BLOK: You May Be Investing In Fool's Gold, Not Digital Gold

BLOK invests in companies involved in blockchain-related technologies.

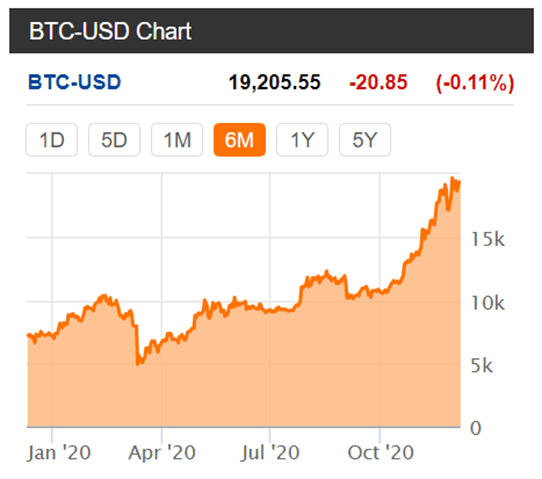

The price of the ETF has more than doubled since the start of the pandemic as money shifted into the "new asset class" - cryptocurrencies.

Bitcoin had a halving event in May. Such events happen every 4 years and typically cause a surge in the price of Bitcoin, followed by a collapse.

While BLOK looks enticing as an investment, it may very well be fool's gold, not digital gold. Be wary of the greed/panic cycle seen in the past.

Another aspect of this investment that environmentalists may want to consider is the large carbon footprint that blockchain processing entails.

(Source: Amplify ETFs)

The Amplify Transformational Data Sharing ETF (BLOK) is an ETF that invests in companies that have an active interest in blockchain-based data sharing technologies. And investors may want to pay attention, because the global blockchain market is "expected to grow from $3B in 2020 to $39.7B by 2025 - a CAGR of 67.3%", at least this is the forecast being touted by Amplify ETFs.

(Source: Amplify ETFs)

And the forecast has been reflected in BLOK's stellar performance of late, with the ETF share price more than doubling since the start of the pandemic.

Competition (Alternatives) in the Blockchain Space

BLOK competes with (at least) three other ETFs in the blockchain-related space: Siren Nasdaq NexGen Economy ETF (BLCN), Innovation Shares NextGen Protocol ETF (KOIN), and First Trust Indxx Innovative Transaction & Process ETF (LEGR).

BLOK appears to be the best performer of the bunch since the start of the pandemic, with slightly higher gain and less volatility than BLCN, while significantly outperforming the other two ETFs in the group.

(Source: Yahoo Finance/MS Paint)

While all of the ETFs have a similar mandate, BLOK is an actively managed fund with a stronger focus on companies using and deploying blockchain technology as compared to the other ETFs. This is, of course, desirable for investors looking a pure blockchain investment.

Expanding on this point, the top holdings of BLOK are digital payment processors utilizing digital currencies, whereas the other ETFs tend to have significant holdings in large investment banks such as Barclays PLC (BCS) and semiconductor manufacturers such as Samsung Electronics (OTC:SSNLF). In the case of BLCN, the car company Daimler AG (OTCPK:DDAIF) is one of its top 5 holdings. Blockchain technology isn't a significant factor for such companies, and they dilute the pureness of the blockchain investment ideology.

In fairness, BLOK does hold semiconductor companies, but they tend to have much lower weightings. And BLOK does not have significant holdings in investment banks, or if there are, they are way down in the list.

BLOK Stock Holdings

More specifically, BLOK holds a disproportionate weighting of companies involved with Bitcoin and other digital currencies, as reflected by the top five ETF holdings as shown in Table 1.

Table 1 - BLOK Top 5 Holdings

| Company | Weight |

| SILVERGATE CAP CORP. (SI) | 5.78% |

| SQUARE INC. (SQ) | 4.92% |

| PAYPAL HLDGS INC. (PYPL) | 4.14% |

| MICROSTRATEGY INC. (MSTR) | 4.11% |

| INTERCONTINENTAL EXCHANGE INC. (ICE) | 3.44% |

Silvergate

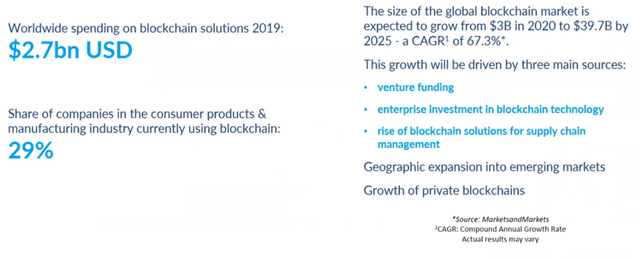

The top three holdings are actually global payments platforms. Silvergate, considered to be a bank, offers what it calls the "Silvergate Exchange Network" or ("SEN"), a global payments platform that facilitates the real-time transfer of U.S. dollars between digital currency exchange customers and institutional investor customers. The growth of SEN transfers and fees over the last few years has been phenomenal at more than 230%+ CAGR.

Square and PayPal

Both Square and PayPal are buying up Bitcoin at a rapid rate, "more than 100% of newly issued Bitcoin as they launch their respective cryptocurrency services." PayPal is launching its cryptocurrency services in 2021, whereas Square already has a mobile payment service called Cash App that is doing exceptionally well, generating $1.63 billion of bitcoin revenue in Q3'20.

MicroStrategy

MicroStrategy is actually a software analytics company but in August decided to start accumulating Bitcoin that now has a value of approximately $766.6 million. This has resulted in greater profits than it has seen in the last 7 years, and the stock price has taken off as a result. The company has announced that it is "exploring Bitcoin data and analytics products for its customers".

Intercontinental Exchange

The Intercontinental Exchange, or ICE, is the owner of the New York Stock Exchange and is the fifth largest holding for BLOK. The ICE has been active on a couple of digital currency fronts, including the generation of a cryptocurrency data feed, and the launch of Bakkt, which offers not only a digital wallet for managing digital assets but also supports payments using cryptocurrencies, and trading platforms for both cryptocurrencies and derivatives.

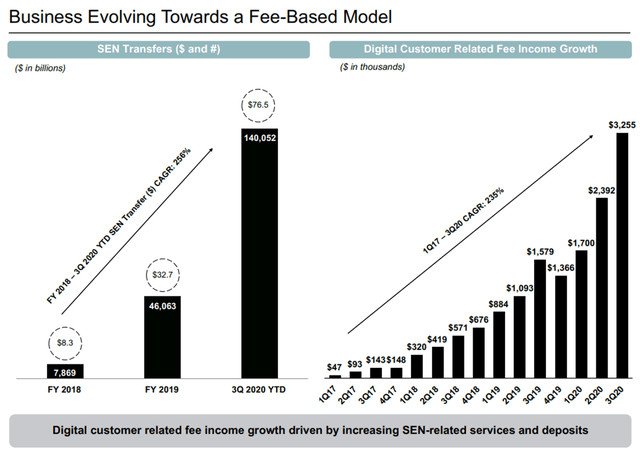

Top 5 Stock Performance

The performance of the top five stocks over the last year has been exceptional and underlines the reason for BLOK's performance this year.

(Source: Yahoo Finance/MS Paint)

Are Cryptocurrencies an Inflation Hedge?

There are many investors, including Paul Tudor Jones, that believe Bitcoin and other cryptocurrencies are an inflation hedge, something that is of concern, given the Federal Reserve's monetary policy over the last 12 years. There is certainly some truth to this based on the way that Bitcoin was implemented. I am not going to delve into this in detail, but in short, the reward for generating Bitcoin blocks is halved every four years (approximately), or every 210,000 block mined. A better, more complete explanation of how the process works can be found here.

These halvings reduce the rate at which new coins are created and thus lower the available supply. This can cause some implications for investors as other assets with low supply, like gold, can have high demand and push prices higher...

The theory of the halving and the chain reaction that it sets off works something like this:

The reward is halved → half the inflation → lower available supply → higher demand → higher price → miners incentive still remains, regardless of smaller rewards, as the value of Bitcoin is increased In the process.

The Halving Effect

One of the past effects observed with halving has been a huge increase in Bitcoin's price.

The first halving, which occurred in November of 2012, saw an increase from about $12 to nearly $1,150 within a year. The second Bitcoin halving occurred in July of 2016. The price at that halving was about $650 and by December 17th, 2017, Bitcoin's price had soared to nearly $20,000. The price then fell over the course of a year from this peak down to around $3,200, a price nearly 400% higher than its pre-halving price.

The most recent Bitcoin halving took place in May 2020, and we may be witnessing a surge in Bitcoin's price, not due to fear over the pandemic or Federal Reserve monetary actions, but simply due to the halving effect.

(Source: Seeking Alpha)

Fool's Gold

If one considers the halving effect and recent hoarding by such companies such as MicroStrategy, investors should be wary of the greed/panic cycle. This apparently new asset class may collapse in a year, just as it has in the past sometime after halving. Investors in Bitcoin may not actually be investing "digital gold" as some believe, but in fact are buying in fool's gold.

Bitcoin Has an Environmental Cost

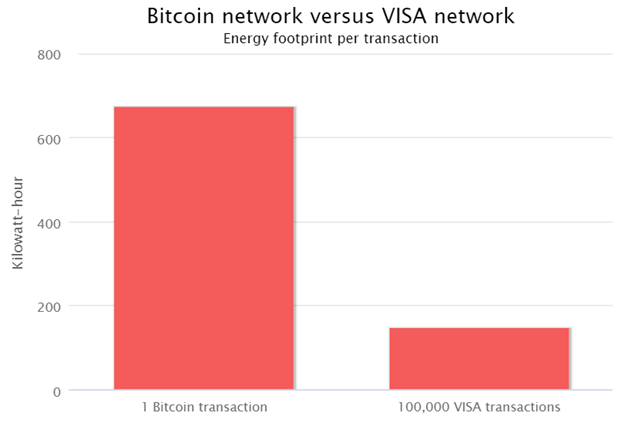

One fact that many investors may not be aware of is the environmental impact of Bitcoin and any blockchain technology that employs a "proof-of-work" consensus algorithm. Huge amounts of energy are required to process blockchains, and the demands are only going to get worse. As it stands, one Bitcoin transaction is estimated to have a footprint of approximately 400,000 Visa transactions.

(Source: digiiconomist.net)

Put in perspective, Bitcoin would be the 39th largest energy consumer by country. Many of the Bitcoin mining operations are located in China, and there is some speculation that they are powered by coal power plants.

Now, this sounds scary, and it should. These statistics that I am tossing around are for Bitcoin only. There are hundreds of other cryptocurrencies, and many other blockchain applications that are likely to spring up. Governments around the world are talking about implementing digital currencies. It is difficult to comprehend how we can be using massive amounts of energy on such technology when we are at the same time in serious talks involving climate control.

There are alternatives to the proof-of-work consensus algorithm that have been in development for several years. Proof-of-stake is one example that requires far less energy but, as far as I know, has not been proven with deployed systems.

Summary and Conclusions

There are (at least) four ETFs that hold securities investing in blockchain products or technologies. The ETFs are BLOK, BLCN, KOIN, and LEGR. BLOK appears to have the best focus on blockchain-related companies without the dilutive effect of large companies with small blockchain activities. BLOK's recent outperformance seems to reflect that focus. The ETF's top three holdings are global payment processors that allow purchases in and of Bitcoin and other cryptocurrencies.

BLOK has had tremendous performance since the start of the pandemic, with the share price more than doubling from approximately $13 to more than $30. Part of the price appreciation is most certainly due to the halving effect of Bitcoin which took place in May 2020. And there is also an aspect of hoarding by companies such as MicroStrategy. It is quite likely that, in a year or two, Bitcoin will crash, just as it has after previous halving events.

Let's also not forget the tremendous environmental impact that Bitcoin and other blockchain technologies will have on our planet. Climate change, whether real or not, is going to involve some serious government policy initiatives that will curb carbon emissions, and Bitcoin at least is heading in the wrong direction. Money talks, and investment dollars have the power of influence. I will leave it at that.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.