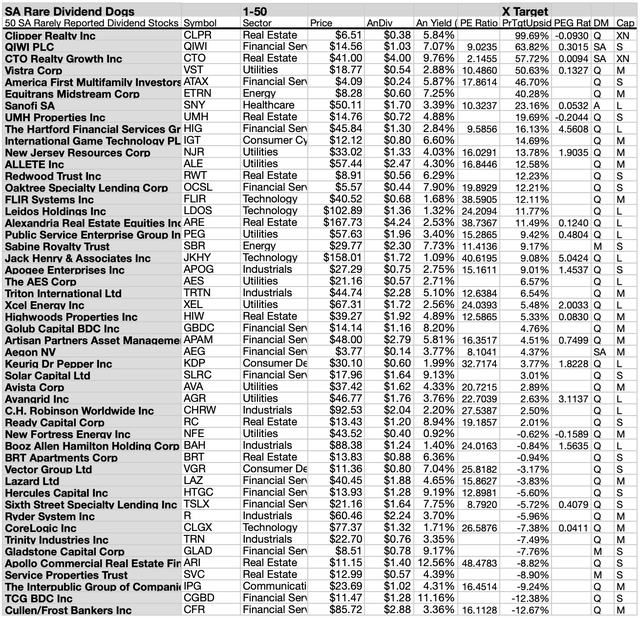

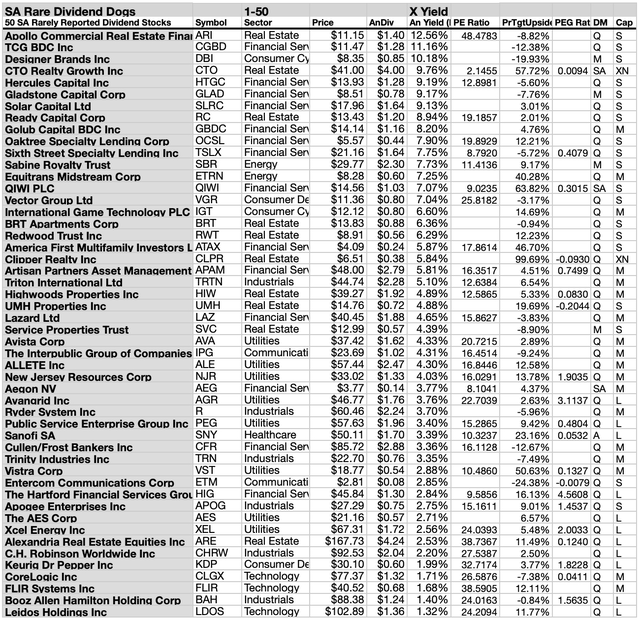

Seeking Alpha lists stocks monthly that are "undercovered" by contributors. December's list numbered in the thousands and included both equities and funds. These 56 were among the rarest equity dividend-payers.

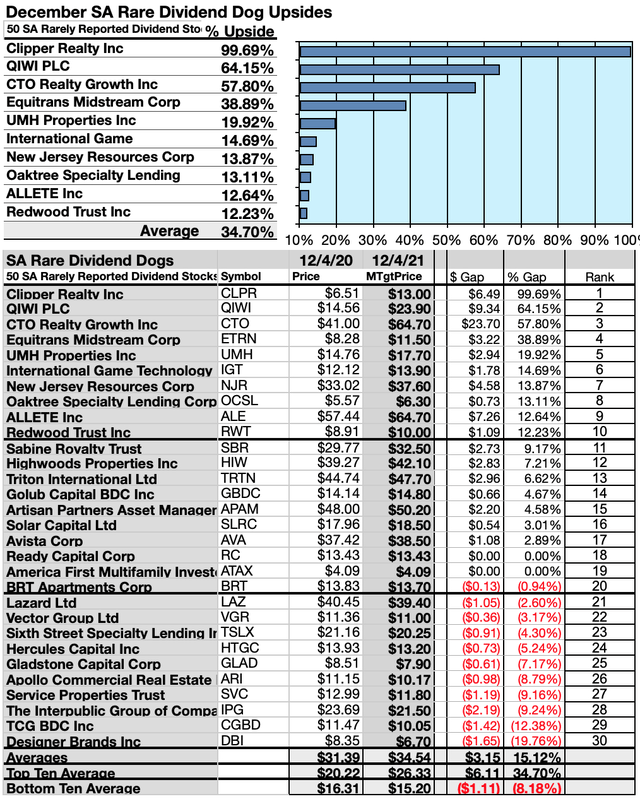

Top-ten SA rare dividend-dogs boasted net-gains from 15.94%-104.53% from ALE, NJR, RWT, OCSL, IGT, UMH, ETRN, CTO, QIWI, and CLPR. Real estate, financial, and utilities led the top-ten gainers.

As of 12/4/20 the top ten ranged 7.9%-12.56% by annual yield and ranged 14.7%-99.69% per broker-estimated price-target upsides.

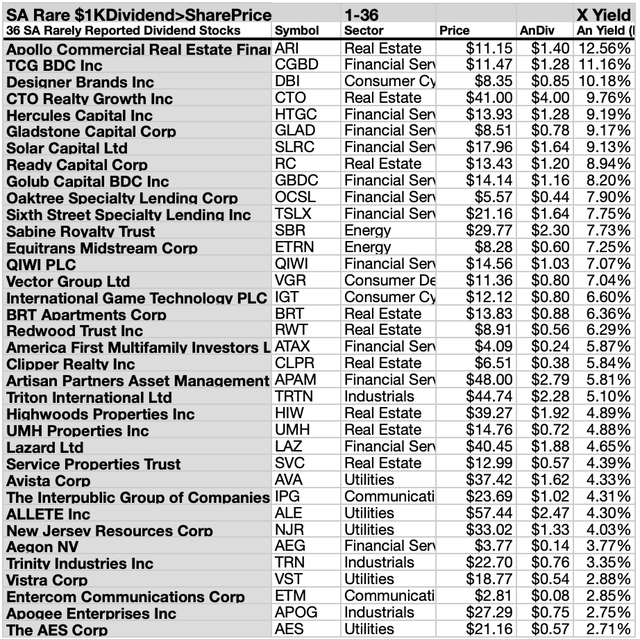

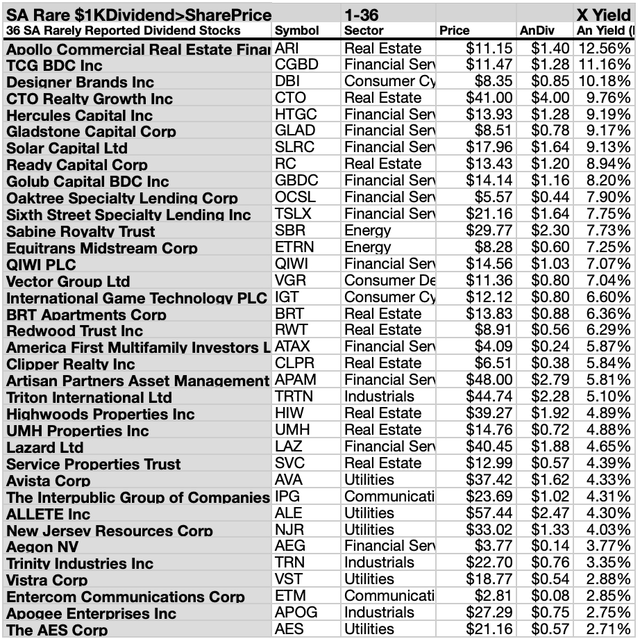

Prices of 36 of these 56 SA Rare Dividend Dogs for December (listed by yield) made the possibility of owning productive dividend shares from this collection more viable for first-time investors.

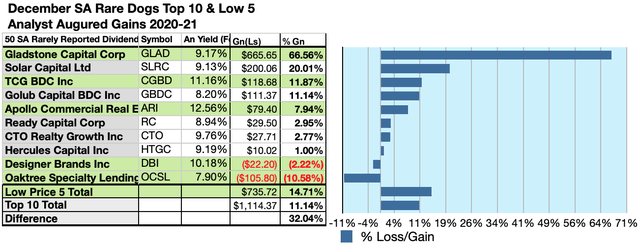

$5k invested in the lowest-priced five in this collection of top-yield ten dividend-boosted dogs showed 32.04% more net-gain than that from $5k invested in all ten. The little (lower-priced) rare dividend dogs ruled this December pack.

Foreword

Any collection of stocks is more clearly understood when subjected to yield-based (dog catcher) analysis, these SA rarely-reported batches are perfect for the Arnold dog catcher process. Here is your December data from Seeking-Alpha for 56 dividend-paying stocks as supplemented by analysis powered by YCharts.

Incidentally, 36 of the 56 December rarely reported dividend stocks on Seeking Alpha met or exceeded the dog catcher buy criterion wherein dividends from $1k invested produce income greater than the single share price.

Source: Seeking Alpha/YCharts

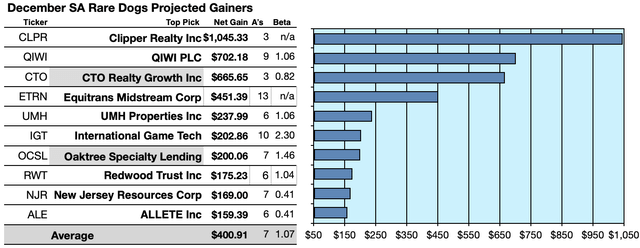

Actionable Conclusions (1-10): Analysts Estimated 16.19% To 138.12% Net Gains For Ten Top SA Rarely-Reported Dividend Stocks For December

Two of ten top stocks by yield were among the top-ten gainers for the coming year based on analyst 1-year target prices. (They are tinted gray in the chart below). Thus, the yield-based forecast for these boosted dividend dogs was deemed by Wall St. Wizards as 20% accurate.

Source: Seeking Alpha/YCharts

Projections were based on estimated dividends from $1000 invested in each of the highest yielding stocks and their aggregate one-year analyst median target-prices, as reported by YCharts. Note: one-year target-prices by lone analysts were not applied. Ten probable profit-generating trades projected to December 4, 2021 were:

Clipper Realty Inc (CLPR) was projected to net $1,045.33, based on the median of estimates from three analysts, plus dividends, less broker fees. A Beta number was not available for CLPR.

QIWI OLC (QIWI) was projected to net $702.18, based on the median of target estimates from nine analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 6% more than the market as a whole.

CTO Realty Growth Inc (CTO) was projected to net $665.65, based on the median of target estimates from three analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 18% under the market as a whole.

Equitrans Midstream Corp (ETRN) was projected to net $451.39, based on the median of target price estimates from thrteen analysts, plus annual dividend, less broker fees. A Beta number was not available for ETRN.

UMH Properties Inc (UMH) was projected to net $237.99, based on the median of target price estimates from six analysts, plus annual dividend, less broker fees. The Beta number showed this estimate subject to risk/volatility 6% over the market as a whole.

International Game Technology PLC (IGT) was projected to net $202.86, based on the median of target price estimates from ten analysts plus annual dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 130% greater than the market as a whole.

Oaktree Specialty Lending (OCSL) was projected to net $200.06, based on dividends, plus the median of target price estimates from seven analysts, less broker fees. The Beta number showed this estimate subject to risk 46% over the market as a whole.

Redwood Trust Inc (RWT) was projected to net $175.23, based on dividends plus the median of target price estimates from six analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 4% more than the market as a whole.

New Jersey Resources Corp (NJR) was projected to net $169.00 based on dividends plus the median of target price estimates from seven analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 59% less than the market as a whole.

ALLETE Inc (ALE) was projected to net $159.39, based on dividends plus the median of target price estimates from six analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 59% less than the market as a whole.

The average net gain in dividend and price was estimated at 40.09% on $10k invested as $1k in each of these ten stocks. These gain estimates were subject to average risk/volatility 7% more than the market as a whole.

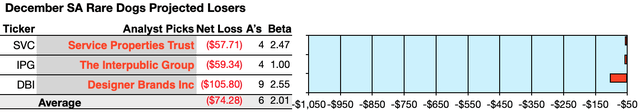

Actionable Conclusion (11): (Bear Alert) Analysts Predicted Three SA Rare Dividend Stocks To Average A 7.43% Loss By December, 2021

The probable losing trades revealed by Y-Charts to 2021 were:

Source: SeekingAlpha/YCharts

Service Properties Trust (SVC) projected a loss of $57.71 based on dividend and a median of the target price estimates from four analysts including broker fees. The Beta number showed this estimate subject to risk/volatility 147% greater than the market as a whole.

The Interpublic Group of Companies Inc (IPG) projected a loss of $59.34 based on dividend and a median of the target price estimates from four analysts including broker fees. The Beta number showed this estimate subject to risk/volatility equal to the market as a whole.

Designer Brands Inc (DBI) projected a loss of $105.80 based on dividend and a median of the target price estimates from nine analysts including broker fees. The Beta number showed this estimate subject to risk/volatility 155% more than the market as a whole.

The average net loss in dividend and price was estimated at 7.43% on $3k invested as $1k in each of these three stocks. These loss estimates were subject to average risk/volatility 101% above the market as a whole.

Source: outsideonline.com

The Dividend Dogs Rule

Stocks earned the "dog" moniker by exhibiting three traits: (1) paying reliable, repeating dividends, (2) their prices fell to where (3) yield (dividend/price) grew higher than their peers. Thus, the highest yielding stocks in any collection became known as "dogs." More precisely, these are, in fact, best called, "underdogs".

34 SA Rare Dividend Stocks Showed Positive Broker-Estimated Target Gains

Source: Seeking Alpha/YCharts

50 SA Rare Dividend Stocks By Yield

Source: Seeking Alpha/YChartsSource: YCharts.com

Actionable Conclusions (12-21): SA Rare Dividend Stocks By Yield

Top ten SA rare dividend stocks reported in December by yield represented three sectors.

Three real estate representatives placed first, fourth, and eighth: Apollo Commercial Real Estate Finance Inc (ARI) [1], CTO Realty Growth Inc (CTO) [4], and Ready Capital Corp (PBT) [8].

Six representatives from the financial services sectorplaced second, fifth though seventh, ninth and tenth. They were, TGC BDC inc (CGBD) [2], Hercules Capital Inc (HTGC) [5], Gladstone Capital Corp (GLAD) [6], Solar Capital Inc (SLRC), Golub Capital BDC Inc (GBDC) [9], and Oaktree Lending Corp (OCSL) [10].

One consumer cyclical sector representative placed third, Designer Brands Inc (DBI) [3] to complete these top ten December SA rare dividend stocks by yield.

Actionable Conclusions: (22-31) Top Ten December SA Rare Dividend Stocks Showed 12.23% To 99.69% Upsides With (31) Eleven Down-Siders Detected

Source: SeekingAlpha/YCharts

To quantify top dog rankings, analyst median price target estimates provide a "market sentiment" gauge of upside potential. Added to the simple high-yield metrics, analyst median price target estimates became another tool to dig out bargains.

Analysts Forecast A 32.04% Advantage For 5 Highest Yield, Lowest Priced Of 10 Top SA Rare Dividend Stocks To 12/4/21

Ten top SA rare dividend dogs revealed 12/4/20, were culled by yield for this update. Yield (dividend/price) results provided by YCharts did the ranking.

Source: Seeking Alpha/YCharts

As noted above, top-ten SA rare dividend dogs showing the highest dividend yields represented three of eleven Morningstar sectors.

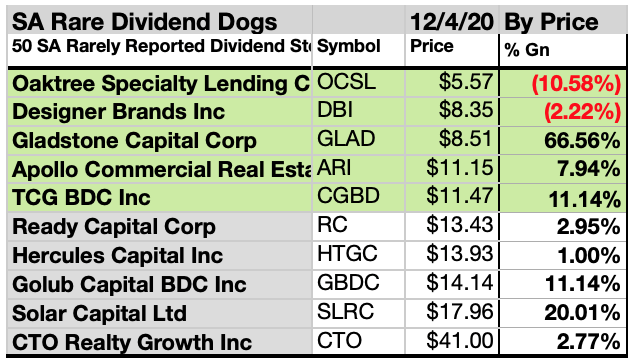

Actionable Conclusions: Analysts Predicted 5 Lowest-Priced Of The Top Ten Highest-Yield SA Rare Dividend Dogs (32) Delivering 14.71% Vs. (33) 11.44% Net Gains by All Ten Come December 4, 2021

Source: Seeking Alpha/YCharts

$5000 invested as $1k in each of the five lowest-priced stocks in the top ten SA rare dividend kennel by yield were predicted by analyst 1-year targets to deliver 32.04% more gain than $5,000 invested as $.5k in all ten. The third lowest priced selection, Gladstone Capital Corp (GLAD) was projected by broker targets to deliver the best net gain of 66.56%.

Source: Seeking Alpha/YCharts

The five lowest-priced top-yield SA rare dividend boosted dogs as of 12/4/20 were: Oaktree Specialty Lending Corp, Designer Brands Inc, Gladstone Capital Corp, Apollo Commercial Real Estate Finance Inc, and TCG BDC Inc, with prices ranging from $5.57 to $11.47.

Five higher-priced SA rare dividend dogs as of 12/4/20 were: Ready Capital Corp, Hercules Capital Inc, Golub Capital BDC Inc, Solar Capital Ltd, and CTO Realty Growth Inc, with prices ranging from $13.43 to $41.00.

The distinction between five low-priced dividend dogs and the general field of ten reflected Michael B. O'Higgins' "basic method" for beating the Dow. The scale of projected gains based on analyst targets added a unique element of "market sentiment" gauging upside potential. It provided a here-and-now equivalent of waiting a year to find out what might happen in the market. Caution is advised, since analysts are historically only 20% to 80% accurate on the direction of change and just 0% to 20% accurate on the degree of change.

The net gain/loss estimates above did not factor in any foreign or domestic tax problems resulting from distributions. Consult your tax advisor regarding the source and consequences of "dividends" from any investment.

Afterword

Here is a reprise of the essential contents of this article, in case you missed it earlier: 36 of the 56 December Seeking Alpha Rare dividend stocks met or exceeded the dog catcher buy criterion of dividends from $1k invested producing income greater than the single share price. The following listing of those stocks is repeated below.

Stocks listed above were suggested only as possible reference points for your Dividend Boosted stock purchase or sale research process. These were not recommendations.

Disclaimer: This article is for informational and educational purposes only and should not be construed to constitute investment advice. Nothing contained herein shall constitute a solicitation, recommendation or endorsement to buy or sell any security. Prices and returns on equities in this article except as noted are listed without consideration of fees, commissions, taxes, penalties, or interest payable due to purchasing, holding, or selling same.

Graphs and charts were compiled by Rydlun & Co., LLC from data derived from www.indexarb; YCharts; finance.yahoo; analyst mean target price by YCharts. Dog photo: outsideonline.com

Get The 'Safer' SA Rare Dividend Stock Story

Click here to subscribe to The Dividend Dogcatcher. Get more information and the follow-up to this article.

Catch A Dog On Facebook At 8:45 AM every NYSE trade day on Facebook/Dividend Dog Catcher, A Fredrik Arnold live video highlights a portfolio candidate in the Underdog Daily Dividend Show!

Root for the Underdog. Comment below on any stock ticker to make it eligible for my next FA follower report.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.