Making The Switch From Growth To Value With VBR

Vanguard's Small-Cap Value ETF is a cheap and easy way to take advantage of the current trend toward value over growth.

Although growth stocks have outperformed value stocks by nearly 70% over the last four years, the trend is finally beginning to reverse.

As M&A activity picks up, both in terms of number of transactions and the total dollar value, this ETF will benefit due to its high concentration of regional banking stocks.

At a minimum, small-cap value stocks are the best short-term play in the segment right now, while longer-term gains are possible depending on how the U.S. economy recovers in the new year.

Investment Thesis

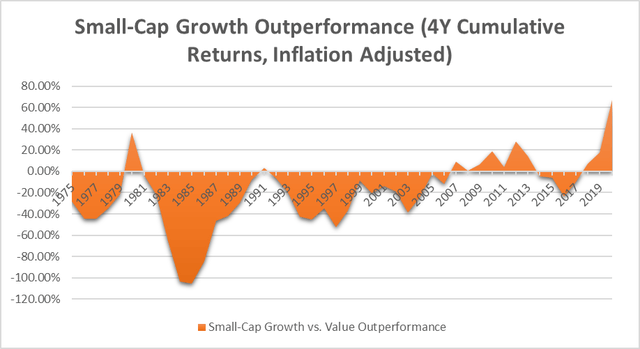

In the last 50 years, there has never been a period of time where U.S. small-cap growth stocks have outperformed small-cap value stocks more than today. Year-to-date, growth stocks have returned nearly 25%, while value stocks will be lucky to break even for the year. But that may be about to change, as small-caps have now outperformed in the last three months. As the U.S. economy recovers in 2021 and beyond, expect M&A activity to increase, which will be a boon for cheap small-cap stocks and will drive up the share price of the most popular ETF in the segment, the Vanguard Small-Cap Value ETF (VBR).

ETF Profile

VBR is advised by the Vanguard Equity Index Group and tracks the CRSP US Small Cap Value Index, which includes U.S. companies in the bottom 2%-15% of the investable market capitalization. The index is reconstituted quarterly, and CRSP uses various fundamental metrics to screen for constituents, including price-to-book and forward earnings per share.

VBR has an expense ratio of 0.07% annually, consisting of a 0.06% management fee and 0.01% for other fees such as transaction costs. Its annual portfolio turnover is 19% compared to 17% for Vanguard's Mid Cap Value ETF (VOE) and 12% for Vanguard's Value ETF (VTV). VBR's higher portfolio turnover can mostly be attributed to the unpredictable nature and poorer liquidity of small-cap stocks.

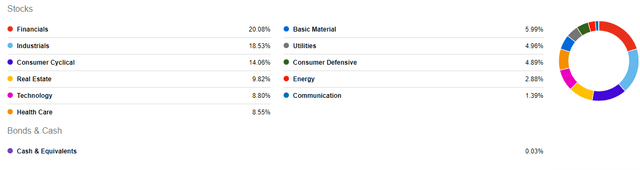

Current sector allocation is heavy on financials, industrials, and consumer cyclicals, making up over half the fund. The fund comprises about 900 securities, as shown below.

Source: Seeking Alpha

Source: Seeking Alpha

The top ten holdings (excluding cash) comprise only 5.62% of the fund, which is reflective of the large number of holdings in VBR. PerkinElmer, a diagnostics and life science research company, is the largest and has seen its operating income jump from 5.74% in 2019 to 57.12% over the last twelve months as it has benefited from the COVID-19 pandemic. Peloton is looking to become the leader in the interactive fitness market, and its content is now available on devices such as Apple TV and Amazon Fire TV. These are two examples of the types of unique companies you get exposure to by investing in small-caps.

Source: ETF.com

Other pertinent details include a dividend yield of 1.84%, a three-year dividend annual growth rate of 9.72%, and a weighted-average market cap size of $4.81 billion.

U.S. Small-Cap Value Stocks Used To Outperform

U.S. small-cap growth stocks are currently riding a four-year winning streak over small-cap value stocks, and the range of returns has gotten has pushed value stocks to rock-bottom prices, primed for a turnaround.

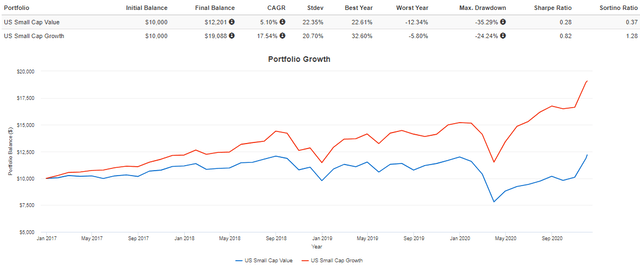

Source: Portfolio Visualizer

The total return since January 2017 has been 90.88% for small-cap growth stocks compared to just 22.01% for small-cap value stocks for a performance difference of 68.87%. This has not been seen since at least 1975. There was a brief period in the early 1980s where growth stocks materially outperformed value stocks, but that was during a period of high inflation and even more absurd annual returns. Double-digit inflation targets certainly aren't the policy of the Federal Reserve today.

Source: Created By Author Using Data From Portfolio Visualizer

Source: Created By Author Using Data From Portfolio Visualizer

The Mergers & Acquisitions Factor

The P/B ratio of VBR has been steadily decreasing since its inception date in 2007 and currently sits at 2.45 compared to 2.72 for Vanguard's Small Cap Growth ETF (VBK). As one would expect, VBR's P/B ratio is more attractive, which will be an important factor when larger companies look to acquire up-and-coming ones at more inviting prices.

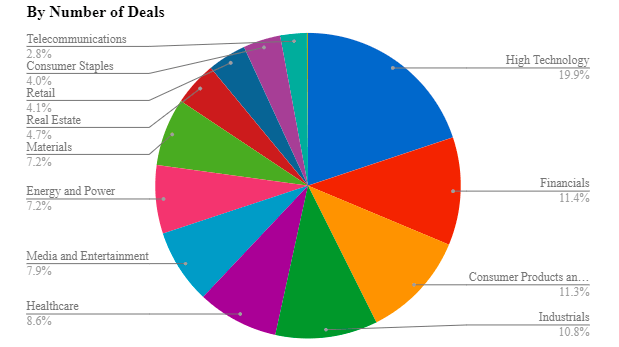

Recall that the financial and consumer cyclical sectors comprise approximately 34% of VBR. Consider this alongside data from the IMAA Institute, which shows that between 2000 and 2018, about 23% of the M&A deals made came from these two sectors as well.

Source: IMAA Institute

Source: IMAA Institute

Digging deeper, the top industry in VBR is regional banks, which make up over 8% of the fund. M&A activity among the banking sector has taken off in 2020, but the transaction values remain quite low. This reflects the uncertainty the pandemic has brought us, along with record low-interest rates that make financing these deals relatively cheap. If transaction values can rise as they did in the late 1990s and 2000s, a small-cap value ETF like VBR should benefit.

Investment Recommendation and Conclusion

I am bullish on VBR for several reasons. First, it appears as though small-cap value stocks have turned the corner and are in the process of reversing the largest four-year performance discrepancy against growth stocks in the last 50 years. Second, the P/B ratio of the ETF is more attractive at 2.45 compared to its small-cap growth counterparty, VBK, at 2.72. And finally, since the ETF is the heaviest in financials, it is well set up to benefit from increased M&A activity among the banking sector. A potential drawback is that M&A transaction values will not increase with the number of deals made, but I believe this is more than offset by the three other main reasons to own VBR. I recommend investors choose Vanguard's best-in-class small-cap value ETF to diversify by market-cap size and take advantage of the reversing trend into value instead of growth stocks.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.