KushCo Holdings: Prudence Will Make This A Future Leader

Management has achieved solid performance in cost reduction metrics that will play out well in the future.

Revenues remain lower and not increasing on an increasing basis, despite the rest of the industry seeing continuous increases.

The stock remains above value despite revenue losses and guidance that revenues will not necessarily increase anytime soon.

KushCo Holdings (OTCQX:KSHB) is firing on all cylinders in some regards, but missing in others. In an industry that is increasing MoM very rapidly, revenues at the company fell off as it shifted to a different customer focus. And, the highest revenue levels have yet to be eclipsed. Despite this, KushCo’s cost metrics are easily the most impressive in the industry. If the company gets to economies of scale with its revenues along with its cost metrics, it could become the banner of profits in the cannabis industry. But what about buying right now?

My long-term readers will recall that I had been heavily invested in the cannabis industry. I have been working over the past few weeks trying to get my portfolio back up and running after having it entirely liquidated about 18 months ago (a result of a health issue). So, I have systematically been working through the cannabis sector. I wrote up many articles here on Seeking Alpha along the way as I added these companies into my portfolio with the intention of holding these stocks for some time. Now, I am looking at the sector once again.

KushCo Holdings had always been on my list of things to do, but unfortunately, my time ran out at that time. Now, I have all the time I need and am finally looking at the company. There are things I like about KushCo and there are things that I think still need a lot of work on within the company.

Cannabis in Canada and the US

Where most focus predominantly on one country, there are a couple that have operations in both the United States and Canada. KushCo is one of those companies that have operations inside both.

There have been some waves made lately regarding the legalization of cannabis on the federal level; the House of Representatives passed a bill on December 4th to the effect. But as everyone knows, both Mitch McConnell and the Senate loom. The passage of the bill seemed more ceremonial than anything to me. I don’t see the Senate passing, it nor a lame-duck president.

Nonetheless, this is a step in the right direction for cannabis and its proponents. However, that is just one step. Take, for instance, Colorado. The state laws do not allow for any operations of nearly any kind in other states. Nor is cannabis legalized in various states on any level, least of which on the adult-use, recreational level. Granted, Colorado is one example; other states have other laws. However, all of these attempts seem almost futile, because the various states still have to get their own legislators together and figure out new laws before there can be any new ground broken. Still, I expect it to happen at some point.

Both the United States and Canada are seeing their respective cannabis sales continually increase. In the United States, cannabis sales are on pace to increase by 40%. In Canada, it is expected to be nearly double for the year over last year’s sales levels. Considering that, any business in the industry is operating in an environment where there is a lot of positive momentum.

Revenues

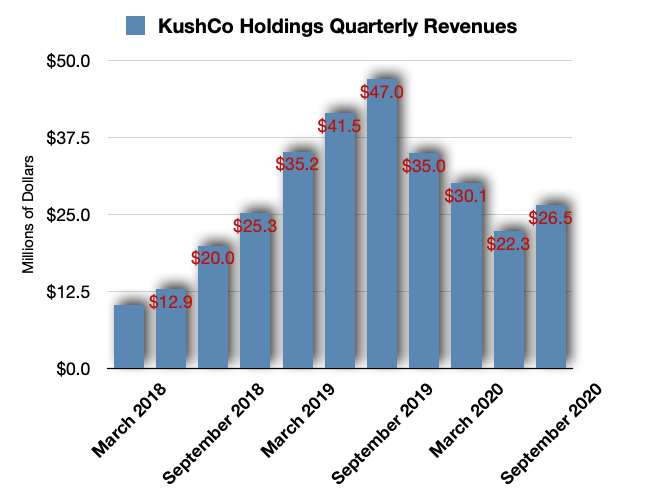

Here is a look at KushCo’s revenues that have come in over the past few quarters, from the company's financials:

(Data Source: Company Data - Author’s Chart)

There was an increase in the past quarter, as you can see in the chart. But in both the United States and Canada, retail sales numbers have been progressively increasing during the past year. This downward trend is out of line with the overall picture - this, despite the entire industry operating within the bounds of COVID-19. So, the downward trend is a bit off from the overall trend. But maybe that is an opportunity.

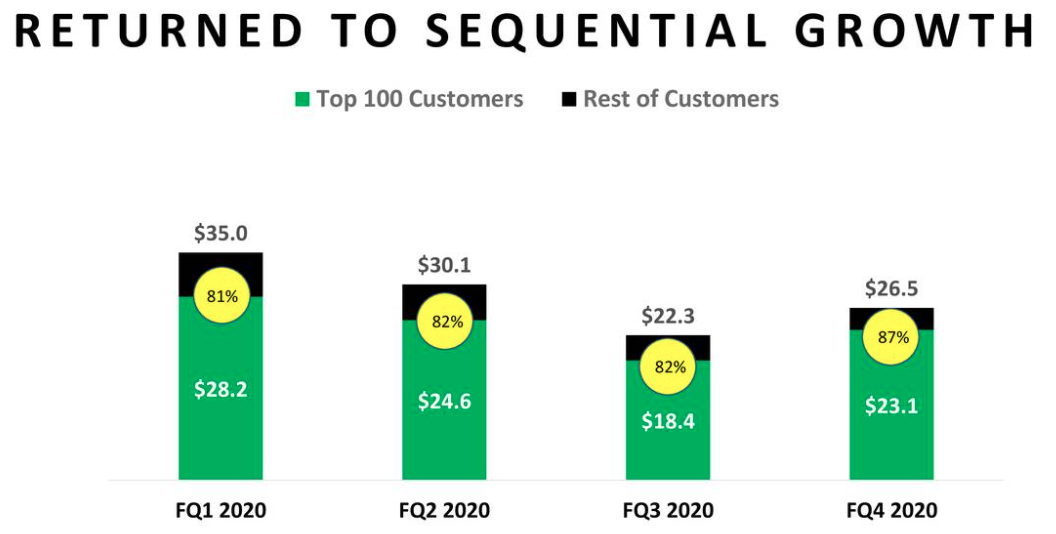

The fact is, management took a left turn with their focus on which companies KushCo focuses its sales on. As CEO Nick Kovacevich stated, there is continued consolidation in both countries as the bigger companies are increasingly accounting for more sales on a progressively larger and larger scale. I couldn’t help but notice that the 80/20 Rule is applied to the sales numbers at KushCo:

(Data Source: Company Presentation)

From the company's earnings presentation, this is a look at the top 100 customers that KushCo deals with. The 80/20 Rule states that 80% of your results will come from 20% of your efforts, and in this case, 20% of KushCo’s customer base is providing 80% of its revenues. It is obvious who the company should be focusing on if it wants to see its revenues continually increase.

This trend has been the overall push at the company, focusing on the bigger clients. KushCo points out that a smallish retailer was acquired by a bigger player - the bigger player being one that already does business with the company - and that consequently, there is a new retail outlet that is carrying KushCo’s products, to which the CEO states (from the earnings release transcript):

The moral of this example is that it's better to be aligned with the larger operators since they will be the acquirers, rather than scrambling to try to secure all of the smaller operators who are likely to end up being consolidated down the road.

I can agree with that, but my first thought is that this bigger player now has more bargaining power, and that may affect margins.

Net Margins and Operating Efficiency

Probably the one thing that stood out to me was KushCo’s margins and its efficiencies.

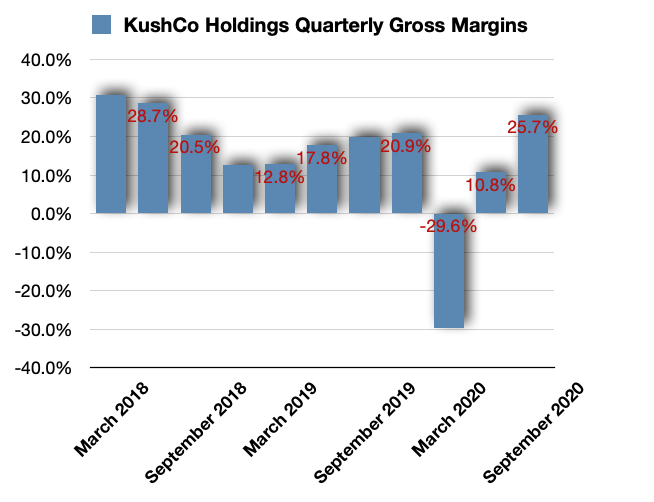

(Data Source: Company Data - Author’s Chart)

When I consider all of the companies I have been looking at over the past few months, KushCo’s gross margins are actually on the lower end that I have seen. But they are consistent, one outlying quarter notwithstanding. This consistency gives a working idea of what to expect in the future, should the company continue with its progress of advancing revenues.

But it was the operating efficiency that impressed me the most:

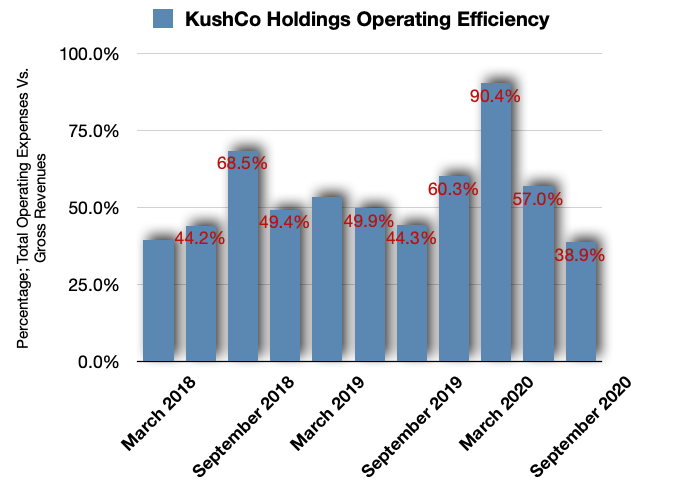

(Data Source: Company Data - Author’s Chart)

This is actually impressive for two reasons: First, consistency - along with the gross margins. But, the second reason may not be as obvious - that being it is below 100%. You don’t always find this with cannabis companies that are still trying to achieve consistent numbers and work within some bounds of prudence.

Gross margins are a factor of cost of goods over gross revenues, giving you an idea of how much of the input costs of the product take away from the total revenue. Operating efficiencies deal with the cost of labor and other operational costs - total operating costs over total revenues. The fact that the numbers above are below 100% is a solid indication that KushCo is on track to being a profitable company, notwithstanding the fact that it is not currently profitable.

But we can actually get a better sense of how this company will perform in the future given the two numbers here, and that makes KushCo one of the easier companies to look at in the industry. More on that later, however.

Net Income

Here is a look at Net Income for KushCo Holdings for this most recent quarter:

(Data Source: Company Data - Author’s Chart)

This is starting to inch its way upwards towards breakeven. The encouraging thing from this is, again, consistency. Management is focused on costs, as the above two charts show. Because of that, economies-of-scale will be achieved as long as the costs are maintained in a consistent manner - something that I believe the company will continue to do.

Let me explain. Revenues for the quarter were $26.5 million. This puts gross margins at $6.81 million. Operational costs efficiencies come in on average about 50%. However, what if KushCo were to top its previous revenue total of ~$47.0 million? Given a gross margin rate that is consistent, we can use some linear math to determine that the company would have a solid $12 million in gross profits - nearly double.

Then, with operating efficiencies, if KushCo printed a solid $47.0 million and maintained its ~50% average operating efficiencies, while it was also able to maintain the same rate of gross profits, the picture would look quite different for the company. Instead of a loss of some $7 million, given all the other cost factors, it may achieve a positive revenue level.

KushCo is getting more efficient at what it does and is spending less making what it makes. Given higher revenue numbers, the company could easily be printing positive economies of scale and turning a solid profit.

The only factor that I see as the real concern is the fact that while a lot of other companies within the cannabis industry have been seeing rising revenue increases, KushCo’s revenues fell off during this same time.

There is just one other thing that I noticed about KushCo that would give me pause with placing some shares in my portfolio - that being the value of the stock and what you get for buying the stock.

Book Value

What do you get out of a company you own? One thing to look at is the company’s earnings, and from that, you can project future earnings. That can potentially tell you what the value of a stock could be. However, KushCo is not profitable. So, we cannot predict what future value will be based upon that.

However, book value gives us at least the concept of liquidation, which is useful if for no other reason than to tell us what the worst-case scenario is with a company.

Here is the book value for KushCo:

(Data Source: Company Data - Author’s Chart)

Its book value is listed at about $0.69 per share. There had been a downward slope in assets over the past few quarters, with an in-kind downward slope in liabilities. That being said, this is below the stock current price.

KushCo Stock

KSHB is trading at $0.96 per share. The current price is higher than book value by a bit. And the current short-term trend for the stock is moving upwards:

(Data Source: TradingView)

Given the momentum of the stock, investors are more focused on the future earnings potential for KushCo. The current stock price leaves no room for margin of safety. I have seen a few cannabis companies whose stock price has been sold off so much that it is some 30% of book value. These companies would be significantly undervalued.

That does not mean that KushCo is overvalued right now. As I said, investors are fronting the potential earnings that the KushCo will be capable of printing. This takes away that element of safety, but the company is poised very well to increase earnings based upon the industry momentum and the prudence with which management runs the company.

Key Takeaway: Is KushCo a Buy?

Being a numbers guy where I distill things down to trends and metrics, KushCo management is on the right track with costs. They have the best prudence of cannabis companies I have run into yet.

But the two issues that I see that are making me hesitant are book value and future valuation of the company, and its declining revenues despite the rest of the industry performing well during the same time.

With regard to the revenue keeping up with the rest of the industry, KushCo management took a turn with their focus and are only putting their energies into these bigger players. A company can get better results that way because bigger companies place bigger orders.

Moving forward, KushCo believes that the revenue stream will actually be bumpy and inconsistent. So, if the company does not see any continuous increases in revenues on an upward trend, despite the general industry trend, I have a tough time seeing it. Eventually, however, KushCo will prevail and start increasing revenues back up to its peak levels. We have no guidance as to how long that will take.

Still, what I think this company does demonstrate is that management is crucial to the future of a company. The margins are impressive and the best I have seen. The only thing KushCo needs to accomplish is an economies-of-scale level of revenue. If it continues to maintain its prudence, it may become the most efficient company in the industry.

The lack of cushion in the stock price is something that would have me pause with placing the stock in my portfolio. There are a few excellent companies that are increasing their revenues and are significantly below value. KushCo is not one of them.

I believe that KushCo stock will head higher eventually over the long term. However, for right now, I am going to hold off until we see more data coming in that shows the company’s revenues lining up with those of the rest of the industry, or at least if the book value aligns more with the stock price.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.