All three major US stock indices finished at fresh records while Chinese indices underperformed.

Despite estimates-beating PMIs, actions from both the U.S. and Chinese government led to soured sentiment.

JD Digits' involvement in China's digital yuan trial bodes well for Alipay's prospects.

Alibaba continues to have positive news flow in the electric vehicle/autonomous driving space.

The ho-hum nature of the ground-breaking digital banking award in Singapore to Ant Group exemplifies how investors are shunning Alibaba due to past scars.

By ALT Perspective for Chinese Internet Weekly

On Friday, all three major US stock indices finished at fresh records, capping a buoyant week. Investors looked past the rising coronavirus cases, choosing to stay positive on the vaccine developments and indications that new US stimulus could be forthcoming.

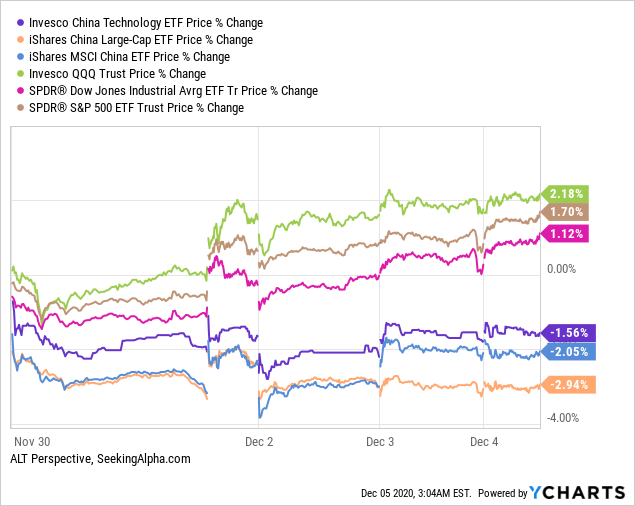

There was also good news from China in the form of November's purchasing managers indices [PMIs] exceeding forecasts. However, these were overshadowed by the House's passing of the Holding Foreign Companies Accountable Act and an expansion of a blacklist of alleged companies linked to the Chinese military.

In the past week, the representative ETFs of Chinese companies (CQQQ)(FXI)(MCHI) were in the red, declining 1.6 percent to 2.9 percent. On the contrary, their U.S. counterparts (QQQ)(DIA)(SPY) rallied 1.1 percent to 2.2 percent to set new highs.

Data by YCharts

Data by YCharts

Readers of my recent articles covering U.S.-listed Chinese companies often lament the lack of mention of the implications of the "delisting" Act. As I have already done so at length in several prior updates, and there are numerous valuable inputs from astute readers in the comments section of those pieces, I encourage interested readers to head there instead.

At the risk of not doing the great comments from readers on the subject justice, here are the key ideas:

- Many vested interests in the U.S. could lobby for the listings to remain,

- The majority of the U.S.-listed Chinese companies employs the Chinese entities of the Big Four auditors, which gives them confidence that high standards have already been complied with,

- If push comes to shove, fund managers, such as those running exchange-traded funds, would be happy to take over affected shares from retail investors,

- Given that it would take three failures over the same number of years for a forced delisting to happen, the company would have plenty of time to arrange a secondary listing elsewhere and make the new shares fungible with its U.S. ones.

There are also mitigating developments. The Chinese authorities have expressed their willingness to seek a resolution to the complaints. The Securities and Exchange Commission [SEC] has also proposed a "co-audit solution" based on the President's Working Group [PWG] recommendations to allow the Big Four accounting firms to validate their Mainland subsidiaries' audit work.

As I was writing, I received the weekend newsletter from Bloomberg where the headlines provided a succinct sum-up on the topic:

Source: Google (screenshot)

There were also a couple of self-inflicted bruises. In late October, proposed changes in Chinese regulations forced a suspension at the 11th hour of the intensely anticipated initial public offering of Alibaba's (BABA) Ant Group. Following the issuance of draft proposals for new rules to root out monopolies in the internet sector by China's financial regulator on November 10, the authorities declared plans to impose "special and innovative regulatory measures" on the country's financial technology giants.

Guo Shuqing, chairman of the China Banking and Insurance Regulatory Commission and Party Secretary of the central bank, emphasized that the proposed regulations "should cover all financial institutions, businesses and products," implying that the moves were not targeted at any company. Perhaps he didn't want anyone to think the government was being petty, acting in the response of what Jack Ma, founder of Alibaba Group, said in an offensive speech in October.

Guo also threw another curveball on investors, calling China's property market the biggest "gray rhino" in terms of financial risks. He cited loans related to the property market currently accounting for 39 percent of total bank loans in China. Already a substantial share, there's also a large amount of bonds, equities, and trust investments with exposure to it to contend with.

Interestingly, some optimists told me they were expecting a diversion of funds from a potential curtailment of property investments (or speculations, if you prefer) to pour into the Chinese equities markets. Hence, the news should be regarded as a positive one for the stock market. Apparently, the dour performance of the Chinese stock indices suggests this view is in the minority.

Some readers were concerned that the recent signals sent by the Chinese government seemed to indicate it is becoming more controlling and possibly overreaching to the extent of stifling the business growth. On the contrary, I believe the heightened scrutiny facilitates the ongoing reforms to push to a free market.

The "opening up" could make it more likely that investors will pile into a small number of highly profitable companies and those deemed to have better prospects. Such clustering could concentrate funding to the market favorites and result in them becoming too dominant and powerful. Tesla (TSLA), and the Chinese electric vehicle manufacturers, is arguably a good example of this phenomenon.

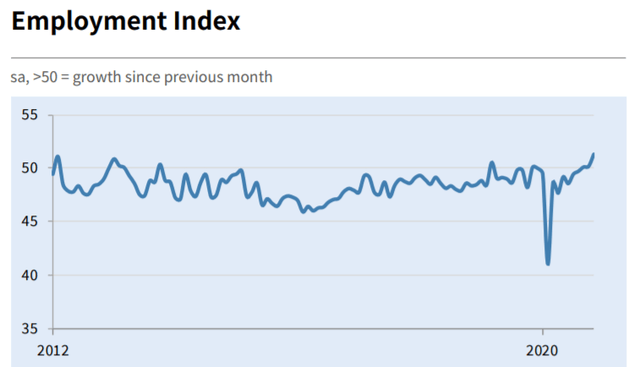

Going back to the PMIs. Both the official and privately compiled readings surpassed consensus forecasts for another month. It seemed the economists were addicted to being pessimistic about China's economy, choosing to believe that each month's survey results were too good to be sustainable.

From the estimates, we could see that economists were expecting a slowdown from October, essentially the same pattern that was observed from the previous months. The actual results proved them wrong again, delivering not just a simple beat, but a substantial one and bettering October's scores.

The official manufacturing PMI for November came in at 52.1, higher than October's 51.4 and beating the consensus estimate for 51.5. The official non-manufacturing PMI was clearly in the expansionary territory at 56.4, higher than October's 56.2 and the consensus estimate for 56.0.

The Caixin China General Manufacturing PMI compiled by IHS Markit (INFO) for November was 54.9, beating the consensus at 53.5 handily and was higher than October's reading of 53.6. The indicator reflected the sharpest improvement in conditions since November 2010, a decade ago! Critically, both the output and new orders indices increased at the fastest rates in ten years while employment expanded at the quickest pace since May 2011.

Sources: Caixin, IHS Markit

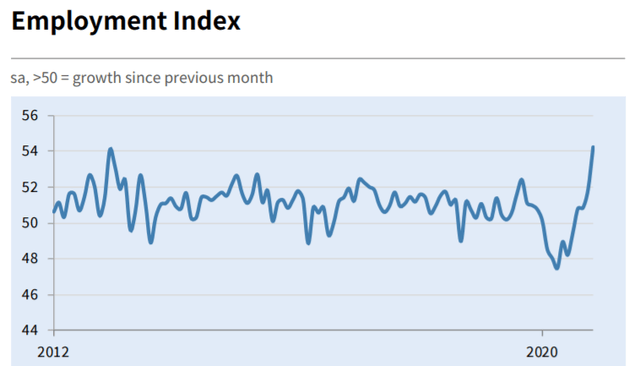

The Caixin China General Services PMI similarly posted a solid beat at 57.8 versus the consensus estimate for 56.4 which implied the economists were anticipating a slowdown from October's 56.8. The services employment index chart looks even better than the manufacturing one, with the gauge staying in positive territory for the fourth consecutive month and achieving the highest reading since October 2010.

To put the magnitude of the optimism in perspective, Dr. Wang Zhe, Senior Economist at Caixin Insight Group, remarked:

"The gauge for business expectations reached the highest point since April 2011. A majority of surveyed service providers were confident about the control of the epidemic and the economic recovery, while only 2% said they were pessimistic."

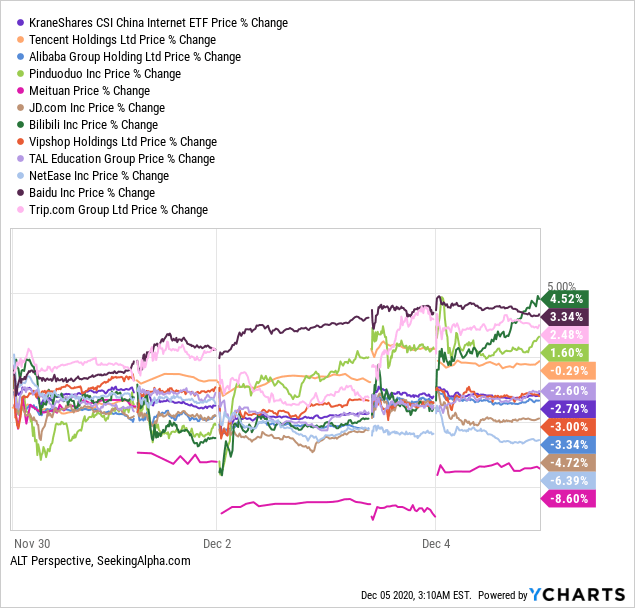

The Chinese Internet sector representative ETF, the KraneShares CSI China Internet ETF (KWEB), was similarly dragged down by the negative sentiment, closing down 2.8 percent for the week. Among the key holdings of the KWEB ETF, the share prices of e-commerce players Bilibili (BILI), and Pinduoduo (PDD), together with Baidu (BIDU) and Trip.com (TCOM), ended the week with positive gains.

At the other end of the spectrum, Meituan-Dianping (MEIT)(OTCPK:MPNGF)(OTCPK:MPNGY) and NetEase (NTES) posted hefty losses, declining 8.6 percent and 6.4 percent respectively. Meituan-Dianping reported Monday a 28.8 percent revenue growth year-on-year for the third quarter this year, beating consensus estimates.

However, investors were worried about the impact of the looming regulatory threat from Beijing as mentioned earlier, due to its dominance in food delivery. There were also concerns that the announced plans to expand its warehouse network and logistics capabilities so that Meituan-Dianping could fulfill its strategy of delivering "everything to customers' homes" would result in significant capital expenditures in the coming years.

Heavyweights Alibaba and JD.com (JD) were lower by 3.3 percent and 4.7 percent respectively, despite positive news flows. JD.com's healthcare unit, JD Health, is well on track for its public debut in Hong Kong on December 8. The IPO, priced at HK$70.58 (US$9.1) per share, raised $3.5 billion.

An August 17 update from JD Health

Source: JD.com

JD Health is in the hot businesses of online pharmacy and telehealth services, accelerated by the COVID-19 pandemic. Incidentally, thanks to the ill-fated Ant Group's IPO, JD Health has the honor to be Hong Kong's biggest debut of 2020. This is despite the IPO size being lower than the initial range touted to be up to $4 billion at the high end, which would have brought the valuation to nearly $30 billion.

Besides JD Health, JD.com also has another promising unit in fintech, JD Digits. I shared the history and prospects of the division in the article JD.com: Tremendous Value To Be Unlocked Soon. On Saturday, JD Digits revealed that it would accept digital yuan as payment for some products on its online mall, boding well for its public listing in the future.

The first virtual platform to accept China's central bank digital currency [CBDC], JD Digits would help test the digital yuan concept in the city of Suzhou. The country is relatively advanced in its evaluation of CBDCs in the world. In April, the trial had already been extended to foreign consumer companies like Starbuck (SBUX), McDonald's (MCD), and Subway.

The involvement of JD Digits helps dispel somewhat the concerns of the shareholders of Alibaba and Tencent (OTCPK:TCEHY)(OTCPK:TCTZF) that their mobile wallets could be rendered useless when the CBDC is fully implemented. Whether it's legal tender traditional money, CBDCs, or cryptocurrencies, digital wallets are still needed for storage and distribution.

Mobile payment apps in China (top left to right, bottom left to right): Alipay, WeChat Pay, QQ Wallet, JD Pay  Source: ALT Perspective

Source: ALT Perspective

Speaking of cryptocurrencies, we are all aware of how the share price of Square (SQ) has benefited since it announced enabling its crypto wallet feature. With PayPal (PYPL) jumping onto the bandwagon, cryptocurrencies appear to be going mainstream. I am wondering about how much the valuation of Ant Group might appreciate if it was listed and Alipay announces its entry into the crypto wallets arena.

Source: Ant Group

With electric cars and autonomous driving now the rage, it's puzzling why investors were not excited by the announcement by Alibaba-backed AutoX. COO Jewel Li told CNBC's Squawk Box Asia on Friday that self-driving cars without human drivers as a back-up were now being tested in Shenzhen, the city dubbed China's Silicon Valley. The startup plans to expand to 10 cities globally in the next six months.

I mentioned in an earlier article that SAIC Motor, China's largest state-owned automobile manufacturer, established a private equity fund to finance a collaboration with Alibaba to invest in smart electric vehicle technologies. YunOS (also called Aliyun OS), developed by Alibaba Cloud, has already been deployed in some of SAIC's Roewe sports-utility vehicles enabling features such as an intelligent digital map, voice control, action cameras, and internet ID.

Alibaba's Gaode Maps (AutoNavi in English) is currently the most downloaded free iOS navigation app in China. It recently incorporated a new AR navigation feature that warns drivers of upcoming collisions, pedestrians, and traffic lights. These developments suggest Alibaba could be a worthy contender in the hot field of electric vehicles and autonomous driving.

On Friday, the Monetary Authority of Singapore [MAS] revealed four successful digital bank applicants. The highly anticipated announcement saw an entity wholly-owned by Sea Ltd. (SE) winning the Digital Full Bank [DFB] license. The company often referred to as Southeast Asia's Tencent, saw its share price rising as much as 10 percent before paring some gains at the close on profit-taking.

An entity wholly-owned by Ant Group was awarded a license for Digital Wholesale Bank [DWB]. The MAS defined the difference between DFB and DWB as follows: "DFBs will be [sic] provide a wide range of financial services and take deposits from retail customers, while DWBs will focus on serving SMEs and other non-retail segments."

Ostensibly, Ant Group's DWB license is a diminished operation than Sea's DFB. However, the category fits very well into Alibaba's stated ambition to help millions of SMEs. It also allows the fintech unit to learn from the experience before applying for an upgrade when the opportunity arises in the future, avoiding the losses from potential mistakes.

As the saying goes, when one door closes, another one opens. The Singapore DWB license provides Ant Group with a whole new area of growth, even as the "door" in China has not closed but just partially blocked. With Alibaba owning a third of Ant Group and seeing nary an uptick is adding to the mystery of its share price's doldrums, also considering the other positive developments as mentioned earlier.

As explained in a past issue of the Chinese Internet Weekly, I found the KWEB ETF holding the most representative stocks in the sector. As such, an overview of the week's share price movements of the top few holdings of KWEB as compared with the ETF itself is provided as follows for convenient reference especially for the stocks mentioned in this article.

Data by YCharts

Data by YCharts

What is your take? Share your thoughts with the Seeking Alpha community in the comments field. If you like this article, click on the orange "Follow" button and make sure the "Get email alerts" is checked so that you will be informed of my next article the moment it's published. Leaving a comment would ensure you have access to the comments stream after the article goes behind the paywall.

Disclosure: I am/we are long BABA, BIDU, JD, TCEHY, TCOM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.