Don't Let Wabtec Derail Your Portfolio

I'm impressed by the fact that management turned a profit in the teeth of slowing demand in 2020. This, plus the improving capital structure, has filled me with some confidence.

I think the market is way overconfident about the future, and so, I recommend avoiding the shares. The more you pay for an investment, the lower your subsequent returns.

Normally, I recommend short puts, but the premia on offer are terrible. This is another sign of an overconfident market.

Since I put out my latest “avoid” piece on Wabtec (WAB) this past June, the shares have returned just over 6% against a gain of 14.5% for the S&P 500. I think it’s time to look in on the name again, as much has happened since. In particular, the company has reported financial statements, and judging by Mr. Market, the world has put this COVID-19 nonsense in the rear-view mirror. For that reason, I want to try to work out whether it makes sense to buy at current levels or not. Also, I’m the sort of small-minded cretin who never passes up an opportunity to take credit for something that was, in all likelihood, luck - and my short put trades here offer me an opportunity to do just that. In all seriousness, I think short puts are a very powerful tool for the retail investor, and so, I take any opportunity to proselytize about them.

You’re a busy crowd, dear readers, and I see no benefit to subjecting you to my wordy prose. For that reason, I’ll come right to the point. I think this is a reasonably good business, and I’ve been impressed by its financial performance so far this year. The company managed to boost profits dramatically in spite of a drop in revenue. The problem is that the market seems to be very optimistic about the future here, and that’s never a good sign, in my estimation. This is evidenced by the normal valuation measures I look at, and the fact that the premia on offer for put options is quite thin. I think investors would be wise to avoid the name until the price drops to a more reasonable level.

Financial Update

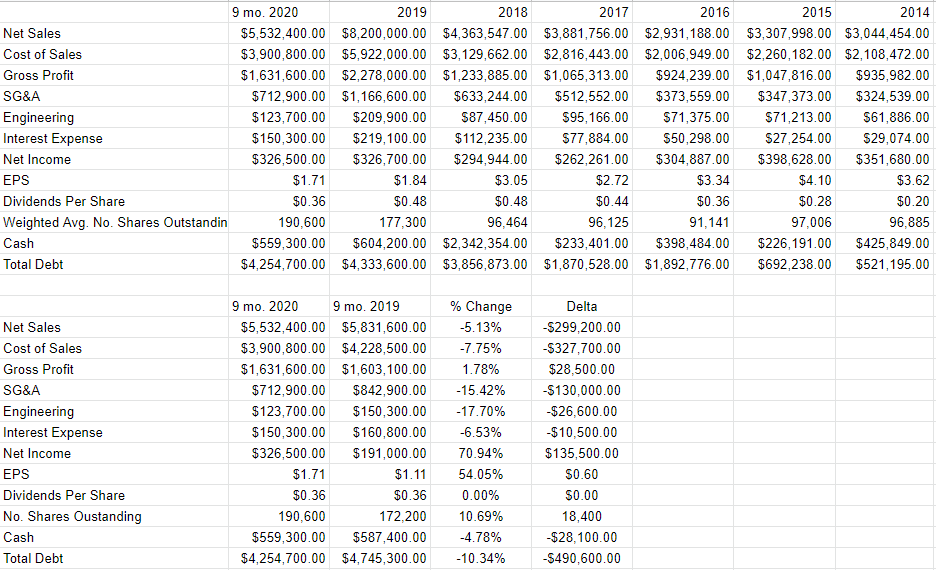

I’ve written a great deal about the long-term financial performance here, some of the drivers (forgive the pun) for positive train control etc., and the sustainability of the dividend in previous articles, so I recommend those for anyone who’s interested. In this financial update, I’ll focus on the most recent nine-month period and compare that to the same time period in 2019. In many ways, 2020 has actually been very good for Wabtec. In spite of a 5.1% decline in revenue from the same period a year ago, net income actually spiked by ~71% to $326,500. This was accomplished primarily as a result of reductions in COGS, engineering expenses, and SG&A, which dropped by 8.5%, 17.7%, and 15.4% respectively. I don’t know much more costs can be wrung out of the system, but the fact that management reacted this quickly is impressive, in my view.

I should also write about interest expense here, as I think it’s relevant. The company started spending more on interest expenses than engineering starting in 2018, and this proud tradition lingers. In fairness, though, interest expense did drop by just over 6.5% from the same period in 2019 to now. This relates very closely to the fact that the company has been actively improving the health of the capital structure, with total debt down ~10% from the year-ago period. This move obviously reduces the risk with this investment. Based on that, I’d be happy to buy the shares at the right price.

(Source: Company filings)

The Stock

The words “at the right price” are three of the most important in investing, in my view. The simple fact is that if an investor overpays for an investment - any investment - the long-term results will be poor. In other words, a great company can be a terrible investment, and a mediocre business can be a great investment at the right price. In this context, “right” equals “cheap.” I’m not cursed with being cheap in my daily life, but when it comes to stocks, I’m absolutely miserly.

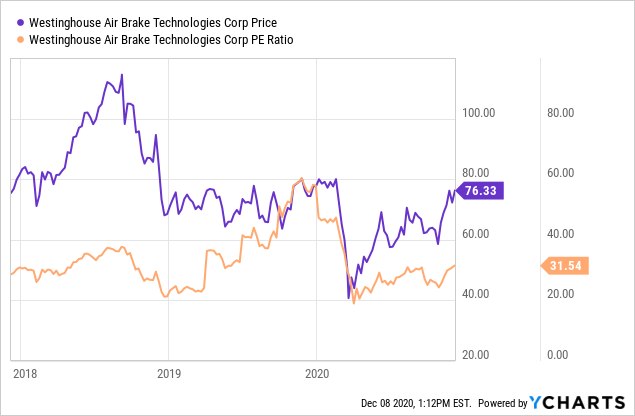

I judge whether shares are cheap or not in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of price to some measure of economic value, like earnings, free cash flow and the like. Ideally, I want to see the ratio at a low relative to both the overall market and the company’s own history. In my previous missive on Wabtec, I made much of (went on about?) the fact that the shares were trading at a P/E multiple of ~31.5. You may recall from the previous section that earnings are much higher this year in spite of a slowdown in sales. Thus, we might be hopeful that the P/E ratio is better now, given the expansion of “E” in that formulation. Our hopes would be immediately dashed after looking at the following:

Data by YCharts

Data by YCharts

It seems that the recent rise in price has matched earnings growth, to the point where the shares are basically as expensive now as they were this past summer.

In addition to looking at the simple ratio of price to some measure of economic value, I also want to try to understand what the market is currently assuming about future growth. In order to do this, I turn to the methodology described by Professor Stephen Penman in his book "Accounting for Value." In this book, Penman walks an investor through how, with a little help from the magic of high school algebra, they can isolate the "g" (growth) variable in a standard finance formula to work out what the market must be thinking about the future for a given business. It seems that at the moment, the market is assuming a growth rate of just over 12% for this business, which I consider to be an extraordinarily optimistic forecast. Based on the above, I can't recommend buying at current levels.

Short Put History

Back in late August 2019, I recommended people eschew the shares that were then trading at ~$67, and instead, sell some April 2020 put options with a strike of $50. These were bid at the time at a price of ~$2. I was exercised on these after the market swooned in early 2020, and I’m happy with the result. It’s certainly superior to the results achieved by people who simply paid $67 for the shares because they “don’t do options.” This past June, I sold the shares at ~$72 because I thought they were overpriced. At the same time, I sold some more puts. This time, they were the January 2021 puts with a strike of $50. These were bid-asked at the time $2.30-3.70, and last traded hands at $.24 and are currently bid at $0. Their value has obviously been negatively affected as the share price has risen.

Hopefully, my history with short puts is instructive, dear reader. I’ve clipped what I consider to be very decent premia in return for being willing to buy this business at a very good price. I don’t want to sound too much like a primary school teacher, but I think the lesson is important enough that it needs repeating occasionally: the more you pay for any investment, the lower your subsequent returns will be. Thus, if we have the opportunity to “lock in” lower prices with put options, we should take it.

Although I like to try to repeat success when I can, there are no opportunities available to short put writers, I’m afraid. The premia on offer for reasonable strike prices are too thin to make the exercise worth it. For example, the July 2021 puts with a strike of $50 are bid at $1.10. This is less than half what the same strike and time value was bid this past June. Admittedly, the shares have risen in price (slightly), but to have premia cut in half in this way is a sign that the market isn’t properly pricing risk, in my estimation.

Conclusion

In my opinion, there’s a negative correlation between price paid and long-term returns. For that reason, I think investors need to remember that “price” does not equal “truth,” and that what the market giveth in short-term gains, it can certainly taketh away with a quick correction. For that reason, we need to be disciplined about never overpaying. Although I think Wabtec is a reasonably good business, and that management demonstrated some skill at controlling costs in the teeth of the downturn, I don’t think it’s a good investment at the moment. I don’t know how much more costs can be wrung out of the system, and the market seems to be forecasting a very rosy future for the firm. This makes no sense to me in light of the fact that the world is in the midst of a recession. Mr. Market seems to have forgotten this inconvenient fact. I also think the thin premia on offer for put options is yet another sign of the fact that the market is way too sanguine at this point. I think investors would be wise to avoid this name until the price falls to the $50-55 range.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Although I sold my WAB earlier, I'm still short the puts described more fully in the previous article.