Xcel Energy: This Dividend Contender Is A Buy Around $55/Share

Based on Xcel Energy's diluted EPS forecast for this fiscal year, Xcel Energy's diluted EPS payout ratio is slated to be in the highly sustainable range of 60-62%.

Despite COVID-19 headwinds, Xcel Energy's YTD revenues are down only 1.7% YoY while Xcel Energy's diluted EPS are up 8.2% YoY YTD.

Unfortunately, shares of Xcel Energy are trading at a 17% premium to fair value.

Between its 2.6% yield, 6.0-7.0% annual earnings growth potential, and 1.6% annual valuation multiple contraction, shares of Xcel Energy are positioned to fall short of my 10% annual total return requirement.

At a 3.1% yield and the same 6.0-7.0% annual earnings growth potential, shares of Xcel Energy would be poised to meet my 10% annual total return requirement.

I will be examining yet another publicly traded utility because of the fact that utilities provide essential services to their consumers, and as a result, are able to endure even the most difficult economic conditions.

One example of a well run utility that has managed to produce strong operating results in a tough operating environment is Xcel Energy (XEL).

I will be revisiting Xcel Energy for the first time since I initiated coverage in the stock in August 2019.

I'll be reexamining Xcel Energy's dividend safety and growth potential, discussing recent operating results and Xcel Energy's risk profile, evaluating Xcel Energy's stock price relative to what I believe is its fair value by using two valuation metrics and a valuation model, which is what led me to reiterate my hold rating on shares of Xcel Energy at this time.

Xcel Energy's Dividend Remains Safe And Mid-Single Digit Annual Growth Potential Remains Intact

Xcel Energy's 2.61% yield is within the realm of reasonable given the S&P 500's current yield is 1.59%, and the market is pricing in the safety of Xcel Energy's dividend from that standpoint alone, but I will nevertheless be weighing Xcel Energy's YTD diluted EPS against its dividends that have been paid out YTD as another measure of Xcel Energy's dividend safety.

As I have noted in my past several articles on utilities, I will be ignoring the FCF payout ratio due to the fact that utilities are constantly investing to expand their rate base, which often causes FCF payout ratios to be dramatically skewed from one year to the next.

As long as a utility is able to secure allowed rates of return from regulators that are higher than their cost of capital, shareholder wealth will be created, and that is what really matters.

Through the first nine months of this fiscal year, Xcel Energy has generated $2.25 in diluted EPS (per page 3 of Xcel Energy's Q3 2020 earnings press release) against $1.265 in dividends/share paid out during that time, for a diluted EPS payout ratio of 56.2%.

And as if the above diluted EPS payout ratio isn't impressive enough, it marks a slight improvement over the 57.2% diluted EPS payout ratio through the first nine months of last fiscal year.

When considering the stability of the dividend even last fiscal year and the continued improvement in Xcel Energy's diluted EPS payout ratio, I believe that Xcel Energy's dividend remains rather safe going forward.

Since Yahoo Finance is forecasting that Xcel Energy will deliver annual earnings growth of 6.2% over the next 5 years and the stock's payout ratios are positioned to slightly expand over the long term, I believe that dividend growth over the long term will slightly exceed earnings growth.

Therefore, I believe that a 6.5% annual dividend growth rate over the long term is a reasonable expectation for shares of Xcel Energy.

Xcel Energy Is Delivering Strong Operating Results In A Tough Operating Environment

Image Source: Xcel Energy Third Quarter 2020 Earnings Report Presentation

In light of the financial difficulties that many businesses have endured this year as a result of COVID-19, I believe that Xcel Energy has delivered strong results for both the third quarter and this fiscal year overall.

Xcel Energy posted 5.6% YoY growth in its revenue, from $3.013 billion in Q3 2019 to $3.182 billion in Q3 2020 (as indicated on page 3 of Xcel Energy's Q3 2020 earnings press release).

This growth in revenue during the third quarter was primarily driven by an increase in Electric segment revenues from $2.771 billion in Q3 2019 to $2.941 billion in Q3 2020, which was only slightly offset by a decrease in Natural Gas segment revenues from $222 million in Q3 2019 to $219 million in Q3 2020 (as per page 3 of Xcel Energy's Q3 2020 earnings press release).

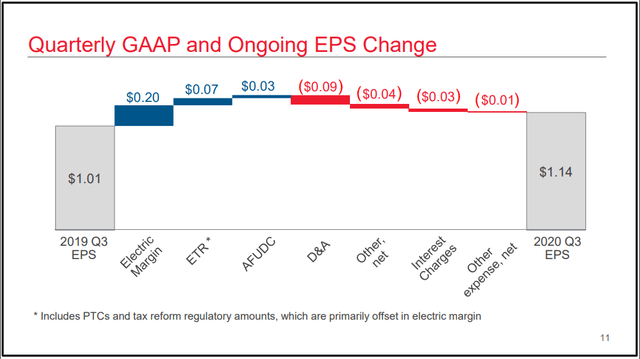

Moving to diluted EPS, Xcel Energy was able to post $1.14 in diluted EPS during Q3 2020, which represents a 12.9% YoY increase from the $1.01 in diluted EPS generated in Q3 2019, as noted by CFO Brian Van Abel's opening remarks during Xcel Energy's Q3 2020 earnings call.

Xcel Energy's higher Electric segment margins driven by riders and rate outcomes accounted for a $0.20 increase in diluted EPS, a lower effective tax rate generated an additional $0.07 in diluted EPS, and allowance for funds used during construction resulted in a $0.03 increase in diluted EPS, as per CFO Brian Van Abel's opening remarks in Xcel Energy's Q3 2020 earnings call.

On the other hand, depreciation and amortization reduced diluted EPS by $0.09, other items lowered diluted EPS by $0.04, interest charges reduced diluted EPS by $0.03, and other expenses lowered diluted EPS by $0.01, as indicated by CFO Brian Van Abel's opening remarks during Xcel Energy's Q3 2020 earnings call.

Xcel Energy's revenues have declined 1.7% YoY from $8.731 billion in the nine months ended last fiscal year to $8.579 billion in the nine months ended this fiscal year (as noted on page 3 of Xcel Energy's Q3 2020 earnings press release).

Xcel Energy's 1.2% increase in YTD Electric segment revenues ($7.345 billion in the nine months ended last fiscal year versus $7.430 billion in the nine months ended this fiscal year per page 3 of Xcel Energy's Q3 2020 earnings press release) was slightly more than offset by the 18.3% decrease in YTD Natural Gas segment revenues ($1.324 billion in the nine months ended last fiscal year versus $1.082 billion in the nine months ended this fiscal year according to page 3 of Xcel Energy's Q3 2020 earnings press release).

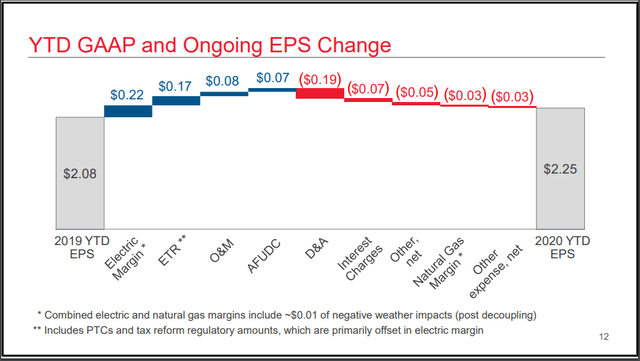

Xcel Energy has delivered an impressive 8.2% YoY growth rate in its diluted EPS, from $2.08 through the nine months ended last fiscal year to $2.25 in the nine months ended this fiscal year, which in addition to the same factors we discussed above for the third quarter, was helped by an $0.08 decrease in O&M and offset by a $0.03 decline in Natural Gas segment margin (as per page 3 of Xcel Energy's Q3 2020 earnings press release).

Image Source: Xcel Energy Third Quarter 2020 Earnings Report Presentation

Image Source: Xcel Energy Third Quarter 2020 Earnings Report Presentation

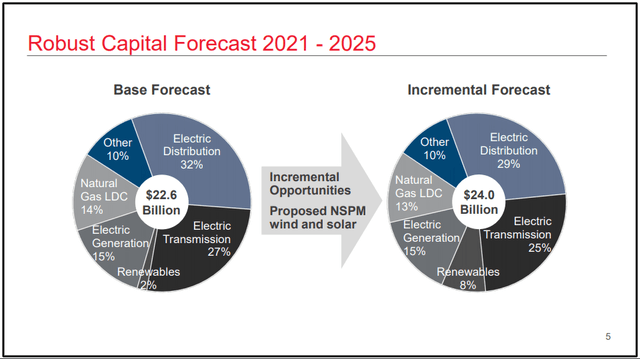

In addition to Xcel Energy's strong operating results YTD, the company's capital spending forecast for the next 5 years produces a high likelihood that the company will be able to meet its long-term 5-7% annual earnings growth target.

Xcel Energy is planning to spend at least $22.6 billion in capital over the next 5 years on projects that are spread across Electric Distribution, Electric Transmission, Electric Generation, Natural Gas LDC, Other, and Renewables projects, with a potential $1.4 billion in additional capital spending on proposed NSPM wind and solar projects, as indicated by the above slide.

Image Source: Xcel Energy Third Quarter 2020 Earnings Report Presentation

Image Source: Xcel Energy Third Quarter 2020 Earnings Report Presentation

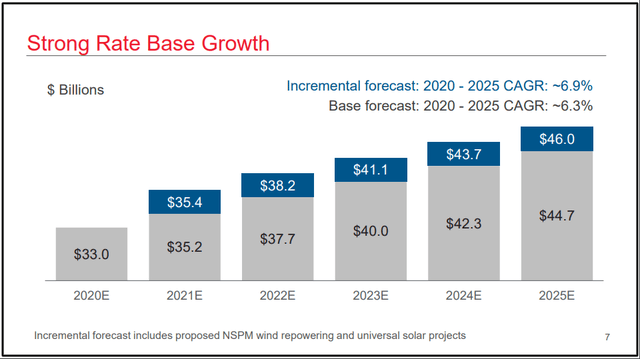

Xcel Energy is poised to deliver a 6.3% to 6.9% CAGR in its rate base over the next 5 years, taking the rate base from ~$33.0 billion at the end of 2020 to upwards of $46.0 billion at the end of 2025, as illustrated by the above slide.

This would result in similar annual earnings growth over that time span, assuming even flat utility rates across its markets.

Image Source: Xcel Energy Third Quarter 2020 Earnings Report Presentation

Image Source: Xcel Energy Third Quarter 2020 Earnings Report Presentation

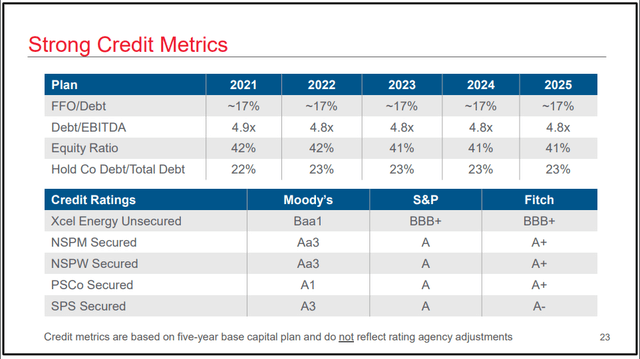

Rounding out my discussion of Xcel Energy's operating fundamentals, Xcel Energy's balance sheet is in a strong position.

As part of Xcel Energy's 5 year base capital plan, the company is forecasting a steady 17% FFO/debt metric as shown by the above slide, which reinforces the notion that Xcel Energy is able to adequately cover its debt with funds from operations.

Through the first nine months of this fiscal year, Xcel Energy's interest coverage ratio came in at just below 2 (as per page 3 of Xcel Energy's Q3 2020 earnings press release), which is respectable for a utility given the reliance on debt to fund capital projects and the overall stability of a utility's earnings regardless of economic conditions.

When taking the above analysis of Xcel Energy's balance sheet in consideration, Xcel Energy enjoys investment grade Baa1, BBB+, and BBB+ credit ratings from Moody's, S&P, and Fitch, respectively.

Factoring in Xcel Energy's strong operating results this fiscal year, Xcel Energy's $22.6-$24.0 billion capital spending plan over the next 5 years, and Xcel Energy's respectable balance sheet, I believe that shares of Xcel Energy could be a great long-term investment if acquired at or below fair value.

Risks To Consider

Although Xcel Energy is a utility and that itself comes with a certain level of certainty, it is essential as an investor to occasionally monitor the risk profile of investments, and Xcel Energy is no exception, which is why I will be outlining risks from both Xcel Energy's previous 10-K and its most recent 10-Q.

As it relates to the ongoing COVID-19 pandemic, Xcel Energy faces a set of risks, including the possibility of disruptions to its operations, no guarantee that the company will be able to recover higher costs that are associated with doing business during COVID-19, and uncertainty over future liquidity, financial conditions, and results of operations (page 34 of Xcel Energy's most recent 10-Q).

If Xcel Energy's supply chain is interrupted as a result of the COVID-19 pandemic and its accompanying restrictions in Xcel Energy's service areas or Xcel Energy's facilities are impacted by an outbreak of COVID-19, this could result in an inability on the part of Xcel Energy to meet the demand of its customers, which would harm Xcel Energy's short-term financial results and also result in some level of damage to the company's reputation.

Given that Xcel Energy's expenses are higher as a result of the COVID-19 pandemic and that the ultimate duration of the pandemic is still unknown at this time, it is worth monitoring the extent to which Xcel Energy will be allowed by regulators to recover these costs as this could materially impact Xcel Energy's financial results in the near-term.

Moreover, the uncertainty of the ultimate duration of the COVID-19 pandemic also precludes Xcel Energy from being able to definitively state whether the COVID-19 pandemic will have a significant impact on the company's financial results or liquidity in the quarters ahead.

The first non-COVID-19 related risk facing Xcel Energy is that as a utility, Xcel Energy is subject to long-term planning and project risks (pages 15-16 of Xcel Energy's previous 10-K).

Because of the rapid technological advancements in energy efficiency, wider adoption of renewable generation, and so forth, there is the possibility that Xcel Energy may be unable to viably operate some of its projects in the future, which could lead to excess transmission and generation resources, as well as stranded costs if Xcel Energy is unable to fully recover its costs and investments.

As a utility, Xcel Energy is also exposed to the risks of natural gas and electric transmission and distribution, as well as its nuclear generation via its subsidiary, NSP Minnesota (pages 15 & 16 of Xcel Energy's previous 10-K).

As one would imagine, any leaks, explosions, or incidents at any of Xcel Energy's facilities would impact Xcel Energy in a variety of ways.

Should any of the above situations play out, Xcel Energy may find that its insurance doesn't fully cover the costs, which could materially impact the company's liquidity and financial results due to legal settlements, fines/penalties, and increased future compliance costs.

Image Source: Xcel Energy Third Quarter 2020 Earnings Report Presentation

Image Source: Xcel Energy Third Quarter 2020 Earnings Report Presentation

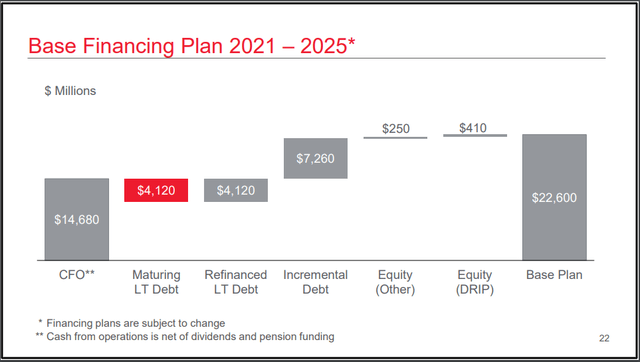

Xcel Energy is also dependent on the capital markets to issue debt and equity in order to fund its capital projects (page 17 of Xcel Energy's previous 10-K).

While the above slide illustrates Xcel Energy's forecasts that the bulk of its $22.6 billion in base capital spending over the next 5 years will be funded by cash from operations, net of dividends and pension funding, Xcel Energy will also be reliant on refinancing its maturing long-term debt, as well as the issuance of additional debt and equity.

If Xcel Energy for any reason isn't able to issue debt or equity at reasonable terms in the years ahead, this could lead to challenges in funding capital projects, which would likely weigh on the company's long-term growth prospects.

While I have discussed several key risks associated with an investment in Xcel Energy, I haven't discussed all of Xcel Energy's risks. For a more complete discussion of Xcel Energy's risk profile, I would refer interested readers to pages 15-20 of Xcel Energy's previous 10-K, page 34 of Xcel Energy's most recent 10-Q, and my previous article on the stock.

A Wonderful Business Trading At A Premium

Even though Xcel Energy is a well run utility, it remains important for both current and prospective shareholders to avoid overpaying for shares of Xcel Energy to minimize the risks of a lower starting yield, valuation multiple contraction, and lower annual total return potential.

With the above in mind, I will be utilizing two valuation metrics and a valuation model to arrive at the fair value of Xcel Energy's shares.

The first valuation metric that I'll use to determine the fair value of shares of Xcel Energy is the TTM dividend yield to 13 year median TTM yield.

According to Gurufocus, Xcel Energy's TTM yield of 2.58% is significantly lower than its 13 year median TTM yield of 3.54%.

Assuming a reversion in Xcel Energy's yield to 2.75% and a fair value of $61.64 a share (which I believe appropriately factors in Xcel Energy's risk profile and the interest rate environment that I believe will persist for the foreseeable future), Xcel Energy's shares are trading at a 7.1% premium to fair value and pose 6.6% downside from the current price of $65.99 a share (as of December 5, 2020).

The next valuation metric that I will utilize to estimate the fair value of shares of Xcel Energy is the current Shiller P/E ratio to 13 year median Shiller P/E ratio, which factors in the cyclical nature of corporate earnings.

As per Gurufocus, Xcel Energy's current Shiller P/E ratio of 28.34 is much higher than the 13 year median Shiller P/E ratio of 23.74.

Factoring in a reversion to a Shiller P/E ratio of 25.00 and a fair value of $58.00 a share, Xcel Energy's shares are priced at a 13.8% premium to fair value and pose 12.1% capital depreciation from the current share price.

Image Source: Investopedia

Image Source: Investopedia

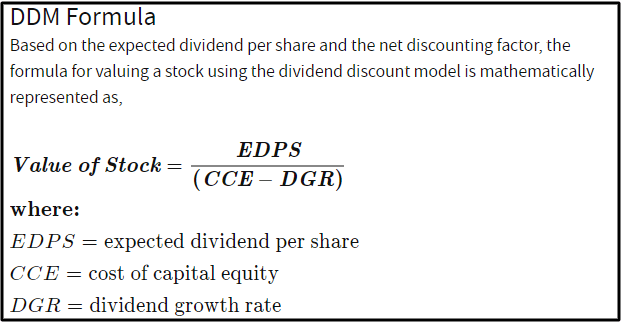

The valuation model that I'll be using to assign a fair value to shares of Xcel Energy is the dividend discount model or DDM, which consists of 3 inputs.

The first input into the DDM is the expected dividend/share, which is simply the annualized dividend/share. Xcel Energy's annualized dividend/share is likely going to be raised 6-7% in February, but for the sake of conservatism, I will be using the current $1.72 annualized dividend/share as the first input into the DDM.

The next input into the DDM is the cost of capital equity, which is another term for the annualized total return rate that an investor requires on their investments. Although this required return rate typically differs from one investor to another, I require a 10% annualized total return rate because I believe that such returns are an adequate reward for the time and effort that I spend researching investment opportunities and periodically monitoring my investments.

The final input into the DDM is the annualized dividend growth rate over the long term or the DGR.

While the first two inputs into the DDM require only data retrieval to arrive at the annualized dividend/share and subjectivity to set a required annualized total return rate, accurately predicting the long-term DGR requires investors to weigh numerous factors, including a stock's payout ratios (and whether those payout ratios are positioned to remain the same, expand, or contract over the long term), annual earnings growth potential, the strength of a stock's balance sheet, and industry fundamentals.

When I factor in that Xcel Energy's diluted EPS payout ratio is positioned to expand over the long term and that Xcel Energy is primed for 6.0-7.0% annual earnings growth over the long term, I believe that a 6.5% annual dividend growth rate over the long term is a reasonable expectation for shares of Xcel Energy.

Plugging the above inputs into the DDM, I arrive at a fair value of $49.14 a share, which indicates that Xcel Energy's shares are trading at a 34.3% premium to fair value and pose 25.5% downside from the current share price.

Averaging the three fair values above, I compute a fair value of $56.26 a share, which implies that shares of Xcel Energy are priced at a 17.3% premium to fair value and pose 14.7% capital depreciation from the current share price.

Summary: Xcel Energy Remains A Hold Until The Mid-$50s

Having raised its dividend for 17 consecutive years, Xcel Energy is firmly established as a Dividend Contender, which also maintains a very comfortable diluted EPS dividend payout ratio of around 60%.

Given that Xcel Energy has experienced only a minimal YoY decline in its YTD revenues this fiscal year and the company has posted 8.2% YTD YoY growth in its diluted EPS, I believe that Xcel Energy has many years of 6-7% dividend growth left in the tank.

Xcel Energy also maintains a respectable balance sheet, with a YTD interest coverage ratio of just under 2 and investment grade credit ratings from the major ratings agencies.

With that said, Xcel Energy's shares are trading at a 17% premium to fair value.

Between its 2.6% yield, 6.0-7.0% annual earnings growth potential, and 1.6% annual valuation multiple contraction, shares of Xcel Energy are positioned to fall short of my 10% annual total return requirement.

At my estimated fair value of $56/share or a 3.1% yield, and the same 6-7% annual earnings growth, Xcel Energy's shares would be poised to meet my 10% annual total return requirement over the next decade.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.