BOK Financial: The Credit Outlook Has Improved, But Future Revenue Looks Underwhelming

Third quarter criticized loan levels were lower than what was seen in the second quarter.

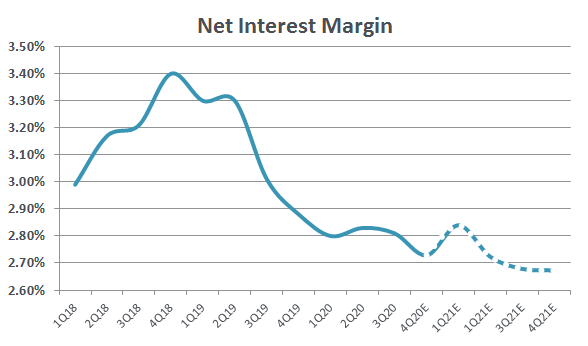

The future net interest margin looks underwhelming and is likely to limit revenue upside.

Fee income was strong but I have my doubts as to how long this strength can sustain itself.

Investment Thesis

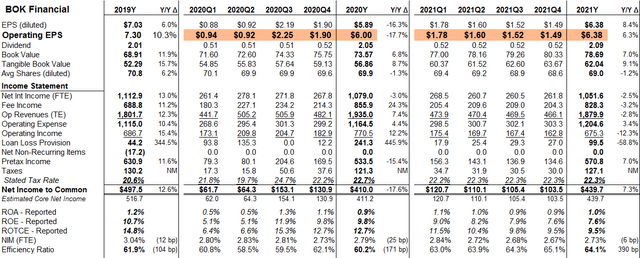

Back in early September, I put pen to paper and published a bearish opinion on Tulsa, Oklahoma-based BOK Financial Corporation (BOKF). Upon further review of both the stock valuation and the third quarter operating results, I now believe I was too hard on the company. When looking back at my previous article, one can boil down the original thesis into one sentence:

... with large exposures in COVID/pandemic sensitive industries like energy, healthcare and others as well as a similar valuation to its peer group median, I believe the stock will most likely under perform peers over the next 12 months.

While my original thesis took into account the outsized energy and healthcare exposures, I now believe my bearish stance was too harsh on the bank’s long-term outlook. While hindsight is 20/20 and it is pretty clear that the stock has performed well relative to both the market and the bank index, I would like to formally adjust my views.

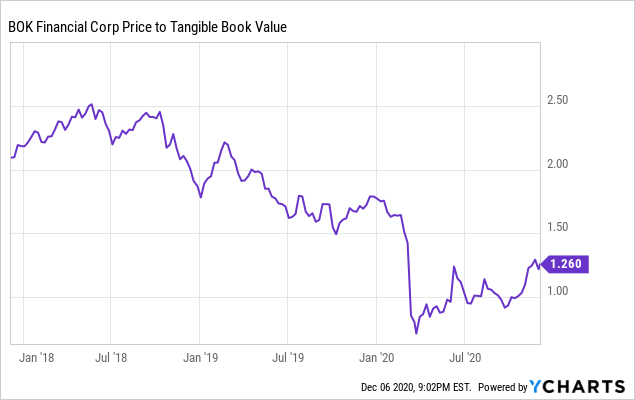

Since the bank has seen a linked quarter reduction to its criticized loans and the overall lending portfolio appears to be on better footing, I change my opinion from bearish to neutral. While the bank’s valuation has clearly increased, I believe it is with merit that its price to tangible book value per share improved to 1.26x per share (relative to peer banks at 1.35x per share).

The price of oil has improved which gives hope to the energy space and BOKF's largest lending category. Also, with many states/economies back open, most healthcare institutions are back open for business (also a large lending class for BOKF). In my mind, BOKF has proven itself to be better than average in terms of credit underwriting (even with the riskier loan concentrations). While its outlook has improved, the stock price has too, and because of that I remain a little skeptical that the bank can continue its outperforming trend.

Data by YCharts

Data by YChartsRevenue Outlook

Like most banks, BOKF had a rather underwhelming summer in terms of revenue upside. The third quarter’s spread revenue was $271.8 million, down more than $6 million from second quarter levels. Outside of top-line spread revenue, I think it is very important to note the activity in the purchase accounting accretion. The third quarter accretion level was $13.3 million, up pretty substantially from the second quarter levels of $3.3 million. Being that accretion is not typically considered “core” revenue, I think it should be backed out when thinking about the core results. When doing so, the third quarter core spread revenue was down $16.4 million from second quarter levels.

This revenue slippage was largely driven by the sizable decrease in average earning assets. Also, the option hedging that BOKF operates also fell $400 million. The culmination of these events caused the net interest margin (NIM) to compress further to 2.81%, down 2 basis points from second quarter levels. When backing out the aforementioned purchase accounting accretion (to get the “core NIM”), the margin compressed further. Third quarter core NIM fell to 2.67%, down from 2.80% seen in the second quarter.

Outside of the spread revenue disappointment, fee income was actually pretty strong. Total core noninterest income came in at $222.9 million, a sizable increase of $9 million from the second quarter levels. While most banks have seen fees continue to increase due to continued strength in the mortgage business, BOKF’s fee income was driven by strength in its brokerage business.

Source: SEC Filings and Author's Estimates

After reviewing the loan portfolio contents, I came away rather unconvinced that the margin was going to increase off current levels. While the interest rate market has proved rather challenging for all banks, BOKF has seen material downside in its NIM since the middle of 2018. Driven by its asset sensitivity, I don't really see the NIM going higher until the Libor market starts to grind back up. While the loan portfolio has seen some material shrinkage, I do believe we are nearing the bottom of this cycle's compression (ex-PPP loans being forgiven).

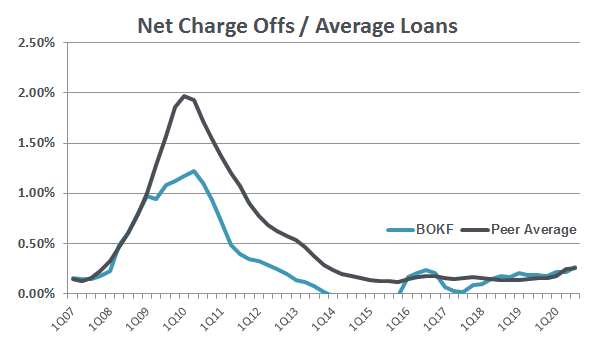

Credit Review

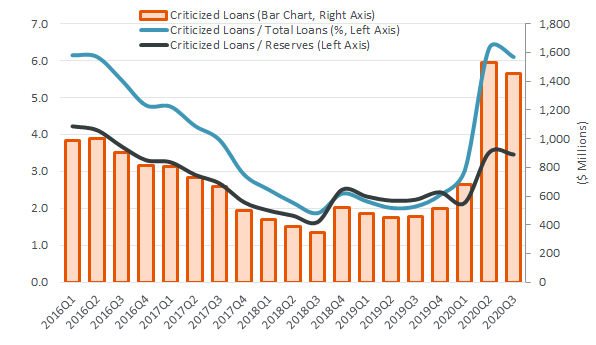

As one can see from the chart below, BOKF has historically done pretty well in terms of its credit soundness. Recall, in my previous article I was pretty bearish on the shares, largely driven by compressed oil prices and closed healthcare facilities. Being that both of those have been reversed, I think that BOKF is much more "in the clear" than where it was just a few months ago.

Source: SEC Filings

Further supporting this view was the lack of a provision expense in the third quarter. While the economic landscape is still pretty volatile, BOKF opted to not take a provision in the third quarter. In my mind, the lack of a provision further solidifies and supports the longevity of the trend seen the chart below.

Source: SEC Filings

As one can see in the chart above, criticized loans look to have turned the quarter and might have started to work its way lower. While this is a very positive data point, I would caution investors that one point does not make a trend. From the second quarter into the third, the reversal in criticized loans points to a positive data point and improved credit.

While the overall economic landscape has improved from this summer's lows, questions still remain as to how long it can sustain this bounce (or continue to work higher). In terms of credit soundness, BOKF looks to be in a much better place than where it was in the second quarter.

Concluding Thoughts

In my mind, the lack of a provision expense and improved criticized loan portfolio more than outweighs the limited net interest income seen in the third quarter. Being that there were more positives than negatives, it makes sense that the stock has improved from being "deeply discounted" to nearly inline with peer valuation levels.

While the easy money has been made in the stock, I think there are too many questions as to the pace at which the credit portfolio will return to pre-COVID levels. Because I don't have a clear line of sight to energy prices or how long the most recent economic shutdowns/restrictions will last, I think it makes sense to err on the side of caution and move to the sidelines.

Source: SEC Filings and Author's Estimates

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.