Tracking Larry Robbins' Glenview Capital Management Portfolio - Q3 2020 Update

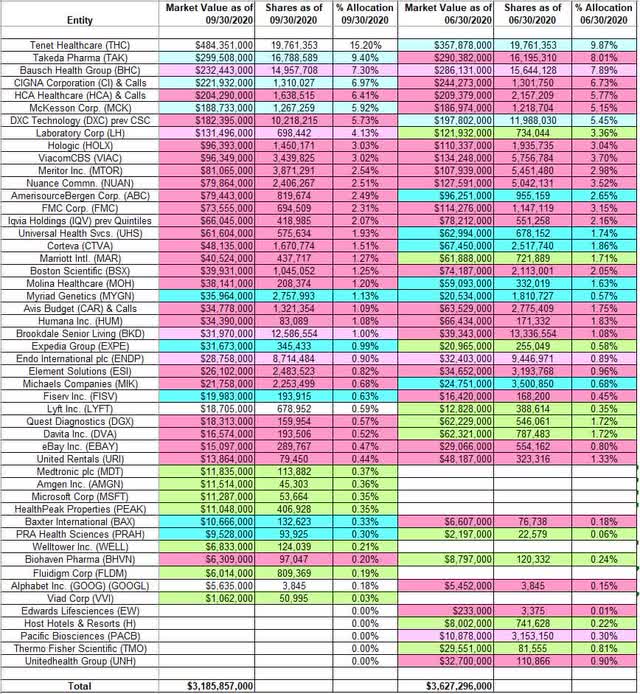

Glenview Capital Management’s 13F portfolio value decreased from $3.63B to $3.19B this quarter. The number of positions increased from 43 to 45.

They increased Myriad Genetics, while decreasing Quest Diagnostics, DaVita, and United Rentals during the quarter.

The top three stakes are Tenet Healthcare, Takeda Pharmaceuticals, and Bausch Health Group. They add up to ~32% of the portfolio.

This article is part of a series that provides an ongoing analysis of the changes made to Larry Robbins’ 13F portfolio on a quarterly basis. It is based on Robbins’ regulatory 13F Form filed on 11/16/2020. Please visit our Tracking Larry Robbins’ Glenview Capital Management Portfolio article for an idea on his investment philosophy and our previous update for the fund’s moves during Q2 2020.

This quarter, Robbins’ 13F portfolio value decreased from $3.63B to $3.19B. The number of holdings increased from 43 to 45. The top five positions are Tenet Healthcare (THC), Takeda Pharmaceuticals (TAK), Bausch Health (BHC), CIGNA (CI), and HCA Healthcare (HCA). Together, they are at ~45% of the 13F assets.

Note: Longview Acquisition Corp. (LGVW), a $345M SPAC sponsored by Larry Robbins, did a ~$1.5B EV deal to merge with Butterfly iQ last month. The business pioneered a handheld portable ultrasound machine.

New Stakes

Medtronic plc (MDT), Amgen Inc. (AMGN), Microsoft Corp. (MSFT), HealthPeak Properties (PEAK), Welltower Inc. (WELL), Fluidigm Corp (FLDM), and Viad Corp. (VVI): These are very small (less than ~0.5% of the portfolio each) new positions established this quarter.

Note: Microsoft is back in the portfolio after a quarter’s gap.

Stake Disposals

Edwards Lifesciences (EW), Pacific Biosciences (PACB), and UnitedHealth Group (UNH): These small (less than ~1% of the portfolio each) stakes were disposed during the quarter.

Host Hotels & Resorts (H) and Thermo Fisher Scientific (TMO): These two small (less than ~1% of the portfolio each) stakes purchased last quarter were disposed this quarter. Thermo Fisher Scientific is a frequently traded stock in the portfolio.

Stake Increases

Takeda Pharma: TAK is now the second-largest position at 9.4% of the portfolio. It came about as a result of Takeda’s acquisition of Shire plc. Glenview had a large position in Shire plc for which they received Takeda shares. They also increased the resultant stake by ~30% in 2019 at prices between $16.70 and $21.50. The last two quarters had seen a ~45% selling at prices between $13 and $20. The stock currently trades at $18.75. This quarter saw a ~3% stake increase.

Cigna Corporation: CI is a very long-term top-five ~7% stake that has been in the portfolio since 2007. The stake has wavered. In recent activity, Q2 and Q3 2019 had seen a combined ~18% stake increase, while next quarter, there was a similar reduction. Q1 2020 saw a two-thirds selling at prices between $130 and $223. The stock is now at ~$218. Last quarter also saw an ~11% further trimming. There was a marginal increase this quarter.

McKesson Corp. (MCK): The large 5.92% MCK stake was first purchased in Q4 2016 and built over the next two quarters at prices between $124 and $167. The position saw a ~130% increase in Q3 2017 at prices between $146 and $168, and that was followed with a ~40% increase the following quarter at prices between $135 and $163. The three quarters through Q4 2019 had seen a ~25% selling at prices between $112 and $153. That was followed with a two-thirds selling over the next two quarters at prices between $116 and $171. The stock is now at ~$181. This quarter saw a ~4% increase.

Fiserv Inc. (FISV): FISV is now a very small 0.63% of the portfolio stake. It was established in Q3 2019 as a result of Fiserv’s acquisition of First Data Corp. that closed in July. Terms called for First Data shareholders to receive 0.303 shares of FISV for each share of FDC. Glenview had 13.77M shares, for which they received 4.17M shares of FISV. That position was reduced by one-third during the quarter at prices between $92 and $109. That was followed with a similar reduction in Q4 2019 at prices between $101 and $117. The next two quarters saw the position almost sold out at prices between $77 and $124. The stock currently trades at ~$117. Glenview is realizing long-term gains. This quarter saw a ~15% increase.

Baxter International (BAX), Expedia Group (EXPE), Myriad Genetics (MYGN), and PRA Health Sciences (PRAH): These very small (less than ~0.75% of the portfolio each) stakes were increased this quarter. The 1.13% MYGN stake was first purchased in Q3 2019 at prices between $22.50 and $47, and increased substantially over the last two quarters at prices between $10.50 and $16.50. The stock is now at $18.88. EXPE is a ~1% position built over the last two quarters at prices between ~$48 and ~$103. The stock currently trades at ~$129. The stakes in Baxter and PRA Health Sciences were increased substantially, but they still are minutely small (less than ~0.35% of the portfolio each) positions in the portfolio.

Stake Decreases

Bausch Health Group: BHC is a 7.30% of the portfolio position established in Q3 2018 at prices between $20.50 and $27.50, and built over the next two quarters at prices between $17.50 and $28.50. The stock is now at $19.91. Q3 2019 saw a ~42% stake increase at prices between $21 and $26. That was followed with a ~20% stake increase next quarter at prices between $19 and $32. For investors attempting to follow, BHC is a good option to consider for further research. The last two quarters saw minor trimming.

HCA Healthcare: HCA is a top-five position at 6.41% of the portfolio. The original stake was from 2011, when 8.8M shares were purchased at a cost basis in the low $20s. The position has wavered. In recent activity, the three quarters through Q4 2019 had seen a ~40% stake increase at prices between $112 and $150. That was followed with a ~72% selling over the last three quarters at prices between ~$68 and ~$151. The stock is now at ~$158.

DXC Technology (DXC) (previously Computer Sciences Corp.): DXC is a 5.73% of the portfolio stake. The position was established in Q1 2016 at prices between $27 and $34. The four quarters through Q3 2018 had seen a combined ~38% selling at prices between $75 and $96, while next quarter, the stake was almost doubled at prices between $50 and $94. Q1 2019 also saw a ~20% stake increase at prices between $53 and $69. There was a ~9% stake increase last quarter and a ~14% reduction this quarter. The stock is now at $24.95.

Note: Computer Sciences Corporation and Hewlett Packard Enterprise (HPE) had announced a spin-merger transaction whereby HPE’s Enterprise Services business was to be spun off and merged into CSC to form a new business, DXC Technology. That transaction closed in April 2017. The terms called for CSC shareholders to receive one share of DXC for each CSC share held.

Laboratory Corp. (LH): LH is a 4.13% of the portfolio stake established last quarter at prices between ~$113 and ~$182, and the stock currently trades at ~$199. There was a ~4% trimming this quarter.

Hologic (HOLX): The ~3% HOLX stake was purchased in Q2 2018 at prices between $36.50 and $40.50, and increased by a whopping ~575% next quarter at prices between $38 and $43. Q2 and Q3 2019 saw a ~24% selling at prices between $43 and $52, while next quarter, there was a similar increase at prices between $45.50 and $53.50. The last three quarters have seen an ~85% selling at prices between ~$29.50 and ~$73. The stock currently trades at $73.16.

ViacomCBS (VIAC): VIAC is a ~3% of the 13F portfolio position established in Q4 2019. Glenview had 4.14M shares of CBS Corporation, for which they received the same number of shares in the new entity ViacomCBS formed in the merger transaction with Viacom. Glenview also increased the position by ~250% during the quarter. The last three quarters saw the position sold down by ~77% at prices between ~$11 and ~$42. VIAC currently trades at $36.95.

Note: Details on the original CBS position follows: A 1.76% stake was first purchased in 2013, and a large increase happened in Q4 2014 at prices between $49 and $57. The position had since wavered. 2017 saw a one-third increase at prices between $55 and $69. There was a ~3% trimming in Q1 2018, and that was followed with a ~35% reduction over the next two quarters at prices between $49 and $59.

Meritor Inc. (MTOR): MTOR is a very long-term 2.54% portfolio stake. The last major activity was in Q3 2018, when there was a ~50% stake increase in the low 20s. The last two quarters have seen a ~45% selling at prices between ~$12.25 and ~$25.50. The stock is now at $28.11.

Note: Glenview controls ~5% of Meritor Inc.

Avis Budget (CAR) and Nuance Communications (NUAN): These two positions saw large increases in H2 2019, but were reduced over the last two quarters. The ~1% CAR stake was increased by ~130% in H2 2019 at prices between $24 and $36.50. The last three quarters saw an ~80% selling at prices between $7.75 and $50.50. The stock currently trades at $39.72. NUAN is a 2.51% position that saw a ~130% stake increase in H2 2019 at prices between $14 and $18. The last three quarters saw an ~80% selling at prices between ~$14 and ~$34. It is now at ~$42.

AmerisourceBergen Corp. (ABC) and Corteva (CTVA): These two stakes were substantially increased last quarter but reduced this quarter. The 2.49% ABC position saw a ~30% stake increase last quarter at prices between $81 and $102. The stock currently trades at ~$103. There was a ~15% selling this quarter. CTVA is a 1.51% of the portfolio position that saw a ~75% stake increase last quarter at prices between $22.25 and $30.65. This quarter saw a one-third reduction at prices between $25.25 and $30. It is now at $38.65.

Universal Health Services (UHS): UHS is a 1.93% of the portfolio position built in H1 2020 at prices between $85 and $111. The stock is now just above that range at ~$135. This quarter saw a ~15% reduction.

FMC Corporation (FMC): FMC is a 2.31% of the portfolio stake established in Q1 2015 at prices between $55 and $65, and increased by ~180% the following quarter at prices between $51.50 and $61. In recent activity, the three quarters through Q4 2019 had seen a two-thirds selling at prices between $71 and $102. That was followed with a ~75% reduction over the last three quarters at prices between ~$60 and ~$113. The stock is now at ~$122.

Iqvia Holdings (IQV) (previously Quintiles IMS): The ~2% IQV stake was established in Q2 2016 at prices between $61 and $71, and increased by ~75% in the following quarter at prices between $65 and $81. There was a stake doubling in Q4 2016, primarily due to the merger transaction between Quintiles and IMS that closed in October. In recent activity, the last three quarters saw a ~90% reduction at prices between ~$84 and ~$170. The stock is now at ~$171.

DaVita Inc. (DVA), Quest Diagnostics Inc. (DGX), and Marriott International (MAR): DVA is 0.52% of the portfolio position purchased last quarter at prices between $65.50 and $88.30, and the stock is now at $109. This quarter saw the stake sold down by ~75% at prices between $80 and $92. The 0.57% DGX position was established last quarter at prices between ~$73 and ~$123, and it currently goes for ~$123. There was a ~70% selling this quarter at prices between $107 and $130. MAR is a 1.27% portfolio stake purchased last quarter at prices between ~$59 and ~$113, and it is now at ~$136. This quarter saw a ~30% selling at prices between $83.50 and $108.

Boston Scientific Corp. (BSX): BSX is a ~1.25% of the portfolio position purchased in Q1 2020 at prices between ~$26 and ~$46, and the stock currently trades at $34.41. This quarter saw a ~50% selling at prices between $34.50 and $42.25.

Biohaven Pharmaceutical Holding Co. (BHVN), Brookdale Senior Living (BKD), eBay Inc. (EBAY), Element Solutions (ESI), Endo International plc (ENDP), Humana Inc. (HUM), Michaels Companies (MIK), Molina Healthcare (MOH), and United Rentals (URI): These small (less than ~1% of the portfolio each) stakes were reduced this quarter.

Note: Glenview controls ~10% of Brookdale Senior Living.

Kept Steady

Tenet Healthcare: THC is currently the largest position at ~15% of the portfolio. It was established in 2012 at a cost basis in the low $20s. The original position saw a ~40% increase in Q4 2013 at around $44. The last two quarters of 2015 saw a combined ~20% increase at prices between $27 and $61. The stock currently trades at $34.58. There was a ~9% stake increase in Q3 2019 at ~$20 per share.

Note 1: Glenview controls ~19% of the business.

Note 2: In August 2017, Glenview’s two directors resigned from THC’s board citing irreconcilable differences. In March 2018, Tenet’s board reached an agreement with Glenview whereby they agreed to vote in favor of the board’s nominees in return for bylaw amendments.

Lyft Inc. (LYFT): LYFT is a very small 0.59% of the portfolio stake established last quarter at prices between $22 and $41. The stock currently trades at $46.10.

Alphabet Inc. (GOOG, GOOGL): GOOG is now a minutely small 0.18% stake. It was first purchased in Q1 and Q2 2015 at prices between $492 and $575. The position has wavered. In recent activity, Q4 2018 saw a ~40% stake increase at prices between $976 and $1203. Q2 2019 saw a ~27% selling at prices between $1036 and $1288, and that was followed with similar reduction next quarter at prices between $1098 and $1250. H1 2020 saw the stake almost sold out at prices between $1054 and $1525. The stock is now at ~$1828. Glenview realized gains.

The spreadsheet below highlights changes to Robbins’ 13F stock holdings in Q3 2020:

Disclosure: I am/we are long VIAC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.