Crocs: Comfortable Even After The Rally

Crocs grew its e-Commerce business by 36.3%. I believe digital will not only be a common distribution channel but also the primary means where brands interact with customers.

The company has significant growth opportunities in Asian markets, particularly China.

CROX is actually still trading at a decent valuation.

I've written about Crox (CROX) in the past. As seen in this article, I felt the company was making the right marketing moves to ensure long-term success in particular when it came to digital and engagement. The company’s stock has risen close to 80% since my initial recommendation. However, after examining earnings results I continue to be optimistic about the company and its future prospects.

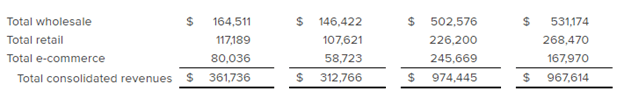

Retail and Wholesale segments remain steady, Growth in e-Commerce is impressive

The company’s Q3 2020 revenue increased by 15.7% (15.9% on a constant currency basis) from $312.8 to $361.7 million. The company saw growth on all channels as restrictions and lockdowns were eased worldwide. Revenues from the wholesale and retail distribution segments grew by 12.4% and 8.9%. Comparable store sales at the retail level had revenue growth of 16.2% in Q3 2020 compared to the growth of 12.5% at the same time last year.

Retail growth was primarily driven by the Americas segment which had comparable sales growth of 22.3% in Q3 2020 compared to 19.1% in Q3 2019. Comparable retail growth lagged in Asia Pacific at only 2.8% and EMEA at a decrease of -4.7%. However, these geographical regions did see a surge in digital sales. Over-all wholesale and retail are the largest distribution channels for the company representing 45.5% and 32.4% of total revenue in Q3 2020 respectively.

Despite the improvement in Q3 2020 results for the wholesale and retail channels, 9 months YTD revenue is still down for these segments over-all. Total wholesale revenue declined from $531.2 million in YTD 9 months 2019 to $502.6 million in YTD 9 months 2020 a decline of 5.4%. Total retail sales fell an even larger 15.7% from $268.5 million to $226.2 million in 9 months YTD 2020. While these declines have been offset by the increase in e-Commerce sales, I can’t help but feel the company has lost some potential sales from impulse shoppers and lack of over-all foot traffic. I expect this segment to bounce back hard as a vaccine for COVID becomes available and we return to some form of normalcy.

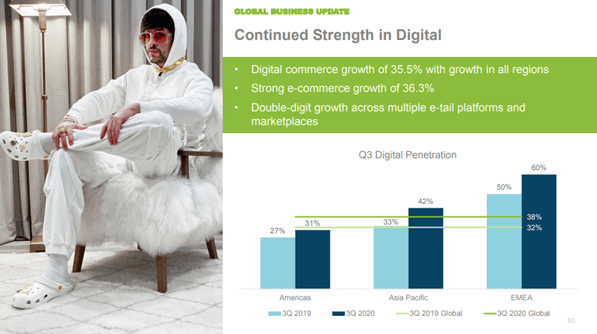

More encouraging details in the company’s earnings results is the 36.3% growth of the company’s e-Commerce business. The growth in e-Commerce is important as I believe digital will not only be a common distribution channel but also the primary means where brands interact with customers. I have long noted that apparel companies that have a strong digital presence are the ones best prepared for the future of retail.

The fact that Crox had a pretty strong digital footprint was something I pointed out in my previous article. Digital sales as a percent of total revenues in Q3 2020 was 37.7% globally compared to 32.2% at the same time last year. Surprisingly the growth in digital sales lagged a bit in the Americas as digital sales as a percent of total revenue grew from 26.9% in Q3 2019 to 30.8% in Q3 2020. Digital sales were strongest in EMEA and Asia. YTD 2020 e-Commerce sales were up 46.3% from $167.9 million in 2019 to $245.7 million in 2020. The company’s operating margin was 20.8% in Q3 2020 compared to 14.2% at the same time last year.

Investment thesis moving forward

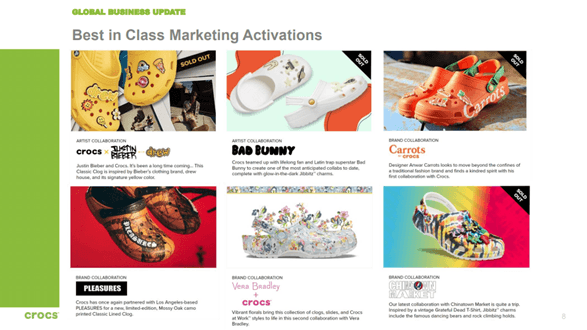

I’ve laid out in my previous article the long-term thesis that Crox will do well due to extremely savvy marketing. In the past quarter, the company has signed up multiple partners and celebrities showing the company’s marketing skills. The company’s stock popped upon the announcement of a collaboration with global superstar Justin Bieber. This isn’t particularly unusual as the company has a history of unique collaborations with celebrities. I consider this marketing savvy as a narrow long-term competitive advantage for the company in the sense I am not totally convinced that Crox has the same lasting appeal as a brand like Nike (NKE). The key risk here is that if fashion opinions turn on Crox and it is no longer seen as a “cool” brand. Thus it is good to see the company build upon previous marketing wins.

Crox also has significant growth opportunities in the Asian markets particularly China. Currently, the Asia Pacific region only accounts for 23.3% of the company’s YTD sales. This is a lot smaller than the Americas which accounts for 56.8% of total sales. The Asia Pacific region is primarily driven by the wholesale channel. This is surprising as there are 136 retail locations in the region which is close to the 165 in the Americas. Furthermore, a total of 6 retail locations were closed in this region between Q2 2020 and Q3 2020. What this tells me is that the company still needs to work on its brand identity in the Asian context as its performance in the region isn’t so strong. I believe though the company has the marketing expertise to solve this puzzle. The partnership with Yang Mi, a popular Chinese celebrity, seems to be a step in the right direction.

From a China perspective, we see good performance on our digital business. We're very much encouraged by the reaction to our new store concepts that we talked about at our last earnings call. But we are concerned about our partner store portfolio. So our partner store portfolios generally are in poorer retail locations, and they have not bounced back as quick as the rest of the economy. And as we look at that, we anticipate that we’ll do further investment and optimization with partner store network in ‘21, before we can get back to wholesale growth in ‘22 within China.

Crocs, Inc. (NASDAQ:CROX) CEO Andrew Rees on Q3 2020 Results - Earnings Call Transcript

Valuation and Conclusion

In terms of valuation, the company is actually still trading at a decent valuation with a TTM P/E ratio of 28x earnings and 22.3x forward earnings. The company has a strong balance sheet with very little debt ($135 million long-term debt against cash of $123.5 million).

Using 2019 earnings though the company is at a P/E of 36.6x. The company had a net loss in the 5 years prior to 2019. The company does not have a solid performance history to rely on. An investment in the company makes the assumption that the current trend has some permanence and will continue to the future. The earnings call actually had a pretty interesting discussion on the sustainability of the Crocs fashion trend and I believe management’s answer is spot on.

So let me start off and say, I do understand why investors are concerned, right, about sustainability. If you look at the history of the company, it has been through, I would say three significant cycles, right. But I would also tell you, I think today, the company and the brand is a very different brand and a very different company. So, if I start with the sort of consumer-facing side of the business, I think the breadth of consumer engagement with Clogs, with Sandals, with Jibbitz and Visible Comfort Technology, is very different to how it's been in the past.

Crocs, Inc. (CROX) CEO Andrew Rees on Q3 2020 Results - Earnings Call Transcript

An analyst from investment firm Susquehanna thinks Crocs' momentum will continue post-pandemic and the company will emerge as a winner in the retail landscape. I agree. The company continues to build upon its digital strengths in consumer impressions and social media engagement. I continue to believe that Crocs has been making the right marketing moves that are setting up the company for long-term success. I have Crox as a buy.

Disclosure: I am/we are long CROX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Caveat emptor! (Buyer beware.) Please do your own proper due diligence on any stock directly or indirectly mentioned in this article. You probably should seek advice from a broker or financial adviser before making any investment decisions. I don't know you or your specific circumstances, therefore, your tolerance and suitability to take risk may differ. This article should be considered general information, and not relied on as a formal investment recommendation.