Onward And Upward (Technically Speaking For 12/8)

Brexit issues are back on the table.

The UK is the first country to start a mass vaccination program.

The markets continue to move higher.

Remember Brexit? It's back and not in a good way (emphasis added).

Remember Brexit? It's back and not in a good way (emphasis added).

With time running out and the gaps still wide, Prime Minister Boris Johnson took personal control of the Brexit negotiations on Monday, declaring that he would travel to Brussels later this week for a last-ditch effort to strike a trade agreement between Britain and the European Union.

Mr. Johnson’s announcement, after a 90-minute phone call with the president of the European Commission, Ursula von der Leyen, raised the stakes as the talks enter their endgame. After 11 months of grinding negotiations, it appears, only a face-to-face meeting of political leaders can produce a breakthrough.

“We agreed that the conditions for finalizing an agreement are not there,” Mr. Johnson and Ms. von der Leyen said in a statement, adding that they had asked their negotiators to “prepare an overview of the remaining differences to be discussed in a physical meeting in Brussels in the coming days.”

This couldn't come at a worse time. However, the entire Brexit affair has been characterized by last-minute breakthroughs.

But, it's not all bad news from the UK, as the country becomes the first to roll out a vaccine:

British health officials hailed the first injections as a turning point in the fight against a virus that has infected 67 million people around the globe, killing more than 1.54 million. The vaccine was developed jointly by pharmaceutical giant Pfizer and German biotech firm BioNTech.

...

And the world is watching to see how the country where vaccines were invented three centuries ago rolls out its largest- and speediest-ever health campaign, deploying a revolutionary new vaccine that requires extremely special care and handling.

November 9 -- the date when Pfizer announced its very successful vaccine trials -- marks the date of the pandemic's last phase. Going forward, be particularly sensitive to negative news related to the rollout. For example, a very adverse reaction, even if it's only for a single person, will probably start a sell-off.

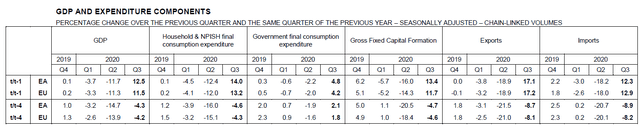

In the second 3Q20 EU GDP report, growth still strongly rebounded:

In the third quarter of 2020, seasonally adjusted GDP increased by 12.5% in the euro area and by 11.5% in the EU compared with the previous quarter, according to an estimate published by Eurostat, the statistical office of the European Union. These were by far the sharpest increases observed since time series started in 1995, and a rebound compared with the second quarter of 2020, when GDP had decreased by 11.7% in the euro area and by 11.3% in the EU.

Here's the table from the report:

The top two rows show the Y/Y percentage change. All categories of GDP expenditures rebounded strongly in the 3Q20. This follows the same pattern as other countries.

The top two rows show the Y/Y percentage change. All categories of GDP expenditures rebounded strongly in the 3Q20. This follows the same pattern as other countries.

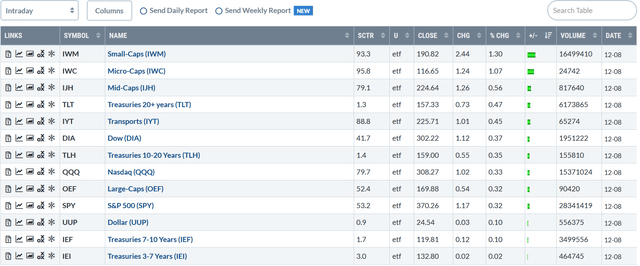

Let's take a look at today's performance tables: All the indexes were higher. Small caps were at the top of the table, followed by micro and mid-caps. Interestingly, the long end of the treasury market also rallied today, outpacing the QQQ and SPY.

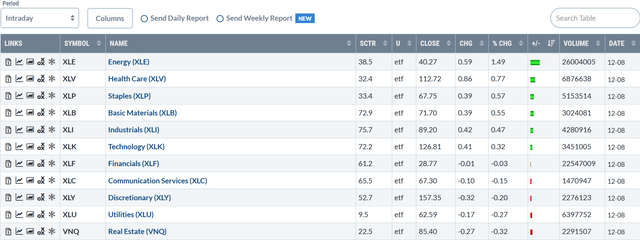

All the indexes were higher. Small caps were at the top of the table, followed by micro and mid-caps. Interestingly, the long end of the treasury market also rallied today, outpacing the QQQ and SPY.  Despite the gains, sector performance was a bit disappointing. Only six of eleven sectors were higher. Once again, the energy sector ETF is at the top of the list, gaining 1.49%. Two defensive sectors -- health care and consumer staples -- round out the top three. Tech and communication services -- the two largest components of the QQQ -- were up or down marginally. Utilities and real estate -- two sectors that are interest rate sensitive -- declined.

Despite the gains, sector performance was a bit disappointing. Only six of eleven sectors were higher. Once again, the energy sector ETF is at the top of the list, gaining 1.49%. Two defensive sectors -- health care and consumer staples -- round out the top three. Tech and communication services -- the two largest components of the QQQ -- were up or down marginally. Utilities and real estate -- two sectors that are interest rate sensitive -- declined.

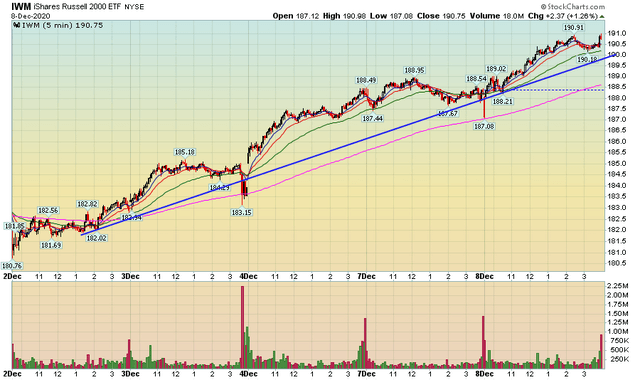

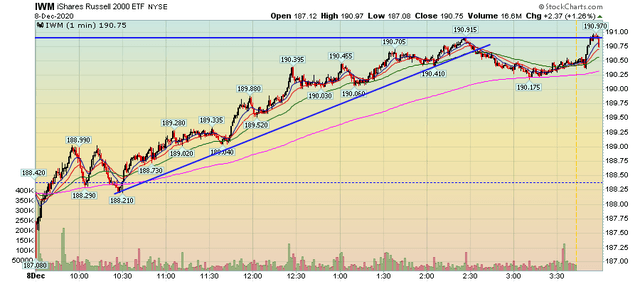

The 1-day charts are impressive. IWM 1-day

IWM 1-day

Let's start with the IWM. It gapped lower at the open but quickly rebounded. It then rallied until 2:30PM. It sold off modestly but closed the session near a session high.

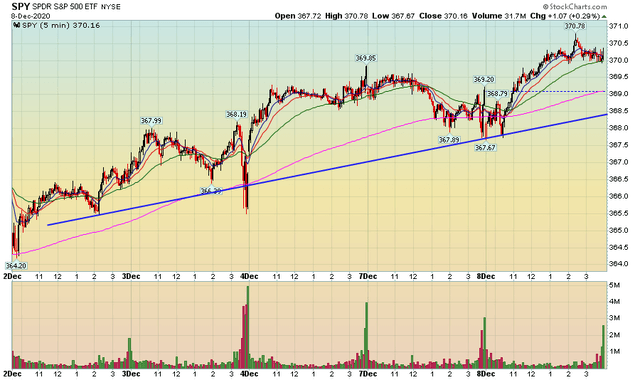

The SPY remained underwater for a bit longer but it also caught a bid mid-morning. It leveled out around 1:30PM and consolidated gains for the rest of the day.

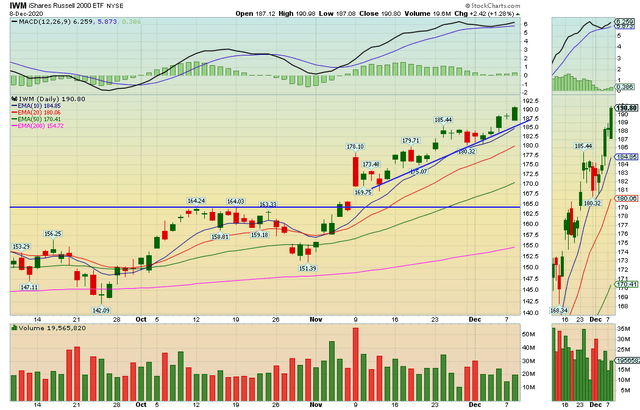

The five-day charts are also very bullish:

The IWM is in a very nice rally that runs from the southwest to the northeast.

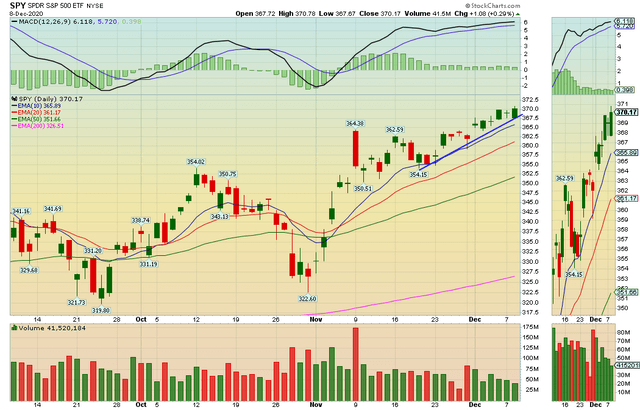

The SPY has a similar chart.

This continues the 3-month uptrend:

The IWM started a rally on November 9 with the Pfizer vaccine news.

SPY 3-Month

The SPY's uptrend is a bit shorter; it started mid-November.

This rally is beginning to remind me of the pre-pandemic rally, which was one of the most unloved rallies in stock market history. Yet, despite the negativity, the market is grinding higher.

Disclosure: I am/we are long IWM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.