We believe consensus on ZAGG Inc. is far too negative for a traditionally high margin, high FCF business whose stock has been beaten down since March on COVID concerns.

With recent exits from negative EBITDA business lines, ZAGG is well positioned for strong cash flow to pay down its Revolving Credit Line even in downside scenarios.

Further, ZAGG remains a strong takeover candidate. As recently as August 2019 ZAGG reportedly fielded multiple buyout offers in the range of $9 a share, almost triple the current price.

Editor's note: Seeking Alpha is proud to welcome Radiant Capital as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Editor's note: Seeking Alpha is proud to welcome Radiant Capital as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

We strongly believe ZAGG Inc. (NASDAQ:ZAGG) is currently undervalued and an attractive buy because of its strong structural profit margins which are likely to be buoyed further by recent exits from EBITDA negative product lines, something we feel has not been fully incorporated into the stock. Further, ZAGG generates significant FCF, and even in downside scenarios will generate more than enough cash to service and pay down its Revolving Credit Line, mitigating what we feel is the market's primary concern with the stock. Finally, there is additional potential upside for a future buyout, as evidenced by multiple buyout offers ZAGG received in the $9 range as recently as August 2019.

Company overview and recent history

Zagg, founded in 2004, is a maker of mobile accessories, including screen protectors, battery charging packs, wireless keyboards, and phone cases under the InvisibleShield, Mophie, IFROGZ, GEAR4, HALO, and BRAVEN brands. In Q1 2020, Zagg announced it would be exiting the BRAVEN business in addition to several EBITDA negative product lines, including ZAGG keyboard and mophie power stations.

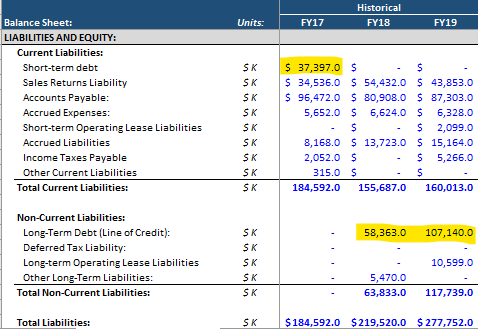

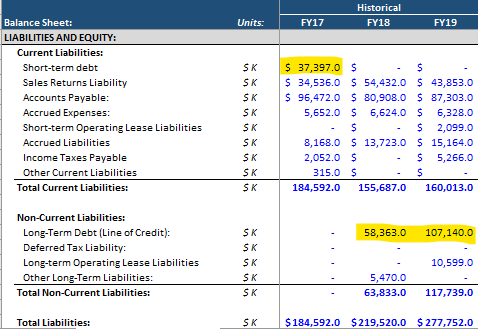

The business is traditionally high margin, sporting gross profit margins in the mid 30's, with strong EBITDA of ~$70M in FY2017 and FY2018 on sales of $540M. In recent years, the capital allocation focus for management has been on acquisitions, acquiring HALO in 2019 for $43 million and BRAVEN and Gear4 in 2018 for $4.5M and $28M, respectively. At the same time, the company has drawn extensively on its Revolving Credit Facility, with balances increasing from $37M in 2017 to $107M in 2019.

Make no mistake, ZAGG is absolutely a value play. It's a classic high margin, high EBITDA business with low to stagnant growth but currently trading at ~0.85 P/B. At the current valuation, we believe investors are more than compensated for the risk even in downside scenarios, and feel the stock could re-rate once management proves it can return the company to EBITDA growth with a leaner, more focused product offering, while at the same time remaining a potential buyout candidate.

Financials

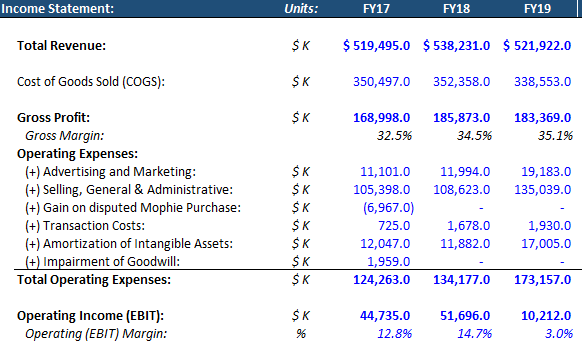

Income Statement:

Zagg has had very strong gross and operating margins over the past three years, with gross margins in the 32-35% range and EBIT margins in the 13-15% range for FY17 and FY18 on flat to slightly up revenue, though EBIT margins dropped in FY19 to 3% from costs related to the HALO acquisition:

Source: Figures from 2018 and 2019 Form 10-K

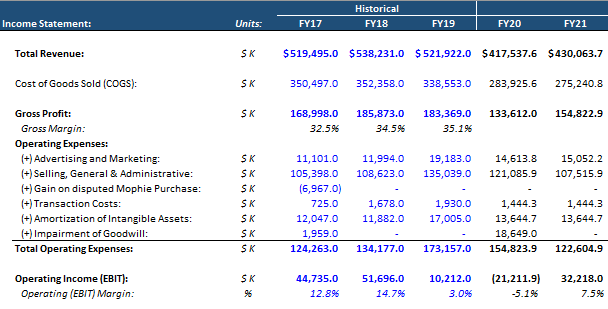

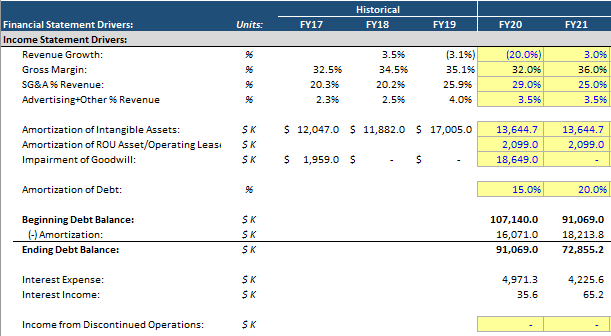

As we forecast out to FY20 and FY21, we absolutely expect both EBIT and Gross margins to improve as the company has made significant strides to trim less profitable product lines and tighten up operations. Below we include our income statement forecasts and related assumptions for the next two years:

Forecast:

Assumptions:

Source: Radiant Capital Pro-Forma Forecasts

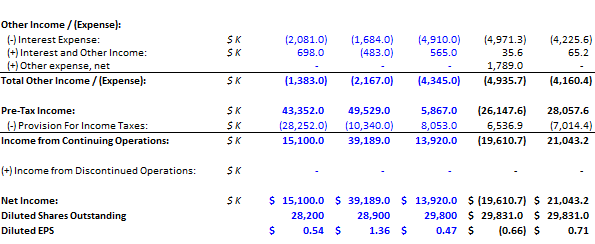

We forecast EPS of -$2.17 for FY20, about in line with consensus, but see that rebounding sharply in FY21 to $0.71, versus consensus of $0.21. For our FY20 forecast, one important note is in Q1 the company took a $45M write-down on inventory related to exiting several product lines. Our assumptions are fairly conservative at 3% YoY revenue growth for FY21 on top of already depressed FY20 sales levels, coupled with sharply lower Operating Expenses as a % of Revenue based on management guidance from Zagg's Q1 2020 conference call , which estimated $120M in operating expense run-rate (assuming high-end of the mid $20's to $30M operating expense per quarter):

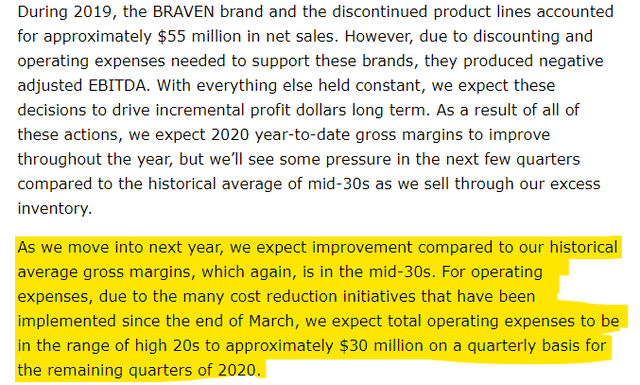

Source: Q1 2020 Earnings Call Transcript

Overall, we see the primary drivers of our forecasted EPS outperformance as improving Gross margins and lower operating expense as a percentage of revenue as a result of the aforementioned product line exits, as well as comping over a $19M Goodwill impairment in FY20 and the aforementioned inventory write-off which we feel has not been incorporated into consensus. In addition, with the release of the iPhone 12 and expected supercycle of customers replacing several year-old phones, we expect sales of mobile accessories to spike this year. It's just another factor that we feel buoys the stock, and may not be fully incorporated into consensus.

Balance Sheet:

Zagg's balance sheet is a bit of a mixed bag. On the plus side, the company has limited Current Liabilities outside of Accounts Payable, and Assets continue to improve in quality as the company amortizes Intangible Assets from its acquisitions. On the other hand it has significant debt in the form of its revolver. Looking forward, our view is that the critical factor in Zagg's balance sheet is how it handles repayment of its revolver and related interest payments. On this front, we believe Zagg's cash on hand in addition to its strong cash flows generation from business operations will be more than sufficient to service and pay down its debt.

Source: Figures from 2018 and 2019 Form 10-K (in $K)

Cash Flow:

Zagg has had a history of strong EBITDA generation over the past three years:

| $M | FY17 | FY18 | FY19 |

| EBITDA | $62.3M | $71.7M | $36.0M |

Source: Seeking Alpha ZAGG Financial Figures

While our forecast for FY20 EBITDA is -$4,244K, Adjusted EBITDA (which primarily adds back Goodwill impairment and stock-based compensation) remains solid at $18,665K, providing more than enough cash liquidity to cover estimated interest expense of $-4,971K (a conservative estimate based on the Revolver outstanding balance as of year-end 2019, which the company has paid down to $87.7M as of Q3 2020), in addition to further paying down the balance. Moreover, even in an extreme downside scenario of a -25% revenue decline YoY for FY21, we project the company will still generate ~$32M in EBITDA

Valuation:

Zagg currently sports a 10.8X EV/Forward Adj. EBITDA multiple based on our FY20 forecasts, relatively cheap compared to the 13.1x Consumer Discretionary median (for reference, adjusted EBITDA adds back Goodwill impairment, stock based compensation expense, and non-cash transaction costs). In the short term, cash generation is the primary metric to watch, and we feel EBITDA provides the most accurate proxy for true steady state cash generation as the company uses cash to pay interest and principal on its revolver. Looking ahead to FY21, we see the multiple dropping to 5.7x based on today's price, a significant upside from the current forward multiple.

In 2019, Zagg reportly received multiple buyout offers, including from ACCO Brands (ACCO) and an undisclosed PE firm, in the range of $9 a share, valuing it at 7x-8x EBITDA at the time. As we look ahead to FY21 and move past COVID headwinds and towards more normalized figures, we see tremendous opportunity with the stock currently at 5.7x EBITDA based on our FY21 forecast and today's price.

Finally, taking a bottom line value lens, on a P/B basis Zagg is also fairly cheap, at 0.89, versus 2.79 sector median. An important caveat here is the high amount of intangible assets on the balance sheet in the form of Goodwill; Price/Tangible Book is higher at 2.37, though still lower than sector P/B, giving a reasonable margin of safety.

Risks and Challenges:

The primary short-term concern with Zagg is the high balance on the revolving credit line, rising to $107M as of the end of 2019, from $37M in 2017:

Source: Figures from 2018 and 2019 Form 10-K (in $K)

Therefore the key metric to watch is cash flow and related measures such as EBITDA and FCF, and how the company allocates capital to pay back the credit line and interest expense, Encouragingly, the company has been steadily paying back the revolver thus far in 2020 despite a challenging operating environment, with current outstanding of $87.7M as of Q3 2020.

The longer term structural risk to Zagg is the fact that it operates in a commoditized, low moat business. Competitors from China are constantly undercutting Zagg on pricing for screen protectors and battery packs, which will continue to be a longer term threat. In recent years the company has introduced more differentiated products, including a recent proprietary anti-bacterial screen covering that has done extremely well in the COVID era. Efforts like these will help to provide a competitive advantage and help mitigate commoditization pressure.

Market Sentiment:

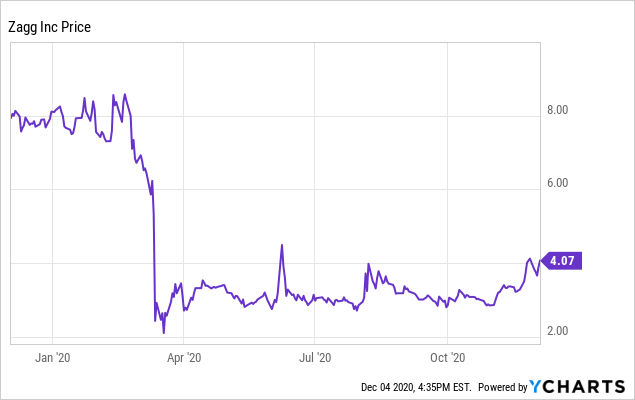

Part of the reason why we believe Zagg is such an attractive opportunity is that sentiment is at historical lows. Post-COVID, the primary concern among investors seemed to be the high debt load in the form of the Revolver. As we have shown above, Zagg should be able to generate more than enough cash flow to cover interest payments in addition to paying down principal, even in extreme downside scenarios. The stock has been trading fairly flat since March, hovering between the 3-4 dollar range, which we feel provides a further boost to the thesis as the stock changes hands between uncertain investors selling to long investors buying:

Data by YCharts

Data by YCharts

Bottom Line:

Zagg is an attractive value opportunity for its high margin, high cash generative business, though in an industry that is extremely competitive with little moat. In addition, Zagg has a substantial debt balance on its Revolver. However, we feel the current valuation is low enough to more than compensate for these risks and presents an upside-skewed risk-reward tradeoff. We believe the stock retains significant upside as the company cuts unprofitable business lines and runs a leaner operation, while also having the potential for a future buyout.

Disclosure: I am/we are long ZAGG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.