Chemours: Outperforming In 2020, Estimates Rising

CC has received multiple upward earnings revisions from analysts over the past month.

CC has very attractive 10% - 12% options yields, which are detailed at the end of this article.

Its earnings and free cash flow bounced back dramatically in Q3 '20.

Looking for basic materials exposure? This sector is up ~21% over the past year. Specialty chemicals is one of the prominent industries within this sector, which is where the Chemours Company (CC) operates.

Profile:

CC is one of the spinoffs from the Dow/Dupont complex, which also involved DuPont De Nemours - DD, and the Dow company - DOW.

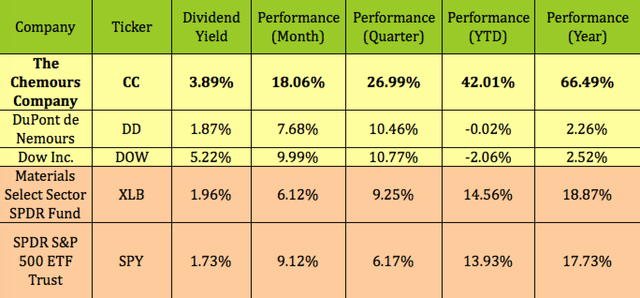

DOW has the highest dividend yield of the group, but Chemours has outperformed both DOW and DuPont by a wide margin over the past month, quarter, year to date, and year. It also outperformed the broad Basic Materials ETF, XLB, and the market:

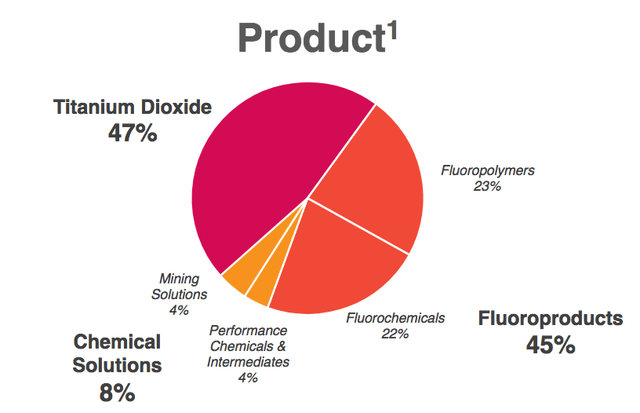

Chemours operates through three segments: Fluoroproducts, Chemical Solutions, and Titanium Technologies. It's a cyclical company and is the world's low-cost leader for titanium dioxide.

Chemours operates through three segments: Fluoroproducts, Chemical Solutions, and Titanium Technologies. It's a cyclical company and is the world's low-cost leader for titanium dioxide.

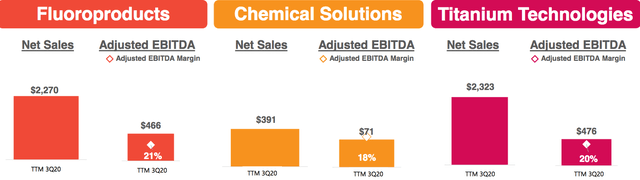

The Flouroproducts and Titanium Technologies segments contributed similar amounts of adjusted EBITDA over the past four quarters, at a similar margin, while Chemical Solutions is a much smaller segment:

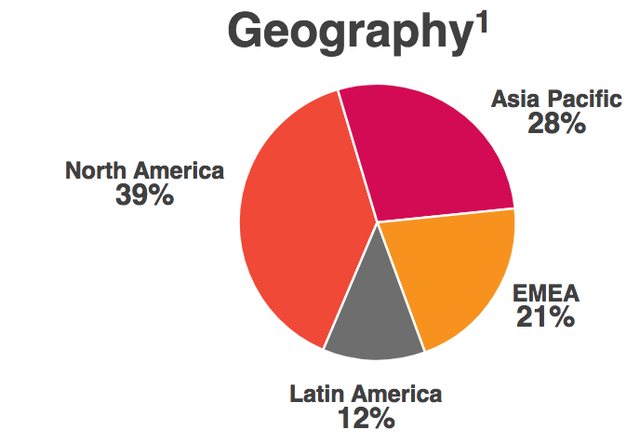

North America remains CC"s biggest sales region, with 39% of ttm sales, followed by Asia Pacific, at 28%, Europe/Middle East/Africa, at 21%, and Latin America, at 12%:

Earnings:

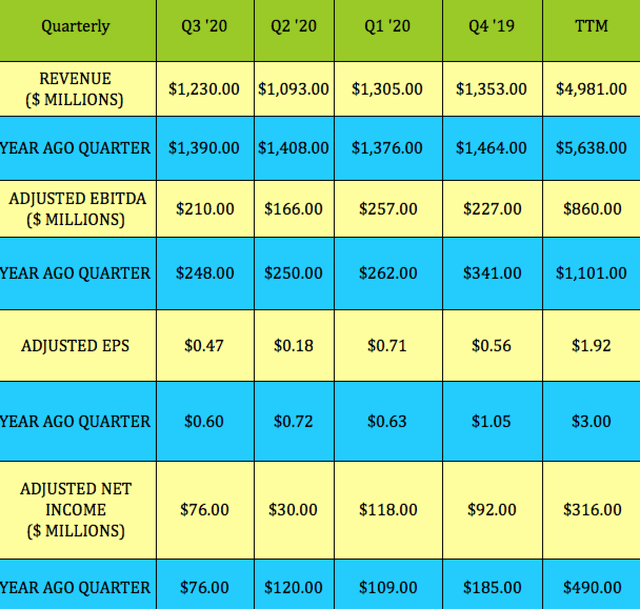

The pandemic has definitely pressured CC's sales and earnings in 2020, particularly in Q2 '20, when revenue fell by -22% vs. Q2 '19, and by -16% vs. Q1 '20. Adjusted EBITDA fell -34% year-over-year, and -35% vs. Q1 '20.

We've been seeing Q2 '20 as the low point in many companies' sales and earnings, and CC fits that mold. Although Q3 '20 sales were down -11.5% vs. Q3 '19, they rose 12.5% vs. Q2 '20 sales.

Adjusted EBITDA, EPS, and net income, while down vs. Q3 '19, all increased substantially vs. Q2 '20:

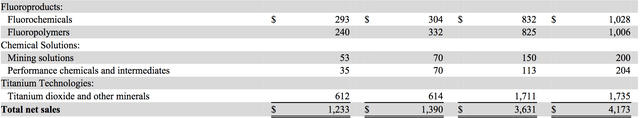

The Fluoroproducts segment has had the biggest sales slowdown in 2020, dropping -18.5%. Chemical Solutions is down ~-10%. The Titanium segment has held up the best, down just -1.4% in Q1-3 2020:

The Fluoroproducts segment has had the biggest sales slowdown in 2020, dropping -18.5%. Chemical Solutions is down ~-10%. The Titanium segment has held up the best, down just -1.4% in Q1-3 2020:

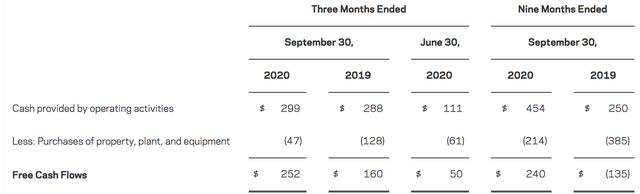

Free cash flow also bottomed out in Q2 '20, at $50M, but rose 5X in Q3 '20 to $252M, which also was 58% than Q3 '19's figure of $160M:

Profitability and Leverage:

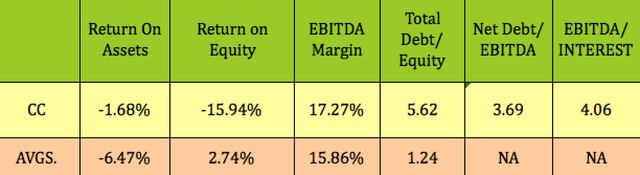

CC has had -$117M in net income over the past four quarters, hence its negative ROA and ROE stats. (It earned $200 in net income in Q1-3 2020, but had a $380 million non-cash charge in Q4 '19.)

At 5.62X, CC's total debt/equity is much higher than the Specialty Chemicals industry averages, while its EBITDA/Interest coverage looks reasonable.

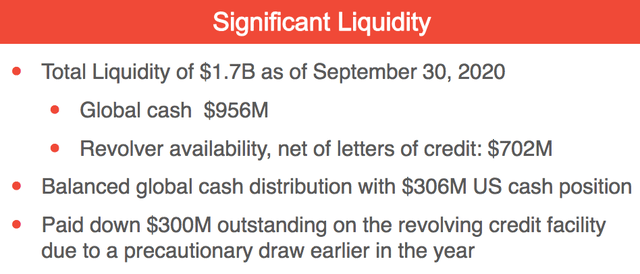

However, CC isn't lacking for liquidity - it had $1.7B as of 9/30/20, including $956M in cash.

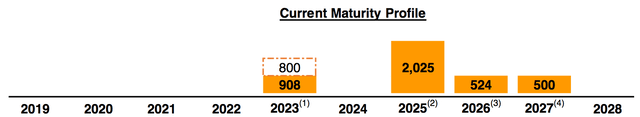

Further good news is that it has no debt maturities until 2023, which gives management ample to time to pay down and refinance those amounts:

Valuations:

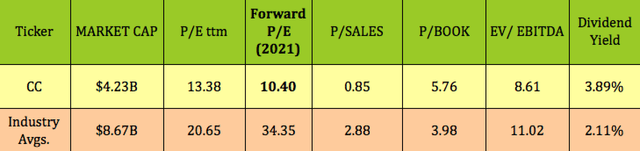

Part of CC's price outperformance in 2020 could be attributed to its lower trailing and forward P/E valuations, which are much lower than industry averages. Its EV/EBITDA also looks lower, while its dividend yield is higher than average.

Analysts Estimates and Price Targets:

Analysts Estimates and Price Targets:

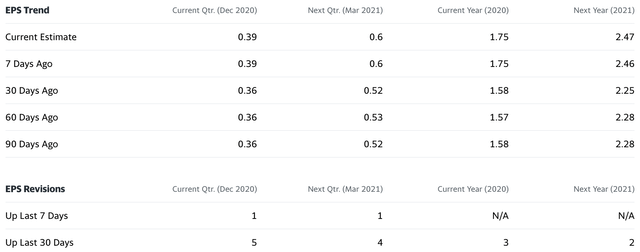

CC's 27% rise over the past quarter also got some help from analysts - there were multiple upward revisions for Q4 '20, Q1 '21, full year 2020, and full year 2021 earnings estimates.

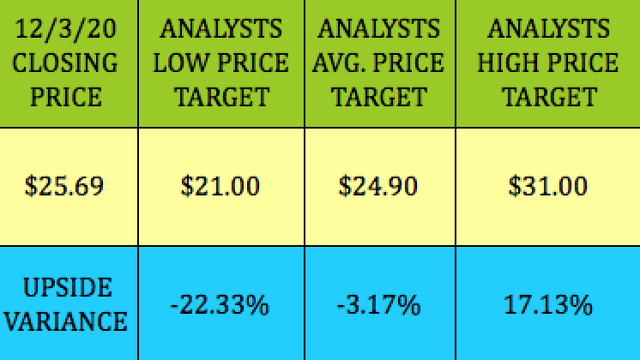

However, the market has pushed up CC's price/share past the average price target of $24.90:

However, the market has pushed up CC's price/share past the average price target of $24.90:

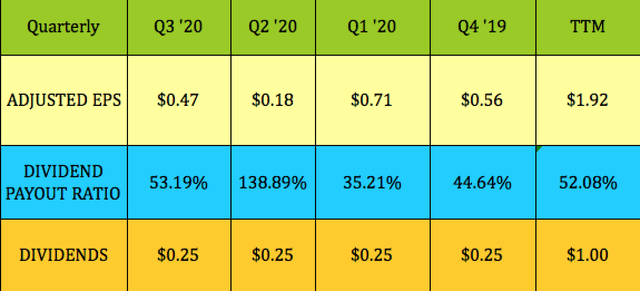

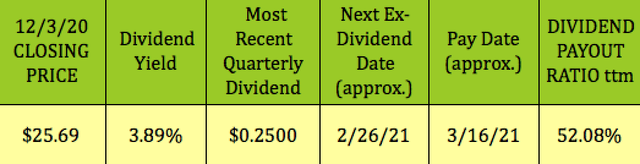

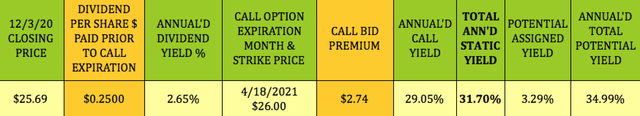

CC has paid $.25/quarter since Q3 '18, and should go ex-dividend next on ~2/26/21. with a ~3/16/21 pay date. At $25.69, it yields 3.89%.

Its trailing adjusted EPS/dividend payout ratio ballooned to 138.89% in Q2 '20, but improved dramatically to 53.19% in Q3 '20, with a trailing ratio of 52.08%:

Its trailing adjusted EPS/dividend payout ratio ballooned to 138.89% in Q2 '20, but improved dramatically to 53.19% in Q3 '20, with a trailing ratio of 52.08%:

Like some of the dividend stocks we've covered in our articles, CC has attractive options premiums.

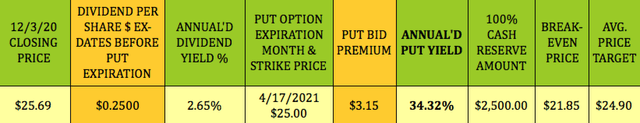

If you want to achieve a lower breakeven for CC, this April 2021 cash secured put trade offers a very attractive put premium of $3.15. That's a 12.6% yield/return over ~4.5 months, or 34.32% annualized.

The breakeven is $21.85, which is 12.25% below the $24.90 average price target:

Conversely, if you're mildly bullish on CC, and you want to hedge your position, there's also an attractive covered call trade which expires in April 2021.

Conversely, if you're mildly bullish on CC, and you want to hedge your position, there's also an attractive covered call trade which expires in April 2021.

CC's April '21 $26.00 call strike pays $2.74, over 10X its $.25 quarterly dividend, for a 10.65% yield/return in ~4.5 months, or 29.05% annualized. The risk is that you only have $.31/share capital gain potential, limiting your upside possible price gains.

Another way to look at this is that, given the $2.74 call option premium at a $26.00 call strike, you're locking an upside price of $28.74.

We updated these two option trades for CC on our free Covered Calls Table and Cash Secured Puts Table, where you can see more details.

We updated these two option trades for CC on our free Covered Calls Table and Cash Secured Puts Table, where you can see more details.

All tables furnished by DoubleDividendStocks.com, unless otherwise noted.

Our Marketplace service, Hidden Dividend Stocks Plus, focuses on undercovered, undervalued income vehicles, and special high yield situations.

We scour the US and world markets to find solid income opportunities with dividend yields ranging from 5% to 10%-plus, backed by strong earnings. We publish exclusive articles each week with investing ideas for the HDS+ site that you won't see anywhere else.

We offer a range of income vehicles, including high yield stocks and bonds, preferred stocks, select REIT's, and CEF's, many of which are selling below their book values or redemption values. Our latest buyout success story has a 40%-plus total return.

Disclosure: I am/we are short CC PUT OPTIONS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: We're short CC put options.

Our DoubleDividendStocks.com service features options selling for dividend stocks. It's a separate service from our Seeking Alpha Hidden Dividend Stocks Plus service.

Disclaimer: This article was written for informational purposes only, and is not intended as personal investment advice. Please practice due diligence before investing in any investment vehicle mentioned in this article.