Hilton Grand Vacations: A Solid Stock For The Post-COVID-19 Recovery

There have been some signs of a recovery this quarter, but the company’s financial results remain depressed overall.

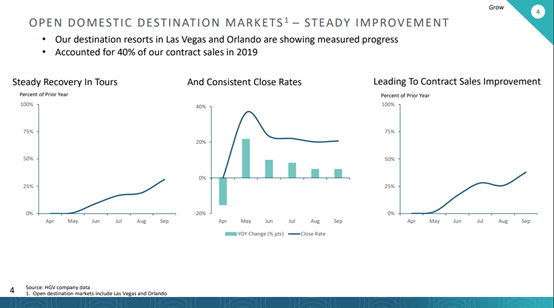

The destination markets like Las Vegas and Orlando are the ones seeing the slowest recovery.

The company is currently trading at a 2019 P/E multiple of 12.2x. Investors could see rapid share price appreciation if a recovery takes hold.

In this article, I'm focused on a stock that could benefit from a "return to normal" in the economy, especially now that we know there are a handful of vaccines on the way. Today, I am examining Hilton Grand Vacations (HGV). The stock has run up quite a bit in recent weeks, and I evaluate the current valuation and business to see if it is worth an investment.

Business Overview

Let's do a quick examination of the company's business. Hilton Grand Vacations is a timeshare company spun out of Hilton Worldwide Holdings (NYSE:HLT) in 2017. The company has an agreement with Hilton Worldwide to license its brand and trademarks for the next 100 years. As of September 2020, it owns 60 properties representing 9,594 units in several premier vacation destinations such as Orlando, Las Vegas, Hawaii, etc. The company makes money through the sale and financing of timeshares or "VOI" as well as the resort's operations and club management. This creates a sort of "flywheel" effect for the company and its revenues. As more people buy timeshares, the company can develop more resorts, and the more resorts available, the greater the network effects for VOI owners.

Like virtually all companies in the services and lodging industry, Hilton Grand Vacations' revenue was greatly impacted by the coronavirus pandemic. There have been some signs of a recovery this quarter, but the company's financial results remain depressed overall. Total revenues for Q3 2020 were $208 million compared to $466 million at the same time last year. The company had a Net Loss of -$7 million for the quarter compared to $50 million in Net Income at the same time last year.

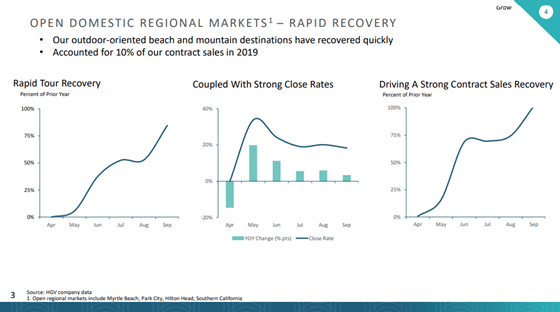

As of October 2020, roughly 75% of the company's resorts are operational albeit at significantly reduced capacity. The company's properties in domestic regional markets like California and South Carolina have had solid recovery in both tours and contract sales. No doubt these are more "regional" vacation destinations such as beaches and mountains accessible via private vehicles.

The destination markets like Las Vegas and Orlando are the ones seeing the slowest recovery. Tours and Contract sales to these destinations are below 50% of what they were a year ago. This is no doubt predicated on people's unwillingness to fly while a vaccine is not yet available. It's true that we are seeing steady recovery, and an uptrend of these metrics, however, these are coming from a low base during the height of the shutdown. What investors need to watch in the subsequent quarters are that these recovery numbers don't sputter out or plateau.

Our regional resorts, particularly, outdoor-oriented locations like South Carolina, California, and Utah have seen a rapid recovery. South Carolina for example is trending 95% of contract sales pace they did in prior year owing to strong close rate gains in occupancy rates in the 90%. As a whole, our regional markets have seen similar improvements, surpassing last year's contract sales levels in the month of September was strong occupancy rate. On the other hand, our largest resorts in destination markets associated with local attractions that have capacity restrictions such as Orlando and Las Vegas have seen more measured progress.

Hilton Grand Vacations' (NYSE:HGV) CEO Mark Wang on Q3 2020 Results - Earnings Call Transcript

Looking at the company's revenue, I was surprised to see that the Resorts Operations and Club Management segment also suffered a large decline. Revenues of this segment were down 43.5% compared to the previous year from $108 million to $61 million. I would have thought that resort management would have provided a stream of steady revenue for times like this. Annual dues would have still been payable regardless of the usage during the pandemic. However, the revenue decline was due to a large decrease in rental and ancillary services, which make up a surprisingly significant portion of the business.

At the end of Q3 2020, Hilton Grand Vacations had total debt of $1.26 billion against total cash of $717 million. This debt had an average interest rate of 3.17%, which is quite low yet unsurprising, given the current interest rate environment. This will make it much easier for the company to manage the cash payments associated with this debt. The company generated $64 million in free cash for the nine months YTD 2020, a huge drop from the $104 million generated the same time last year, but enough liquidity to cover these debt obligations. Hilton Grand Vacations had a net leverage ratio of 2.14 and an interest coverage ratio of 7.17. Overall, I view the company's balance sheet to be in relatively healthy shape despite the challenges brought about by this environment. This basically ensures that the company can weather this environment and hope for a strong economic recovery post-pandemic.

Investor Takeaway

Hilton Grand Vacations is weathering the current environment rather well. No doubt financial performance continues to remain depressed particularly in resorts in certain geographical regions. However, we can see green shoots emerge. There are signs that people would want to travel extensively post-pandemic, and we could be seeing pent-up demand. The company has a strong enough balance sheet to weather the storm and take advantage of a recovery.

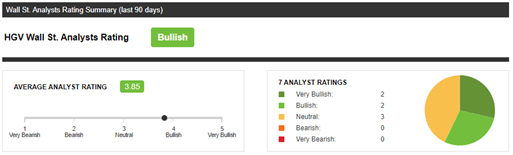

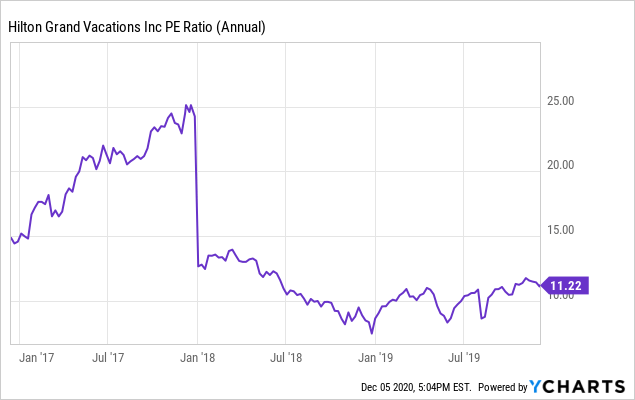

Wall Street analysts have a consensus Buy rating (score of 3.85 out of 5) and an average price target of $28.6, which is about where the company is trading now. However, I believe these analysts will all revise their estimates once it is certain that a recovery is in motion. The company is currently trading at a 2019 P/E multiple of 12.2x. This is at the low end of the company's historic range pre-pandemic. I believe Hilton Grand Vacations is a decent choice for investors looking to get into the "recovery from COVID-19" play. I have the company at a neutral rating.

Hilton Grand Vacations Inc. (HGV) Wall St. Analysts Rating

Data by YCharts

Data by YCharts

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Caveat emptor! (Buyer beware.) Please do your own proper due diligence on any stock directly or indirectly mentioned in this article. You probably should seek advice from a broker or financial adviser before making any investment decisions. I don't know you or your specific circumstances, therefore, your tolerance and suitability to take risk may differ. This article should be considered general information, and not relied on as a formal investment recommendation.