Chiasma Trades At A Big Discount To Fair Value With Mycapssa On The Market

Chiasma launched its first product, Mycapssa, on August 31, 2020.

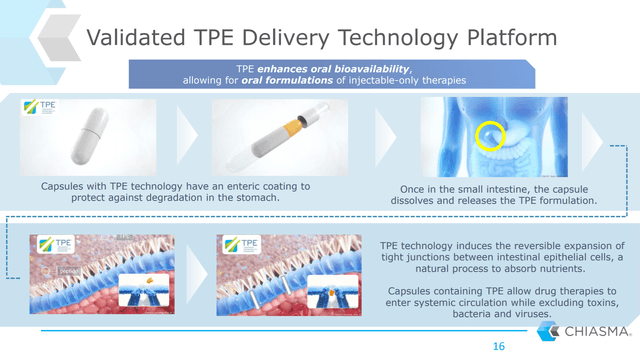

Mycapssa is the first product utilizing Chiasma's proprietary technology platform that enables oral version of previously injection-only therapies by transiently enhancing intestinal permeability.

Chiasma is well-funded for this launch with over $175 million in cash and equivalents in the bank, likely enough to last through mid-2022.

Chiasma trades for less than probable Mycapssa peak sales which leaves a lot of potential upside from present levels.

Chiasma (CHMA) ((pronounced key-as-ma)) is a recently commercial stage biopharma that I’ve been interested in researching for a while now. Its first product, Mycapssa, just launched on August 31 and utilizes the company’s proprietary technology platform to enhance oral bioavailability of larger peptide therapies that traditionally had to be given in injectable form. I really like what I’ve seen as I’ve dug into Chiasma, and projected peak sales of Mycapssa suggest strong potential long-term upside.

Chiasma’s First Product Mycapssa Utilizes its Unique Technology Platform

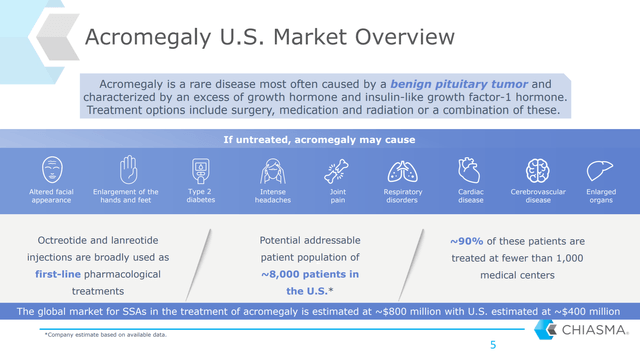

Mycapssa is an daily-use oral form of octreotide to treat acromegaly, a disorder where the pituitary gland produces too much growth hormone, resulting in abnormal growth of things like bone, cartilage, bodily organs, and other tissues. Patients can cause undesirable appearance changes like swollen-looking ears, noses, and hands, but acromegaly also increases a patient’s risk of more serious diseases like high blood pressure, heart disease, and type 2 diabetes.

25,000 people in the US in total are thought to have acromegaly with an additional 3,000 people diagnosed each year. A majority of these cases are caused by a pituitary tumor and can be cured by surgical intervention. The rest are treated by medicine of which somatostatin analogs like Mycapssa/octreotide are the primary form. Other types of treatment include dopamine agonists and growth-hormone receptor antagonists, but the common thread is that they all work by decreasing growth hormone levels.

The current standard-of-care therapies for non-surgical candidates, and thus the primary competitors for Mycapssa, are injectable forms of octreotide and lanreotide, which are both somatostatin analogs like Mycapssa.

Figure 1: Chart on the US Acromegaly Market (source: Chiasma’s September 2020 Investor Presentation)

Somatostatin analogs work by inhibiting the overactive growth hormone that is the hallmark of acromegaly. Somatostatin is a normal hormone in the human body that is sometimes also referred to as growth hormone inhibiting hormone. By using an analog of this hormone, patients should then have lower levels of circulating growth hormone thus alleviating disease symptoms.

Somatostatin analogs have traditionally had to be injected because the molecule is a peptide that is too large to be well-absorbed in the intestinal lining. Mycapssa utilizes Chiama’s proprietary technology platform that makes these peptides more soluble and bioavailable through transiently increasing intestinal permeability.

Mycapssa received a broad indication that covers approximately 99% of the current market for somatostatin analog therapy which is roughly 8,000 patients in the US. Mycapssa is now the only oral somatostatin analog therapy and likely will become the new pharmacologic standard of care, especially given that KOL’s have also seemed to be very positive on the new therapy.

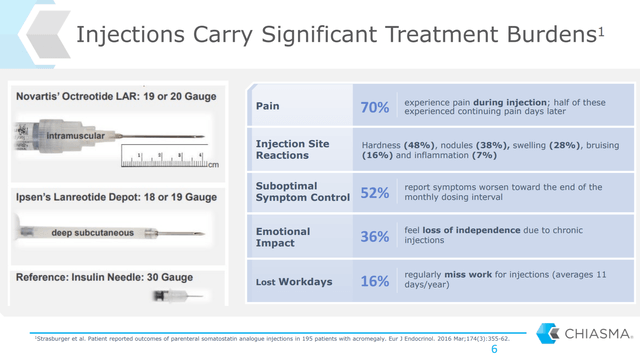

Figure 2: Chart on the Drawbacks of Injections (source: Chiasma’s September 2020 Investor Presentation)

Routine injections are not a trivial thing for patients. A convenient, daily-use oral therapy is a substantial improvement in patient quality-of-life and should quickly take significant market share from a market estimated at $400 million in the US and another $400 million in the EU.

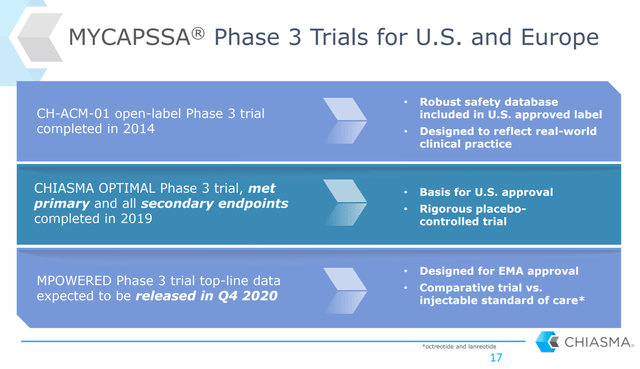

Chiasma recently provided additional clinical data that demonstrates significant long-term safety and durability of effect. 90% of patients who completed the 36-week Chiasma Optimal study enrolled in the 48-week open label extension presumably due to their preference of continuing an oral therapy. Mean IGF levels, an important growth-hormone-related biomarker, were maintained within normal limits at the end of the open label period. 18 of 20 patients that enrolled in the open label extension completed the entire 48-week period, including all 14 responders who rolled over from the original study. 93% of these then maintained a normal IGF response throughout the trial. Mycapssa’s safety profile was also consistent with the original Optimal trial despite the extended use.

Figure 3: Chart on Mycapssa Clinical Data (source: Chiasma’s September 2020 Investor Presentation)

Mycapssa’s clinical data on the whole was strong, and this new data on long-term efficacy and durability should help uptake of the therapy. Over 300 patients globally have been involved in these trials which is a large number considering again that the entire US acromegaly population on somastatin analog therapy is just 8,000.

Chiama is also hoping to get Mycapssa approved in the EU soon. The company just reported data from an ongoing nine-month Phase 3 trial with 92 patients enrolled. Chiasma reported that Mycapssa met its primary endpoint of noninferiority to the standard-of-care injectable therapies, and after the full nine-month course of treatment, Mycapssa patients still had IGF-1 levels of .9 x ULN. Chiasma says it still intend to file an MAA for European approval in the first half of 2021. This is an important opportunity given that Chiasma views the EU market as being essentially a second US market in overall size and sales potential.

Chiasma’s transient permeability enhancement technology platform should also easily expand into other rare disease areas, and the company has already confirmed this type of expansion activity is ongoing.

Figure 4: Chart on Chiasma’s Transient Permeability Enhancer Technology (source: Chiasma’s September 2020 Investor Presentation)

Chiasma can use the same strategy they did with octreotide by converting an already used injectable drug to pill form, and Mycapssa itself should be able to be extended into certain neuroendocrine tumors. As I’ll discuss more below, I don’t believe the current market cap assigns any value to this technology platform, so I think any additional proprietary uses or partnerships using the technology would create substantial long-term value for shareholders.

Mycapssa Looks Prepped for a Strong Launch

Mycapssa was just launched August 31, but there are definitely reasons to think uptake should be good. First, the acromegaly market is very concentrated, with 90% of patients being managed by fewer than 1,000 medical professionals.

Chiasma has thus chosen to market Mycapssa itself using a small, specialty sales force. The company has already hired around 20 sales professionals on its way up to a planned target of 45 total. A big component of the launch will be remote given the continued impact of COVID-19, and Chiama’s team has already been having remote interactions with healthcare providers since late July.

Chiasma already has manufacturing capacity to meet all expected initial launch demand. It’s worth noting though that continued capacity is contingent on the FDA accepting Chiasma’s manufacturing supplement to the NDA regarding a new manufacturer for the API of Mycapssa. This is one area that I will be keeping a close eye on. While it’s not concerning yet, I would be worried it could hamper Mycapssa availability during the key sales ramp-up phase if we don’t hear about an approval of the supplement by early next year. Chiasma previously said itwould not launch Mycapssa until the supplement was approved, but that appears to have changed now, signaling to me that the company is confident in near-term inventory levels.

Chiasma is also still in the process of securing payor coverage for Mycapssa. Pricing is competitive with injections though, and since injections are already covered, this will not be a new cost for payors. I would thus be surprised to see coverage being a major hurdle to Mycapssa uptake. Mycapssa saw Q3 sales of $142,000 in really just its first month. I'll be watching closely to see what happens from here with product uptake.

Chiasma has the Balance Sheet Strength to Successfully Launch Mycapssa

Chiamsa is currently focusing all assets on the launch rather than splitting it to pipeline development for now. At the end of Q3, the company reported having $177.1 million in cash and equivalents, this after Chiasma conducted a $75 million equity financing and received $25 in additional financing through a prior deal with Healthcare Royalty Partners all in Q3. I generally love deals like this and think they are a savvy way to raise non-dilutive capital, and Chiasma’s case is no different. On top of the money already received, there is an additional $25 million to potentially come down the road based on Chiasma hitting commercial milestones.

I think Chiasma’s management of cash flow has also been good. At the end of Q3, the company reported $13 million in SG&A expenses which is about $52 million annualized and $4.5 million in R&D which is about $18 million annualized. Chiasma's Q3 net loss was about $18.5 million which is roughly $75 million in annual cash burn at present which should give Chiasma a two-year runway without factoring in product sales or the additional $25 million from the royalty deal.

Cash flow will be a big thing to watch over the course of the next year though. Obviously if sales uptake is slow it could lead to significant dilution and diminished shareholder returns.

Also just to note, there haven’t been any substantial buys or sells by insiders within the last year or so. Institutional investors own a pretty substantial portion of the company though, including noted fund Baker Bros. that purchased a $5 million stake in Q2 at an average cost of $5.38 per share, far above where it currently trades.

Chiasma’s Valuation is Attractive Here

Chiasma stock has sold off hugely post Mycapssa approval.

Figure 5 Chiamsa Stock Chart (source: finviz)

This actually makes the stock more appealing to me because nothing has changed that should negatively impact the company from a fundamental standpoint at least. Chiasma’s market cap is only about $250 million here, and its enterprise value should be about half of that given that Chiasma should now have about $175 million in cash and equivalents and only about $50 million in deferred royalty obligations. Considering I’ve seen peak sales estimates for Mycapssa ranging from about $300 million to $400 million, it’s pretty hard to see there being much long-term downside from here.

Mycapssa appears to have a $5,152 average cost for a 28-day supply. If you then calculate the value of a one-year supply for Chiasma’s estimate of 8,000 US acromegaly patients on somatostatin therapy, you get closer to a $500 million ceiling on potential sales versus the peak sales estimates in the $300 million to $400 million range. That means that Chiasma would only have to take 50% market share, despite having superior technology to its competitors, to have peak sales equivalent to its current market cap, implying 4x to 5x potential upside if Chiasma were eventually to trade at the industry average multiple for sales. There is also substantial room on top of this for upside surprise with additional uses for Chiasma’s technology platform or if peak sales end up higher than $250 million.

This is a delayed release article from my Marketplace Service, Biotech Value Investing. Subscribers received this a little over 30 days ago along with my present value estimate for the company, but I believe the research is still applicable today. Biotech Value Investing provides in-depth coverage of my approach to finding high-quality, value-oriented companies in the biotech sector. This approach is intended to use the inherent volatility of the biotech sector to my advantage while using options to help generate a high compounded return while ensuring optimal entry and exit points. Check us out today with a free trial.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I’m not a registered investment adviser. Please do not mistake this article, or anything else that I write or publish online, as any type of investment advice. This article and anything else that I post online are for entertainment purposes only and are solely designed to facilitate a discussion about investment strategy. I reserve the right to make any investment decision for myself without notification except where required by law. The thesis that I presented may change anytime due to the changing nature of information itself. Despite the fact that I strive to provide only accurate information, I neither guarantee the accuracy nor the timeliness of anything that I post. Past performance does NOT guarantee future results. Investment in stocks and options can result in a loss of capital. The information presented should NOT be construed as a recommendation to buy or sell any form of security. Any buy or sell price that I may present is intended for educational and discussion purposes only. Please think of my articles as learning and thinking frameworks--they are not intended as investment advice. My articles should only be utilized as educational and informational materials to assist investors in your own due diligence process. You are expected to perform your own due diligence and take responsibility for your actions. You should consult with your own financial adviser for any financial or investment guidance, as again my writing is not investment advice and financial circumstances are individualized.