Copart: A Little Rich, Waiting For A Pullback To Add

The sustainable earnings growth of Copart over the next 3-5 years is very attractive, even if the multiple is currently a little rich.

Following FY21Q1 earnings, my 50:50 DCF:FY23 EV/EBITDA multiple derived price target is $94.

A retracement to around $100 would provide a great opportunity to add stock.

I am initiating coverage of Copart (CPRT) with a Neutral rating following a healthy run in the stock post March lows. Better than expected ASPs coupled with greater availability of totalled, yet higher value cars, through the back end of CY20, has led to a slight near term over-valuation. I believe the business is a strong, long-term compounder that has the ability to consistently provide shareholders with mid-to-high double digit annual returns, nonetheless, my 50:50 DCF:FY23 EV/EBITDA multiple derived price target of $93.89, suggests a better entry point is necessary to provide a compelling IRR.

Throughout this piece, I aim to outline reasons for my rating, along with key return drivers in the business over the next 6-12 months and a longer-term investment thesis.

Introduction

Copart is a predominantly US company that operates in the salvage car auction market. Strategic investments by management over the last 5 years, however, have enabled a business pivot, fostering a more international outlook, sowing the seeds for continued and sustainable top and bottom-line growth. I view Copart as having an incredibly robust, flywheel type business model, that based on my calculations, will lead to a near doubling of sales by FY2025.

Copart and its VB3 (Virtual Bidding Third Generation) salvage car auction platform, acts somewhat like eBay (EBAY), whereby individuals, insurers and salvage car dealers, can bid for whole cars and/or parts, with Copart taking a service fee on sale prices. Higher ASP’s, along with greater demand for rebuildable vehicles and increases in total loss frequency, has meant the higher margin services revenues, that represented ~90% of FY20 sales, have grown >10% YoY despite the pandemic. In the US, CAD and 7 out of 11 other international countries they operate in, Copart predominantly acts as an agent in the facilitation of sales; thus, allowing a very capital light business model that provides consistent, mid-20s returns on capital and dependable buoyancy in the services fees generated.

Additional sales, accounting for ~10% of the business come from the Vehicle Sales segment. VS is where Copart acts as principal; acquiring cars and placing them in their nominee to then sell on their VB3 platform. This segment involves greater costs and risks and is principally prevalent in the key European markets of Germany and the UK. The German market especially, is nascent, thus, the margin profile doesn’t compare favorably to the US. Nonetheless, key structural changes, which I will discuss later, provide fertile ground for future sales growth and margin expansion that can continue to drive the stock higher.

Business Fundamentals and Metrics

The flywheel model CPRT employ, along with discernible management execution over the last few years, gives me confidence in the long-term thesis and the ability to produce mid to high double-digit earnings growth out to 2025. There is no competitor that has the scale and network affects inherent at CPRT, thus, similar to the models deployed at the successful tech companies, the marginal cost of expansion and member acquisition is becoming cheaper. To illustrate the flywheel in practice, I think it is worth highlighting management comments from the Q420 earnings call, back in September:

The flywheel model we have is such that, with an increase in total loss frequency, the auction process brings with it, better ASPs and returns for sellers. As new/ prospective members [“buyers”] on the platform see the ASPs increase, they provide a greater pool of liquidity which generates, along with higher ASPs, more sellers. Source: Copart Q420 Earnings Call

The expansion into international markets and cultivation of new members, whilst increasing scale and diversification of sales, also implicitly increases the liquidity on VB3, referenced above. I think this is a very important function of the bull case and something that, if executed correctly, can provide a sustainable runway with a sizable TAM that leads to further healthy shareholder returns.

The increasing focus and expansion in Europe gives CPRT an opportunity to significantly expand its member base and fuel US like growth out to FY25 and beyond. The emphasis and understanding of the opportunity, is evident in the continued CAPEX and investments in the region. This has been a worry for some analysts in recent quarters; thinking additional CAPEX bandwidth is going to negatively affect FCF and dilute management resources, when there is an already impressive business in the states. Nonetheless, I believe these investments are warranted if CPRT is to further entrench their position, solidify VB3 and take share.

As previously noted, there are structural differences between the US and European salvage car markets, particularly on the insurer side. In the US, CAD and UK, when a claim is made subsequent to a crash/ vehicle damage, the insurance company pays the insured party and then takes possession of the vehicle in order to sell on in the after-market, re-couping some of the pay-out costs. In EUR, primarily down to inertia and antediluvian practices, it works the other way; the insurer pays out when a claim is made, but it is down to the individual/insured party to then find a buyer for their vehicle. This fragmented approach, from a CPRT perspective, leads to lower profitability and increased risks, as more business is funneled through the Vehicle Sales segment, vs the more lucrative Service Sales segment.

Owing to the pandemic, that sense of inertia and recalcitrance on the continent, in my analysis, is slowly starting to soften. Ways of increasing profitability, especially for banks and insurers are all the more important in a low/ negative rate world, therefore, a transition to using major players like CPRT, can facilitate that pickup in growth seldom seen in European finance post 2008. The opportunity for CPRT in EUR, in my calculations, is a big as the opportunities realised in the US to date. As per a recent market data forecast, the European Auto Aftermarket stood at $256bn in 2019, but is set to rise to $369bn by 2025.

Increased penetration, investment and share gains in the region can very easily allow the ~6% auto aftermarket CAGR to flow through to CPRT sales. Convincing insurers, dealers and banks that the auto auction method is the far superior model for all parties, can then enable some very compelling operational leverage, which will of course increase profits, but also reduce the company’s cost of capital as a result of reduced risk.

Macro Dynamics and Trends

Whilst I am currently neutral on the near-term outlook for the stock, I believe some of the trends we are seeing in the macro data are transitory. Moreover, despite the softer near term macro outlook, Copart has still managed to replenish its capital stock, with cars on its platform now standing at around 191k. This replenishing of stock, primes the company for a strong CY21

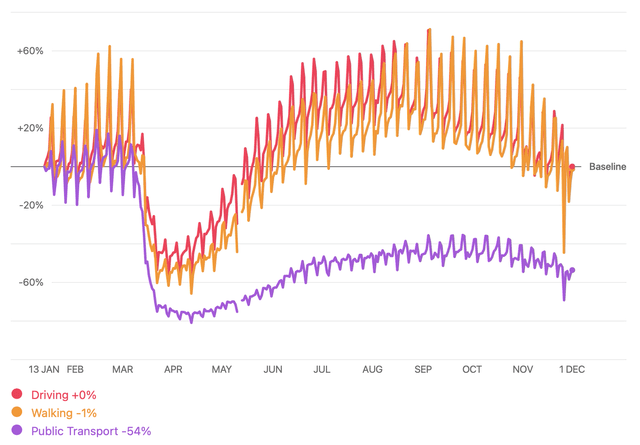

This rate of change is also what I am modelling in my forecasts for FY21 through FY23. Parsing Apple mobility data, below, it is clear to see an increased pickup in vehicle traffic from the March nadir.

As crass as the relevance of the above graphic is, an increase in driven miles and vehicle activity, has a strong correlation with vehicle inventory passing through the VB3 platform, which drives EPS.

Valuation

I have sought to derive the value of CPRT stock using both a 3 statement DCF* coupled with an FY23 EV/EBITDA multiple. The use of both, I believe, allows me to capture some of the market premium currently being placed on companies with robust, insulated long term growth, whilst still being able to keep a handle on underlying business fundamentals.

*As a caveat, CPRT heavily relies on ESOPs, thus, some methods of deriving FCFE, namely CFO-Capex, can and will incorrectly add back ESOPs. I have utilized a cleaner, more granular FCFE calculation, whereby the only non-cash charges assumed, are D&A.

Despite the plateauing of mobility trends in the US, I have modeled double digit revenue growth for CPRT through FY22 (+13.77% and +13.17%) followed by +9.83% growth in FY23. This durability stems predominantly from the increased geographic diversification of the customer base, that will become even more important should we realise a weaker $ in 2021 and a mechanical increase in TLF.

FY21 FCF has been modeled at $408mn, with the +25% YoY increase coming from a smaller cost base, following a major UK customer transitioning from a Vehicle Sales contract to a consignment, service fee contract. Moreover, further normalized traffic on VB3 in key markets will add to FCF generation trends. I estimate that D&A, which is accounted for on a straight-line basis over the useful lives of the investments ex. software, will continue to be a healthy NCC for the foreseeable future, coming in at ~4.5% of PP&E. As investments in expansion plans persist, I have modeled these NCC’s to grow in proportion with sales through my explicit forecast period.

Analysing prior fixed capital investment spend and new sites opened per year, I have forecast CAPEX to be $356mn per year. Changes in NCWC have been estimated on the assumption linear relationships to income statement items continue to hold.

Conclusion

Assessing all of the aforementioned factors outlined throughout this piece, I have discounted FY23 EBITDA and then applied a 20x multiple. Combining it with my DCF PT on a 50:50 basis, I derive a $94 PT.

I believe CPRT will continue to generate robust shareholder returns, however, based on the current valuation and premium to peers/ market vs historic averages, I consider the stock to be currently a touch overvalued. A retracement to a low 22x FY21 EBITDA multiple or around $100 would be a justifiable entry point and allow for a strong IRR.

Disclosure: I am/we are long CPRT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.