EasyJet: The Rally Is Overdone

EasyJet's full-year results were dreadful, but that was expected.

The current outlook also suggests the company is focused on cash preservation.

Shares have surged with the vaccine news but a lot remains to be seen about future demand, while cash burn continues.

The valuation does not reflect that. I avoid.

EasyJet (OTCQX:ESYJY, OTCPK:EJTTF) has had a tough year, to put it mildly. The company recently issued its full-year results. It is fair to say that these didn’t contain any real surprises. Yes, it was a terrible year for the company – but that had been well signaled beforehand.

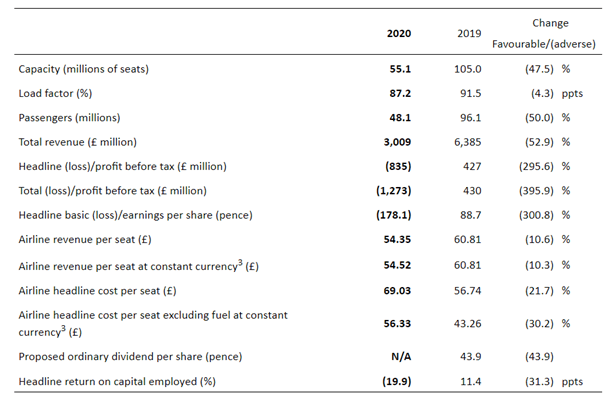

The numbers speak for themselves and are dreadful.

Source: company annual results

The one number I think merits specific comment is revenue per seat. The double-digit fall in that figure does not look good. With fewer routes flying in recent months, I would hope yield management was such that revenue per seat would be static if not actually higher than usual. Based on the full-year numbers, at least, that doesn’t seem to have been the case. However, as I will discuss below, the company seems to be onto this with a focus over winter on cash generative flying.

The Company Remains Focused on Survival

In its full-year results announcement, the company declined to provide guidance for the current year. That suggests a high level of unpredictability, which is no surprise. It did, however, say that it expected to fly no more than c.20% of planned capacity in its first quarter. That is half of what Ryanair expects and around half of the 38% EasyJet itself managed in its fourth quarter. It said it would focus on cash-generative flying. It did note that it was ready to ramp up capacity as demand returned.

But the question is: why does EasyJet only expect to have half the capacity Ryanair (NASDAQ:RYAAY) (OTCPK:RYAOF) does at roughly the same time? After all, Ryanair currently has a load factor in the mid-sixties: far below its 96% level last year but still economically viable, it seems. Ryanair isn’t offering twice the capacity of EasyJet by flying empty planes.

The answer as far as it can be surmised from EasyJet’s comments in its annual results seems to be its focus on cash generation. I interpret that its capacity is focused on routes and dates where it can turn a profit. Given the high fixed cost base of any airline, I don’t like that as a fleet utilization strategy. But it does have the benefit of stanching cash burn. The company has raised over £3.1 billion in cash since the onset of the pandemic. It had cash and cash equivalents of £2.3 billion as at 30 September, and cash burn has been easing slightly. Q4 cash burn of £651 million was a reduction of 16% from the prior quarter. That is still a lot of money going out the door, though: the £2.3 billion cash pile isn’t enough for a year at that rate. So, the Q4 capacity reduction to focus on cash-generative routes I see as indicative of management thinking. It is not currently focused on long-term strategy (unlike Ryanair, with its massive 737 Max order). Instead, it is firefighting in the ditches to make the cash pile stretch as long as it can, hoping for a recovery in the meantime.

On a positive note, it has more levers to pull if necessary. Its sale and leaseback programme has continued apace, with 30 more aircraft sold since the end of September. Again, in the long term, it may not be the optimal strategy for the airline or it would have done it before. For survival, though, it’s helpful: another £717 million of cash hit the coffers in consequence, more than enough to cover another quarter’s cash burn. EasyJet isn’t living hand to mouth, but it’s definitely focused on liquidity and cash conservation. While I do think that is positive for the company’s survival chances, I do think it makes the shares somewhat less attractive. The post-pandemic EasyJet is set to be less profitable than the pre-pandemic iteration, paying to lease dozens of plans it owned at the start of 2020.

It should be able to offset that financial impact somewhat by finding new revenue sources, and it has been busy on that. The company attracted a lot of negative attention in the British press recently after revealing plans to charge for cabin baggage in overhead lockers. Predictably this led to complaints about price gouging. I think those complaints are reasonable personally and am not a fan of nickel and diming passengers in such a way. However, that is the nature of the low cost business model. With the move, the airline is bringing itself in line with low cost rival Ryanair. That looks good for business – for little extra cost, the airline will increase revenue. The charge will start at around £8, so if only 10% of all passengers take it up, that would still have generated around £76 million in ancillary revenues, based on pre-pandemic 2019 passenger numbers.

The prospect of widespread vaccination and a return to more normal passenger numbers has been a boon for the company’s share price. It rose 59% in November.

Directors Have been Buying

Management seems to see improved prospects for the airline. After the annual results close period, a trio of directors and connected persons bought shares at prices between 753p and 772p.

Source: Hargreaves Lansdown

That, I imagine, reflects the expected benefit of vaccine news announced earlier in November. I find it interesting that these directors were willing to spend around 200p more per share than they could have done just a few weeks before for the same shares. It suggests to me that they too expect the vaccine news to improve prospects for the shares significantly.

The Valuation Improvement is Ahead of the Business Improvement

Long term, EasyJet has been a well-run airline and rewarding to shareholders. With its survival focus I outlined above, I expect it to return to that status in the future. However, there is a long road ahead. Meanwhile, the share price has leapt off the back of the vaccine news.

Source: Google Finance

However, unlike Ryanair, EasyJet remains far below its highs from earlier in the year. It trades at around 60% of its year high versus Ryanair which is back to 99% of its year high. That makes sense to me: Ryanair is in long-term strategic mode again already – albeit with significant business headwinds present – while EasyJet is still in the trenches fighting for the short to medium term.

In fact, I think the basis for the November rally was exaggerated. Vaccine rollout will help demand almost definitely. But it is not clear at what pace, or to what level. We are very far from knowing, for example, what proportion of passengers will simply never return to flying, with or without a vaccine. More importantly in my view, we don’t know the timeline for a ramp-up to the new normal level. Anecdotally, many people I know will not consider travel before Summer 2021 at the earliest, even if a vaccine is successfully rolled out at scale in the short-term, which remains to be proven.

Meanwhile, the ramifications on demand of the end of the Brexit transitional period remain unclear. At £1.2 billion last year, UK revenue for EasyJet fell by 55%. But it was still the largest market, larger on its own than either Southern Europe or Northern Europe. Brexit isn’t just about travelling rights for passengers. It could impact the company in other ways; for example, if post-Brexit healthcare arrangements lead to a lot of Britons who reside in France and Spain deciding to relocate home, that would certainly dent the company’s revenue in coming years.

With the recent run-up in shares, the company is trading at a P/E of around 11x its pre-pandemic 2019 earnings. 2020 was lossmaking and on current projections it is hard to see how 2020 and perhaps 2021 will be anything other than lossmaking too. When earnings do return, they will likely take some time to get back to pre-pandemic levels. So a prospective P/E of 11 for some years from now for a business which has halted its dividend and continues to face significant market outlook uncertainty largely beyond its own control looks overpriced. I continue to avoid.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.