Sanofi Has A Promising Earnings Outlook

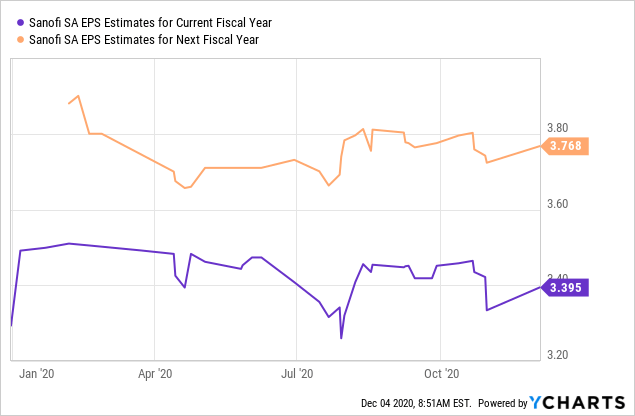

Sanofi raised its 2020 EPS guidance for the second time this year, to 7-8% in CER terms.

There are multiple medium-term drivers for earnings, including new products, sales growth for existing products and cost savings.

Downside risks include growing generic competition and execution risks from further bolt-on acquisitions.

Valuations remain undemanding, with the stock trading at 13.5 times its expected 2021 earnings.

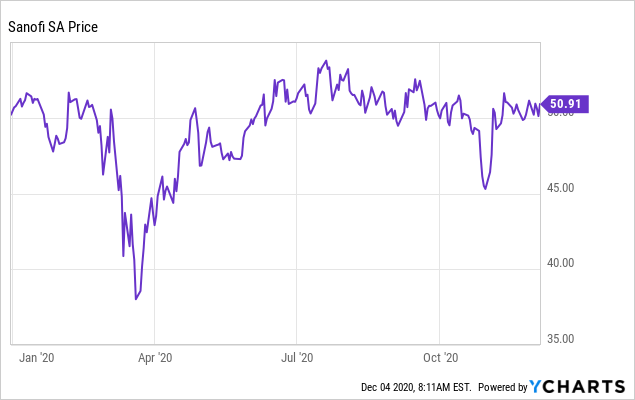

Sanofi (NASDAQ:SNY) has promising potential as the French pharmaceutical group’s strategic transformation continues to bear fruit. Buoyed by better-than-expected third-quarter results, the drugmaker raised its 2020 earnings guidance for the second time this year. It now expects earnings per share at constant exchange rates to increase by 7-8% this year, up from the 6-7% previously.

Transformation

Impressive sales growth for anti-inflammatory drug Dupixent helped to lift Sanofi’s net income in the third quarter to €2.0 billion ($2.4 billion), up 10.5% on a reported basis, more than offsetting the volume impact caused by fewer in-person physician visits due to the pandemic.

Additionally, the group’s vaccine franchise saw Q3 net sales grow 13.6% in CER terms to €2.1 billion ($2.5 billion), as it benefited from increased calls by governments for influenza vaccination as a measure to relieve pressure on already-stretched healthcare systems during winter.

Hit by patent losses for legacy blockbusters in the formerly entrenched diabetes and cardiovascular fields, Sanofi has been rapidly building up a leading specialty care biotech franchise to offset the impact of falling sales. The specialty care business now accounts for 29% of the group’s total sales, up from around 18% three years ago. Meanwhile, Sanofi maintains strong diversification, with general medicines (38%), vaccines (22%), and consumer healthcare (11%) making up the group’s remaining total sales.

Data by YCharts

Data by YCharts

Medium-term Drivers

Going forwards, Sanofi remains confident that Dupixent would reach peak sales of more than €10 billion ($12 billion). Dupixent is an important driver of growth for the group, with it seeking to build out the range of potential indications that it could be used for. The drug, which was initially approved to treat moderate-to-severe atopic dermatitis, also known as eczema, has since been approved as an additional maintenance therapy for certain patients with asthma.

Further opportunity exists across multiple diseases where type 2 inflammation plays a role. The drug has seen worldwide growth of 69% from last year, to €918 million ($1.1 billion) in Q3, despite the impact of COVID-19.

Elsewhere, there are multiple potential positive catalysts in 2021, with Sanofi expected to announce the results of at least nine pivotal studies in the coming year.

Among these will be the readout of our SERD, Amcenestrant in second and third-line metastatic breast cancer, as well as the much anticipated Phase 3 result of our two key hemophilia therapeutics, Fitusiran and BIVV001, the readout of Dupixent in chronic spontaneous urticaria is also going to be very important for us, given the size of that neurological indication. And it goes without saying that the entire world will be eagerly watching for the readout of our coronavirus vaccines.

John Reed, Head of R&D, from the Q3 Earnings Call

Sanofi is working on two vaccine candidates for the COVID-19 virus. The candidate that is further along is the one in collaboration with GSK (GSK). Sanofi is contributing its S-protein COVID-19 antigen, which is made using a similar recombinant DNA approach as used for one of its seasonal influenza vaccines, while GSK is offering its pandemic adjuvant technology. GSK believes that its adjuvant can enhance the immune response of the vaccine and create a stronger and longer-lasting immunity against infections.

Preliminary phase 1 and 2 data for the vaccine candidate is expected to be released later this month, with phase 3 trials set to begin before the end of the year. The group expects that it would take at least until the end of the first half of 2021 before the vaccine would gain regulatory approval for widespread use.

Separately, in collaboration with Translate Bio (NASDAQ:TBIO), Sanofi is developing a vaccine using the messenger RNA approach. Vaccines from both Moderna (MRNA) and partners Pfizer (PFE) and BioNTech (BNTX) are similarly made from mRNA and have demonstrated impressive efficacy of 90% or above in phase 3 trials. Regulatory approval for this vaccine candidate is not expected until at least Q4 2021.

Of course, new pharmaceutical candidates are not without their risks. As it is often the case, even the most promising drugs can fall at the final hurdle. However, given the sizeable late-stage pipeline that Sanofi has put in place, there is a decent likelihood that growth from these new specialty care drugs will more than offset the decline in sales from diabetes and other formerly established areas.

Lockdowns and the severely strained resources of local healthcare systems have prevented some patients from seeking treatment and reduced the availability of non-urgent care. This has no doubt had a knock-on impact on volumes for some of Sanofi’s products, given the much reduced numbers of new patient starts, and lower demand for pediatric and adult booster vaccines, as well as for consumer healthcare products. It therefore stands to reason that a decent proportion of these revenues has been delayed rather than lost forever, and so there may be considerable pent-up demand once the pandemic’s threat subsides.

Margin Expansion

Under CEO Paul Hudson, who joined the company in September last year, Sanofi is undergoing a strategic reorganization to cut costs and improve margins. He is putting into action a plan to narrow the company’s focus, by dropping diabetes and cardiovascular diseases as core areas of research. After years of trying, the company has struggled to find new blockbuster treatments in its formerly established areas. Going forwards, it expects that it would need to spend even more in order to compete with deeper-pocketed rivals.

Instead, it intends to devote more attention to oncology, rare diseases, and immunology. But there’s no guarantee that returns in these areas will be better. The market for cancer treatments is becoming increasingly crowded - it now makes up more than a third of the industry’s pipeline with over 5,000 drug candidates in this space. I expect it will take us a long time to find out whether this strategy will eventually pay off.

The group may find that acquisitions and collaboration could offer better returns. Following the divestment of part of its stake in Regeneron (REGN), it has some serious spending power that could be put to use. The question now is what the group is on the lookout for, bearing in mind the execution risks for shareholders.

Meanwhile, Sanofi is keen to keep costs under control as its margins have been lagging some of its rivals. It is aiming to deliver €2 billion in annual cost savings by 2022 - it has so far achieved just under half of that in H1 2020. Along with sales growth and an improved operational performance, management expects the group’s adjusted operating margin to improve from 27% in 2019, to 30% by 2022 and more than 32% by 2025.

Robust growth in its vaccines and specialty care franchises, together with management initiatives to improve margins, could see Sanofi achieve mid-to-high single-digit EPS growth in CER terms over the medium term.

Data by YCharts

Data by YCharts

Free Cash Flow

The group is also keen to improve the conversion of earnings to free cash flows. It has set a target to increase its annual free cash flow by 50% by 2022, from its 2018 base, subject to stable exchange rates.

A stronger financial performance, better spending control, together with a series of one-off benefits, which included asset disposals, favorable impacts to receivables and the phasing of tax payments, lifted its adjusted free cash flow in the first nine months of 2020 to €5.5 billion ($6.6 billion). This was 69% higher than for the same period in 2018 and covered the cash outflow of dividend payments by 1.38 times.

In spite of nearly €5.8 billion ($7.0 billion) spent on acquisitions and new license payments in the period, stronger free cash flow and the sale of its Regeneron shares drove net debt down by €5.5 billion ($6.7 billion) from the start of 2020, to total €9.6 billion ($11.7 billion) at the end of Q3.

Structural Trends

Looking further ahead, long-term structural trends seem to be in its favor, given aging populations and increased healthcare spending, particularly for cancer and specialist treatments where Sanofi is bolstering its presence in.

Moreover, the COVID-19 pandemic could positively influence vaccination trends for many years to come. Governments around the world are paying more attention towards increasing vaccination rates and have stepped up efforts to ensure adequate vaccination facilities. Sanofi, being the fourth-largest vaccine maker worldwide, stands to benefit from this growing market.

Against these tailwinds, rising healthcare costs have attracted growing political and regulatory scrutiny on how much profits are being made by pharmaceutical companies. Particularly, there has been a lot of criticism regarding drug pricing in the United States, with Americans spending on average about $1,200 per year on prescription drugs - more than anywhere else in the world. Pharmaceutical companies therefore increasingly need to demonstrate that they deliver value for money.

Risks

While vaccines and specialty care are real bright spots for Sanofi, there are some areas of concern too. The consumer healthcare division continues to be drag on growth - Q3 sales declined 1% on lower in-person pharmacy traffic. Heartburn medication Zantac® (ranitidine) is still withdrawn as tests found unacceptably high levels of N-nitrosodimethylamine, or NDMA, a possible carcinogen.

Sales from established cardiovascular and diabetes products continue to make up the largest share of the group’s revenues, putting the group at risk of patent expiration and growing generic competition. And even though the pipeline has delivered some reasonable results thus far - offsetting much of the decline in sales of legacy products, further bolt-on acquisitions and collaborative partnerships may be needed to deliver sustained growth in earnings.

In the short to medium term, it’s clear that growing sales of Dupixent will be the group’s main driver of growth. This exposes the company to headline risks in the case of any setbacks in terms of new clinical data or adverse regulatory news related to the drug. Weaker than expected sales growth for the blockbuster drug could force a reset of expectations and spark selling pressure for the stock.

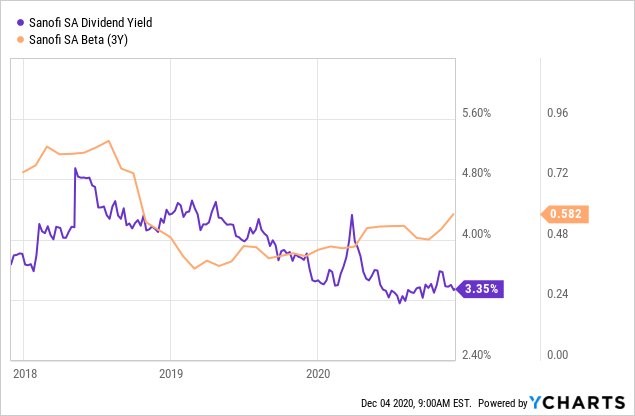

Nevertheless, much of these risks appear to have already been priced in. As although Sanofi’s share price has made up more than its losses in March, valuations remain undemanding - the pharmaceutical group trades at 13.5 times its expected 2021 earnings. The stock offers defensive qualities too, with a 3-year beta of 0.58 and a dividend yield of 3.35%.

Data by YCharts

Data by YCharts

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.