The Precious Metals R&S Index declined by 7.08% in November.

The Precious Metals R&S Equally Weighted Index increased by 1.37%.

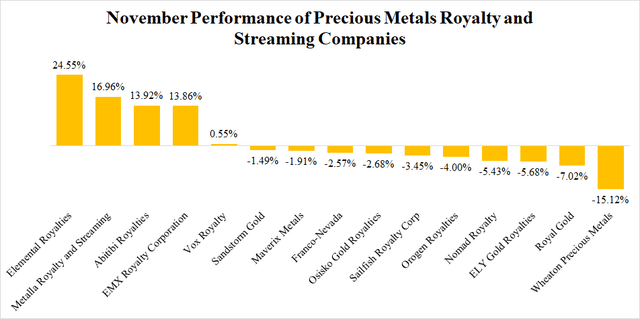

The best performance was recorded by Elemental Royalties; its share price grew by 24.55%.

The biggest decline was experienced by Wheaton Precious Metals; its share price declined by 15.12%.

Precious metals royalty and streaming companies represent a very interesting sub-industry of the precious metals mining industry. They provide some leverage to the growing metals prices, similar to the typical mining companies; however, they are less risky in comparison to them. Their incomes are derived from royalty and streaming agreements. Under a metal streaming agreement, the streaming company provides an upfront payment to acquire the right to future deliveries of a predefined percentage of metal production of a mining operation.

The streaming company also pays some ongoing payments that are usually well below the market price of the metal. They can be set as a fixed sum (e.g., $300/toz gold) or as a percentage (e.g., 20% of the prevailing gold price), or a combination of both (e.g., the lower of a) $300/toz gold and b) 20% of the prevailing gold price). The royalties usually apply to a small fraction of the mining project production (usually 1-3%), and they are not connected with ongoing payments. They can have various forms, but the most common is a small percentage of the net smelter return ("NSR"). The NSR is calculated as revenues from the sale of the mined products minus transportation and refining costs.

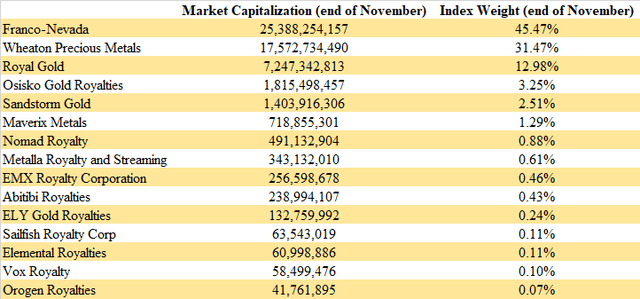

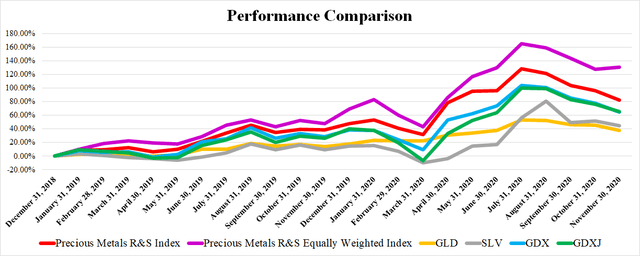

To better track the overall performance of the whole sub-industry, I created a capitalization-weighted index (the Precious Metals Royalty and Streaming Index) consisting of 11 companies (in June 2020, expanded to 15, by adding Nomad Royalty (OTCQX:NSRXF), Vox Royalty (OTC:VOXCF), Elemental Royalties (OTCQX:ELEMF), and Orogen Royalties (OTCPK:EMRRF)). Later, based on the inquiries of readers, I also introduced an equal-weighted version of the index. Both indices include the same companies and are calculated back to January 2019.

The previous editions of the monthly report can be found here: May 2019, June 2019, July 2019, August 2019, September 2019, October 2019, November 2019, December 2019, January 2020, February 2020, March 2020, April 2020, May 2020, June 2020, July 2020, August 2020, September 2020, October 2020.

When looking at the precious metals royalty and streaming industry, the month of November was quite interesting. The big three (Franco-Nevada (FNV), Wheaton Precious Metals (WPM), Royal Gold (RGLD)) didn't do well and it was outperformed by some of the smaller players significantly. As a result, the combined weight of the big three declined below the 90% level for the first time since the establishment of the market capitalization-weighted index, back in January 2019. Some minor changes occurred also at the very bottom of the table, as Elemental Royalties (OTCQX:ELEMF) outgrew Vox Royalty (OTC:VOXCF).

As mentioned above, the big three did unusually poorly. In November, the worst results out of the 15 companies were recorded by Wheaton Precious Metals. Its share price declined by 15.12%. The decline started after the Q3 financial results were released. However, the results were not bad, so this may be only a coincidence. The second worst performance was recorded by Royal Gold whose share price declined by 7.02%. Franco-Nevada did significantly better, losing only 2.57% of its share price. On the other hand, Elemental Royalties recorded the best results, growing by 24.55%. The market reacted positively to the acquisition of a royalty portfolio from South32 (OTCPK:SOUHY). The second highest share price growth was recorded by Metalla Royalty & Streaming (MTA). Also Metalla made an acquisition of a royalty portfolio.

Gold and silver experienced a wild ride in November. They started good, and for several days, it seemed like the summer highs might be approached again. However, after the U.S. presidential elections ended and positive news regarding the development of the anti-COVID-19 vaccine started arriving, the gold and silver prices started declining sharply. The share price of the SPDR Gold Trust ETF (GLD) ended the month down by 5.41% and the iShares Silver Trust ETF (SLV) lost 4.27% of its value. These developments weighed negatively also on the gold and silver mining industry. The share price of the VanEck Vectors Gold Miners ETF (GDX) declined by 7.5% and the share price of the VanEck Vectors Junior Gold Miners ETF (GDXJ) declined by 5.98%. The value of the Precious Metals R&S Index declined by 7.08%, which is in line with GDX. However, the Precious Metals R&S Equally Weighted Index did quite well, growing by 1.37%. In this case, the four companies that recorded double-digit gains outweighed the poor performance of the rest of the industry.

The November News

In November, the majority of news was focused on the Q3 2020 financial results. However, also several transactions took place. What is interesting, similar to the previous months, the smaller companies seem to be much more active (at least in terms of news releases) than the big ones.

Franco-Nevada released its Q3 2020 financial results. The gold equivalent sales equaled 134,817 toz gold. The revenues, operating cash flow, and net income set new record highs of $279.8 million, $212.2 million, and $153.9 million respectively. The net debt declined to -$466.8 million. An article focused on Franco-Nevada's Q3 can be found here.

Wheaton Precious Metals released its Q3 2020 financial results. Moreover, the company has increased its dividends by 20%, from $0.1 to $0.12 per quarter. The annualized dividend equals $0.48 which leads to a dividend yield of approximately 1.17% at the current share price.

On November 5, Wheaton announced the closing of the transaction with Caldas Gold (OTCQX:ALLXF) under which it acquired 6.5% of gold and 100% of silver production from the Marmato mine for $110 million and ongoing payments of 18% of the gold and silver spot price.

Royal Gold announced its Q3 2020 (fiscal Q1 2021) financial results too. Its gold equivalent sales equaled 76,900 toz. The revenues, operating cash flow, and net income increased to $149.6 million, $94.2 million, and $106.9 million respectively. Royal Gold also increased its quarterly dividend from $0.28 to $0.30 per share. It equals $1.2 per year and at the current share price, the dividend yield stands approximately at 1.01%. An article focused on Royal Gold's Q3 can be found here.

Osisko Gold Royalties reported Q3 financial results. The attributable gold equivalent production equaled 16,739 toz. The revenues climbed up to the C$41.2 million ($32.2 million) level, the operating cash flow equaled C$36.1 million ($28.2 million) and the net income equaled C$12.5 million ($9.8 million).

On November 25, Osisko announced the completion of the Osisko Development spin-out transaction. Shares of Osisko Development began trading on TSX Venture Exchange on December 2. Another important news is that Sandeep Singh became the president and CEO of Osisko Gold Royalties, and Sean Roosen became the Executive Chair of the Board of Directors of Osisko Gold Royalties and CEO of Osisko Development.

Maverix Metals announced that in Q3, its attributable production equaled 7,797 toz of gold equivalent, and it generated revenues of $14.9 million, net income of $14.4 million, and adjusted net income of $5.3 million. It also repaid a debt of $41 million.

Nomad Royalty reported its Q3 financial results. It received 3,100 toz gold and 52,616 toz silver. The revenues amounted to $7.6 million. The net income equaled $0.5 million and adjusted net income equaled $2 million. As of September 30, Nomad held cash of $15 million. The quarterly dividend was set at C$0.005 ($0.0039). The dividend yield equals 1.8% at the current share price.

On November 19, Nomad announced the closing of the Coral Gold Resources (OTCQX:CLHRF) acquisition. The acquisition cost approximately $45.8 million. Nomad made the acquisition especially due to the 1.0-2.25% NSR royalty on Nevada Gold Mines' Robertson Property.

Metalla Royalty & Streaming noted to its shareholders that Monarch Gold Corporation (OTCQX:MRQRF) got acquired by Yamana Gold (AUY). This is important news as Metalla owns a 1.5% NSR royalty on the Wasamac Project and 1% NSR royalty on the Camflo Project. Both projects are owned by a strong and experienced company now, which increases their chances to be developed soon.

On November 4, Metalla announced the acquisition of 11 royalties from two private entities. Metalla will pay $4.125 million in cash and shares.

EMX Royalty announced its Q3 financial results too. It generated revenues of C$1.261 million ($1 million) and a net loss of C$0.913 million ($0.71 million). What is important, the company holds cash of C$55.627 million ($43.51 million) and investments and loans receivable worth C$22.824 million ($17.85 million).

Abitibi Royalties (OTC:ATBYF) reported that it generated a cash flow of C$1.8 million ($1.4 million) in Q3. The cash position of the company improved to C$65.8 million ($51.5 million). The monthly dividend was set at C$0.0125 ($0.01) which leads to a dividend yield of approximately 0.61% at the current share price. Moreover, the Canadian Malartic (Abitibi holds a 3% NSR royalty on various parts of the deposit) underground mine development progresses well. Abitibi also announced that it has established a project generator division that should help to generate new royalties organically.

ELY Gold Royalties has reached an agreement to acquire private mineral interests on 8,000 acres of private fee ground in Elko County, Nevada. The interests cover portions of Gold Standard Ventures' (GSV) Dark Star, Pinion, Jasperoid Wash, OD, and Bald Mountain deposits. The acquired leases will generate a 1.15% NSR royalty and $150,000 in annual lease payments. ELY will pay $4.017 million and 300,000 warrants in total.

Sailfish Royalty announced that Mako Mining (OTCQX:MAKOF) mined the second full bench at its San Albino mine. The mined ore should contain 1,532 toz gold and 2,569 toz silver. The material should be processed during the ramp-up period in Q1. Sailfish owns a 3% NSR royalty on the Mako project.

VOX Royalty announced a normal course issuer bid under which it can repurchase 1,628,289 shares (5% of its outstanding shares). The program is valid until November 18, 2021.

The company also entered an agreement to acquire a portfolio of 8 royalties from Breakwater Resources for C$455,002 ($354,000) in cash and C$525,000 ($408,000) in shares. All the royalties cover projects in the USA and Canada. Probably the most advanced of them is Alamos Gold's (AGI) Lynn Lake - MacLellan project, with reserves of 1.88 million toz gold and projected production of 143,000 toz gold per year.

On November 25, VOX announced the acquisition of a 1.75% gross sales royalty on Bushveld Mineral's (OTCPK:BSHVF) Brits Vanadium Project. Brits is located right next to a producing vanadium mine and it is expected to start production in the near future. VOX will pay up to $2 million in cash and shares in order to acquire this royalty.

Elemental Royalties reported the Q3 financial results. It recorded revenues of $1.15 million and a net loss of $1.22 million. Its cash position equaled $8.76 million as of the end of September. On November 4, Elemental's shares started trading on the OTCQX market.

On November 23, Elemental announced the acquisition of three Australian gold royalties from South 32 (OTCPK:SOUHY). One of the royalties should start generating cash flow in H1 2021. Elemental paid South 32 $40 million in cash and $15 million in shares. However, there are some serious doubts about whether the price isn't too high. To finance the acquisition, Elemental made a C$15 million private placement.

In late November, Elemental announced that Premier Gold Mines (OTCPK:PIRGF) made some very good drill interceptions at its Mercedes Project, where Elemental owns a 1% NSR royalty. The results include 10.03 g/t gold and 118.89 g/t silver over 4.2 meters, or 20.23 g/t gold and 631.4 g/t silver over 6.3 meters.

The December Outlook

The month of December started positively and the gold and silver prices erased a part of the late November losses. However, the situation was similar also in November and the month didn't end well. The earnings season is over and the news flow will be probably much weaker in December. The share prices of the precious metals royalty & streaming companies should be driven mostly by the metals prices. However, the tax-loss selling season may play a part too.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.