We've seen a resurgence in M&A activity in Q4 for the gold sector, with five deals completed in the past two months alone.

However, the average price paid per ounce has continued to dip despite near-record gold prices, with the 4-period moving average for explorers globally falling to $48.63/oz.

Fortunately, there is one group that continues to receive top-dollar in transactions, and this is Tier-1 jurisdiction gold explorers and producers.

This article examines trends in M&A valuations, and looks at one company that is a top takeover target in the sector.

It's been a busy year thus far for M&A in the gold sector (GLD), and Q4 has continued this trend, with five deals in the past two months alone. However, the price paid per ounce in these deals continues to trend lower across both explorers and producers, which is good news for the sector, but bad news for investors hoping to sell their miner holdings at large premiums. The one group that remains resilient to this trend lower in prices is Tier-1 jurisdiction gold explorers and producers, where suitors have shown no hesitation to pay premium valuations. In this article, we'll examine the trends in M&A valuations and look at one company that could be an acquisition target. All figures are in US Dollars unless otherwise noted.

We've had a busy start to Q4 for M&A activity in the sector with five deals already, ranging from just below $100~ million to over $4 billion, with the latter being the proposal for Australian producers Northern Star Resources (OTCPK:NESRF) and Saracen Mineral Holdings (OTCPK:SCEXF) to merge. While the mega-deal between Saracen and Northern Star translated to a new multi-year high paid for a gold producer of $256.47/oz, the transactions in the pre-revenue explorer space have come in at lukewarm valuations, with an average price paid of $49.00~/oz. The deals this quarter are shown below in order of size:

- Northern Star Resources merges with Saracen Mineral Holdings

- Endeavour Mining (OTCQX:EDVMF) offers to acquire Teranga Gold (OTCQX:TGCDF)

- Yamana Gold (AUY) offers to acquire Monarch Gold (OTCQX:MRQRF)

- Seabridge Gold (SA) purchases Pretium's (PVG) Snowfield Project

- Dacian Gold (OTC:DCCNF) offers to acquire NTM Gold (OTCPK:NMGNF)

Let's take a look at how M&A valuations are trending since the Q3 figures, and which group suitors are willing to pay up the most for when doing M&A:

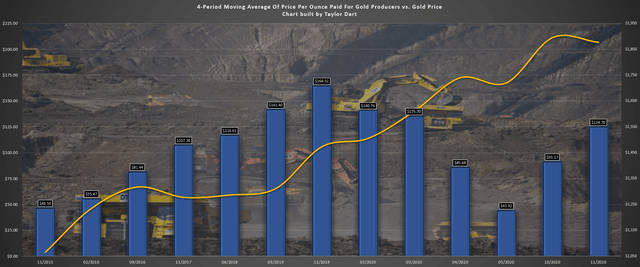

Gold Producers - All Jurisdictions

Beginning with gold producers in all jurisdictions, we previously saw the price paid per ounce in acquisitions (blue bars) follow the gold price (yellow line), but we have a significant divergence thus far in FY2020. In fact, the price paid per ounce peaked at $164.52/oz in November 2019 when the gold price was at $1,450/oz, and the price paid per ounce is still over 20% below its peak at $124.70/oz, despite the gold price being 25% higher.

This is likely due to some lower-quality and high-cost acquisitions, as explained in more detail in the Q3 update for M&A valuations, but it's still a little disappointing for investors. The good news is that the recent Saracen merger at $256.47/oz and the Teranga deal at $175.79/oz suggest that we could finally be seeing a change of character. For now, however, the 4-period moving average is being held down by lower-quality takeovers earlier in the year, and is sitting at just $124.70/oz.

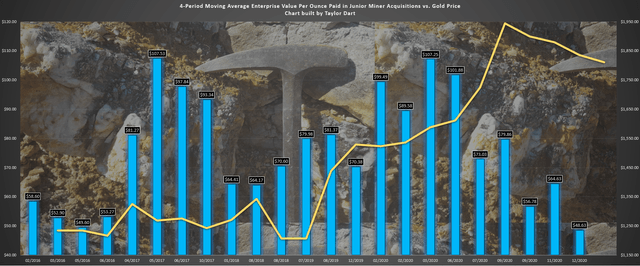

Gold Explorers - All Jurisdictions

If we look at the 4-period moving average of the price paid per ounce for gold explorers in all jurisdictions, we've seen a continued trend lower since the peak in May 2017. Earlier this year, we saw Ramelius Resources (OTCPK:RMLRF) fork over more than $200.00/oz for Spectrum Metals, which pushed the 4-period moving average up to $107.25/oz, but this was still marginally shy of the previous peak of $107.53/oz in May 2017. However, since the double-top for the price paid per ounce in March 2020, the downtrend in the 4-period moving average has declined at a rapid pace.

Currently, the average price paid per ounce is sitting at $48.63, weighed down by the recent purchase of more than 34 million ounces of low-grade gold by Seabridge from Pretium Resources on Friday. This deal came in at a price tag of barely $120~ million in terms of upfront and contingent payments (excluding the net-smelter-royalty). I have not included the net-smelter-royalty in the deal as there's no guarantee that Snowfield will ever go into production with upfront capital costs of $3.40~ billion. Given that this project is a huge deviation from most of the projects and juniors being acquired due to its massive capex, I would not put any weight into the price paid of less than $4.00/oz. However, even ex-Snowfield, the 4-period moving average price paid per ounce for gold explorers globally continues to trend lower and is sitting at $64.63/oz.

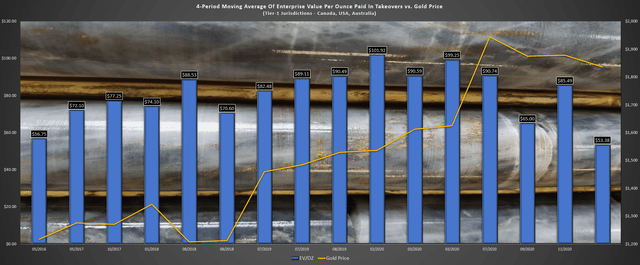

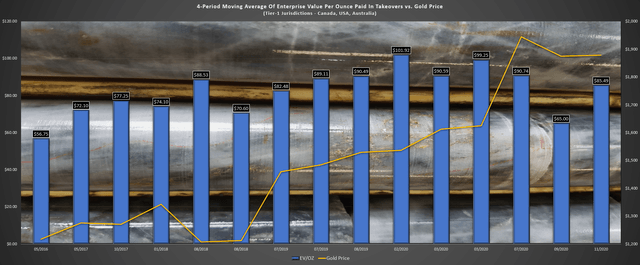

Tier-1 Jurisdiction Gold Explorers

Fortunately, while gold explorers across all jurisdictions continue to get sold off for relatively low prices, gold explorers in Tier-1 jurisdictions such as Canada, Australia, and the United States are tracking near their highs. As shown above, gold explorers/gold projects in Tier-1 jurisdictions have consistently been purchased for above $50.00/oz, with the peak for the 4-period moving average of the price paid per ounce coming in at $101.02/oz in February.

The 4-period moving average has since slid to $53.38/oz, but this is strictly due to Seabridge's Snowfield acquisition at below $4.00/oz, a massive anomaly. If we exclude this deal, which was a large deviation from the average (figure below), the price paid per ounce is sitting at $85.49/oz, only slightly below the peak. On a long-term basis, since the bull market began in Q1 2016, the average price paid per ounce for gold explorers & projects in Tier-1 jurisdictions $80.51/oz.

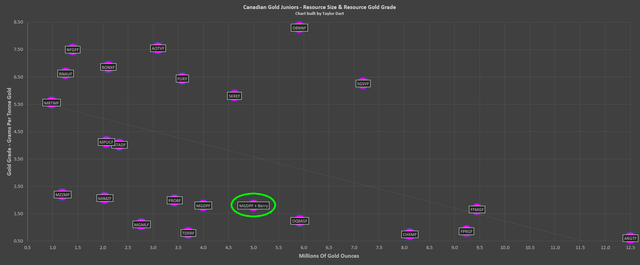

This is good news for investors focusing on gold juniors in Tier-1 jurisdictions, and it suggests investors can get away with paying over $70.00/oz for juniors and still seeing long-term upside potential. While Marathon Gold (OTCQX:MGDPF) currently trades near the high end of the Tier-1 explorer average based on its current resource (4.0 million ounces), the stock is still trading at a discount to the group based on my expectations that 5.0 million ounces can be proven up here in the next 18 months.

This upgraded resource target is based on the newly defined Berry Zone and other targets on its 20-kilometer gold trend. Assuming the company is successful and meets my resource target of 5.0 million ounces at its Valentine Lake, I still see the company as reasonably valued. Therefore, while the stock has outperformed its peers, I would view any 15% pullbacks as buying opportunities, given that the stock remains one of my top-5 takeover targets.

Currently, Marathon is valued at just above $90.00/oz based on 4 million ounces and below $75.00/oz based on an 18-month outlook of 5.0 million ounces. As we can see below, it's one of the few large-scale open-pit gold projects held by Canadian gold juniors. The majority of 4+ million-ounce gold projects in Canada are either low-grade or underground and require significant upfront capex to move into production. Meanwhile, Marathon Gold offers a large production profile (225,000 ounces of gold produced per year) at industry-leading all-in sustaining costs of $739/oz for the first nine years.

At the current gold price of $1,820/oz~, this translates to nearly 60% margins. However, the best part about the project is that the initial capex requirement of $205 million is very reasonable and appeals to both small-scale and large-scale producers with significant annual output but low upfront capital. If the stock were to pullback below US$1.70, where the valuation would bake in a large margin of safety, I would view this as a buying opportunity.

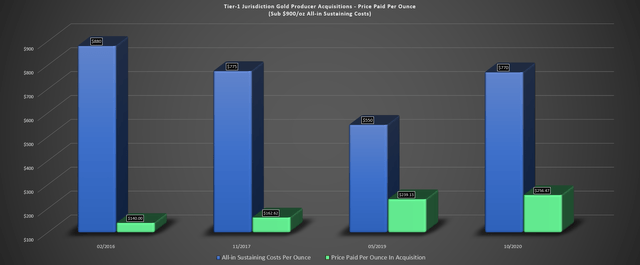

Tier-1 Jurisdiction Gold Producers

Finally, when it comes to Tier-1 jurisdiction gold producers with industry-leading costs (below $900/oz), we've actually seen the price paid per ounce hit a new multi-year high in Q4. As shown below, suitors are willing to pay up significantly for Tier-1 jurisdiction gold producers with high margin operations, with an average price paid of $199.55/oz since gold bottomed in 2015. This is nearly double what suitors are willing to pay for both high-cost producers and all gold producers acquired in non-Tier-1 jurisdictions.

Previous to the most recent Northern Star & Saracen merger of equals, the highest price paid per ounce since 2015 for a gold producer was $239.13/oz. This company was high-margin junior producer Atlantic Gold (OTCPK:SPVEF). The fact that we've seen a new multi-year high of $256.47/oz suggests that investors can feel comfortable paying above $200.00/oz for gold producers in the best jurisdictions with industry-leading costs as suitors aren't hesitating to pay top-dollar for the best assets in the world.

While it may be discouraging to see the price paid per ounce trending lower for gold juniors in all jurisdictions worldwide despite a higher gold price, it's worth noting that this is because most of these projects are not in high demand. While there is a dearth of low-cost gold producers and world-class gold projects out there in Canada, Australia, and the United States, gold projects in Tier-2 and Tier-3 jurisdictions like Africa, Brazil, Mexico, Guyana, and other jurisdictions are a dime a dozen.

Therefore, it should be no surprise that suitors are under-bidding these projects and coming in at low valuations as they do not foresee any bidding war occurring. For this reason, I continue to see a high risk in paying more than $50.00/oz for Tier-2 and Tier-3 gold juniors, as suitors are clearly not willing to pay much more than this even after accounting for a premium in an acquisition.

(Source: Osisko Mining Company Presentation)

(Source: Osisko Mining Company Presentation)

Several gold names continue to be promoted heavily across stock boards like New Found Gold (OTCPK:NFGFF) and Tudor Gold (OTCPK:TDRRF) that are currently trading well above $150.00/oz despite being far too early-stage to be potential takeover targets. In these cases, investors need to realize that chasing these stocks higher at valuations above $150.00/oz is quite risky, especially when the potential suitors most knowledgeable in the sector are unwilling to pay more than $100.00/oz on average for pre-revenue gold explorers.

For investors looking for potential M&A targets in 2021 that are still reasonably valued, I continue to like Marathon Gold and Skeena Resources (OTCQX:SKREF) on sharp pullbacks. Meanwhile, Integra Resources (OTC:ITRG) significantly undervalued at below $40.00/oz with a massive 4-million ounce resource in Idaho. However, I would view this name as a more long-term play and not an immediate takeover target until its Pre-Feasibility Study is completed in Q4 2021.

Disclosure: I am/we are long GLD, MGDPF, SKREF, ITRG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.