Vital Farms: Put Your 'Eggs' In This Basket

Vital Farms is disrupting the egg industry by focusing on the simple idea that happier hens produce better eggs.

Vital Farms is gaining significant market share through conscious capitalism, ethical farming practices, genius marketing, and improving financials.

The recent price selloff after the company's Q3 update presents an opportunity for investors to put their "eggs" in Vital Farms.

Investment Thesis

Vital Farms (VITL) started trading in July and has been trading in the $35 to $42 range. The recent selloff after its Q3 update provides an adequate margin of safety for investors interested in investing in a mission-driven company. VITL's values towards conscious capitalism, ethical supply chain, excellent marketing execution, and improving financials, as well as favorable consumer trends and growth potential, make VITL a great basket for investors to put their "eggs" into.

Conscious Capitalism

Every time I go to the grocery store, I always pay a visit to the egg section - I was a competitive powerlifter so I need lots of protein on the cheap. Being the pretentious person I was, I would always pick Kroger's (KR) Simple Truth Organic Eggs just because it's "organic" and it's the cheapest in the organic basket - about $3.49 per dozen eggs. As I transferred the eggs from the fridge to my shopping cart, I can see from the corner of my eyes other egg brands with higher price tags. $4.99. $5.99. $6.99. I never considered them.

One day, a friend of mine picked up a beautiful carton of eggs. He opened the carton to check if the eggs are all good and then all of a sudden, he flashed a flyer out of the carton which says "Bird of the Month", to which my friend said: "I'm going to eat the eggs of Gorgeous Ginger!" That caught my attention because no other egg brand has done that - to commemorate chickens for their hard work in laying eggs for us humans. It's different and enlightening. And from that day onward, I became more conscious about what I put in my shopping cart and what ultimately ends up in my mouth.

(Source: Google Image)

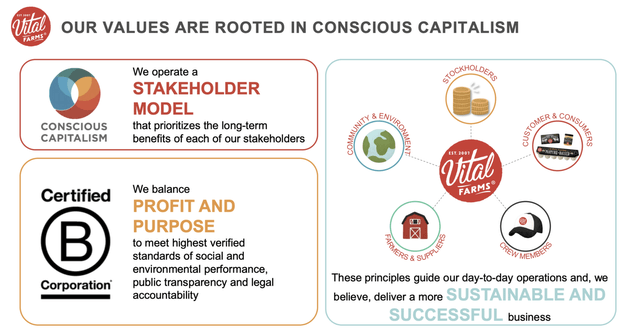

The brand of the eggs that my friend picked up was Vital Farms. VITL produces pasture-raised products through the simple guiding principle of Conscious Capitalism. Under this principle, VITL operates an ethical decision-making model that serves to benefit all stakeholders, namely: farmers and suppliers; crew members; customers and consumers; community and environment; and stockholders. Being a mission-driven company, VITL structures itself as a Certified B Corporation as the company aims to profit while advocating for the social, environmental, and public good.

In essence, VITL strongly believes in the idea that happier hens produce better eggs.

(Source: Vital Farms 2020 Q3 Presentation)

This simple guiding principle of Conscious Capitalism is the very reason that made VITL the leading US brand of pasture-raised eggs and butter and the second largest US egg brand by retail dollar sales. As of Q3 2020, VITL has 80% market share in the US pasture-raised eggs category. Whether we're conscious of it or not, VITL's conscious capitalism approach helps spur conscious consumerism as both producer and consumer aim to promote sustainable farming practices and eradicate unsustainable ones.

Ethical Supply Chain

VITL aims to remove factory farming practices by establishing and growing a network of over 200 small farms to produce pasture-raised eggs. Factory farming practices involve confining chickens in small cages or cramming thousands of them in small buildings. Sure, more eggs will be produced. But this is at the expense of egg quality as these chickens have elevated stress levels due to poor living conditions. VITL, on the other hand, partners with small family farms that raise chickens on pasture where they have the freedom to roam and forage outdoors as they like. Fresh air, sunshine, and exercise leads to healthier hens and consequently, better eggs. It's that simple.

VITL also select farms specifically in the Pasture Belt where pasture-raised eggs can be produced year-round. Given that VITL has 80% market share in the pasture-raised eggs market, it is reasonable to assume that VITL has locked in 80% or more of pasture-raised eggs farms in the Pasture Belt. Such an established network of high-quality egg producers creates barriers to entry as there are a limited number of farms in the Pasture Belt. Furthermore, the ability to produce year-round allows for consistent cash flow, reducing the seasonality effect in the process.

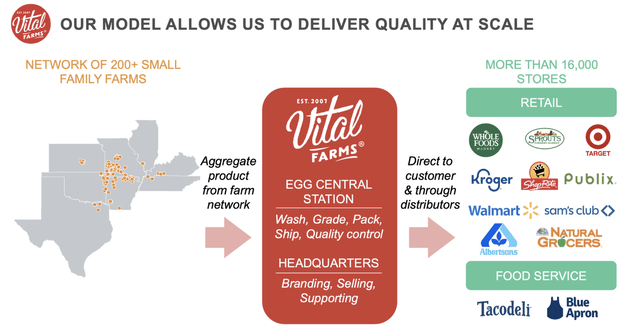

(Source: Vital Farms 2020 Q3 Presentation)

Not only does VITL's humane and ethical supply chain benefit the hens, but VITL farmers and employees benefit as well. According to the company's S-1 filing, farmers are offered educational programs on best farming practices and they are paid competitive prices for producing high-quality eggs. VITL also invests in their employees with resources as well as professional development opportunities. In fact, VITL employees seem to be loving the company - VITL has a Glassdoor rating of 4.6 out of 5 while its biggest competitor, Cal-Maine (CALM), has a rating of 3.1 out of 5.

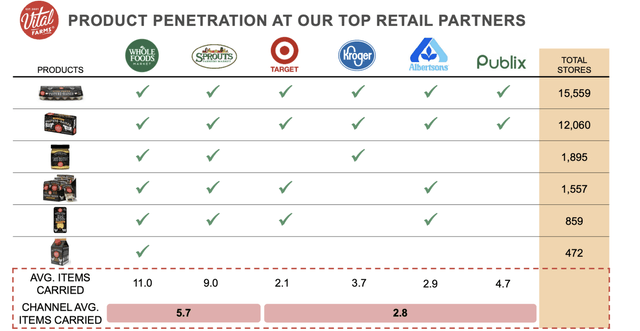

After the eggs are collected from partner farms, the eggs are then processed in Egg Central Station. They are then distributed nationwide across 16,000 well-known retail stores such as Whole Foods, Sprouts (SFM), Walmart (WMT). VITL also works with foodservice companies such as Tacodeli and Blue Apron (APRN).

(Source: Vital Farms 2020 Q3 Presentation)

Genius Marketing

In the grocery store, VITL eggs stand out above the rest. Its product packaging illuminates the eggs section with a striking black-colored packaging, populated with labels such as "Ethical Eggs", "Happy Hens", and "Certified Humane." The most prominent is the large "Pasture-Raised" label written on the top and sides of the packaging. As consumers open the packaging, they are welcomed with a flyer which is essentially the company's very own newsletter called Vital Times. It is a neat little way to inform customers about things such as Vital Farms news, Bird of the Month, and other egg-related information. In addition, VITL launched its food traceability feature which enables customers to "See A Farm" by inputting the farm name found on the packaging onto the company's websites, which will then show a 360-degree video footage of the family farm where the specific carton of eggs was produced. With all these elements combined, VITL made a seemingly boring egg purchase into a refreshing and enjoyable customer experience. I've never seen anything like this - it's genius marketing and it's disruptive.

(Source: Compilation of Google Images)

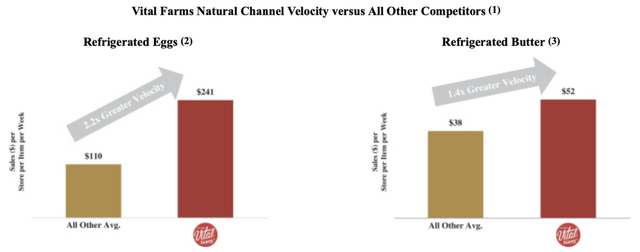

VITL's unorthodox marketing strategy explains why the company was able to gain market share while raising awareness for pasture-raised products. VITL's retail store customers are also loving the company as VITL products drive higher velocities and profitabilities for them. According to the company's S-1 filing, VITL refrigerated eggs and refrigerated butter have 2.2x and 1.4x greater velocity than competitors, respectively. Greater velocity means less waste, higher inventory turnover, and faster cash generation. At the same time, VITL's marketing strategy has led to a large following. As of this writing, VITL has over 89,000 Instagram followers - that's a lot for an egg company.

(Source: VITL S-1)

VITL eggs are not cheap by any means - they are priced around $5 for a dozen eggs. But why are customers willing to pay a premium for VITL products? The answer is clean label. According to a survey conducted by GutCheck, 63% of consumers are willing to pay more for "clean label." If you look at today's egg packagings, you'll see labels such as "Cage-Free", "Free-Range", "All Natural" and so on. A lot of these labels are misleading. I don't want to get down into all the details; interested readers can read this article. The bottom line is, the label "Pasture-Raised" is the cleanest label of all the egg labels out there. Furthermore, VITL makes sure they convey this message clearly by launching their Bull***t Free Eggs campaign.

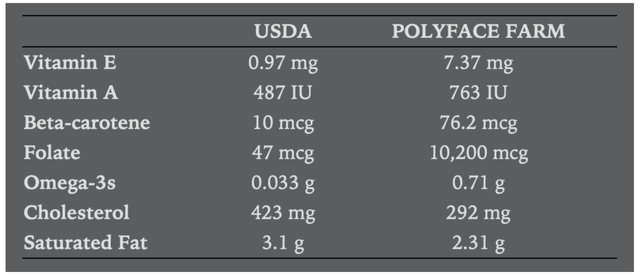

(Source: Vital Farms Youtube)

However, one area that VITL lacks in terms of marketing is showing customers how their eggs are better than conventional eggs - VITL claims that happier hens produce better eggs without showing how. In my research, I found that pasture-raised eggs are more superior in terms of nutritional content. According to Joel Salatin's book Folks, This Ain't Normal: A Farmer's Advice for Happier Hens, Healthier People, and a Better World, pasture-raised eggs (polyface farm) have 7x more Vitamin E, 1.5x more Vitamin A, 21x more Omega-3s, and lower cholestrol and saturated fat than conventional eggs (USDA). So while VITL eggs are more expensive, the marginal benefit of purchasing pasture-raised eggs is higher than factory-processed eggs because of the higher nutritional content packed in each pasture-raised egg. In that regard, I would like to see VITL add "nutritional benefits" as part of their marketing strategy. This should help consumers justify the higher prices.

(Source: Folks, This Ain't Normal: A Farmer's Advice for Happier Hens, Healthier People, and a Better World by Joel Salatin)

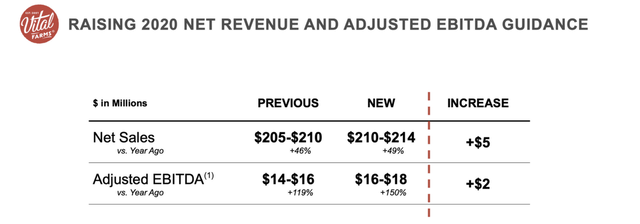

Digging The Financials

VITL displayed strong growth over the last few years and even more so during the pandemic due to the stay-at-home trends. In Q3 2020, revenue grew by 57% to $53.4 from $34.1 million in Q3 2019. However, this number was not as great as the company's Q2 results, which saw revenue grew by 84% to $59.3 million from $32.3 million in Q2 2019. The slowdown in growth is likely due to social distancing measures being lifted and quarantine fatigue prompting consumers to go out more. Nonetheless, VITL's growth has been encouraging and the company should continue to post double-digit growth in the next 5 years. Management has also raised FY 2020 guidance by a few percentage points. Despite all the positive Q3 update, the stock sold off by over 30% from its high of $42 to about $28 as of this writing - the slowing growth rate could be the culprit.

(Source: Vital Farms 2020 Q3 Presentation)

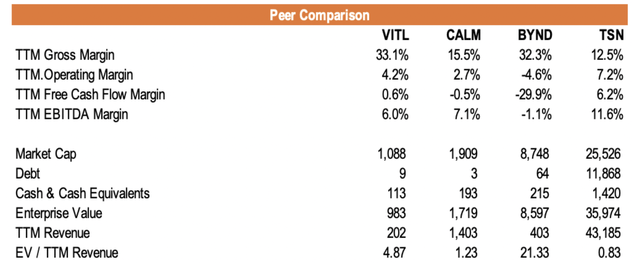

Another key milestone is that VITL has turned free cash flow positive due to its high gross margins - VITL has over twice the gross margin of its largest and closest competitor, CALM. However, its operating margin is still low at about 4.2%. I expect operating margins to expand as the company scales further, possibly to the mid-teens. For further context, I added fellow ESG peer Beyond Meat (BYND) and conventional meat producer Tyson Foods (TSN). As you can see, BYND is still burning lots of cash despite the same level of gross margin as VITL.

(Source: Seeking Alpha and Author's Analysis)

Turning to valuations, VITL is definitely not cheap. It has a market cap of over $1 billion, even after the recent selloff. VITL has an EV / TTM Revenue ratio of 4.87x as compared to CALM's 1.23x. However, due to superior financial metrics and favorable consumer trends (such as conscious consumerism), just like its egg prices, the price premium is well justified. Furthermore, VITL has substantial growth opportunities ahead. For example, VITL's household penetration is only 3.6% compared to the shell eggs category as a whole, which has approximately 98% penetration. VITL's household penetration is already trending upwards each quarter and the higher the penetration, the higher the revenue growth potential.

(Source: Vital Farms 2020 Q3 Presentation)

Despite the price premium, VITL looks cheap compared to BYND's 21.33x multiple. Unlike, VITL, BYND is still burning cash and has no dominant market position.

Growth Opportunities

The growth story remains intact as there are numerous opportunities for VITL to expand their business. An area where I believe VITL can capitalize on is its foodservice segment, which only makes up $0.6 million of the $53.4 million revenue recognized in Q3 2020. Partnering with other mission-driven companies like Chick-fil-a, premium fast-food chains like Super Duper Burger, and breakfast/brunch cafes such as First Watch are some examples. Working with fine dining restaurants to provide high-quality eggs can also be beneficial. These will not only drive sales but raise awareness as well.

Another opportunity would be expanding retail distribution. Within stores, VITL can ramp up distribution for existing SKUs to more stores. Additionally, SKU innovations would also be key for customers to continually be excited about VITL products. Geographically, VITL can expand to more stores domestically, as well as begin international distribution to neighboring countries once the company has sufficient scale.

(Source: Vital Farms 2020 Q3 Presentation)

Finally, educating the public in terms of the benefits of its product, nutritionally and socially, would be key in helping customers justify the price premium. For example, partnering with food and nutrition social media influencers to promote VITL products, such as Youtuber Flavcity by Bobby Parrish, would help with raising additional awareness.

Limitations

According to CALM, the company has approximately 19% market share of the US egg shell market in FY 2020. With $1.35 billion in sales in FY 2020, that values the US eggshell market at about $7.1 billion ($1.35 billion / 19%). If that number is correct, then that would make VITL's potential upside very limited. Can VITL be a $5 billion company? That is likely. How about $10 billion? The company would need to generate revenue from another major business segment besides eggs. $50 billion? Quite impossible. The point is: there's limited upside given the relatively small US eggshell market.

While VITL can launch new products, I only see expansion towards farm-related byproducts like milk, yogurt, and egg mayo. I do not see the company selling meats from pasture-raised cows or chickens as slaughtering animals is negative for VITL's brand image. Therefore, there are limitations to SKU innovations as well.

(Source: Google Image)

Finally, it takes considerable time to scale the business and onboard new farms in their supply chain. In the company's Q3 earnings call, management mentioned that the average lead time to onboard new supply is about 12 months. Therefore, growth will be slow and laborious.

Yes, so we've talked about this previously, the lead time to put down new supply for us comfortably is about a year, we can definitely speed that up a little bit closer to the eight months' timeframe. But again, 12 months is comfortable for us. And so we have actively been working as we always do on looking forward and measuring what we think we need to have down in terms of growth to support the demand profile that we see in the business ahead of us.- VITL Q3 Earnings Call

Conclusion

VITL is a brilliant company disrupting the egg industry by incorporating ethical production methods and involving small farms of America. The company aims to treat animals right and promote the highest of standards for consumer staples. VITL has a strong mission, ethical supply chain, and genius marketing strategy. At the same time, its financials have been improving year over year, which gives the company an added advantage to scale effectively.

For investors who'd like to support ethical farming practices, small farms, and high-quality products, VITL is definitely an attractive investment. With the recent post-IPO selloff, it presents an opportunity for investors to put their "eggs" in VITL and join company's movement for conscious capitalism.

If you enjoyed this article, please like the article, leave a comment, and follow me for more in-depth company analysis.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in VITL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.