IDT Corporation: A Fintech And Cloud Communications Growth Story

IDT reported its fiscal 2021 Q1 results highlighted by firming margins and accelerating earnings.

The company's payments services and separate business cloud communication platform are driving growth, balancing softer trends from the legacy traditional voice calling segment.

A solid balance sheet with no-debt along with ongoing operating momentum supports a positive long-term outlook.

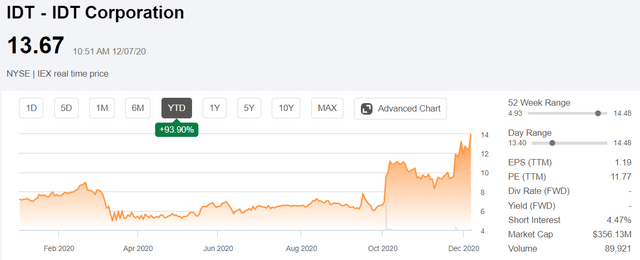

IDT Corporation (IDT) is undergoing a transformation from its traditional telecom services towards more high-tech solutions including mobile payments and a business-level cloud communications platform. The company just reported its latest quarterly results highlighted by accelerating earnings and strong momentum in new initiatives. Indeed, the stock is up over 90% this year with a growing recognition that the company is succeeding in building its market share with a global expansion strategy. We are bullish on shares of IDT which appears to still offer good value at the current level even following the impressive rally in recent months. The combination of a solid balance sheet with no debt and firming margins supports a positive long-term outlook.

(Seeking Alpha)

IDT Earnings Recap

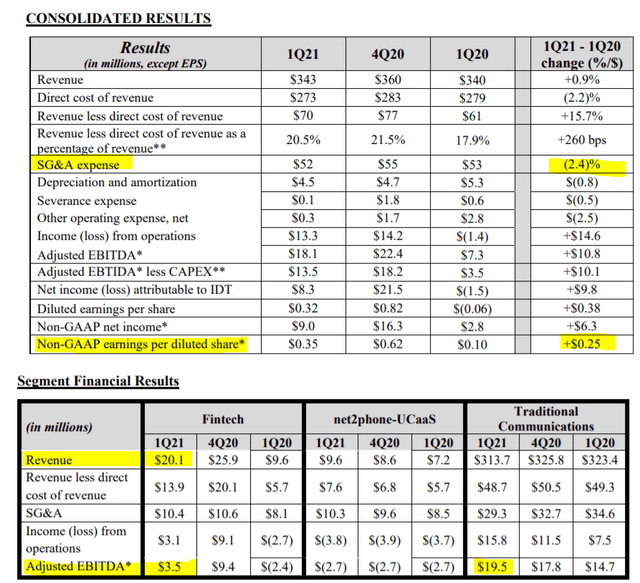

IDT Corp. reported its fiscal 2021 Q1 earnings on December 3rd with revenue of $343 million, up 0.9% year over year. While the top-line growth is only modest, the story here is climbing earnings driven by higher margins. The company's adjusted gross margin as a measure of revenue less the direct cost of revenue reached 20.5%, up from 17.9% in Q1 2020. SG&A expense declined by 2.4% y/y driving a decrease of 2.6% in total operating expenses. The result is that the adjusted EBITDA in the quarter at $18.1 million was up 148% y/y. Non-GAAP EPS of $0.35 represented an increase of 250% y/y from $0.10 in the Q1 fiscal 2020. Similarly, GAAP EPS of $0.32 reversed a loss of -$0.06 in the period last year.

(source: company IR/ annotation by BOOX Research)

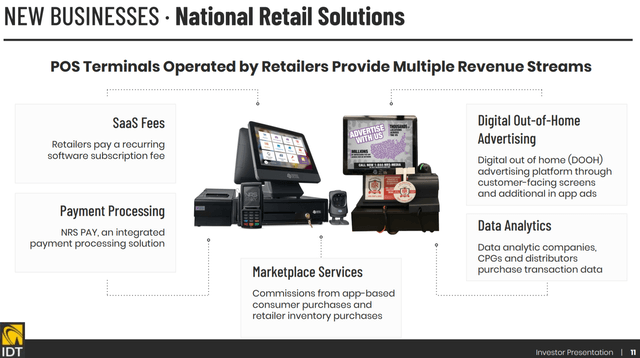

By segment, growth in the high-value fintech and net2phone-UCaaS "unified communications-as-a-service" segments were the strong points this quarter. Fintech business revenues are up 109% y/y to $20.1 million was able to turn a positive adjusted EBITDA of $3.5 million, reversing a loss of $2.4 million in the period last year. Fintech includes the 'BOSS Revolution Money App' targeting consumer international money remittances, along with 'National Retail Solutions' "NRS" which is a point-of-sale retail network for payment processing and related services.

(source: Company IR)

The attraction of business is the platform's mobile-ready integration allowing customers to order online which has gained momentum during the pandemic. The company explains that it already has around 12,000 terminals deployed worldwide and is adding between 450 and 500 accounts per month. The company also launched NRS Petro as a solution for independent gas stations to offer pay at the pump touchless and mobile payment. From the conference call:

The COVID-19 pandemic has definitely impacted consumer spending patterns and many local convenience stores are benefiting from increased foot traffic. I am more excited than ever about the potential of our NRS business. Our most promising offerings, including advertising, payment processing and analytics have just begun to realize their potential. And we continue to grow our retail network, adding 450 to 500 new POS terminals a month. We expect the pace of growth to accelerate once COVID vaccines are widely available. By the end of the quarter, we were billing for over 12,000 deployed terminals.

In the net2phone-UCaaS business, revenues climbed 33% y/y to $9.6 million. Management highlights the integration of several third-party customer relationship management applications and productivity tools like Microsoft (MSFT) Teams, Slack Technologies (WORK), and Salesforce.com (CRM) supporting the momentum of the voice over internet "VoIP" platform. The company has seen strong traction from Latin America with revenue climbing 30% sequentially in the region.

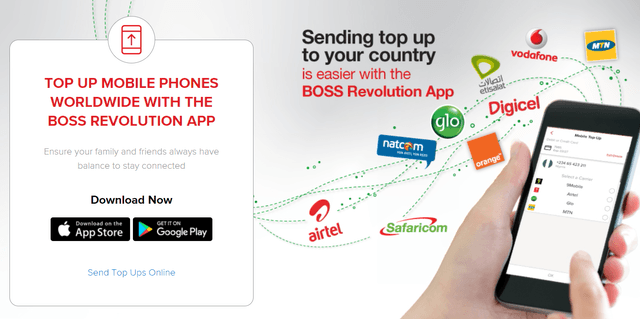

The more favorable trends here have balanced the weakness from the 'Traditional Communications' segment where revenues declined by 3% y/y to $313.7 million. While the business still represents 91% of total revenues, the company is focusing on maintaining market share and high-margin products and services. Within the group, carrier services revenue decreased by 23% y/y to $88 million reflecting border industry-wide decline of international voice calling, accelerated by the theme this year of corporate customers transitioning to work from home arrangements. Still, services from BOSS Revolution like 'Mobile Top-Up', which allows consumers to recharge prepaid wireless balances partnering with over 150 global carriers in 150 countries, maintains growth with sales climbing 25% y/y to $96 million in the last quarter.

(source: BOSS Revolution)

Overall, it was a solid quarter with impressive trends in financials and optimism towards new growth opportunities. While the company does not offer official guidance, the expectation is that momentum continues through the next year driven by ongoing product launches including efforts towards banking type products. CEO Shmuel Jonas made the following comments in the conference call:

Across our businesses, we continue to invest to develop new technology driven offerings and features that will enable us to better serve and maintain our customers and to pursue exciting growth opportunities as well as systems that make us more efficient. Within FinTech, we will roll out BOSS Money Visa Card in peer-to-peer transfers early next year. This is the first step in a broader and strategic challenger bank initiative that we are now focusing on to help our immigrant under-banked and unbanked customers conveniently access and participate fully in the digital economy.

Finally, the company ended the quarter with $119 million in cash and equivalents against zero long-term financial debt. The company's financial current ratio of 1.0x highlights the stable liquidity position. Furthermore, the company generated a positive free cash flow of $14.2 million this quarter which has supported its stock repurchasing program. IDT bought back $2.8 million in common stock during the last quarter.

Analysis and Forward-Looking Commentary

We're encouraged by the financial trends for IDT which has several areas of growth as upside catalysts over the next year. The company is expanding into new markets and continues to innovate with new products and services. We like the consumer services ecosystem which benefits from cross-selling opportunities and brand momentum to its customer base.

(source: finviz.com)

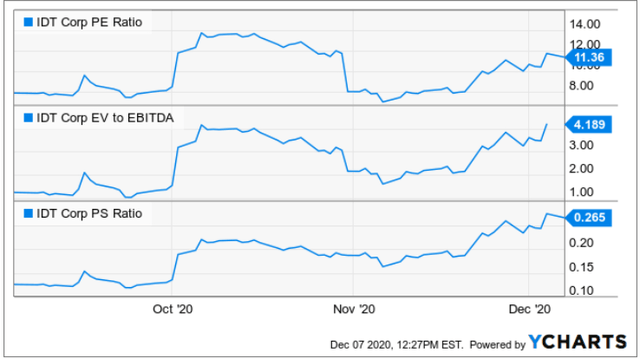

The rally in the stock has gained momentum going back to the fiscal 2020 Q4 earnings release in late October which included a surprising profit. The stock is up by nearly 120% in just the past 3 months suggesting a renaissance for the company's outlook. In terms of valuation, including the latest Q1 earnings, EPS over the trailing twelve months at $1.11 imply the stock is trading at a P/E ratio of 11.4x. An EV to EBITDA multiple of just 4.2x and price to sales ratio of 0.27x highlights the attractive value in the stock even with the ongoing rally.

Notably, there are no current consensus estimates published for the company given its relatively small-size with a $350 million market cap and otherwise low-profile. We sense that this creates an opportunity as the stock is still undercovered with most investors likely not aware of the turnaround compared to the company's history over the past decade when it was pressured by weak growth and limited earnings. The company's shift more recently towards tech solutions is beginning to pay off and the outlook is as strong as ever in our opinion. We expect growth in the key fintech and UCaaS cloud communications segment to maintain momentum going forward.

The challenge here is that the market segments IDT operates in are highly competitive. In the money transfers business, larger corporations like The Western Union (WU), MoneyGram International (MGI) compete for the same market share of remittances. IDT is also up against fintech leaders like Square (SQ) and 'Clover', a subsidiary of Fiserv (FISV) offer similar payment solutions. Leading telecom companies like AT&T (T) and Verizon Communications (NYSE:VZ) in the U.S. along with others internationally have substantial advantages in offering traditional voice services. In many ways, the competitive landscape adds to long-term uncertainties.

Still, we believe there is room for IDT to grow by focusing on its niche segments including targeting international markets for high growth opportunities. We think that the continued execution of its strategy in fintech and UCaaS can continue to generate value supported by fundamental tailwinds balancing the structural challenges of the traditional phone service business.

Final Thoughts

IDT is a high-quality small-cap with strong fundamentals. We rate shares as a buy with a year-ahead price target of $16.00 per share, representing an 18% upside from the current level. Momentum in high-growth segments supports a positive outlook that can drive a higher premium for the stock. Longer-term, we'd like to see an acceleration of the top-line figure which could be a catalyst for shares to move higher.

The risk here beyond a deterioration to the global macro environment included weaker than expected growth and softer margins. Key monitoring points in the upcoming quarters include the company's cash flow generation and the ability to stabilize the environment for the traditional phone service business. A significant slowdown in the operating metrics could force a reassessment of the long-term outlook and renewed bearish sentiment towards the stock.

Add some conviction to your trading! We sort through +4,000 ETFs/CEFs along with +16,000 U.S. stocks/ADRs to find the best trade ideas. Click here for a two-week free trial and explore our content at the Conviction Dossier.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in IDT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.