Aaron's Company And Its Post Spin-Off Strategy Couldn't Be More Different Than Progressive's

Investors in "old AAN" received one share of "new AAN' and two shares of PROG Holdings in the recent spinoff.

PROG Holdings has performed slightly better than new Aaron's Company since the split, and there might still be a tough short-term environment ahead for Aaron's.

The newest valuation estimates for the two newly separated companies based on adjusted EBITDA make their current multiples seem reasonable, but the future outlook on both couldn't be more different.

In the latest press release by The Aaron's Company Inc., dated 12/1/20, the company reported that it has completed its spin-off and will trade on the NYSE under the familiar ticker AAN.

Followers of this story might recall how I analyzed the spinoff back in August and concluded that investors who owned the previous parent company might want to sell the stock pre-split and reinvest the funds into either Progressive or Aaron's post split.

Part of this reasoning was the findings of Joel Greenblatt's excellent book You Can Be a Stock Market Genius, wherein he noted that the short-term stock returns immediately following a spin-off tended to be really strong in many cases. Wall Street can view a transaction like this to be value accretive and investors usually pile into the stock with the better growth story. But also, a big component of this reasoning is that both stocks in the post-spinoff will tend to sell-off as investors shed the business they least are interested, which creates the buying opportunity.

However, the bigger reasoning for my recommendation was that it's better to wait on more information before choosing whether an investor wants one of the two separated companies, or both.

Important Details About the Split

Going back to the details of the press release, shareholders of the "old AAN" received one share of the "new AAN" for every two shares held in "old AAN." Investors also received two shares of PROG Holdings (NYSE:PRG), which holds the Progressive Leasing business.

Because the terms of this entire transaction are confusing, I'll do my best to summarize. The "old AAN" was named Aaron's Inc., the company we loved and hopefully profited from (I was a previous long-term shareholder and pocketed a 60% gain, so I have my affinities).

Now, the "old AAN" was spun off ("Spin Co") and its name changed to Aaron's Company Inc. (I'm calling it "new AAN" because it continues to trade with the familiar AAN ticker).

What's confusing is that the remaining company ("Remainco") changed its name to PROG Holdings Inc. and trades with a new ticker PRG.

Somewhere in there you had Aaron's Inc. changed to Aaron's Holdings Company Inc. and now you have it directed into Aaron's Company Inc. and PROG Holdings Inc.

So the "remainco" is really the company changing its name and taking on the Progressive Leasing business - that's just how the company decided to identify everything, and I hope it's clear now.

For this article, I'll continue to use "old AAN" to refer to Aaron's Inc. pre-split and "new AAN" to refer to Aaron's Company, and just use PRG or PROG Holdings to refer to "Remainco."

As a recap on the generalities of the split:

- "Progressive"

- Includes Progressive business segment and Vive Financial.

- Will be led by pre-transaction CFO Steve Michaels.

- Current president of the Progressive business Blake Wakefield will remain as president of the new Progressive company.

- Current chairman of Aaron's Ray Robinson will serve as Chairman of Progressive.

- "Aaron's"

- Includes Aarons.com and Woodhaven Furniture Industries.

- Will be continued to be led by pre-transaction president and CEO John Robinson, who will also serve as Chairman of new "Aaron's."

Before diving into the juicy specifics, a few charts to assess the fallout of this, post-split:

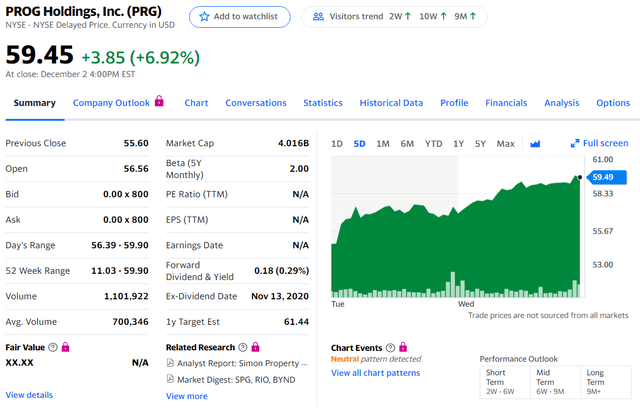

And the chart of the parent, PROG Holdings (PRG), which started trading on December 1st, 2020:

And the chart of the parent, PROG Holdings (PRG), which started trading on December 1st, 2020:

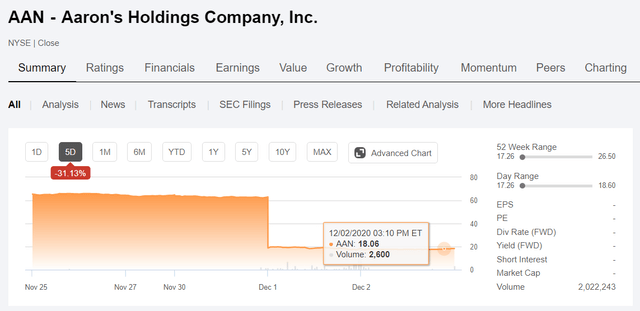

That means that pre-split, we had "old AAN" trading in the $62-$63 range, with the combined companies now trading around ($60 x 2 shares) + ($18 x 1 share) versus the ($62-$63 x 2 shares) of the pre-split.

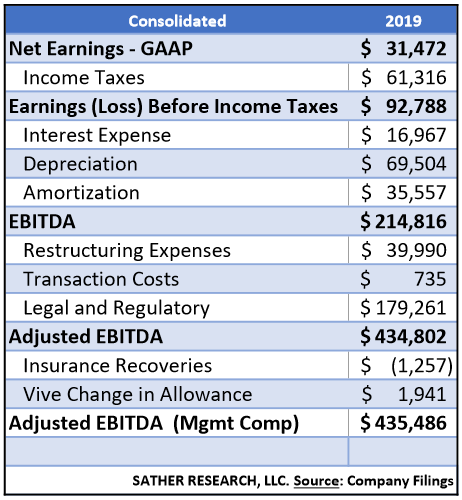

Doing a rough post-split relative valuation analysis, using the Prospectus filed by PROG Holdings on 5/8/20, we can calculate the following:

- Progressive Leasing

- Adjusted EBITDA = $269,250

- Aaron's Business

- Adjusted EBITDA = $164,776

- Vive

- Adjusted EBITDA = -$2,801

PRG (Leasing + Vive)

Price to Adj EBITDA = $4,016,000 / ($269,250 - $2,801)

Price to Adj EBITDA = 15.07

AAN (new AAN)

Price to Adj EBITDA = $1,220,475 / $164,776

Price to Adj EBITDA = 7.4

Note that we are examining Adjusted EBITDA because that is the metric used for management incentive purposes, as the reason behind the low EBITDA for all 3 businesses are due to Legal and Regulatory Expenses, Restructuring Expenses, Transition costs, and other miscellaneous. Also, I'm using price to EBITDA rather than the typical EV/EBITDA due to the limited balance sheet information per reported business segment.

In total, the figures for the consolidated (3) businesses for the fiscal year 2019:

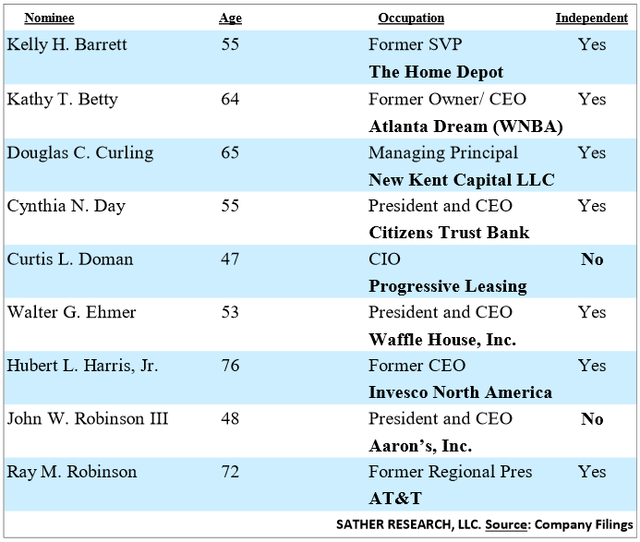

Board of Directors - Joint Proxy Statement

An overview of the previous board of directors again from the prospectus, in which I've abbreviated some of the terms for an easier read:

A healthy balance of independent directors, with a broad range of experiences (between finance, retail, restaurants, and even the WNBA).

It should provide long time shareholders with optimism that this tax-free transaction was indeed value accretive and of benefit. This is integral for investors who need to evaluate the previous competence and general decision making of leadership particularly following a significant business transaction (I highlighted the board of directors for Disney and Aaron's here).

Let's get a taste for management in place, with a few general comments on how investors can consider their respective experiences into the new companies. Firstly, Douglas Lindsay will become the CEO for Aaron's Company, with Steve Olsen as President and Kelly Wall as CFO.

Douglas A. Lindsay (49) | President of Aaron’s Business since February 2016. Prior to joining the Company, Mr. Lindsay served as the Executive Vice President and Chief Operating Officer at ACE Cash Express from February 2012 to January 2016. Previously Mr. Lindsay also served as the Executive Vice President and Chief Financial Officer from June 2007 to February 2012 and the Vice President, Finance and Treasurer from February 2005 to June 2007 for ACE Cash Express. |

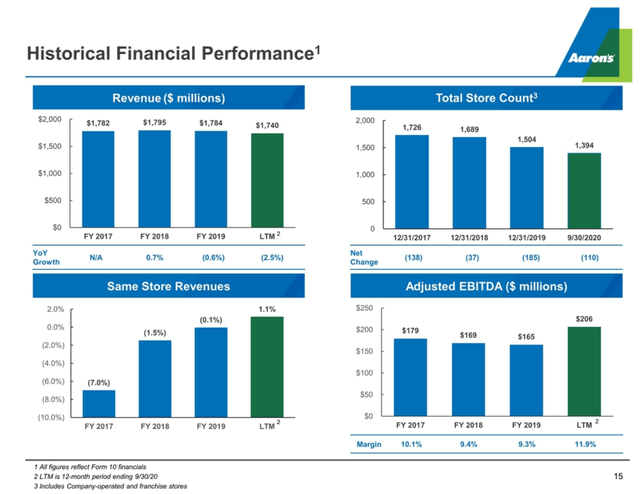

With Douglas Lindsay formerly serving as the president of Aaron's Business group and now becoming CEO, the direction of this business is likely to stay consistent with "old AAN" due to this continuation of leadership, but we should note that the outlook for 2021-2025 includes an initial decline in revenues as the store count will be reduced by 20%-30%. Revenue from same-store sales are expected to increase, and so the short-term decline is expected to be followed up by low single-digit growth to the top line.

Margin for adjusted EBITDA is expected to improve, an obvious benefit of closing down less efficient stores, and management projects that margin expansion to fall in the 11.5%-12.5% range.

Free cash flow is expected at $60M-$90M per year, with modest capital expenditures on the horizon. The strategic moves for the Aaron's Company, closing less productive stores, also has the additional benefit of lowering working capital - another component of free cash flow.

Keep in mind the previous performance of the Aaron's retail business, as these trends are expected to continue according to management's outlook.

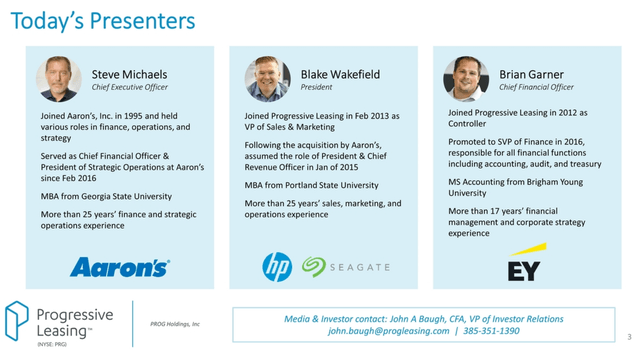

Progressive Leasing Leadership

Former CFO Steve Michaels will head up the new PRG, with Blake Wakefield as President and Brian Garner as CFO. Steve Michaels, like Douglas Lindsey, was an executive who was not on the board for "old AAN". His background was reported as:

| Name (Age) | Position with the Company and Principal OccupationDuring the Past Five Years | |

Steven A. Michaels (48) | Chief Financial Officer and President of Strategic Operations since February 2016. Mr. Michaels previously served as President from April 2014 until February 2016, Vice President Strategic Planning & Business Development from 2013 until April 2014, Vice President, Finance from 2012 until April 2014 and Vice President, Finance, Aaron’s Sales & Lease Ownership Division from 2008 until 2011. |

A summary of these leaders was outlined in a recent presentation (8-K):

The company on its own boasts exciting growth prospects, and the performance from this executive team will be interesting to watch. Some of Progressive's biggest retail partners include the likes of Best Buy, Lowe's, and Big Lots, and with 5-year revenue CAGR of about 21.7% the business has been growing like a weed.

The company on its own boasts exciting growth prospects, and the performance from this executive team will be interesting to watch. Some of Progressive's biggest retail partners include the likes of Best Buy, Lowe's, and Big Lots, and with 5-year revenue CAGR of about 21.7% the business has been growing like a weed.

The Verdict - Investor Takeaway

To recap, the distribution of shares post spin-off is best summarized as this (from the 8-K filed 11/18/20 for PROG Holdings):

A shareholder of record holding two AAN shares will receive two shares of PRG (Remainco) and one share of AAN (Spinco) in a stock distribution.

You should've seen this reflected in your brokerage account if you continued to hold through the transaction.

Summarizing the movements in the stock price, an investor would've earned a 6% return holding through the split as the price PROG took off shortly after.

However, I still believe that the overall thesis behind Greenblatt's observations on spinoffs will likely still be intact. A short-term period of tough price momentum might be in store especially for Spinco ("new AAN"), as Progressive Leasing has long held the high growth business segment. For investors certain they want to get rid of "new AAN," this is probably the ideal time to do it.

I'll cover a new analysis on PROG Holdings (PRG) in the months to come, so be sure you're subscribed to my profile to get an instant update on it.

***If you'd like more deep dives into company filings like this one, please do consider Following my profile with email alerts. To access the 52 metrics that I consider essential for investors, check out my Seeking Alpha blog.***

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.