Revolve Group: Has Potential, But Revenue Growth Not Shaping Up

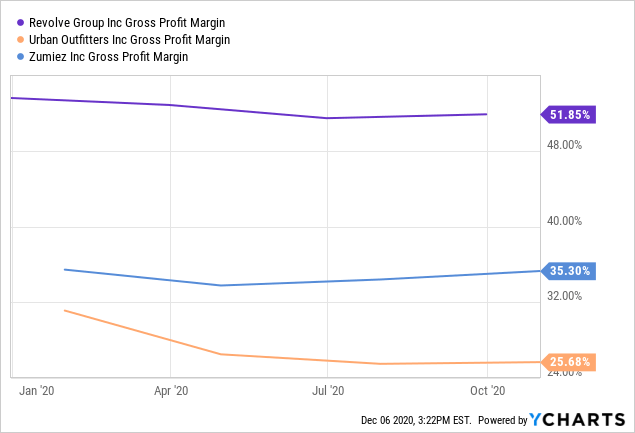

Revolve Group has blockbuster margins of 55%, well above those of competitors.

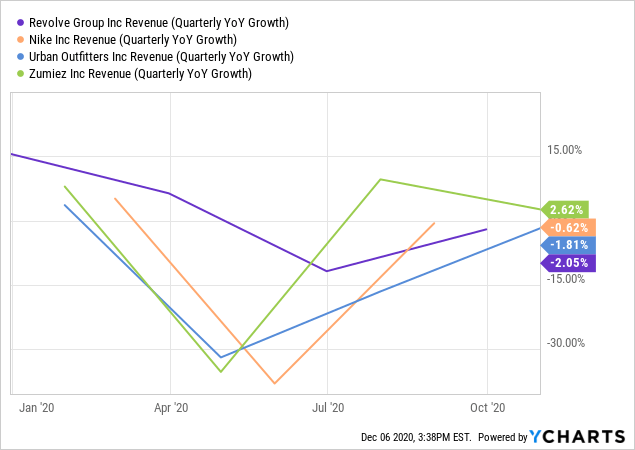

It has disappointing revenue growth at negative 2% for an online-only retailer.

The company is facing more competition from a renewed push into online from bigger retailers.

Introduction

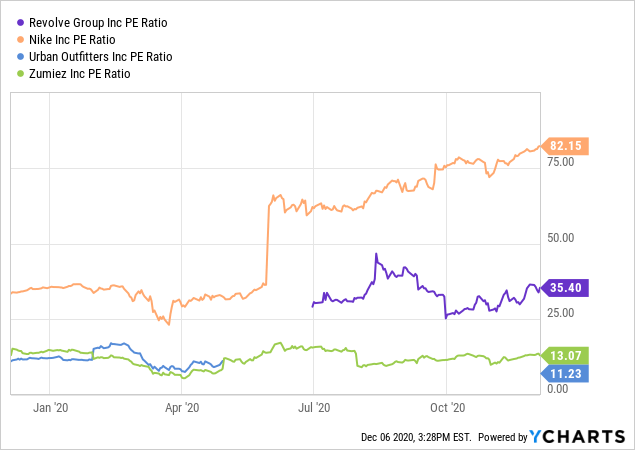

Revolve Group (RVLV) had the opportunity to be a breakout star this pandemic. The company did not achieve that prophecy, with disappointing revenue numbers for an online-only retailer. It seems to be struggling to market itself to a wider array of consumers, and along with that, the company is now facing more competition from previously underdeveloped digital players that have now thrust into the market following pressure on physical stores. Revolve does have unbelievable gross profit margins, and despite a high valuation of a 35.4 P/E ratio, the stock has potential to increase revenue and consumer bases. However, at this time, the disappointing revenue numbers with the high valuation indicate holding off for a just little while.

Data by YCharts

Data by YCharts

More Competition

In order to beat competition from more digitally inclined mega-retailers such as Nike (NKE) (even though Nike is sold at Revolve), the company needs to have more exposure and marketing. It always comes down to marketing - influencers are great but consumers need to understand what your brand is about and how it relates to them. Revolve is both a streetwear and formalwear company, but it has been branded as having only fancier-style clothing. The company is also facing even more social media integrated companies such as PrettyLittleThing and Missguided, which I talked about in a separate article, and is now unable to turn positive net sales growth. Revolve brings something different to the table, and that’s new clothing from brands that most consumers have never seen before, and new items of clothing that are visually and aesthetically pleasing. However, the company is trapped in a box that it created. It doesn’t market its more casual clothes nearly enough, and that has hurt the company.

A broad view of a brand is always a good thing, it makes the consumer realize that they always have more to find and explore at your brand. If customers assume or know you for elaborate skirts and dresses, they won’t be as interested in your loungewear and activewear assortments.

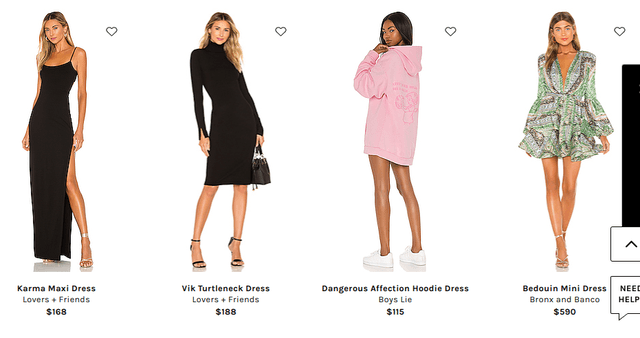

(Source: Revolve.com)

Online-Only Retail

For being an online-only retailer at the time of the pandemic, the numbers were slightly disappointing. While it's understandable that the company is now facing more competition from physical retailers moving into deeper digital penetration, these numbers are still surprisingly low. International net sales increased by 18% year over year, but net sales in the U.S. decreased by 6%. For the entire third quarter, net sales declined 2% year over year. The reasons behind this decline happen to be that the company sells a lot of formal-wear clothing, dresses, and skirts that have fallen out of fashion in the pandemic. This is in contrast to its activewear and loungewear segments that radiated strength throughout the quarter. Many people have argued that Revolve’s position as an online-only retailer alone is the greatest advantage a brand could have, but that is simply untrue. Clothes matter, products matter, and at the end of the day, Revolve was unable to keep up.

(Source: Revolve.com)

Name Brand Apparel

Revolve needs to be able to sell more name-brand merchandise. The company has recently ramped up production, with a 50% increase in new owned brand styles compared to Q3. The flexibility of having owned brands is incomparable against the pressure of being a mainly wholesale retailer. There are benefits to both, but it allows Revolve to retain more security when it comes to fashion retailing, and it also gives the company a unique element against other retailers. Many of Revolve’s brands are private labels, which is another advantage, but Revolve needs to be able to have more control over what merchandise is sold.

The company prioritizes trendier merchandise with more put-together wearable pieces, as well as streetwear style clothing. It does have mid-range to high-end prices with items ranging from around $50 to upwards of $300. It has a wide array of categories, clothing items, and beauty products. Revolve curates a certain customer, with average order value being $232 this quarter. Its consumers remain remarkably generous, and with Revolve’s Forward site the further luxury side of the company (with brands such as Balenciaga and Fendi), it is disappointing to see it not turn the same numbers as other luxury retailers.

Smaller Boutiques

Revolve selling primarily smaller, unheard-of boutiques is a huge advantage. It has a pretty much equal penetration of both mainstream brands such as Nike and smaller, more niche brands, giving the site a unique experience. More brand-conscious consumers have their space, while the site also allows customers to experience new styles not seen before in the atmosphere.

Numbers and Valuation

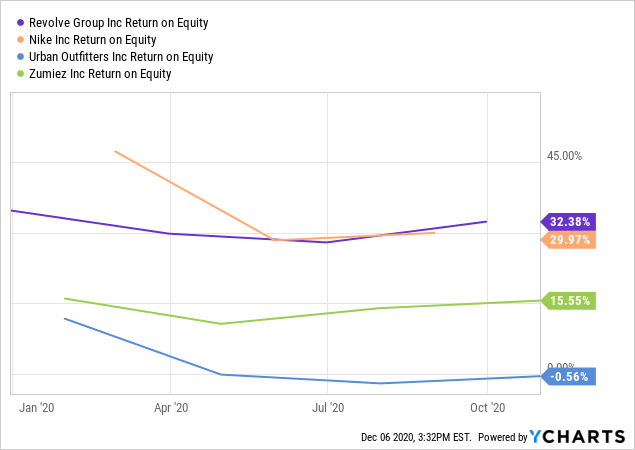

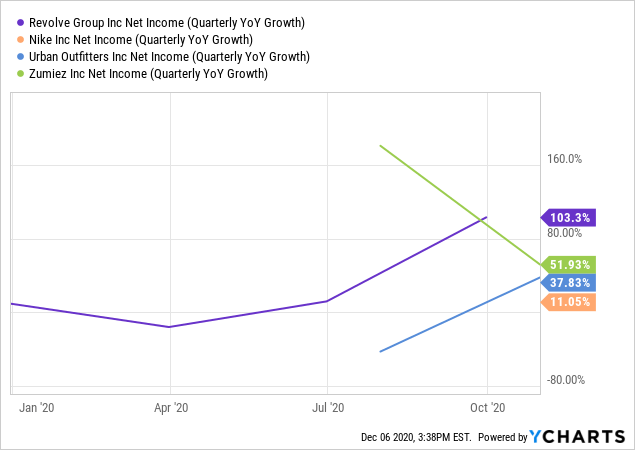

Revolve has the numbers to back up its valuation. The company has returns on equity beating out the likes of Nike, and despite a P/E ratio of 35.4, its gross profit margin at 55% is nearly double that of competitor Urban Outfitters (URBN), which also sells at similar price points.

Data by YCharts

Data by YCharts Data by YCharts

Data by YCharts

The area Revolve falls short in is revenue growth, with a decrease of 2%, but the increase in net income quarterly year over year is nearly double that of Nike at 100%.

Data by YCharts

Data by YCharts Data by YCharts

Data by YCharts

Revolve dropped the ball when it came to capitalizing on the pandemic. Extraneous circumstances aside, the company does have a unique platform that can resonate with new customers. My problem isn’t the fact that revenue dropped 2%, because in reality, that number isn’t that bad - it's just that for being an online-only retailer, the company really failed to harness the momentum behind it. Understandably, it is more expensive, but luxury retailers also were able to turn over nice numbers in this pandemic, so that isn’t much of an excuse. This is still a relatively new company, but changes need to made, especially to the marketing and sales strategy. At the current price point of around $23, it is quite a pricey stock, but the company does deliver nice returns and has little debt. When the stock first debuted in June 2019, the stock was sitting at about $34. In 2021, if the retail industry truly does have a blockbuster year, Revolve doesn’t need to do exceptionally well to capitalize on that, but at the end of the day, the stock just seems too expensive for the low revenue growth. With that mind, I would hold off on the stock.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.