Cinemark: Perhaps We've Been Too Harsh

Cinemark 2020 operating results were disappointing (yet expected), but they get points for control of operating expenses compared to peers.

Cinemark’s liquidity is nothing special, but stronger than competitors'.

Coronavirus may help Cinemark in the long term more than it hurts the company in the short term.

Investment Thesis

Cinemark Holdings, Inc.’s (CNK) stock price was recently demolished due to the effects of the coronavirus, but the market’s reaction was likely more harsh than fundamentals show it deserved. While the effects of the virus are severe in the short term, pre-COVID trends are likely to re-emerge in the coming years and point to a higher value than the stock’s price currently settled at.

Company Overview

Cinemark Holdings, Inc. is a movie theater chain that started operations in 1984 and incorporated in 2006. The chain operates primarily in the United States and also operates theaters in various Latin American countries. The United States theaters make up a little less than two-thirds of the company’s total theaters.

The company generates roughly 55% of its revenues from admissions tickets, roughly 35% from concessions, and 10% from other revenue streams, including advertisements played before movies.

Industry Overview

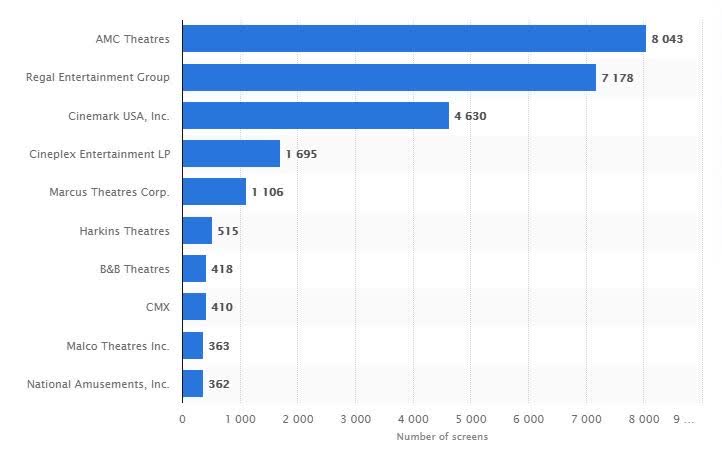

The movie theater industry has been around more than a few years, and currently is dominated by a few large chains. AMC Entertainment (AMC) leads the pack with roughly 8,000 circuits, Regal in second with about 7,000 and Cinemark in third with about 4,600. In the United States the top 50 companies control 80% of total revenues, leaving 20% for small-and-mid-sized theater operations.

Source: Statista.com

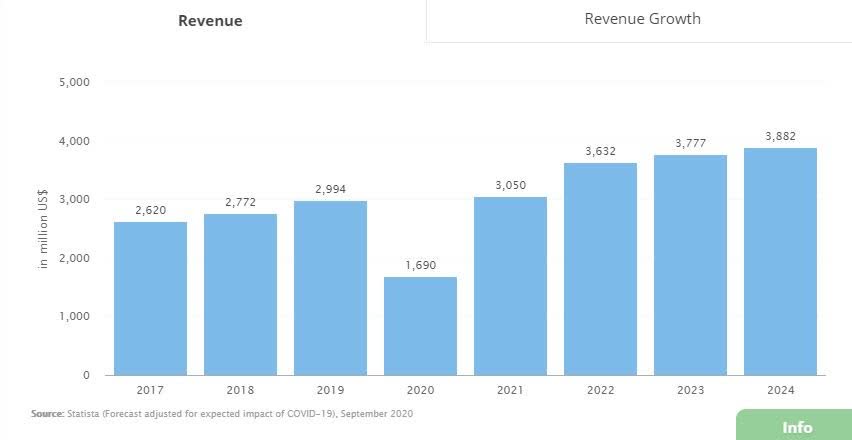

Over the five years from 2015-2020 it’s estimated that the United States movie theater industry revenue has decreased at a CAGR of nearly 17%, after accounting for the effects of the coronavirus. The year 2020 obviously skews these results considerably, so it’s more helpful to look at a chart of revenue growth from 2017 through forecasted 2024. From this, we can see that industry revenue does increase steadily, at a CAGR of 7% from 2017-2019.

Source: Statista.com

Comparing 2020 Results

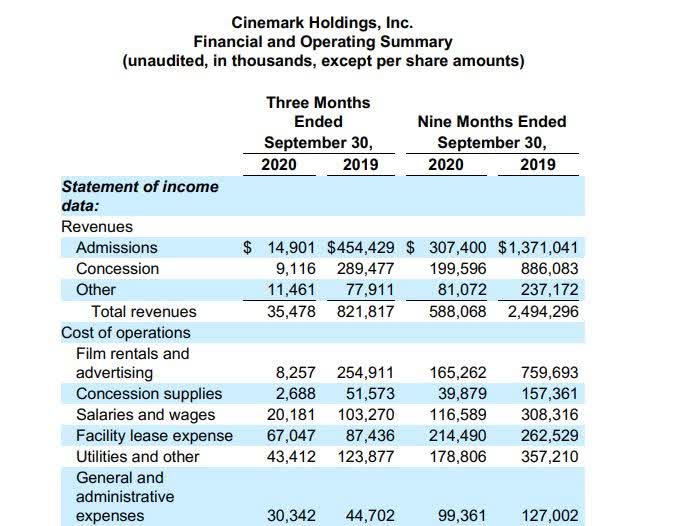

Comparing Cinemark’s Q3 2020 operating results directly to its Q3 2019 operating results without more context would be incongruent given the effects of the coronavirus. To more fairly assess how management handled the effects of the virus on the business, we can compare the company’s operating results to its competitors’.

For the first nine months of 2020, Cinemark’s revenues declined 76%. Most of the company’s expenses stayed at a comparable percentage to its revenues from the same period of 2019 to 2020; however, the percentage of salaries and wages increased from roughly 16% to 19% and general and administrative expenses increased from roughly 5% of total operating expenses to roughly 17%. Fixed expenses, like leases, ate up considerably more of Cinemark’s operating expenses in 2020 than it did in 2019, as well.

Source: ir.cinemark.com

For comparison, AMC’s theater chain segment’s revenue declined 73% during the same period. While the 3% difference between AMC and Cinemark’s revenues may represent large dollar amounts, it is likely negligible in determining which company operated more efficiently during the pandemic. For that, we can look to expense management. AMC managed to decrease its film exhibition costs as a percentage of revenues from 31% in 2019 to 27% in 2020 over the same period. Food and beverage costs increased modestly from 5% to 6% of total revenues. Total operating expenses as a percentage of total revenues were 390% for AMC compared to 179% for Cinemark. The totals in operating expenses as they relate to total revenues tell us Cinemark’s management was able to control operating expenses much more efficiently than AMC was able to in 2020 so far.

Liquidity Positions

Withstanding the effects of the coronavirus alone should attest to the balance sheet strength of Cinemark and its major competitors. However, we should look at the environment it operated in prior to the virus and how the virus has impacted the balance sheet of Cinemark and AMC to ensure they can survive to the end of 2020 and beyond.

For starters, Cinemark took on a considerable amount of debt in 2020, resulting in a long-term debt increase of roughly 33%, from $1.8 billion to $2.4 billion. This obviously helps short-term survival but swaps it for potentially slower long-term growth. AMC increased its corporate borrowings over the same period from $4.7 billion to $5.8 billion, an increase of 23%.

Because AMC and Cinemark increased their current ratios by tacking on long-term debt, it would be useful to compare current ratios pre-pandemic. Cinemark’s current ratio at the end of 2019 was roughly .84 and AMC’s current ratio at the same time was roughly .27. While neither current ratio is particularly strong, with both being under a current ratio of 1, we see that heading into the pandemic, Cinemark was significantly more prepared from a liquidity perspective than AMC.

The cash burn rate up to the end of September in 2020 was around 28% for Cinemark. While this is a large burn rate for only 9 months of a year, we know this is attributable to the coronavirus almost exclusively, and assuming the pandemic ends by the end of 2022 and movie theater admissions return to a more normal level, Cinemark has a fair chance of not being a bankruptcy risk.

Effects of Coronavirus

As mentioned earlier, coronavirus has obviously negatively impacted Cinemark and every other movie theater chain over the past year and this trend is set to continue into 2021. From an investment perspective, this certainly makes Cinemark’s future cash flows look unattractive. However, we can look at this from a different perspective, and that is coronavirus is significantly impacting small businesses more than it hurts larger chains, with considerable financial resources to withstand the pandemic.

It’s expected that the effects of coronavirus will force the bankruptcy or closing of 69% of small-and-mid-sized movie theaters. A low interest rate environment, solid balance sheet strengths, and growth plans will allow Cinemark and other large movie theater chains to capitalize on the closed locations by absorbing them. This wipes out over two-thirds of small competitors and could significantly increase future cash flows to the larger chains.

Risk - Future of Moviegoing

Much has been made of recent threats to the movie theater industry, including new movies immediately available for streaming as well as titles that streaming services release exclusively for their services, like Netflix (NASDAQ:NFLX), which bypass theaters altogether. This trend was made much more popular due to the effects of the coronavirus. Because we are still in the middle of the pandemic, there is not much reliable data for how much lasting effect this trend will have on the industry. What we can point to is that the movie theater industry continued to grow at a respectable 7% CAGR prior to 2020, and this was years after streaming services started releasing exclusive titles. We believe it’s reasonable that the movie theater industry, once the effects of the virus have subsided, will continue to grow, even if it means at a more modest CAGR.

Valuation Analysis

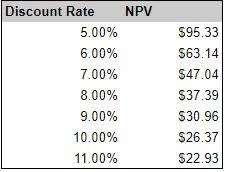

Our assumptions in our valuation led us to a higher NPV in Cinemark than was expected given the coronavirus. It should be noted that there is still substantial risk revolving around the lasting effects of the virus as well as Cinemark’s ability to generate cash flows in the future.

We started by deflating all of the revenues in the first forecast period by the reported 80% and then increased them 350% in the second forecast period to reflect close to 2019 operation results, but still slightly lower. We kept most of the operating expenses at the same percentage of revenues as they were previously, as Cinemark has stayed relatively strong in its attempts at expense management.

Source: Author’s Calculations

Even with tacking on the additional long-term debt that Cinemark adopted in 2020, as well as the interest expense that it entails in the coming years, we value Cinemark significantly higher than its current stock price of $13.99 (December 4, 2020) at what we consider most reasonable discount rates.

For transparency of our valuation of Cinemark and to test your assumptions against ours, please see the financial model here: CNK_Financial_Model.xlsx

Key Takeaways

With the coronavirus ravaging movie theater chains and the future of the industry hanging in the balance due to existential threats like streaming services, we still see a positive future for Cinemark and its peers. If it can make 2021 more of a return to normalcy and improve revenues at comparable rates as it did pre-2020, then we believe the effects of the coronavirus have forced the company’s stock price too low and it will be due to rebound strongly in the coming months.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.