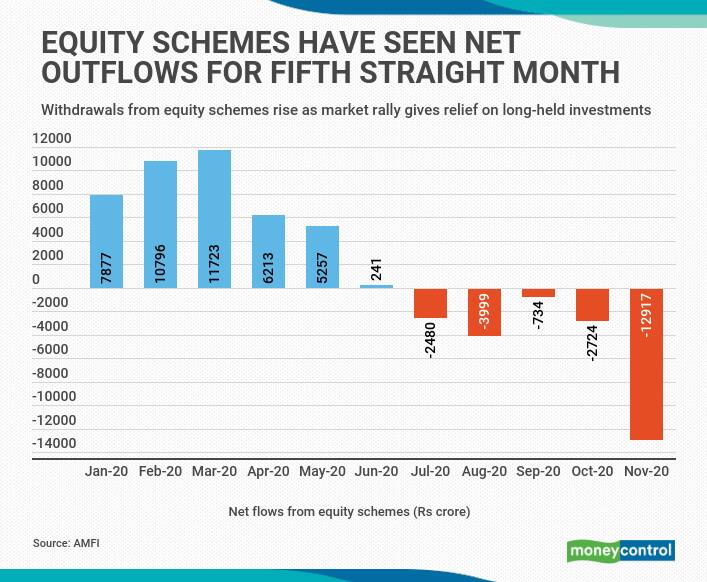

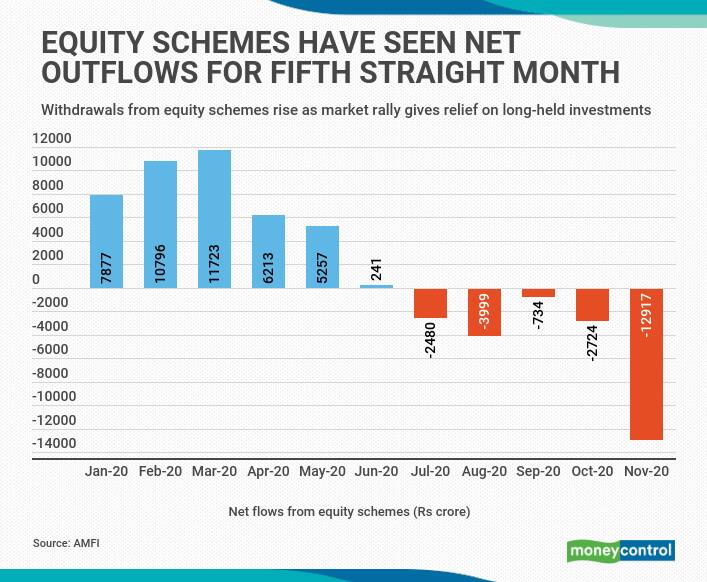

Equity mutual fund (MF) schemes saw their worst monthly outflows in November – Rs 12,917 crore. This is the fifth month in a row that equity schemes have witnessed net outflows, data from mutual fund industry body, AMFI, showed.

The redemptions (withdrawals) from equity schemes stood at Rs 27,113 crore, while fresh inflows were at Rs 14,195 crore. The redemptions were 33 percent higher than in the previous month.

Wary equity fund investors

Mutual fund experts say that the large quantum of withdrawals indicate that investors are not betting on a continued market rally, but are more interested in taking money off the table.

“These redemptions can be attributed to the equity schemes that have underperformed benchmark indices for several years. Investors are seeing the recent market move as a relief rally and taking money off the table,” says the chief executive officer of a mutual fund, requesting anonymity.

Redemptions may continue

Mutual fund distributors say that the redemptions could continue over the next few months.

“After being patient for several years, investors are not seeing the net asset values (NAVs) of their schemes return to the levels at which they had invested. And in some cases, they are seeing additional returns. Investors are not yet bullish on economic recovery and want to protect their capital,” says Ritesh Sheth, Chartered Wealth Manager.

The uptick in NAVs has come on the back of a sharp run-up in benchmark indices since the lows of March 2020.

Since then, the Sensex is up 75 percent, while the Nifty is up 76 percent.

Data from Ace MF shows that large-cap funds have given returns of 27 percent on an average during this period. Mid-cap and small-cap funds have delivered returns of 37 percent and 47 percent, respectively, on an average.

The withdrawal from equity schemes is also having an impact on systematic investment plans (SIPs), which is what most retail investors opt for.

In November, the contribution from SIPs was Rs 7,300 crore, which was a steep reduction of 6.4 percent over the previous month.

The monthly SIP contribution is now down 15 percent, from its peak of Rs 8,641 crore in March.

_2020091018165303jzv.jpg)