Silver One Resources: High-Risk, High-Reward

Silver One Resources is one of the top-performing silver stocks this year, up over 75% with excitement surrounding the company's Candelaria Project in Nevada.

Fortunately, the company has been able to significantly increase its balance sheet the past year, which should allow the company to continue exploring without dilution for 18 months.

However, with an early-stage play like this, there is very high risk, and I am not overly impressed with the track record of the company over the past four years.

Therefore, I believe there are much better ways to play the silver price from a reward-risk standpoint, and I see Silver One as high reward but extremely high-risk at C$0.70.

It's been an incredible year for the silver explorer and producer space, with many names like Silver One (OTCQX:SLVRF), Golden Minerals (AUMN), and Aftermath Silver (OTCQB:AAGFF) enjoying triple-digit returns at their year-to-date highs. However, a sharp correction in the price of silver (SLV) and general malaise in the sector has put a dent in a few companies, with Silver One Resources sliding more than 30% from its year-to-date highs. While this has left the stock trading at a roughly C$3.00/oz for its 45.4~ million-ounce silver resource, I see the stock as high-risk given its uninspiring track record for the past four years. Therefore, I see much better ways to get leverage to the silver price. All figures are in Canadian dollars unless otherwise noted.

(Source: Company Presentation)

Silver One Resources is a relatively under the radar name with a market cap of just C$137~ million, and up until recently, only a historical resource on its flagship Candelaria Project in Nevada. However, due to a high-profile private placement earlier this year and strength in precious metals prices, the stock is up nearly 80% this year. This demand for the company's shares has allowed it to bolster its balance sheet to over C$13 million in cash, and the company now seems to be taking a more U.S. based focus, with the sale of its Mexican silver assets in Q3. Let's take a closer look at the company below:

(Source: Company Presentation)

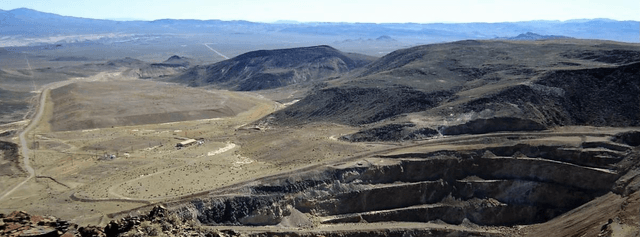

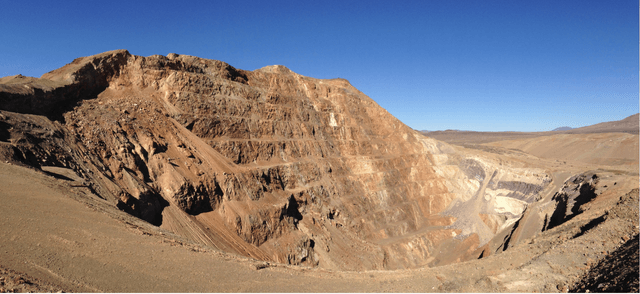

As shown in the chart, Silver One has two projects in Nevada: Cherokee and the Candelaria Mine Project. In this article, we'll focus solely on the latter project. This is because the Calendaria Mine Project is the most advanced and the project where we have a current silver resource in place. For those unfamiliar, the project is a past-producing site serviced by paved road, power, and water, and reclamation of the site has been ongoing since 1998. The project has a great address as it sits in the #3 ranked mining jurisdiction in the world (Nevada) and in the richest silver mining district within the state: the Candelaria Mining District. The most recent production was 47 million ounces of silver between 1980 and 1999, with Kinross Gold (KGC) producing 13 million ounces between 1994 and 1999. Silver One now has an option to acquire 100% of the project from SSR Mining (SSRM) that completed a technical report on the project in 2001.

(Source: Company Presentation)

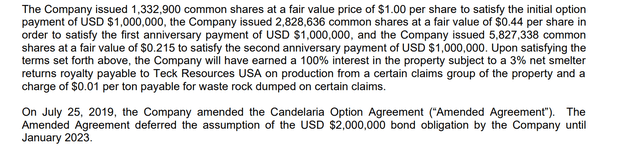

To date, Silver One has continued to satisfy its requirements to acquire a 100% interest in Candelaria, with 9.9~million shares issued to SSR Mining to date and a recent deal to pay Maverix Metals US$1 million if the mine goes into commercial production. Meanwhile, Silver One recently issued C$100,000 in shares to both Maverix and SSR Mining. Finally, Silver One will need to assume a US$2.0 million reclamation bond on the larger of the two heap leach piles at Candelaria. This requirement has been amended to 2023 from 2020 previously. I don't anticipate any issue with Silver One meeting all of the remaining conditions, so it's fair to say that the company should have no problem gaining full control of the project.

(Source: Management Discussion & Analysis)

However, even when the company gains 100% control, it's important to note that there's a hefty 3% net-smelter-return [NSR] on a certain portion of the lands held by Teck Resources (TECK) and a C$0.01 per tonne charge for rock dumped on specific claims. While the latter rock dumping charge might not seem like much, that is equal to C$10,000 per 1 million tonnes of rock, which can add up if mining does commence here. Therefore, both the NSR and the additional minor rock dumping charge will have to be eventually factored into the economics here.

(Source: Company Website)

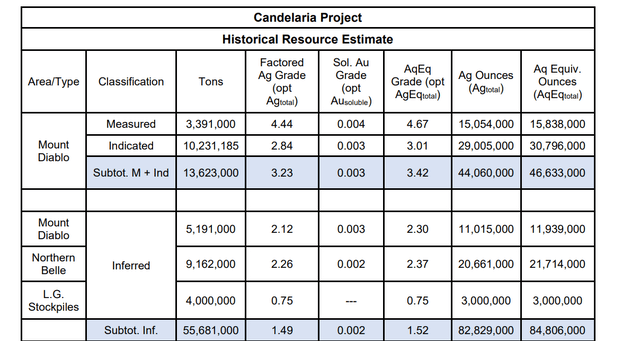

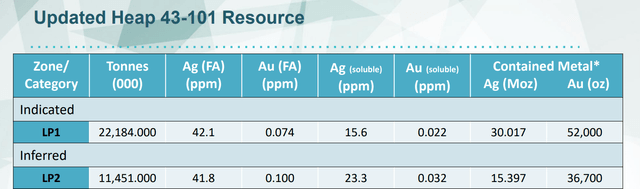

Before Silver One acquired Candelaria, the project held a historical resource of 126.8 million ounces of silver. This has since been updated to a resource of 45.4 million ounces of silver and 88,000 ounces of gold (GLD) as of this summer's resource update. While this is a solid resource, we've seen only limited drilling to date by Silver One to corroborate this resource. However, the company has finally begun a 15,000-meter drill program recently. This should give us a better idea of if drilling is reconciling to the current resource and if there's an upside in grades going forward.

(Source: Company Presentation)

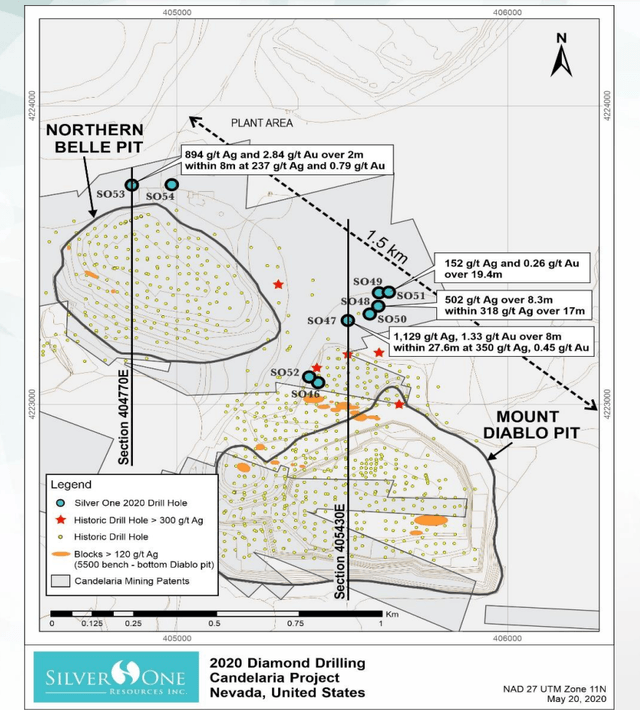

As shown below, the four holes reported to date were decent, but I wouldn't call them extraordinary by any means. The most significant hole (SO47) was 8 meters of 1,129 grams per tonne silver and 1.33 grams per tonne gold, equating to an average silver-equivalent grade of roughly 18~ grams per tonne. This was an impressive hole, but the other holes to date have been at much lower grades, with SO53 intersecting 8 meters of 237 grams per tonne gold and 0.79 grams per tonne gold, or roughly 4.5~ grams per tonne silver equivalent. Meanwhile, the hole drilled just northeast of SO47 intersected 19.4 meters of 152 grams per tonne gold and 0.26 grams per tonne gold, or closer to 2.10~ grams per tonne silver-equivalent. Therefore, I would argue that the high grades in SO47 could be an anomaly, but these are still decent grades given that this is a past-producing mine in a #3 mining jurisdiction.

(Source: Company Presentation)

Some investors might argue that Silver One is deeply undervalued based on a market cap of C$137.3 million and a 45.4~ million ounce silver resource, giving the company a valuation of roughly C$3.02/ounce. However, with earlier stage plays like this, the biggest factor is execution and a company's previous track record as there is still tons of work that needs to be done to bring this mine into production ranging from further drilling, economic studies, and eventual financing. The key for shareholders to make money is for minimal dilution during this process because a bloated share structure and constant share issuance, ultimately, dilute early investors leading up to the point when a mine finally does start generating revenue. When it comes to the track record over the past four years and share dilution, I wouldn't say I'm elated with the track record.

(Source: Company News Releases, Author's Notes)

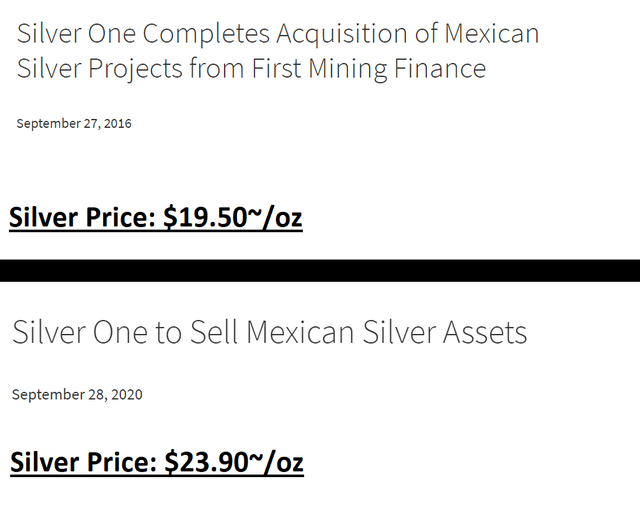

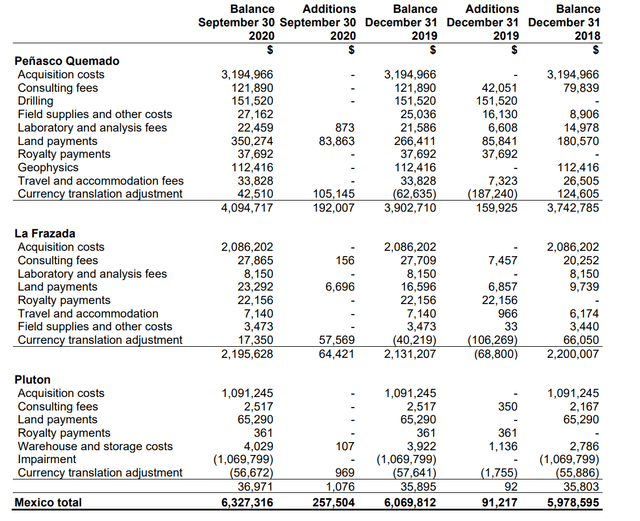

As mentioned earlier, Silver One sold its Mexican assets recently, and this was highlighted as "providing excellent value to Silver One." However, these assets were bought at a silver price of US$19.50/oz for consideration of roughly C$6.3 million and translated to a 7.4% share dilution at the time. Fast-forward four years later, and the assets have now been sold for C$1 million in cash and C$5 million worth of Plymouth's common shares (the buyer). If we add in the C$990,000~ spent on the project on geophysics, travel, drilling, land payments, and consulting fees following the 2016 acquisition, this resulted in a net loss of over C$1 million at the Mexican assets. This does not include lost time and money spent on G&A during this period on assets that did not generate any value for shareholders.

(Source: Management Discussion & Analysis)

While some investors might argue that it's not a big deal to lose a little over C$1 million on the transaction over four years, it's important to note that there's no guarantee of the future value of Plymouth's shares. Therefore, the deal's true consideration is variable, as it depends on what price Silver One can get for its Plymouth shares once they are sold. Worse, the silver price is over 20% higher, so we would expect to see value generation in this period. This net loss is based on acquisition costs of C$6.3~ million, spending of C$0.9~ million, and sale consideration of C$6 million, with 83.3% of that payment in shares.

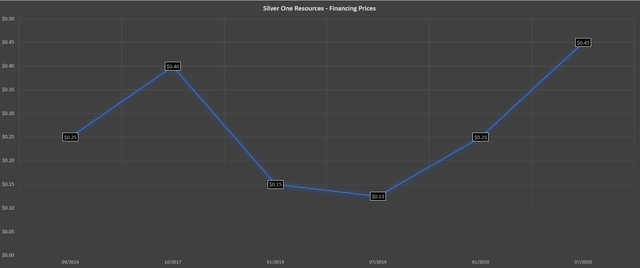

(Source: Author's Chart)

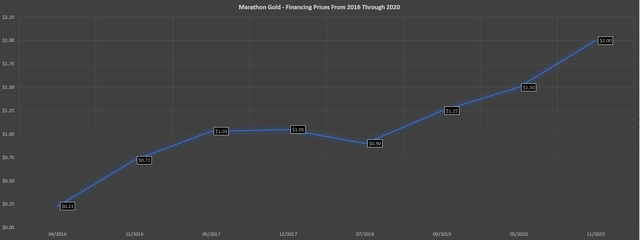

Moving over to share dilution, we can see that the trend has improved recently based on the financing in July for C$9.5 million at C$0.45. However, this trend is not impressive relative to other juniors, with several other names seeing a trend of consistently higher prices for capital raises since 2016. In fact, Silver One is one of the most heavily-diluted names in the junior space since FY2016, with the share count increase by over 260% from Q2 2016 to the most recent quarter. This is because the share count has grown from 55~ million shares in Q2 2016 to 199~ million shares currently. In comparison, Marathon Gold has consistently raised money at higher prices in the same period, has more than doubled its resource, and the share count has grown by barely 100% in the same period.

(Source: Author's Chart)

So, what's the good news about Silver One?

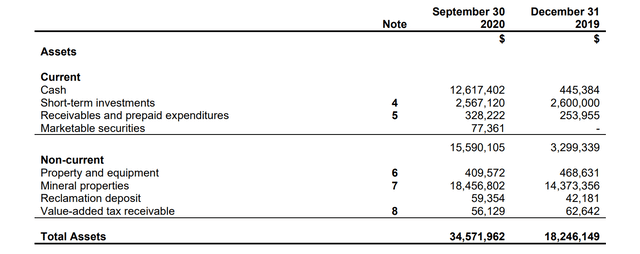

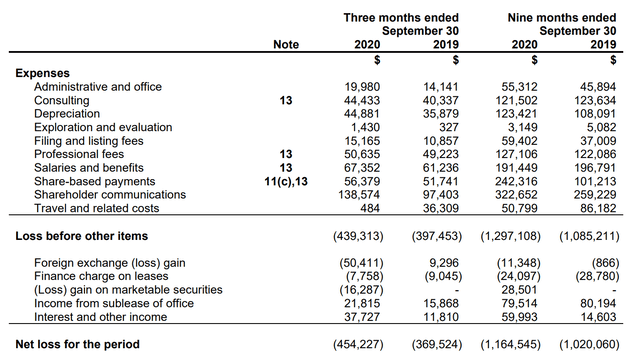

The good news is that Silver One is sitting on a decent-sized resource in a premier mining jurisdiction and currently has over C$13 million in cash, which should fund drilling and operations for over 18 months. The below table shows C$12.6 million in cash, but the company recently received C$1 million upfront for the sale of its Mexican silver assets. As shown below, the company's burn rate over the past nine months was C$1.3 million in general expenses, and the company also incurred costs of C$2.7 million on its properties year-to-date. This translates to C$4.0 million spent in the first nine months of 2020. If we assume that drilling is ramping up, we should see between C$6 million and C$7 million spent in FY2021, leaving the company with a cash balance of over C$5 million. Therefore, investors need not worry about dilution in the next 12 months and can look forward to quite a bit of drilling results.

(Source: Management Discussion & Analysis)

(Source: Management Discussion & Analysis)

While it's excellent news that investors won't have to worry about dilution going forward, I prefer to focus on companies with exceptional track records if I am going to invest in companies with market caps below C$200 million. In Silver One's case, the company has a solid resource, a great location, and lots of cash, but I am not elated with the lack of focus over the past four years and the massive increase in share dilution. Therefore, while this is undoubtedly a high-reward opportunity if we see bonanza-grade drill results and a strong drilling season, it's also an extremely high-risk play if we don't, or if the company cannot continue to raise money at higher prices. For this reason, I believe there are better ways to gain leverage on the silver price, and I prefer safer options like Wheaton Precious Metals (WPM).

Disclosure: I am/we are long GLD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.