Anthem: The Government Is Your Friend

Some health insurance investors are concerned about the growing political pressure for a government-based health insurer for all.

The American public wants a government option in addition to, and not instead of, private insurance options.

Anthem has a very large exposure to existing government programs, Medicare and Medicaid and would actually benefit from an expansion in Obamacare, which Biden supports.

Anthem (ANTM) is the second largest health insurer in the U.S. and currently has 42.5M covered members. Understandably for such a large insurer with a market cap of nearly $80B and TTM revenue of over $100B, investors may be concerned about a potential future government intervention with a Medicare For All (NYSE:MFA) policy that could decimate its revenue and send Anthem into a world of irrelevance. However, this is likely an overstated risk that would only happen with an extreme version of MFA.

Medicare For All Impact Is Nuanced

The effect MFA would have on Anthem depends on the specific implementation and what role the policy would leave for private insurers. Certain politicians prefer a single-payer and fully government run system. Most politicians, including president-elect Joe Biden, want to continue to allow roles for private insurers by expanding Obamacare. If we operate on that assumption, any expansion of government spending on healthcare programs under Obamacare is likely to give Anthem a boost because Anthem actually has significant exposure to the government sector.

Membership and Revenue Breakdown

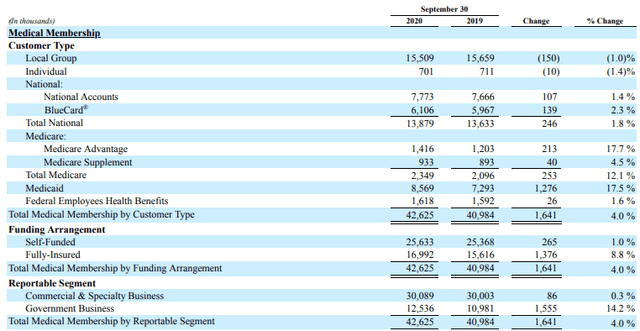

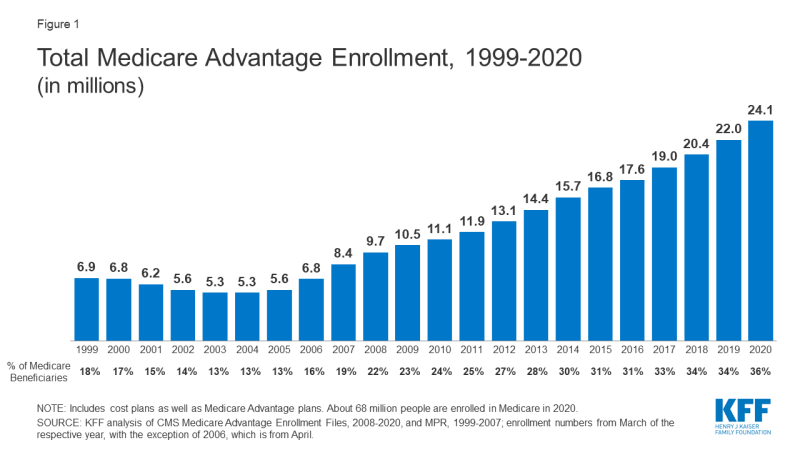

Source: Anthem September 30, 2020 10-Q

Government (Medicaid and Medicare)

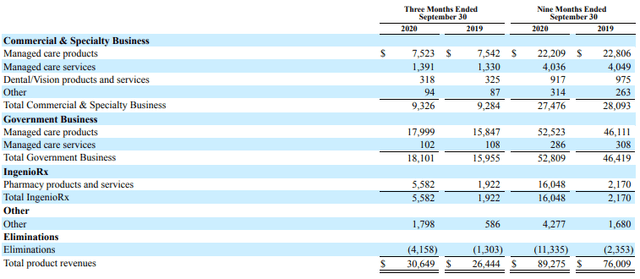

Source: Anthem Investor Outreach

Many people are surprised to hear that Anthem actually has a significant business centered around insuring Medicare and Medicaid members. Anthem earned nearly twice as much government revenue in the first three quarters of 2020 ($52B) as commercial revenue ($27B). Of its 42.5M members, 12M (28%) of them come from Medicare or Medicaid.

While Medicare and Medicaid are government programs, the government actually contracts with private insurers to offer private options of Medicare (Medicare Advantage) and Medicaid. This is because many members prefer the expanded coverage versus government-run traditional Medicare/Medicaid. The government will heavily subsidize member premium payments to private insurers and the private insurers will assume the risk of health costs for members.

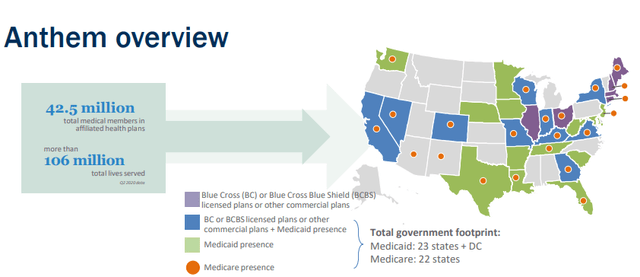

Source: KFF

In 2020, 36% of Medicare members obtain it through private insurance and this number has continued to grow throughout the last few decades. For Medicaid, over two-thirds of members are enrolled in private insurance.

Anthem benefits greatly from this arrangement. This has also created a buffer for Anthem during the COVID-19 pandemic. Anthem's commercial business is flat to slightly negative in both membership and revenue but has grown about 14% for the government business year over year due to increased enrollment in Medicaid as families lost their jobs from the pandemic.

While Medicaid and Medicare members have the highest associated health risk and costs, this is managed by a few items. The first is that Anthem can and must utilize the same payment schedule as traditional Medicare and Medicaid programs which minimizes costs it pays to providers for the Medicare and Medicaid members it insures. Medicare rates are nearly half of private insurance rates.

The second, Anthem charges very high premiums to cover this risk and these premiums are heavily subsidized by a single low risk payer, the Federal government. This high premium is evidenced by the fact that while government members are just 28% of membership, they represent 58% of revenues for the first three quarters of 2020.

Increasing Access To Government Healthcare Is a Boon For Anthem

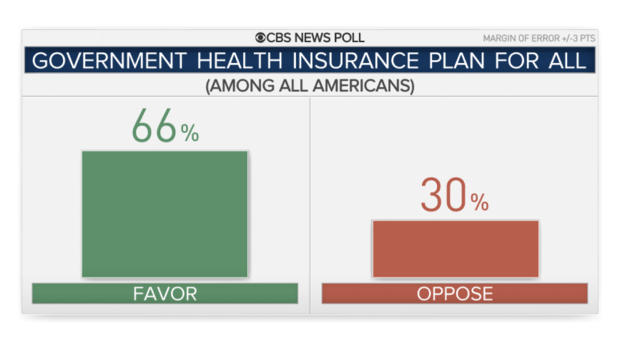

Currently, Medicare and Medicaid eligibility is limited based on age, health, and income. The majority of Americans support a creation of a government health plan available to all Americans.

Source: CBS News

However, of those who favor a government health plan, a majority of those would like to keep private insurance options.

Source: CBS News

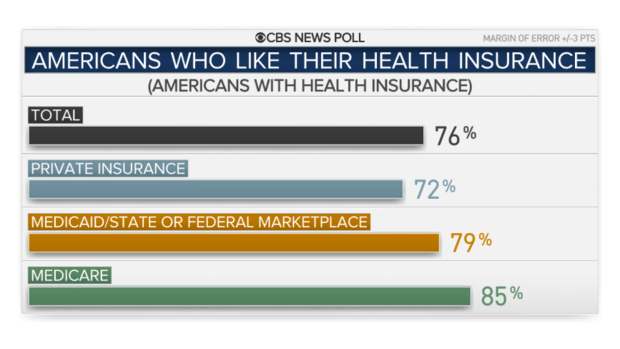

Overall satisfaction with their current health insurance coverage and option is fairly high amongst private and government options.

Source: CBS News

These polls fall in line with the growing preference of Medicare members electing Medicare Advantage. Members want their healthcare to be subsidized by but they want to have choices on coverage and networks. Anthem's government segment provides that option for members.

Additionally, for members that didn't qualify for Medicare or Medicaid previously are likely healthier and represent higher profitability for Anthem should they absorb them into their government business.

Conclusion

Given desires for private insurer options from the American public, the general trend of Americans opting for Medicare Advantage/Medicaid with private insurers, and Biden's plan to expand Obamacare rather than create a single-payer system, there is evidence for a big boon for Anthem's government business which is the majority of its revenue. Any losses from its commercial business will likely get made up for in its government side with a much more credit-worthy payer. I do not believe investors should be concerned about any significant downside impact from health care policy with the upcoming Biden administration.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not a financial advisor. All recommendations here are purely my own opinion and is intended for a general audience. Please perform your own due diligence and research for your specific financial circumstances before making an investment decision.