NexTier Oilfield Solutions: Putting ESG Into The Frack Patch

NexTier has the liquidity to make back to a 400 rig market.

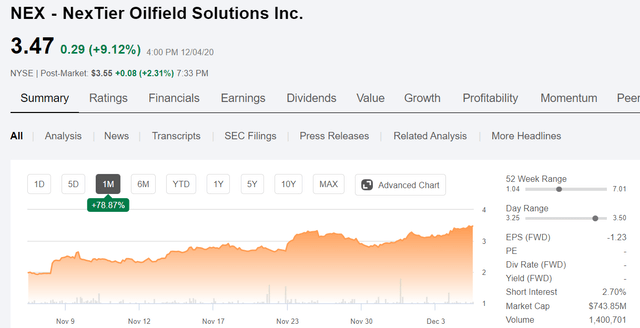

The company has rebounded strongly with other shale players in the last six weeks.

While we like the company, we would wait for better pricing.

Introduction

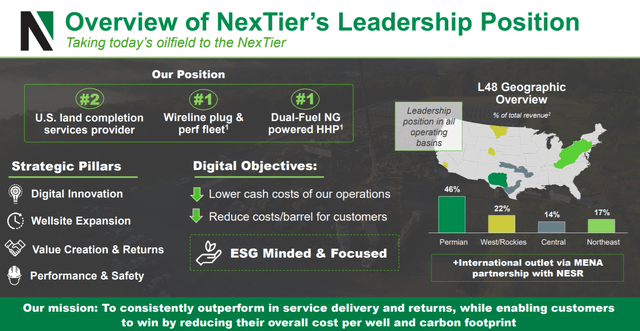

NexTier Oilfield Solutions (NEX) is another shale fracker that I had to be reminded of and was a little surprised at the size and scope of the company. It was formed in 2019 with the merger of C&J Oilfield Services and Keane Group. NEX hit the ground running with 2.3 million HHP and 50 fleets, and a host of ancillary equipment. This was probably a great idea as the virtual "hailstorm" that hit the frack patch in 2020 has taken down a number of competitors, among them namely BJ Services and Pumpco.

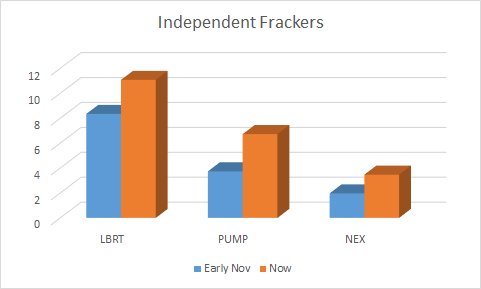

So, this article completes a tour de force of at least 70-80% of independent frack market, having recently covered Liberty Oilfield Services (LBRT) and ProPetro (PUMP). These companies, as a result of pristine or at least manageable balance sheets and a loyal customer base, appear to be headed for the winner's circle where business will once again begin to expand in 2021.

As you can see, in spite of its massive percentage run-up over the last month, shares of NEX have lagged behind competitors LBRT and PUMP. Is this an opportunity, or a warning sign?

Chart by author

The thesis for NexTier

NEX has maintained a broad footprint across the frac patch through out the downturn. That said, most of their business comes out of the Permian, so one has to question their commitment to far-flung regions like California for example. I would expect a frac crew in California to be lonelier than the Maytag man of old. That said, they are where they need to be.

One of things NexTier is committed to doing is reducing the size of the U.S. Frac Fleet. Toward that goal, it announced in the call that it was permanently retiring 400K HHP, bringing the total to nearly 650K HHP since the merger. One way to get prices higher is to reduce the marketed inventory.

Robert Drummond, NEX CEO, comments about inventory reductions:

"We will reduce our marketed hydraulic fracturing fleet by an additional approximate 400,000 horsepower, and we'll utilize the major components over time to bolster our maintenance inventory. Once consumed, we will cut up the frames and permanently remove them from the marketed base of equipment.

Combined with the fleet's retirements announced at the closure of our merger between C&J and Keane, we'll have removed nearly 650,000 Tier 2 diesel-powered horsepower from the market since the merger one year ago. We continue to play our part in aligning frac supply with demand and applaud our industry colleagues who have taken similar recent measures."

The only hope for the fracking industry to regain pricing power are actions like this. The frack patch's glory days are behind it. There is no point in having 10-15 million HHP just sitting idle, and putting a drag on the entire industry. Cut it up and sell it by the pound for boat anchors.

Liquidity

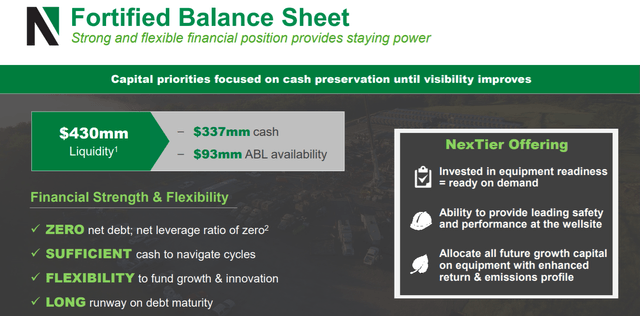

One of the things we've been taking a hard look at as we've probed the patch for bargains is liquidity. There's no point in sinking hard earned capital down a rabbit hole. We only want to take chances on companies that can stay the course, although the course is getting shorter.

Something we like to see is no debt or manageable debt. NEX meets that second criteria handily. With only minimal borrowings against its ABL, they present no challenge. The 2018 term loan exited Q3 at $337 million, but presents repayment ladders of just $3.5 million in each of the next 5 years. The term loan has a maturity of May 2025.

I am going to give NexTier a passing grade here. With cash on hand nearly equal to the term loan and a long runway before they have to cough up any serious cash to pay down debt, I don't see a problem that can't be dealt with.

Differentiators

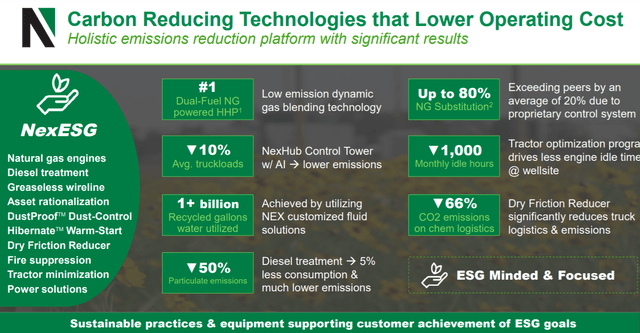

One of the problems pumpers have is "dumb iron." Historically, that's been the way big chunks of iron and steel were viewed. Now as frac fleets are upgraded to new fuels, and some of their functionality gets transferred to the cloud, they have an opportunity to reduce their carbon footprint on the rig site. This is by no means an avalanche yet as diesel frac spreads still represent about 70% of the market domestic inventory.

NexTier

NEX has put together a fairly sophisticated ESG focused platform that begins with dual-fuel optionality for the client and tiered pricing according to the amount of diesel the client wants to displace, and related NOX and Co2 emissions. They've also done a good job of managing the totality of the process through their NexHub central planning and AI architecture.

Robert Drummond, NEX CEO, discusses the optionality they are building into their premium Platinum frac fleets:

"The objective really is to build the capabilities to fuel our own demand, and when you think about the economics around that, a hard running diesel fleet, a burn in excess of $12 million a year in diesel. So converting that stream to natural gas or CNG is an opportunity to not only reduce emissions but to take advantage of the fuel arbitrage between natural gas and diesel, which, as oil price goes back up and diesel price goes back up, that's only going to make those economics even better.

But the key thing is our customers want to use field gas, and many of them are building our networks to be able to do that. So part of the service offering of power solutions is going to be able to help them make that connection and make that happen most cost effectively."

As someone who has worked in the oilfield, I can you tell this type of thinking is way overdue. For most of its history, the industry has put in places technical solutions to problems that paid no attention to the environment or the sustainability of the enterprise. Diesel was cheap. Diesel engines were cheap. Why would anyone care about exhaust?

The oilfield is learning a hard and overdue lesson. We have an image to project. It can be to go with the current popular trends of minimizing carbon footprint, that helps the client meets their own goals in that regard. Or it can be seen as non-compliant and working counter-productively to climate goals. The smart approach is to embrace the new era and make it work for you.

Q3 finances

Total third-quarter revenue totaled $164 million compared to $196 million in the second quarter. Total third-quarter adjusted EBITDA was a loss of $2 million compared to $2 million of positive adjusted EBITDA in the second quarter.

In the Completion Services segment, third-quarter revenue totaled $154 million compared to $179 million in the second quarter. Completion service segment adjusted gross profit totaled $15 million compared to $32 million in the second quarter. During the third quarter, they deployed an average of 13 completions fleets, and when factoring in activity gaps, NEX operated the equivalent of 11 fully utilized fleets.

NEX exited the second quarter with eight fully utilized completions fleets. As market conditions started to improve, they successfully redeployed one or two fleets each month throughout the third quarter, resulting in 13 fully utilized and 14 deployed fleets when exiting September.

On a fully utilized basis, annualized adjusted gross profit per fleet, which includes frac and bundled wireline, totaled $6 million compared to $11 million per fleet in the second quarter. They were significantly impacted by utilization inefficiencies resulting from calendar white space in the quarter.

Adjusted EBITDA for the third quarter includes management adjustments of approximately $20 million, consisting primarily of $7 million of merger and integration costs mainly from the implementation of their NexTier ERP platform.

Third-quarter selling, general and administrative expense totaled $26 million compared to $38 million in the second quarter. Excluding management adjustments, adjusted SG&A expense totaled $20 million compared to adjusted SG&A of $31 million in the second quarter.

Cash on the books in the third quarter totaled $305 million compared to $337 million of cash at the end of the second quarter. Total debt at the end of the third quarter was $336 million net of debt discounts and deferred finance costs and excluding finance lease obligations compared to $337 million in the second quarter.

Cash flow used in operations was $28 million during the third quarter, while cash flow used in investing activities totaled $3 million driven by maintenance CapEx and the finalization of the NexTier ERP deployment. This resulted in free cash flow use of $31 million in the third quarter. Excluding $7 million in merger and integration cash costs and $1 million in market-related severance and restructuring cash costs, adjusted free cash flow used totaled $23 million in the third quarter.

They are increasing the investment in Tier 4 dual fuel capabilities that will be partially delivered in the fourth quarter of this year. Factoring in these strategic investments, they are slightly revising the 2020 CapEx outlook from the range of $100 million to $120 million to a new range of $120 million to $130 million.

Your takeaway

Coming off losses for the prior quarter, it's hard to put a valuation on NEX. Their non-GAAP free cash flow for Q3 gives us a place to start. With an EV of ~$1.0 billion, they are selling for 43X free cash flow. By comparison, LBRT is selling for 20X FCF.

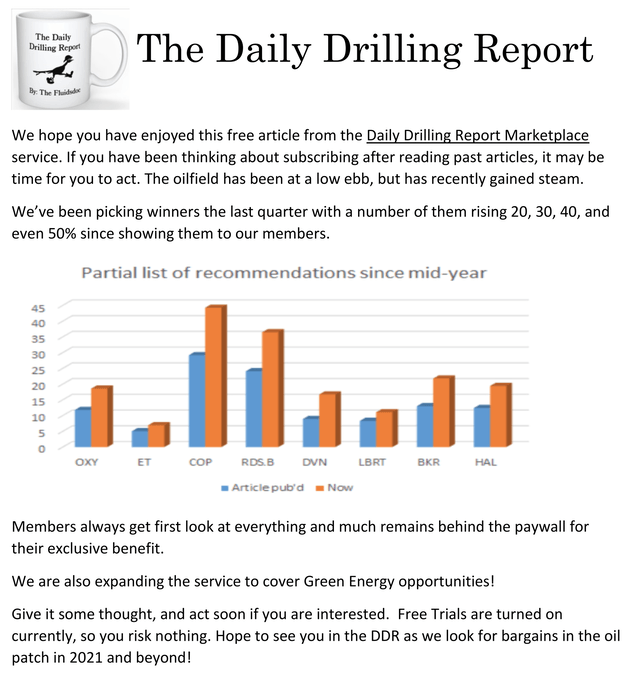

One thing the oilfield has currently is momentum. Every company we have looked in the last six months is substantially higher, and generally most of this coming in the last month or so. This makes us want to have patience as regards to NEX. 70% in a month will sell off pretty quickly at the first sign of negative news. That's what I am waiting for and I'd suggest you not chase NEX higher at this point in time. It will go higher eventually as the frac business repairs itself through equipment attrition and working smarter, but there could be quite a bit of fluctuations on the way.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not advice to buy or sell this stock or ETF. I am not an accountant or CPA or CFA. This article is intended to provide information to interested parties and is in no way a recommendation to buy or sell the securities mentioned. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to do their own due diligence before investing their hard-earned cash.