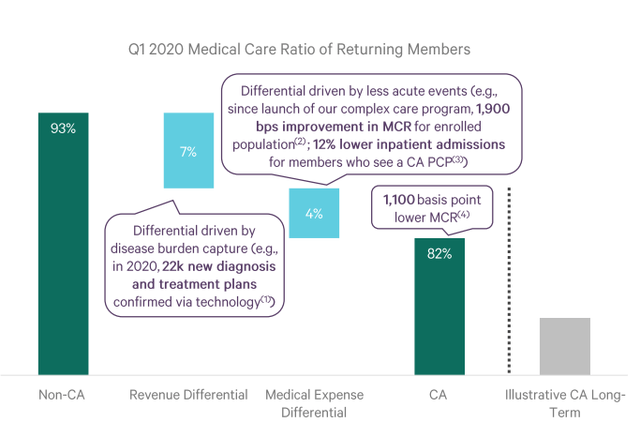

Long term, it is really important to watch how quality of care translates to repeat visits, costs, and scores throughout the plan. I believe these are the key metrics that will drive long-term financial success. Management is also focused on these today, which is important and bodes well.

Source: Investor Relations

Stars

It is worth mentioning that an upgrade in Stars rating to 4+ will significantly enhance the business over time. This is likely the largest catalyst for a re-rate in the stock. If Clover can achieve 4 or 5 Stars, its eligible patient base grows, and likely, its operating metrics on a trailing basis would have improved. Clinical improvement of its patients is the long-term underlying metric that really matters. Clover has already outlined its plan to improve its rating.

Source: Investor Relations

Risk/Reward

This is one deal behind IPOB, which is already trading at $25/share. I believe IPOC could easily hit $20/share by mid Q1 2020, which would imply roughly 90% upside from buying the pure stock today. I am supplementing that position with warrants that have a breakeven around $14/share (conservative inclusive of transaction fees). If the stock can trade at $20/share, I estimate the warrants would be trading at a significant premium to today's prices (50%+ upside in less than 6 months).

If the Clover Health deal gets delayed or called off, that is the downside scenario. The warrants could expire worthless, although IPOC still has 1.5 years left to make a deal. Let's take the worst case scenario and apply $0. With the warrants trading at a ~$2/share today, that would imply significant downside.

If we weight both scenarios as 50/50 likely, we still get to 25% upside within 6 months. I believe this in itself shows the value in believing that the transaction will close and allocating a small percentage to IPOC.W warrants.

Positioning

IPOC is getting a lot of retail attention in the last few days as IPOB anticipates a close by the end of 2020 and investors look at the remaining series. I would position a 1-2% position into the name as it is high risk and high reward. Healthcare can be slow to move, and the deal still needs to close, which means that capital can go to zero, especially with warrants. A more conservative way to invest is with stock, which should really only drop to $10/share per intrinsic trust value.

Disclosure: I am/we are long IPOC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.