Aleafia Health: Significantly Undervalued And About To Make A Profit

Gross revenues continue their decline despite positive environment. The company is already guiding for stronger revenues in Q4.

Inconsistencies in gross revenues have been addressed by management as they move away from wholesale-only sales into more premium brands.

Book value-to-share price is significantly skewed. The stock should go upwards based on this alone.

Cannabis has highly sought-after components that are either psychoactive or medicinal. Aleafia (OTCQX:ALEAF) is a health-focused cannabis company focusing on the latter, but it also has the former. Through Canabo Medical Inc., it owns 25 clinics via its subsidiary, Aleafia Health. It is Canada’s largest network of referral-only medical cannabis clinics. Having access to so many clinics has helped Aleafia sell a consistent amount of its medical cannabis. The atmosphere for cannabis continues to grow in revenues in Canada. Aleafia had a tough quarter but expects a rebound in the next quarter.

Given the positive upward moves in revenues for cannabis in Canada, along with owning the largest coast-to-coast referral clinics in the nation, the question is: Is Aleafia a buy?

As my long-time readers may know, I am building up a portfolio of cannabis companies for a long-term investment. I had started doing this about three years ago. Unfortunately, while traveling through Central and South America for my coffee and chocolate business, I contracted a virus that had me laid out in a bed for 15 months. My portfolio was entirely liquidated; albeit, the saving grace was that the liquidation was at the peak of cannabis euphoria. A minor trade-off.

I am looking at building up this portfolio again and am approaching the industry with a fresh set of eyes. I believe now is a far better time to get into these stocks than when the industry first started out. I had my eye on Aleafia before, but never fully investigated the company enough to determine if it was a buy or not. Now, I have the time to do so.

Cannabis In Canada

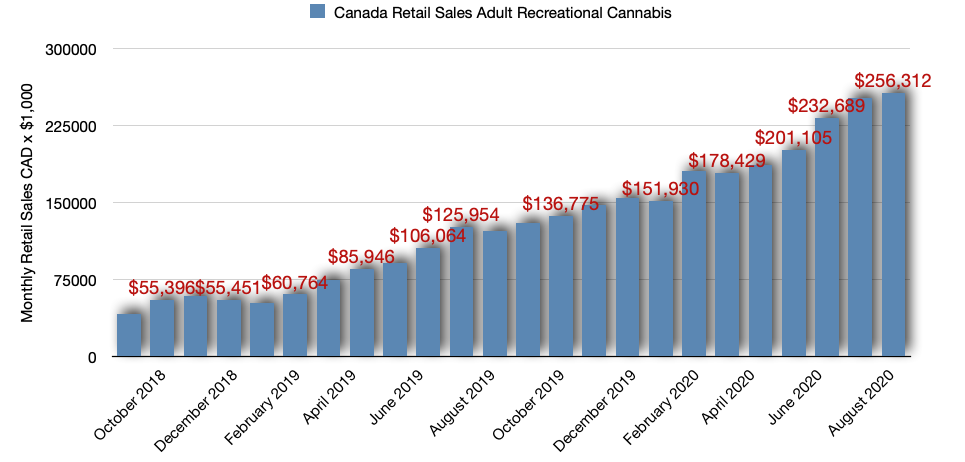

An investor should bear in mind the backdrop for the industry that a company works within. Here are the total retail sales for cannabis in Canada:

(Data Source: StatCan - Author’s Chart)

As you can see, there is a continuous upward increase in cannabis retail sales in Canada. But this chart is both medical and adult-use, or recreational. It is important to note that since Aleafia deals primarily in medical cannabis, there is a strong correlation between medical and recreational cannabis use in Canada. I checked StatCan to see if I could come up with an exclusive chart showing just medical, but I have not been able to find that data.

Instead, the data they do give is that there were 100,989 kilos of cannabis sold in September 2020. Of that, 50,495 kilos were medical - almost dead-on 50% of total retail sales. I’m not so sure that the number is continuously 50% throughout Canada’s legalization history. Medical sales were available in Canada prior to October 2018, so there would have been some build-up in the earlier years.

Nonetheless, this gives us a working idea of what medical cannabis is doing up in Canada despite not having 100% of the data. In a nutshell, both medical and adult-use cannabis is moving upwards and has since adult-use began in October 2018. This will be a positive aspect for Aleafia.

Company Revenues

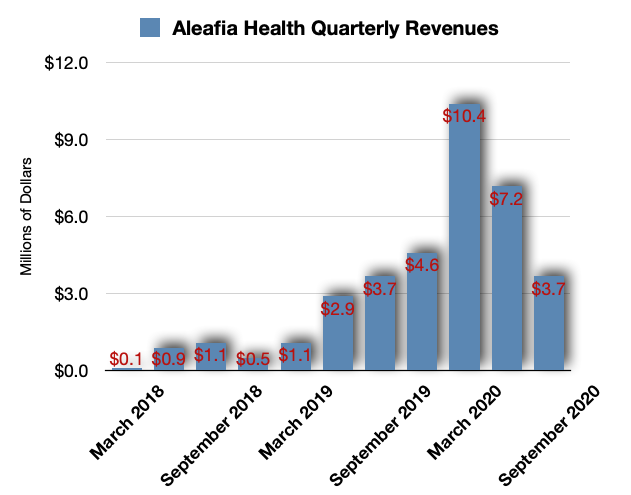

Now that we have a good idea of how the medical and adult-use cannabis sales are faring in Canada, here are the gross Q3 revenues for Aleafia:

(Data Source: Company Data - Author’s Chart)

The decline in revenues is significantly out of line with the current fundamentals for cannabis in Canada.

Here’s something interesting, should you want to read the latest earnings release transcripts. I did a search for how many times the company stated “Q3” in its third-quarter earnings transcripts versus “Q4”. The phrase “Q3” was used 16 times, but five of those times were either unrelated or in the title and would not have mattered, bringing the actual number down to 11. “Q4” was used 20 times. The company is quite excited about the upcoming quarter versus this quarter. I had a tough time narrowing down all of the aspects of Q3 simply because it did not seem to be what management wanted to focus on.

That being said, if you read the transcripts, you find that there were some seasonality aspects involved in the decline in gross revenues; the company sold out of its outdoor-produced products too quickly and had little inventory remaining for sale for this quarter. However, and as you can guess, Q4 is looking quite a bit better.

The comments state that already there has been some C$16 million booked in revenues for the upcoming quarter, but the company was not entirely certain that all of the revenue would be booked in Q4.

Given that, assuming that the C$16 million (equating to $12.4 million in USD terms for the chart above) did not happen all at once, but instead happened during two consecutive quarters split in half, at $6.2 million per quarter, revenues have increased significantly.

Also, there will be other sales that the company can book during the quarters for Q4 2020 and Q1 2021. Given that, I could see the potential that Aleafia will surpass its Q2 2020 revenues of $7.2 million at least two quarters consecutively. And as the company states in its earnings release, there is reason to believe this is very possible:

First of all, we have $16 million in booked near-term sales through the domestic wholesale channel. We expect the majority of this revenue will be recognized in Q4, with the remaining shipments to customers being completed in Q1 2021, but this major sequential increase in revenue is not just attributed to the $16 million sales I just noted. In the fourth quarter, we expect to see major growth in adult-use cannabis revenue.

We are on track for record medical cannabis revenue, and depending on the timing of receiving necessary import and export permits, we may also report record international cannabis revenue. Looking forward to the fourth quarter, we expect to have our best results to date.

I see this as an opportunity that the market may not have caught on to in light of such a negative earnings release for Q3.

A note on Cannabis 2.0

Aleafia, along with many other companies, is seeing results from Cannabis 2.0. For those of you who are just discovering cannabis stocks, Cannabis 2.0 is the second wave of legislation on the federal level in Canada. In this legislation, the federal government expanded what was allowable to be produced, sold, and consumed in Canada to include edibles such as chocolates, gummies, candies, and sodas, as well as vapes.

I have homes in both Colorado and California, and have seen firsthand what this industry is doing. Because of where I live, I am very focused on the industry and its products; they are ubiquitous. There are no real, concrete data points that I know of for consumables. But from the conversations I have had, these consumables account for approximately 15-20% of revenues. The thinking is that people who do not like to smoke products would instead ingest something - such as a chocolate or a soda - more readily than smoking. But these people do not consume these products on a regular basis.

Instead, many people consume some products on some infrequent basis that amount to a large pool of people adding to the overall revenues for these companies. If you think about it, it does make a lot of sense. The more seasoned individuals would smoke something regularly. But novices would want to ingest something a lot more along the lines of something a novice could handle. Enter: edibles and consumables.

Already, Aleafia is stating that its vapes are garnering increases in revenues without poaching sales from other areas of their business. In fact, a lot of the companies that I look at have been seeing in-kind increases in edibles and consumables. Aleafia has a strong consumer base with its clinics and would be able to sell through these outlets.

Management has stated that their focus has been a shift away from the wholesale sales of cannabis and more towards premium branding. I have seen this very same shift in nearly every company’s earnings transcripts. The reason is simple: with so many companies that rushed to create so many products, there was a race to the bottom in price, and that dwindled margins.

To me, this is an opportunity.

Aleafia Operating Efficiency

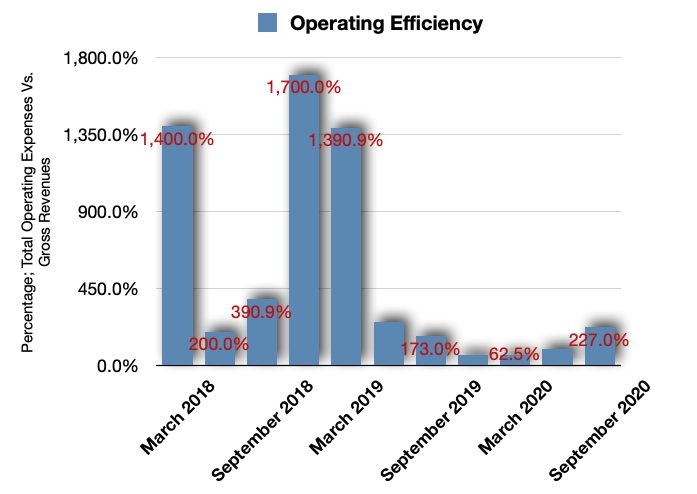

A look at operating efficiency begins to show that Aleafia is still trying to figure out a few things in the cannabis world:

(Data Source: Company Data - Author’s Chart)

For those not certain about this metric, operating efficiency is calculated by dividing operating expenses by gross revenues. Normally, revenues are far greater than operating expenses. An investor would want to see numbers below 100%, for obvious reasons. Also, consistency would be a good thing to see.

But this company is still finding its footing within the industry. I have seen other companies doing far better in the cannabis sector with this metric. But while Aleafia is still “finding themselves,” the costs involved in these lines in the ledger are more closely related to actually running the business on a day-to-day basis. Employing capital to start up a facility is another line in the ledger. So, I’d be very interested that as Aleafia moves forward with its business operations, it also does business a lot more prudently. Overall, I see this as something disconcerting.

Eventually, management will eventually get their footing; they would have to in order to continue to exist as a company. If I were going to pull the trigger on this company, this would be one of the key variables that I would have my eyes peeled towards.

Company Book Value Per Share

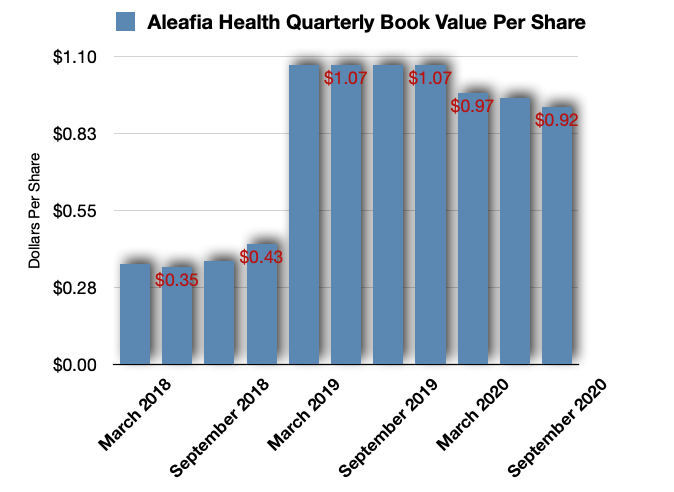

Book value was the one variable of the company that caught my attention the most:

(Data Source: Company Data - Author’s Chart)

Aleafia has built up a very large asset base for the company to operate. If you actually look at the company's financial statements, for Q3 it has $341 million in assets, with only $64 million in liabilities. That is impressive especially when you consider the company's $0.92 per share book value has the stock price trading at $0.39 per share (at the time of this writing).

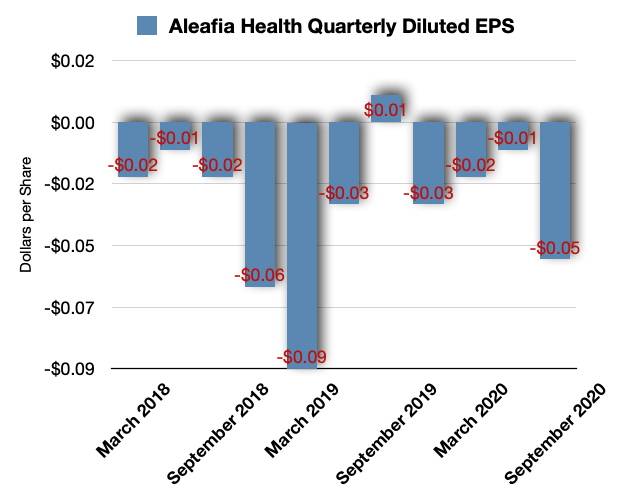

Book value alone would push the value of this stock upwards of some 2.5x. But with a company that is losing money, that is not necessarily a linear equation. Given that, however, net income and diluted EPS are pushing closer to breakeven:

(Data Source: Company Data - Author’s Chart)

The company is currently guiding that it is on track for a banner quarter coming up. The Q3 numbers could be discounted from the calculus simply because of the problems associated with the quarter that I’ve already talked about.

If Aleafia were to achieve the revenue growth it is guiding for, and the mathematics push the company to breakeven, the book value keeps flashing in my mind as potentially a big opportunity. These two factors are what I am keying in on: the guidance for banner revenue and the book value.

The company already has the ability to distribute to a large customer base, since it has the largest referral-only cannabis clinic organization in Canada. If you factor in the potential growth that Cannabis 2.0 may bring to the table, I can see an opportunity here that keeps flashing before my eyes.

Company Stock

On average, ALEAF stock does not see much daily trading activity; today’s volume was all of 190k shares traded. The stock has been pressured lower:

(Data Source: TradingView)

Seeing that ALEAF stock has been pushed down as low as it is, and looking at the book value, I see a lot of opportunity to the upside. And from a long-term perspective, once the company begins to turn a regular profit, the upside really begins to look impressive.

Conclusion: Is Aleafia a buy?

As I mentioned earlier, I have been looking for opportunities to invest for the long term in the cannabis industry. I had worked on this before, but there were health issues that derailed everything.

Now, I am seeing these companies with a fresh perspective. And it is my opinion that since the stocks were sold off so sharply over the past two years, there is far more value today than before. The industry as a whole is trending much higher. At the same time, Aleafia is already gearing up for a very strong upcoming quarter.

However, there are inconsistencies that I think need to be addressed. On some level, Aleafia has addressed these inconsistencies, as it is moving away from the wholesale-only side of the business. The company's premium brands and Cannabis 2.0 are already showing promise.

With the company guiding for a banner quarter upcoming, that alone would push me towards this stock. And I think the market has generally overlooked cannabis since the sell-off from the past two years. This is the opportunity, since there is so much value compacted into the stock.

And then you look at book value. The upside for the stock could be 250% alone when you consider book value. Book value has a $0.39 stock trading at $0.92 per share.

For these reasons, I am very bullish on ALEAF stock and the company.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in ALEAF over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.