Despite the popularity of ETFs, the fund sponsoring business has turned sour as immense fee competition pushes revenue and margins lower.

WisdomTree Investments has been hit particularly hard by the fee-war since its business model does not contain the "ancillary services" synergies of its larger competitors like BlackRock and Schwab.

WisdomTree has hard a particularly poor year due not only to COVID's impact on AUM, but also significant losses due to the rise in gold.

Without a buyer, WisdomTree has poor prospects as there are no signs the fund fee-war will end anytime soon.

Despite its losses, WisdomTree is very cheap compared to its assets under management, opening the door for a strategic buyer looking to gain a foothold in the fund industry.

While the popularity of ETF and passive investing has continued to grow over the past few years, the money to be made off of offering funds has declined dramatically. A 2019 JP Morgan report showed that average ETFs fees have declined from about 35 bps in 2012 to 20 bps last year. The study also showed that lower fee funds garner far more inflows than those with the highest costs, making the ETF market extremely competitive. Fees are normally higher outside of the U.S, but that is now changing as seen by the fresh round of fee cuts by the German asset manager DWS.

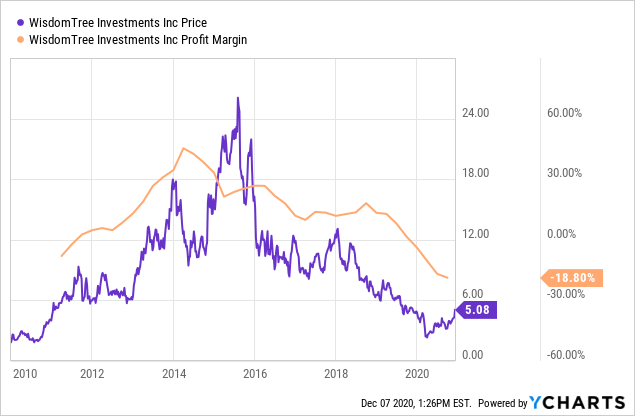

The price war seems to have begun around 2015. Before then, ETFs were still a growing phenomenon so new fund in-flows offset fee competition outflows. However, today many managers are faced with the difficult prospect of declining margins (due to fee-cutting) and declining revenue (due to AUM flows to ever-lower fee providers). This has been a nightmare for fund managers that cannot keep up with the rapidly changing environment. One of the hardest-hit managers is WisdomTree Investments (WETF) which has shed nearly 80% of its value since 2015 and has seen its profit margins collapse. See below:

As you can see, WisdomTree is having a very difficult time fending off competition. This is despite the fact that its AUM recently returned to its peak level of $65B. However, its profit margins are fluctuating near zero and it is not entirely clear if WisdomTree's equity can survive without significant operational changes.

Despite this, the stock has doubled in value since its low earlier this year so many investors are betting on a turnaround. Indeed, if the company is able to bring its EPS back to the level seen only two years ago, it would be trading at an extreme discount today.

Fees: How Low Can They Go?

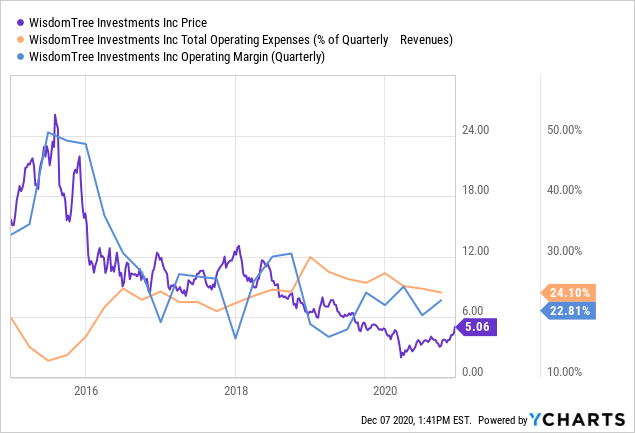

WisdomTree's core issue is that its sole business is essentially fund management with "Advisory fees" making up roughly 99% of its 2020 revenue. Most of this revenue is paid to employee compensation and fund management. Fortunately, WisdomTree has managed to keep its operating expenses in check as seen by its stable "Opex/Revenue" level despite declines in operating margins:

Importantly, WisdomTree's 2020 profits have been particularly troublesome (seen by negative 15-20% profit margins) not only due to AUM volatility from COVID, but also a significant loss to the rise of gold.

In 2018, WisdomTree made a deal to make fixed payments to a company it acquired equating to 9.5K oz per year until 2058 (see 10-Q Note. 11). As the price of gold rises, so too does the present value of this transaction and therefore losses to WisdomTree, making for a relatively large liability. This has harmed the company as it has caused WisdomTree to lose 80% of would-be profits this year ($34.4M gold payment revaluation charge to $42M in operating income). If gold continues to rise, WisdomTree will likely continue to see "other losses" from this segment.

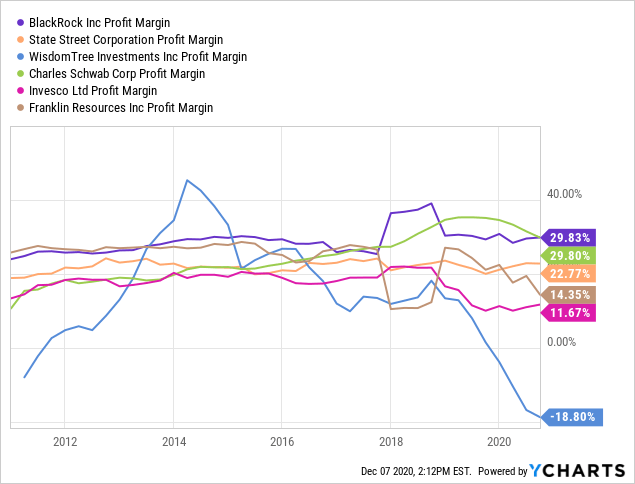

From a longer-term perspective, WisdomTree is struggling to keep up with the ever falling fees from its larger peers like BlackRock (BLK), State Street (STT), and Schwab (SCHW). These companies are also taking a hit due to the fee-war, however, they have a distinct advantage since they offer an array of other more-profitable services such as analytics and brokerage, while WisdomTree is entirely dependent on its fund business.

Importantly, a company like Schwab or BlackRock can hypothetically lose money on their fund businesses since they make secondary income from assets under management through brokerage and technology/analytics services. Put simply, one new client or one more dollar in AUM is worth more to the larger issuers than it is to BlackRock. This is seen very clearly through the profit margins of top fund managers:

As you can see, margins have been declining for most. However, losses have been most extreme for those without significant diversification outside of the fund management business like WisdomTree, Invesco (IVZ), and Franklin Templeton (BEN). As time continues and the fund asset management market continues to fully-mature, fees will likely continue to decline as investors consolidate into funds with the lowest fees. As I mentioned earlier, this could cause WisdomTree's profits to decline into chronically negative territory since BlackRock is able to outcompete due to the fact it generates more profit per AUM due to its business model. If this continues too long it could push WETF's price to zero.

The Bullish Buyout Thesis

While WisdomTree has been the hardest hit by competition, this also provides a potential bullish thesis on the company. Its core issue is not that it has inferior products or excessive operational expenses, it is a lack of synergies that are found in most of the larger competitors. Since the cost of switching funds is near zero and takes very little time, the "economic law" of profit margins declining toward zero holds for fund managers. Given the increasingly competitive environment for ETFs and mutual funds, I believe the fund management business is doomed to deliver zero profits.

Thus, the only way for WisdomTree to continue to make a profit is likely through ancillary services such as those offered through its larger competitors. Of course, it is unlikely that WisdomTree will launch its own, but this does give the company a significant buyout value. At $740M with $65B in AUM, acquiring WisdomTree would allow a larger financial services company a very cheap way to get a significant foothold in the U.S and international fund industries. As an example, Waddel & Reed Financial (WDR) was recently acquired for 50% above its market price ($1.7B).

The Bottom Line

Without a buyer, WisdomTree is expensive today with annual forward EPS not expected to rise above $0.30 on the five-year consensus earnings expectations. This makes WETF relatively expensive with a forward "P/E" of 16-20X+ depending on the timeframe. In my opinion, its earnings may actually continue to decline over the coming years as there are so signs that the fee war is ending anytime soon. Of course, its gold liability also creates significant risks if gold continues to march higher as seen this year.

For the time being, I'd avoid WETF as I believe it may reverse back forward spring levels. The stock has been seen very strong performance since April and is seemingly overdue for a correction. Still, I would not short the stock simply because the company is cheap relative to its AUM and could rise significantly on the news of a strategic buyer. That said if WETF rises to $7-$10 per share I may consider short selling the stock as I doubt a buyer would be willing to pay for much more than that amount for a company with declining profitability.

Interested In More Alternative Insights?

If you're looking for (much) more research, I run the Conviction Dossier here on Seeking Alpha. The marketplace service provides an array of in-depth portfolios as well as weekly commodity and economic research reports. Additionally, we provide actionable investment and trade ideas designed to give you an edge on the crowd.

As an added benefit, we're allowing each new member one exclusive pick where they can have us provide in-depth research on any company or ETF they'd like. You can learn about what we can do for you here.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.