ANGL: Expensive Here With A Historically Low Dividend Yield

The ANGL ETF invests in high-yield bonds that have been downgraded from a previous investment-grade rating.

The fund has an impressive long-term performance history generating excess returns relative to the broader high-yield bond market highlighting the attraction of the strategy.

We take a cautious outlook at the current level following a strong rally in recent months with headwinds heading into 2021 including climbing interest rates.

The fund's dividend yield at 4.7% is at a historically low level implying the fund is expensive.

The VanEck Vectors Fallen Angel High Yield Bond ETF (ANGL) invests in U.S. dollar corporate bonds that have been downgraded by credit rating agencies to below-investment-grade from their original issuance. This year's pandemic leading to financial disruptions in various sectors has created several fallen angels with companies facing pressures to their earnings and credit profile. On the other hand, the all-in approach to stimulus measures by the Fed and on the fiscal side, along with expectations of a firming economic recovery has supported a 12% return in the ANGL ETF year to date. While we recognize the solid fund structure with targeted exposure to an important market segment, we highlight headwinds that may limit the rally going forward. We believe caution in high-yield bonds and the ANGL ETF is warranted at the current level considering a narrow dividend yield and climbing interest rates.

(source: finviz.com)

The Attraction of Fallen Angel Bonds

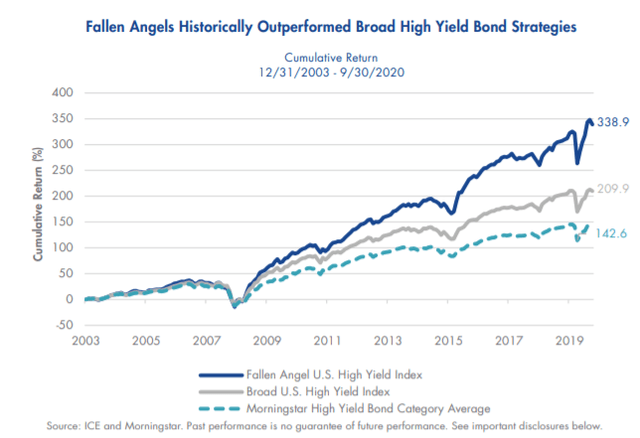

The ANGL ETF tracks the "ICE US Fallen Angel High Yield 10% Constrained Index". According to the fund methodology, bonds that have had their credit ratings downgraded to below investment grade, otherwise known as high-yield or junk status, are added to the fund during a monthly rebalancing. The attraction of the strategy is based on academic research suggesting this segment of the bond market offers higher long-term risk-adjusted returns with fallen angel bonds outperforming the broader high-yield bond market following their downgrade.

(source: VanEck)

The idea here is that bonds often sell-off in anticipation of the downgrade in the market beyond what their underlying fundamentals and long-term outlook would suggest. The result is that fallen angel bonds offer higher yields at a higher average fundamental credit quality relative to other bonds with a similar rating. According to VanEck, there are three explanations for this outperformance.

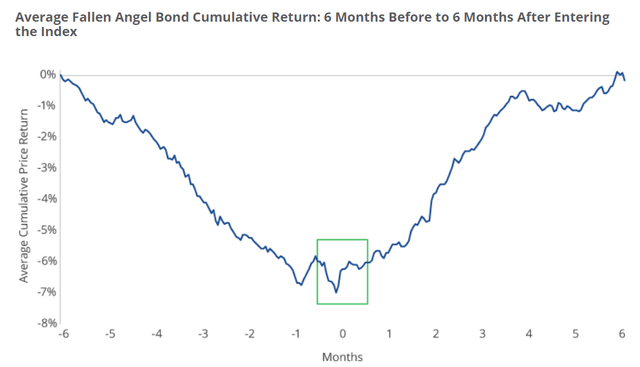

First, the "fallen angel technical effect" is based on a dynamic where some investors are required to sell based on mandates to only hold investment-grade bonds or given portfolio allocation considerations. This forced selling often creates opportunities as the bond pricing becomes detached from their actual financial position and credit metrics. The price appreciation potential of fallen angels may be attributed to bonds being oversold as they are downgraded into high yield only to recover as their credit conditions stabilize. Data shows that within six months of entering the index, fallen angel bond prices tend to recover to levels from six months before entering the index.

(source: VanEck)

Secondly, fallen angel investing can also represent a contrarian investment approach. Essentially, by the time bonds from a sector are downgraded to reflect weaker earnings or cash flow environment, the market may already be looking ahead towards the recovery. That's the case this year with the energy sector considering the collapse in oil prices between Q1 and Q2. Data shows that many bonds that have entered the index this year from the August rebalancing have outperformed with the outlook improving as oil prices have rallied compared to what may have been a worst-case scenario being priced-in at the lows.

Finally, there is also the idea that fallen angels offer relatively higher credit quality compared to other junk bonds. With fallen angels essentially being a group that was downgraded from investment-grade into the 'BB' category on average, it follows that other existing junk-bonds were downgraded to an even lower credit ratio. By this measure, fallen angels are on average coming from a structurally stronger position.

While many fallen angels may indeed have fundamental financial challenges with a weaker outlook, the companies that can survive by adjusting their business model or recovering operating momentum can allow for them to eventually regain investment-grade status down the line supporting upside in the bonds.

ANGL Portfolio

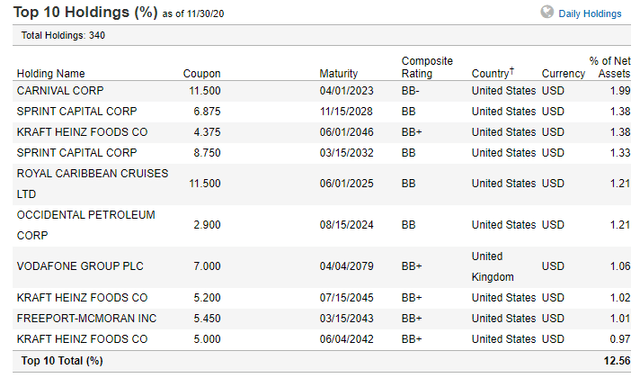

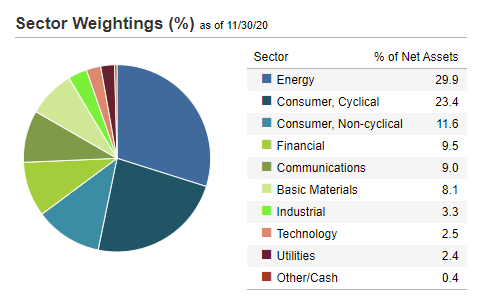

The current ANGL portfolio is comprised of 340 bonds including several issuances from the same company. Energy sector stocks represent the largest weighting by sector at 30% in the portfolio. Bonds from companies like Occidental Petroleum (OXY) and Apache Corporation (APA) are notable new fallen angels entering the fund this year. Bonds from corporates in the consumer cyclical sector at 23% of the fund include Ford Motor (F) which entered the fund in May and Carnival Corporation (CCL), a fallen angel as of July in the fund. Again, the idea is that the strategy calls for acquiring these bonds at discounted prices which can support a high yield and total return potential as their credit conditions recover. Overall, there is relatively good diversification across 108 separate corporates.

(source: VanEck)

ANGL Performance

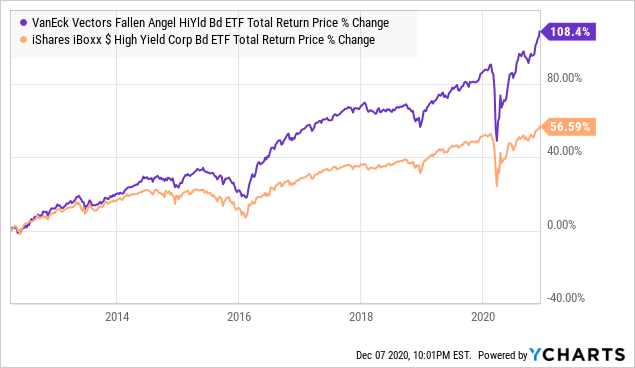

As mentioned, ANGL has returned about 12% year to date which is impressive considering the extreme financial market volatility and economic challenges posed by the pandemic. To illustrate the effectiveness of the strategy, we highlight that ANGL 108% total return over the past 10 years represents a significant outperformance to the iShares iBoxx $ High Yield Corporate Bond ETF (HYG) which we use here for comparison purposes as a benchmark for the broader high yield bond segment, up a more modest 57% over the period.

Data by YCharts

Data by YCharts

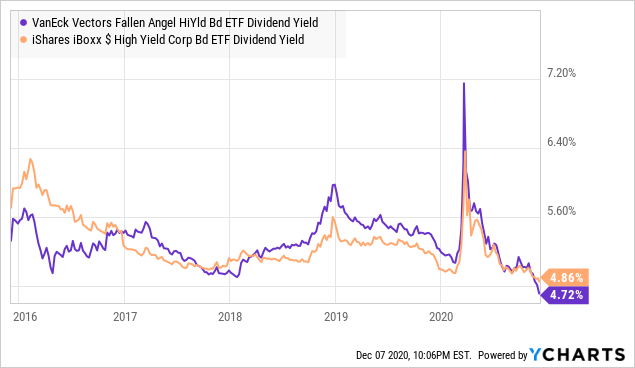

In many ways, fallen angels as a subset of high-yield have a higher quality credit tilt by avoiding the fundamentally weakest corporates. Another important point here is that the ANGL's expense ratio of 0.35% is curiously lower than HYG's 0.49% highlighting the value of the fund. Both ANGL and HYG distribute a monthly dividend and offer a similar yield with ANGL at 4.7% and HYG yielding 4.9%. To this point, we highlight that the yield for ANGL has narrowed to below broader high-yield bonds more recently which is an exception to the typical yield advantage observed in recent years. The dividend yields for both funds are also at historically low levels.

Data by YCharts

Data by YCharts

Analysis and Forward-Looking Commentary

The current development in the market is a sense of optimism for the economic recovery to pick up through next year with the looming COVID-19 vaccine set to effectively end the pandemic. A normalizing environment for economic conditions remains a bullish tailwind for corporate earnings and credit conditions across most sectors. The challenge here is that this dynamic is typically accompanied by rising demand pressures leading to high consumer prices and inflationary trends. This setup may, in fact, be bearish for bonds if rising long-term rates outweigh the benefits of tightening credit spreads which are crucial for high-yield in an economic recovery.

For context, the 10-year U.S. Treasury yield currently at 0.93% has climbed from a low of 0.51% in early August at the cycle lows, and now at the highest level going back to early March. While yields are still well below levels observed going back to 2019 and 2018 when the 10-year approached 3%, our concern is that the risk here is tilted for more upside in rates going forward. While we're not suggesting a runaway breakout higher in interest rates from here, the possibility that the 10-year climbs above 1% in the coming months towards 1.5% could serve as a red flag of sorts driving more bearish sentiment towards bonds as an asset class, in general.

(source: CNBC/ annotation by BOOX Research)

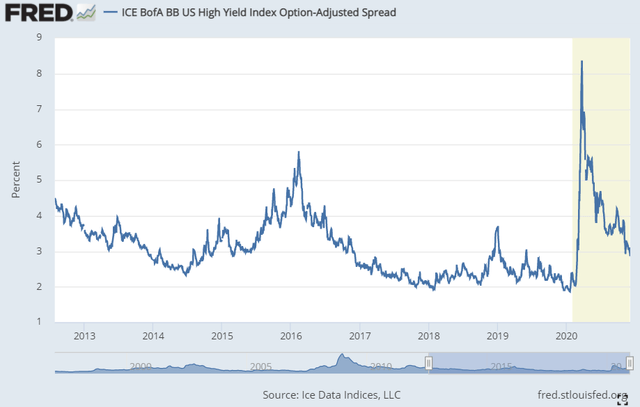

The other important risk to watch is the credit spreads for high-yield bonds. Taking the current 'BB US High Yield Index Option-Adjusted Spread' which proxies the excess yield required to hold 'BB' rated bonds relative to risk-free Treasuries, the current spread at 3% has narrowed compared to highs over 8% observed in the early stages of the pandemic. While the spread is still above the lows from the start of the year when it was under 2%, investors today in ANGL essentially need this trend to continue lower.

(source: St. Louis FED)

The problem we see comes down to the current composition of the ANGL which has gained a tilt towards energy sector issuances. While the price of oil has steadily rebounded in the last several months, the sector remains one of the most pressured in the market with overall still weak credit trends. This implies that investors today in high-yield and ANGL are effectively overweight energy at 30% of the fund and will need it to outperform going forward to drive tighter credit spreads. It's unclear if energy can maintain its momentum and how much of the improving outlook has already been priced-into the corporate credit.

(source: VanEck)

Our point here is that energy and high-yield may have been a good contrarian bet between Q2 and Q3, but likely face a new set of headwinds going forward with reset expectations. While the broader bond market benefited this year from the Fed's quantitative easing program including direct purchases of corporate bonds and even positions in the ANGL ETF, there is some concern that those programs may be ending or will be pulled back as the economy improves. The other risk is that the consensus for an improving macro outlook and accelerating economic growth is simply wrong. In this scenario, we would expect high-yield spreads to widen from here and pressure returns in the ANGL ETF.

Final Thoughts

There's a lot to like about the VanEck Vectors Fallen Angel High Yield Bond ETF. The consistent record of outperforming the broader high-yield bond market speaks for itself and makes it a good choice to hold over the long term in the context of a diversified portfolio and fixed-income allocation. That being said, the case we make today is that it may not be the best time to buy ANGL right now.

In our view, the excess return opportunity in high-yield has passed and the risks are now tilted to the downside. The current trend of rising interest rates warrants some caution towards bonds and the ANGL ETF dividend yield at 4.7% is historically low implying the fund is relatively expensive. We recommend investors move to the sidelines on this one and wait for a better entry opportunity that can offer an improved reward to risk setup. Tactically, we would take a bullish view on the fund on a pullback under $29.00 per share.

Add some conviction to your trading! We sort through +4,000 ETFs/CEFs along with +16,000 U.S. stocks/ADRs to find the best trade ideas. Click here for a two-week free trial and explore our content at the Conviction Dossier.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.