TPHD: Volatility Weighted And Biblically Responsible Dividends

TPHD is a dividend-focused ETF that concentrates on companies that avoid behaviors that Bible-believing Christians find objectionable.

The ETF is also volatility-weighted, a somewhat rare characteristic for a dividend ETF.

The dividend yield at 2.39% is quite low, and it is unknown how well the underlying index picks strong dividend growers.

While the moral screening process will certainly have a strong appeal to a niche audience, it would be nice to see explanations from the ETF sponsor about individual holding exclusions.

A Niche Within A Niche

Amid the ESG tsunami washing over the investment world, there are countless individual facets of "socially responsible investing" ("SRI"), each with their own specialized traits and target audiences. The stock market has been sliced and diced in innumerable ways by these socially responsible ETFs and mutual funds to fill various niches.

The Timothy Plan High Dividend Stock ETF (TPHD) fits squarely into this SRI trend — specifically, in a niche geared toward Christians who want their investments to align with their biblical values. More specifically, it appeals to Christians interested in dividend stocks who want their investments to align with their biblical values. Even more specifically, it appeals to Christians interested in dividend stocks who want low-volatility investments that align with their biblical values.

Obviously, this ETF will not appeal to everyone. TPHD exists within a ("biblically responsible") niche within a ("socially responsible") niche within a ("ESG") niche within yet another (dividend investing) niche. The super-duper niche nature of TPHD is evident in the fund's $108.7 million total assets under management, although that could also be due to the fact that the fund is less than two years old.

In what follows, we'll lay out the distinguishing characteristics of TPHD as a dividend ETF, compare it to similar funds, and conclude with a brief discussion of general thoughts related to the ETF.

Fund Construction and Filtration System

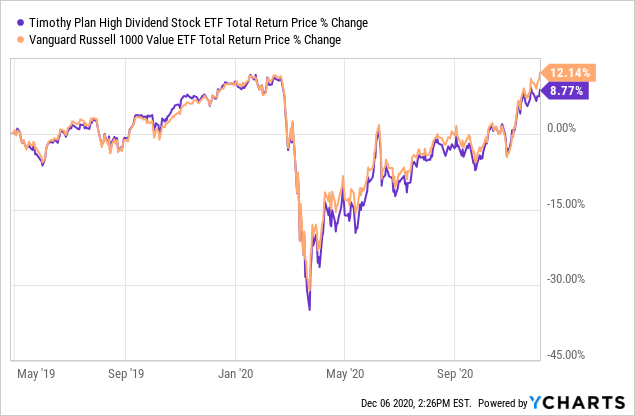

The broad benchmark that TPHD seeks to track or outperform is the Russell 1000 value index, represented in orange below by the Vanguard Russell 1000 Value ETF (VONV). As you can see, the two trade in very close relation to one another.

The process of determining TPHD's underlying holdings begins by tracking the Victory US Large Cap High Dividend Volatility Weighted Index. There is actually another ETF that tracks the same index. It is called the VictorShares US Large Cap High Div Volatility Weighted ETF (CDL). We'll compare the two ETFs shortly.

The index funnels down the universe of large-cap stocks to US companies that pay dividends. TPHD picks out the 100 largest companies in the index. To give an idea of the holding company size, the average market cap of TPHD's portfolio holdings is $25 billion. TPHD also screens for only companies with positive earnings in the last four quarters.

TPHD's stock-picking process then eliminates stocks that do not meet Timothy Plan's "Biblically Responsible Investing" criteria. This is the proprietary filter that distinguishes Timothy Plan's funds from others, even ones that are based on the same underlying index as other funds.

Source: TPHD Fact Sheet

Source: TPHD Fact Sheet

According to Timothy Plan's webpage on its filters, their system is designed to exclude companies involved in what it views as unbiblical practices while arriving at a pro-life, pro-family portfolio. In my estimation, the filtering system picks stocks based not so much on companies that actively promote Timothy Plan's values as ones that avoid opposing those values.

The life value doesn't so much find companies that support pro-life causes as it does filters out companies that support pro-choice causes, engage in fetal tissue research, or manufacture abortifacients. The stewardship value primarily seeks to exclude companies involved in gambling in one form or another, including cruise lines and online gaming software developers.

The purity value translates into avoidance of pornography and adult themes in movies, advertisements, video games, or other media. The longevity value filters out tobacco companies and producers of e-cigarettes. The family value seeks to exclude entertainment and other media companies that portray non-family-friendly activities or themes such as violence, profanity, nudity, drug use, etc.

The sobriety value does what it sounds like it does by filtering out alcohol producers. The liberty value excludes companies that engage, directly or indirectly, in violations of human rights domestically or globally. Finally, the marriage value is probably the broadest and least exclusive, as it would take a lot in a post-Obergefell America to be seen as violating the biblical sanctity of marriage more than any other company.

After Timothy Plan's BRI filtering stage, the 100 holdings are then weighted based on their volatility over the previous 180 trading days, with the least volatile stocks given the largest weighting and the most volatile the smallest weighting. As Timothy Plan explains it on the TPHD webpage:

A volatility weighted index assigns percentage values to each security in the Index based on the volatility of that security in the market. More volatile stocks have a lower weighting, and less volatile stocks are assigned a higher weighting.

Volatility-weighting is a distinguishing characteristic of TPHD, although not one that is exclusive to it. Most dividend-focused ETFs weight stocks either by market cap or dividend yield, each of which has its merits as well as its downsides.

Also, volatility-weighting is not the same thing as low-volatility. Some ETFs target only low-volatility stocks while excluding higher vol stocks, but TPHD simply weights its holdings (determined by non-volatility metrics) based on their volatility. It does hold more volatile names, but they are given a smaller weighting. This prevents completely excluding quality stocks that should be included in any well-balanced fund.

TPHD's expense ratio is 0.52%, which is on the high side for a passive ETF but is to be expected for a specialty fund like this. TPHD does more than just passively track a third-party index. Timothy Plan's team is constantly monitoring portfolio holdings for violations of the above values. If a company has violated those values, the holding is liquidated immediately and must then be replaced with another stock. Thus, TPHD mixes passive index investing with some active management. Hence the somewhat elevated expense ratio.

As of the end of September, 2020, the weighted average price-to-earnings ratio for the ETF was 13.2x. Assuming no change to the earnings of TPHD's underlying holdings, the additional 14% gain in price since then would bring the P/E ratio to around 15.1x.

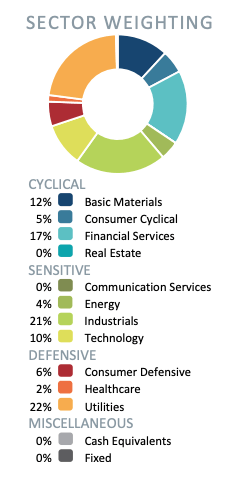

TPHD's largest sector weighting is for (economically) "sensitive" stocks at 35% of the portfolio. Cyclicals — generally, the most economically sensitive companies — make up 34% of the portfolio. Defensive companies make up the remaining 30% of holdings.

Source: TPHD Fact Sheet

Source: TPHD Fact Sheet

As you can see above, the top five industries are:

- Utilities (22%)

- Industrials (21%)

- Financial services (17%)

- Basic materials (12%)

- Technology (10%)

It might seem odd that a volatility-weighted index would have so many economically sensitive holdings in it, but remember, the volatility-weighting is the last step of the stock-picking process. Stocks are not picked based on their volatility but rather are weighted, or sorted, based on it.

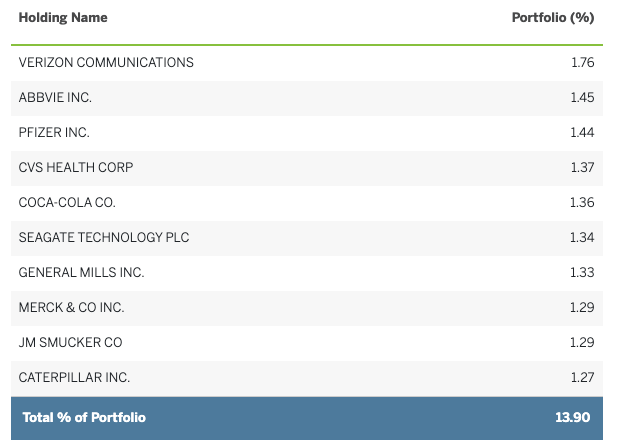

The following two images are TPHD's top ten holdings as well as the top ten holdings of CDL, the ETF tracking the same index but without the BRI values filter.

TPHD's Top Ten Holdings as of Friday, December 4th, 2020:

Source: Timothy Plan TPHD Webpage

Source: Timothy Plan TPHD Webpage

CDL's Top Ten Holdings as of Friday, December 4th, 2020:

Source: VictoryShares CDL Webpage

Source: VictoryShares CDL Webpage

There are a few notable absences from TPHD's portfolio, such as Verizon (VZ), CVS Health (CVS), and Pfizer (PFE). To be honest, I am not sure which of Timothy Plan's values each of these companies violated.

Another significant difference between the two ETFs is the expense ratio. Without the extra steps taken by TPHD to specialize the portfolio, CDL is able to charge a lower expense ratio of 0.35%.

Moreover, while both ETFs pay dividends on a monthly basis, TPHD's dividend yield of 2.39% (based on trailing twelve month dividends) is significantly lower than CDL's 3.37%, presumably because of the stocks it excludes.

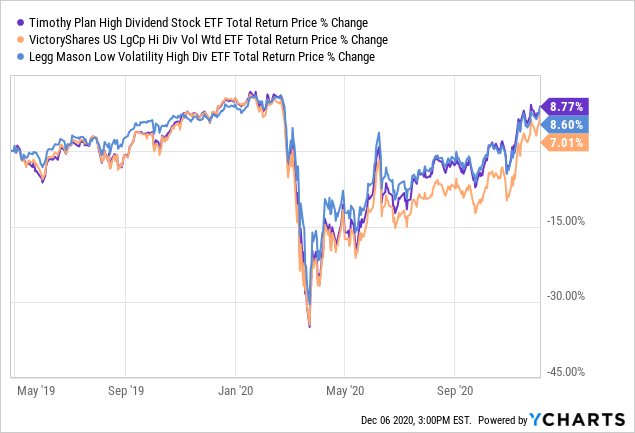

However, the lower dividend yield might be made up for over time by higher total returns. Comparing TPHD to CDL and the Legg Mason Low Volatility High Dividend ETF (LVHD) — not vol-weighted but rather a true low-vol fund — we find that TPHD has slightly outperformed since its inception in the Spring of 2019.

Granted, that's not a very long test period, but it's notable that TPHD bounced back a little better than CDL from the COVID-19 selloff this Spring.

Overarching Thoughts on TPHD & Biblical Responsible Investing

I wrote a book called The Third Temptation: Rethinking the Role of the Church in Politics that was recently released. In it, I discuss how, in Christian thought, everything that exists — all of creation — belongs to God. He "owns" it all, but He has endowed humans with the responsibility of stewarding it for Him. We have been appointed as managers of God's resources — His assets, if you will.

As such, our investing — our management of God's resources and wealth — ought to be carried out in alignment with God's priorities and values. With this in mind, TPHD is a fine choice for Christians who want to take a hands-off approach toward dividend stock investing that is sure to prevent violating their values and beliefs.

One drawback of this hands-off approach, however, is the lack of clarity on how exclusion decisions are made for each individual stock. For instance, it is not clear to me what activity in which Verizon, CVS, and Pfizer participated to be excluded from the portfolio. To my knowledge, this information is not provided by the Timothy Plan. Without knowing their reasoning, I am left wondering about these companies (two of which I own), and whether I would have come to the same conclusion to exclude them based on whatever activities the filter system found.

There are many instances in which thoughtful Christians can come to different conclusions about the same company behavior. And just as TPHD weighted stocks based on volatility, I think that individual believers can weight the import of certain company behaviors and decide for themselves if they find it intolerable.

Moreover, without a clear idea of how rapid TPHD's dividend growth will be as of right now, the ETF's lower dividend yield makes it less attractive as a vehicle for current or future income. Volatility-weighting, however, is a very attractive portfolio characteristic that is relatively rare in the wide world of investment products.

Personally, I am passing on TPHD for now, though it will be one I keep my eye on and return to over the years, I'm sure.

What Are We Buying?

We are sharing all our Top Ideas with the 2,000+ members of High Yield Landlord. And you can get access to all of them for free with our 2-week free trial! We are the largest real estate investment service on Seeking Alpha with over 2,000+ members on board and a perfect 5 star rating!

Join us today and get instant access to all our Top Picks, 3 Model Portfolios, Course to REIT investing, Tracking tools, and much more.

We are offering a Limited-Time 28% discount for new members!

Disclosure: I am/we are long CVS, PFE. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.