There's ongoing consolidation in the asset management space and Victory looks like an excellent takeover target with a forward P/E of less than 6x.

However, the company is bleeding AUM and booked net outflows of $17.8 billion in the first three quarters of 2020.

The main reason for this is Schwab’s purchase of USAA’s brokerage business and I think Victory made a strategic mistake by not buying it itself back in 2019.

With Victory’s rights to use the USAA brand expiring in around 18 months, the AUM issues are likely to become more serious in the future.

I think Victory is in serious trouble and its problems are likely to scare off any potential buyers besides Schwab.

Introduction

There’s consolidation going on in the asset management industry and just last week, Waddell & Reed (WDR) announced a $1.7 billion all-cash sale to Macquarie Group (OTCPK:MQBKD).There’s a lot of speculation on which might be the next company to be acquired and some of the candidates include Franklin Resources (BEN), WisdomTree (WETF), AllianceBernstein (AB), T. Rowe Price (TROW), Ameriprise (AMP), Victory Capital (VCTR) and Artisan Partners (APAM).

Of these companies, I held Victory in my portfolio but I decided to sell on December 3 when share prices rose across the sector. The key reason for this is that I think that Victory is not a good takeover target as it’s likely to get in serious trouble in around a year in a half. Let me tell you why.

How Victory Capital grew its business

Victory is a multi-boutique asset management firm which became independent in 2013 though a management-led buyout. In 2018, the company was listed on Nasdaq after offering 11.7 million shares at $13. This was well below the range of $17 to $19 which appeared on the website of the IPO investment manager.At the time of the listing, Victory had some $62 billion in assets under management (AUM).

In Q1 2018, the company generated GAAP EPS of $0.16 and booked net outflows of $633 million. Not too impressive results and I think it looked overvalued at that point.

Victory’s big break came in November 2018 when it announced a deal valued at close to $1 billion ($850 million guaranteed and the remainder deferred consideration) for the Mutual Fund and ETF businesses of the United Services Automobile Association (USAA) as well as its 529 College Savings Plan.

This deal more than doubled Victory’s size as it brought $69.2 billion in assets under management in 53 investment funds. Just before the announcement, Victory’s shares languished at $7.50, but then they leapt to $11 on the news and never looked back.

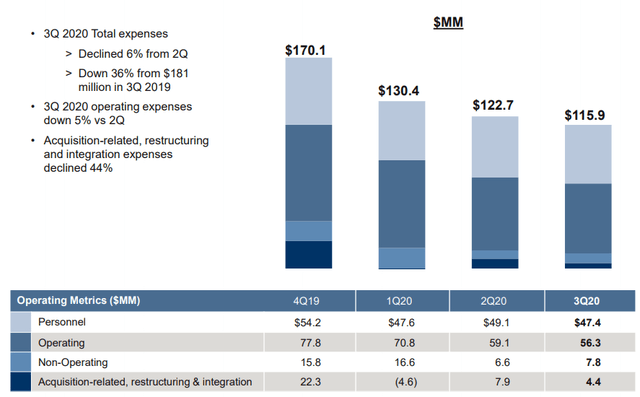

Victory expected to generate cost-synergies of around $120 million per year and has been steadily improving its bottom line since the purchase closed on July 1, 2019.

In March 2020, the company repriced its $952 million Term Loan, which significantly cut interest expenses.

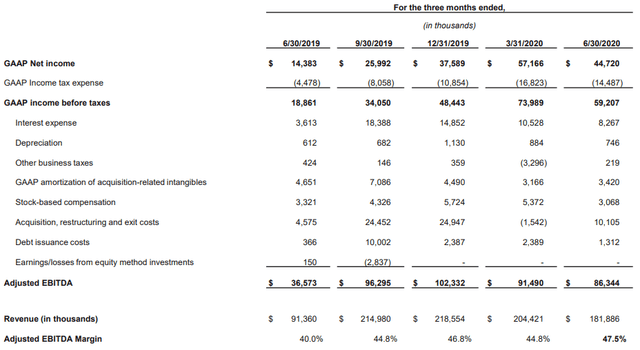

(Source: Victory Capital)

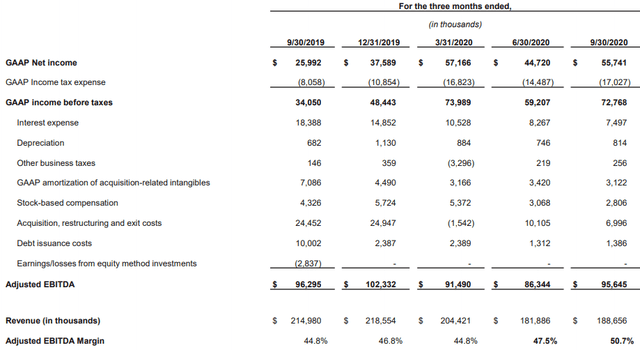

(Source: Victory Capital)

However, look at the revenue numbers. The reason for the declines are significant outflows of funds, which have been somewhat masked by recent strength in the stock markets. Also, Victory has issues with the USAA brand.

The problems

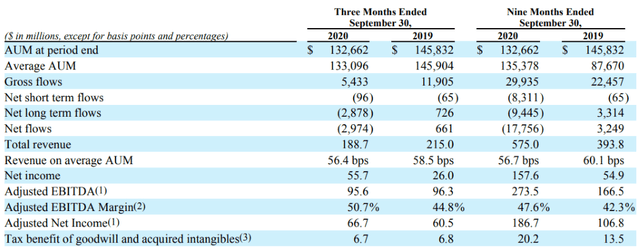

Victory's net outflows stood at $17.8 billion for the first nine months of 2020. Sure, there were outflows of $8.3 billion from money market funds as they transitioned to Schwab (SCHW) after the latter bought USAA’s brokerage business for $1.6 billion in May 2020.

In Q3 2020 alone, the net outflows came in at $3 billion.

While it’s unquestionable that expenses have been optimized, the issue is that Victory can’t stop bleeding AUM since the 2019 acquisition.

(Source: Victory Capital)

(Source: Victory Capital)

(Source: Victory Capital)

As I mentioned, Schwab bought USAA’s brokerage business and a significant part of the attrition is due to this development. Victory has confirmed this and hopes that the outflows will decrease over time.

However, I don’t think this is likely. The reasons are that USAA members are among the more loyal financial services customers in the world and Victory now shares the brand not with USAA itself, but with Schwab. Victory’s rights to use the USAA brand expire in around 18 months and Schwab has taken on some 400 USAA brokers that used to sell its mutual funds. And through its exclusive USAA referral deal, Schwab got 6,000 new accounts in just five weeks.

There's an obvious overlap between the over 1.1 million USAA-referred Schwab clients and the around 1.5 million USAA mutual fund and ETF holders that use Victory. With so many former brokers now working for Schwab, I think the bleeding will continue.

Investor takeaway

I think Victory Capital made a mistake in 2018 and 2019 when it bought USAA's product-maker, but not the brokerage that sold them. The company is now bleeding AUM and competing with Schwab will be a considerable challenge.

Also, these issues are likely to scare off any major asset managers interested in acquiring Victory. Except Schwab, maybe.

Victory is currently generating around $0.80 GAAP EPS per quarter and has an enterprise value of $2.29 billion as of time of writing. On the surface, the company looks cheap. However, profits will start to deteriorate if the AUM bleeding is not stopped and things can get really bad when the rights to use the USAA brand expire.

At this moment, I think Victory shouldn’t be worth more than $19 per share due to these issues.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not a financial adviser. All articles are my opinion - they are not suggestions to buy or sell any securities. Perform your own due diligence and consult a financial professional before trading.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.