Ambev: Volume Growth And Real Appreciation Benefiting The Recovery Story

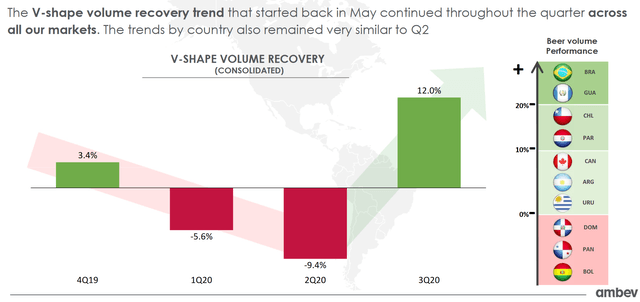

ABEV posted 15.1% growth in net revenues as volume rose 12.0% in Q3, pointing to signs of a recovery as Brazil's GDP jumped during the quarter.

More volume growth ahead should allow revenues to grow and margins to recover, boosting profitability.

However, Brazil's large debt refinancing could possibly have overall economic effects or impacts on the exchange rate, although it is not likely.

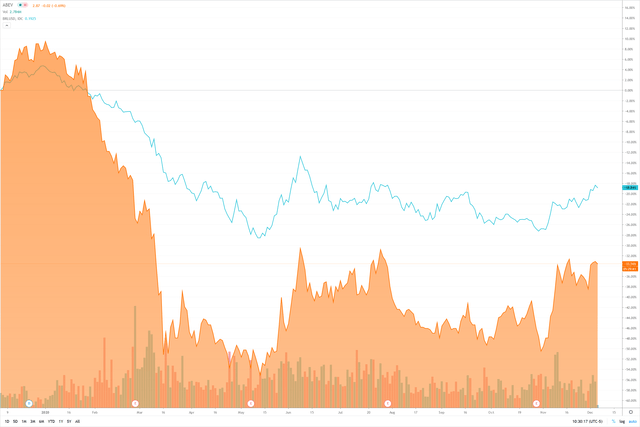

Ambev's (NYSE:ABEV) recovery looks to be starting in stride, with a double-digit jump in both revenues and volume for Q3. Shares had rallied nearly 25% throughout November and have built upon that to start December. Sequential volume growth in a seasonally strong Q4, building upon the pandemic recovery story, and subsequent appreciation of the real could send shares back on an upwards trajectory during 2021.

While the real still remains much weaker relative to the dollar since the pre-pandemic period, Ambev tends to follow the real quite closely in terms of appreciation - Ambev's May/June rally correlated with the mid-summer appreciation in the real, and a similar case is unfolding currently, with the real strengthening slightly from October's levels.

Ambev's Q3 results posted in late October have shown strong upticks in volume and revenues, as a recovery looks to be underway. Net revenues overall rose 15.1% to R$15.6 billion: 21.2% revenue growth in Brazil to R$7.68 billion, 24.6% growth in CAC to R$2.06 billion, 50.0% growth in LAS to R$2.96 billion, and 45.8% growth in Canada to R$2.89 billion. However, much of the revenue growth came from currency translation, as organic growth rates lagged: 1.9% in CAC, 15.1% in LAS, and 6.4% in Canada.

Gross profit rose 21.6% as revenues climbed, on organic growth of 6.2%; however, gross margin fell 390 bp (440 bp organic) to 52.4% as rising COGS impacted bottom line results. Net margin fell 660 bp YoY, from 21.7% to 15.1%. Yet even with margin weakness currently, volume trends are showing signs of a recovery, while normalization in expenses and decreasing COGS as a % of revenues should aid margin recovery.

Volume has recovered significantly well since bottoming in April, which had seen a 27% decline in volume due to lockdowns. May and June started the V-recovery, with May posting a 7% decline and June a 5% increase in volume.

Source: Investor Presentation

Brazil's volume growth in beer led the pack, while markets such as Panama, Bolivia, and Dominican Republic still have declining volumes; when growth starts to pick up in those lagging regions and in others, like Canada and Argentina, Ambev should continue to see high single-digit or even double-digit revenue growth YoY, especially in the upcoming Q1 and Q2.

YTD volume at 114.9 million hl remains down just 0.9% as reported, even with 12.2% growth during Q3 to 42.3 million hl. With ~45 million possible in volume during Q4, FY20 volume would 160 million, still 2.3% off of FY19's volume. Volume recovery to new highs could be seen as early as next year, given the strong recovery during Q3 and continuation of strength and momentum into Q4.

Ambev is also seeing some of its new innovations pay off, such as continuing to launch new flavors, as well as DTC and other channel sales growth. Zé Delivery's DTC presence in Brazil with access to nearly half of the population had already seen monthly orders increase to 5.5 million during Q2, and the app is seeing "a continued significant acceleration in number of orders in 3Q20" with presence nationwide. Appbar in Argentina has grown five-fold YTD compared to FY19, and the BEES B2B platform generates over 75% of all revenues in Dominican Republic.

Strength in DTC and B2B platforms can help accelerate revenues during this recovery period, and volume growth, especially in premium categories (which have contributed double-digit growth during the quarter), will help to drive recovery in profitability. EBITDA margins were higher in multiple segments, even those seeing declines in volume - Brazil Beer and NAB saw growth in both volume and EBITDA margins, while CAC and LAS grew EBITDA margins from currency benefits, although volume slipped.

Brazil's economic picture recovering also points to promising signs for Ambev, even with a GDP increase slightly lower than expected. GDP ramped up 7.7% during Q3, below forecasts for 8.3% from the Economic Ministry, as "the easing of anti-coronavirus lockdown measures triggered a strong rebound in activity across most sectors, especially industry and services, while fixed investment jumped sharply."

GDP for the full year is expected to be down 4.5% as a result of sharp declines early in the year when lockdowns were first imposed. Yet GDP still remains below 2014's peak by about 7%. Emergency assistance funds to over 60 million, in the form of $110 monthly payments, help boost retail spending (household consumption) and industry.

Source: Reuters

Yet the Brazilian economy also does pose risks, especially in early Q1 with some of the largest debt amounts maturing and a R$605 billion refinancing cliff in the first portion of the year. Even though "average interest costs down to their lowest on record, the so-called 'roll-over risk' for the Treasury has increased sharply," given that 6.6% of the country's debt matures next April alone (R$283 billion/3.7% of GDP), nearly all of it domestic.

While the Economic Ministry sees it of little concern, as of now, rates curves are steepening and widening, which could have effects down the road, potentially on the forex rate between the real and the dollar, of which would impact Ambev's share price. Ambev, however, has a very strong balance sheet as well as 36% of debt in foreign currency, so this shouldn't be too much of an issue.

Overall, Ambev still has recovery ahead in volume, revenues, and margins, and the rebound in GDP and slight appreciation in the real have aided returns, with shares rallying through November. Geographical risks do pertain, with Brazil facing a large debt refinancing event as well as Latin American GDP contracting at one of the higher rates across the world due to the pandemic. Continual volume recovery aided by new innovations, drinks, and channel strength in DTC and B2B should provide a runway for profits to recover as revenues start to grow again, which should allow shares to capitalize back to 2020 highs during next year.

Disclosure: I am/we are long ABEV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.