Stitch Fix - Q1'21 Results: Record-Breaking, Algorithm Highly Predictive, Direct Buy Expanding TAM

Stitch Fix reported record-breaking Q1’21 results despite lingering Covid-19 headwinds, the company added the highest number of active clients in a quarter.

It launched multiple innovative features that are bound to improve SFIX's predictive power, as a result, improves conversion and retention.

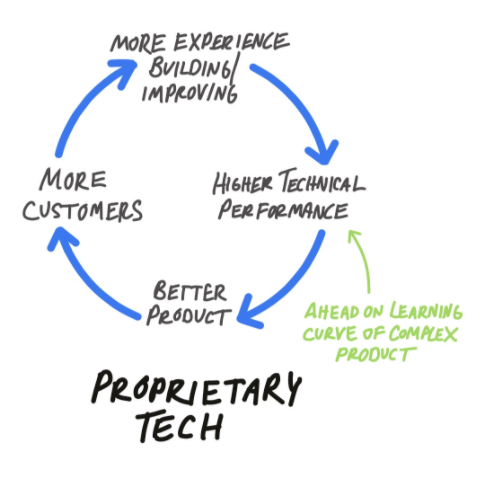

After two successful quarterly earnings during COVID-19, we are more convinced of SFIX’s personalized engine and the flywheel building its network effects moat.

Investment thesis

Our previous bullish article and Q4’20 results review on Stitch Fix (SFIX) placed the company's innovative business model at the center of the thesis. We assert that it is a moat, possessing incredible network effects.

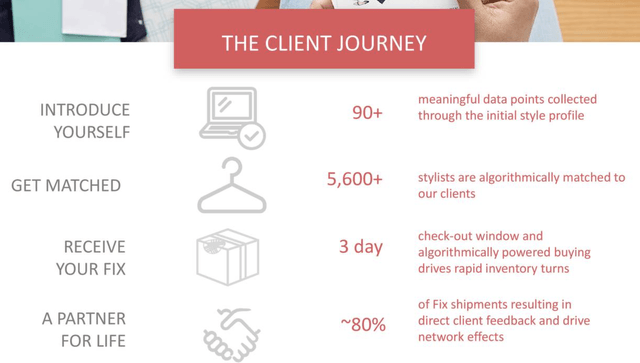

You may ask: “How?” As a quick reminder, SFIX collects valuable client’s measurements and outfit preferences periodically (over 90 meaningful data points) when they first sign-up. Each time they interact on Style Shuffle, and each time they receive a Fix. As a result, as more customers order, give feedback, and interact, SFIX’s brain gets smarter. This, in turn, improves the Fix’s recommendations' accuracy, client conversion, and retention. Hence, we believe SFIX's brain possesses the elusive network effects moat.

Q1’21 results were impressive, given SFIX posted double-digit growth while the apparel industry has been contracting. There were also strong signs that SFIX has product/market fit and that its continuous and methodological innovation launches were not just satisfying existing customers but also expanding SFIX’s total addressable market (‘TAM’).

The market was stunned by the results, and its stock soared 40%.

Source: Yahoo Finance

Q1’21 results – Record-breaking

Financials

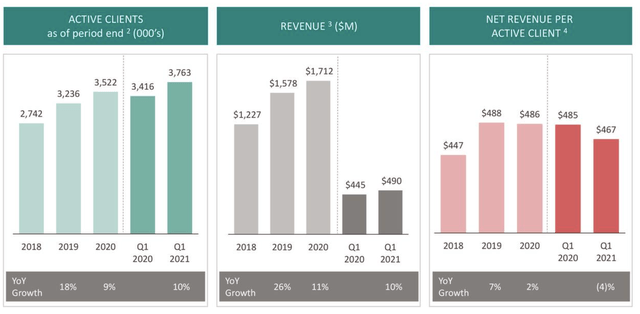

- Net revenue of $490.4 million, an increase of 10% year over year, and a sequential increase from$443.4 million in Q4’20 (up 10.6% adjusted YoY growth).

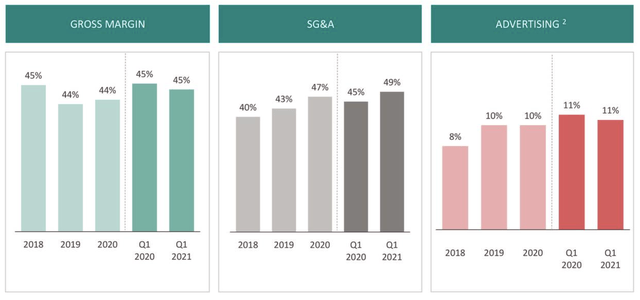

- Gross margin: $219.5M, 44.7% margin, a sequential improvement from $199.1M, 44.9% margin.

- Net income of $9.5 million and diluted earnings per share of $0.09, a substantial improvement YoY and sequentially from$(44.5) million, (10.0)% of net revenue.

- Adjusted EBITDA of $6.9 million, a reduction from $17M compared to the previous year.

- Free cash flow: $51M, an increase from 20M in Q1’20.

- Capex: $6M, <1.5% of sales, extremely capital light.

- Balance Sheet: $387M cash and $140M in capital leases, no debts.

Operations

- Active clients of nearly 3.8 million, an increase of 347,000 or 10% YoY, and 241,000 clients QoQ, from 3.5M in Q4’20, and acceleration vs. 8.8% YoY growth.

- Net revenue per active client of $467, a decrease of 4% year over year, and a deacceleration from $486 in Q4’20, due to record new customer addition.(2019: $488; 2018: $447; 2017: $445).

- Appointment of Dan Jedda as the new Chief Financial Officer, ex-Amazon

- Launched Shop by Category (Style Shuffle feature) to boost Direct Buy and complement Trending for You.

- Launched Fix Preview to remove friction and to improve cold-start experience and conversion.

- Shortened lead time in the Kids unit to less than ten weeks. It strengthened the ability to respond to clients’ changing behaviors.

Guidance

- Q2'21 revenue of $506M to $515M, or 12-14% YoY growth.

- Full-year 2021 revenue of $2.05B to $2.14B, or 20-25% YoY growth.

For more details, click here.

SFIX started FY21 with a bang. Despite the uncertainties and challenges in the apparel industry, SFIX posted double-digit revenue growth, improved gross margin to nearly 45%, generated a positive net profit of $9.5M, and generated free cash of $51M, or about 10% free cash flow margin.

Source: SFIX Q1'21 earnings presentation

Source: SFIX Q1'21 earnings presentation

But these headline financials are not as impressive as what SFIX had been cooking behind the scene. Let’s go through it one by one. Starting with the operations, then the bullish guidance, and finally, the innovations behind it all.

Operational performance

SFIX achieved record-breaking sequential new client additions. SFIX added 241K client QoQ to a total of 3.8M. The achievement means that it returned to double-digit active client growth, up 10% YoY.

Source: SFIX Q1'21 earnings presentation

The main driver was the impressive conversion rate. In Q4’20 and Q1’21, nearly 80% of the first-timer purchased at least one item in their first Fix and looked forward to their second Fix.

This conversion rate is the highest in the last five years, reflecting SFIX’s ability to acquire clients and its ability to meet the client’s needs and preferences right from the get-go. The high success rate is also a validation of SFIX’s superior product/market fit.

In terms of existing customer retention, SFIX has done well too! Leveraging the data and proprietary algorithm enabled the company to meet the demand and client preferences timely.

Many of the product categories saw triple-digit growth, for example, athleisure, kids – Back-to-School, to name a few. In fact, across all of the Fix categories, clients took less time to make a purchase.

This shows how much trust clients have in SFIX’ s ability to provide them with outfits that would just fit, thanks to the innovative algorithm that continues to improve every time they order.

Bullish guidance

The management was so confident of the momentum and innovations (more below) that they guided 20-25% growth for FY2021. We did not expect them to provide guidance, not to mention such a high rate.

Here is Katrina Lake, the CEO’s take on why guidance is so strong,

Our powerful personalization engine is evolving, and innovations in our Fix and direct buy offerings will expand our addressable market, deepen client engagement, and grow wallet share over time. We're excited about the momentum in our business, confident in the future ahead, and we expect to deliver between 20% and 25% growth for the full year.

Source: SFIX Q1'21 earnings presentation

Source: SFIX Q1'21 earnings presentation

Effective innovations

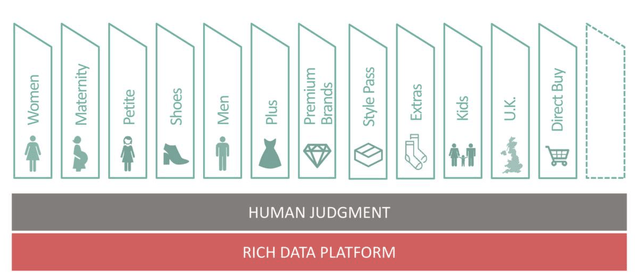

What we like about SFIX is the rapid pace of improvements and innovations. In Q4’20, they tried out a few strategic initiatives.

- Adding new features: 'direct buy' and 'trending for you' features

- Expanding product lines: Kids, active wears, and plus-size

- Expansion to non-US markets: the U.K. as a testbed

In Q1’21, SFIX disclosed a few more.

- Expanding Direct Buy, adding Shop-by-Category, leveraging data from Style Shuffles (6 Billion data point)

- Added Fix Preview, enabling higher conversion, rolling out in the UK then the US.

Source: SFIX's earnings presentation

Source: SFIX's earnings presentation

The slide above shows SFIX's expansion to different product lines, markets, and innovative features.

The most notable mention was the expansion of Direct Buy, built on ten-years of data and algorithm iterations in Katrina's words. The CEO expects Direct Buy to drastically expand SFIX’s total addressable market (‘TAM’).

The other notable mention is Shop-by-Category, which, again, was built from an enormous data lake, 6 billion interactions with clients (likes generated through SFIX’s Style Shuffle data). Shop-by-Category complements SFIX previous roll out - 'Trending for You' and Style Shuffle features, allowing each client to see their own individualized ‘wardrobes’ built on themes categories, such as athleisure, sweaters, etc. The feature recommends products that clients would buy outside of their regular Fixes, increasing their average spent.

But, more importantly, Shop-by-Category and Style Shuffle add another layer of feedback to the predictive algorithm and allow clients to feel more engaged with their SFIX's wardrobe. The by-product of this is that clients automatically become a partner and co-creator of their own SFIX storefront.

We believe that SFIX's focus on data science is unique and incredibly convincing. Collecting feedback is very arduous, yet more than 50% of SFIX's active clients provide feedback daily (via Style Shuffle). Coupled with the initial survey and feedback at each Fix, the app's daily interaction makes SFIX's incredibly scalable.

Conclusion – Long-term outperformance

Q1’21 results were a ‘home run’ because of the combination of record client additions, strong retention, and successful first Fix rate. Finally, substantial innovation success further fuelled the personalization engine that position SFIX for an auspicious future.

At 3x EV/Sales multiple, although relatively high compared to its historical levels, SFIX is still in the early innings of its growth. We intend to add more to pullbacks.

Disclosure: I am/we are long SFIX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.