The year 2020 that started off on record highs in January is likely to sign off in style as well, with both the Sensex and the Nifty climbing crucial peaks and looking strong in the near-term.

The S&P BSE Sensex has gone past 45,000, while the Nifty50 surpassed 13,250 for the first time in the first week of December.

After recording a double-digit return in November, the benchmarks are looking strong but experts favour booking partial profits and re-entering on dips.

The market-cap-to-GDP ratio is trading above historical averages, which also suggests that investors should move with caution. The Mcap-to-GDP that was at 79 percent in FY19, dipped to 56 percent (FY20 GDP) in March 2020 and then moved higher towards 91 percent at present (FY21E GDP), above its long-term average of 75 percent.

The ratio, also known as the Warren Buffett indicator, compares the value of all stocks at an aggregate level to the value of the country's total output.

A value above 100 percent indicates that the market is overvalued, while a number close to 50 percent indicates that it is undervalued. The ratio is more applicable to developed countries and might not reflect the true picture for investors here in India, say experts.

Also read: Market Cap-To-GDP Ratio Moves Above Long Period Average; Time For Caution?

The Nifty is trading at a 12-month forward RoE of 13.4 percent, catching up with its long-term average of 13.8 pecent, Motilal Oswal said in a report.

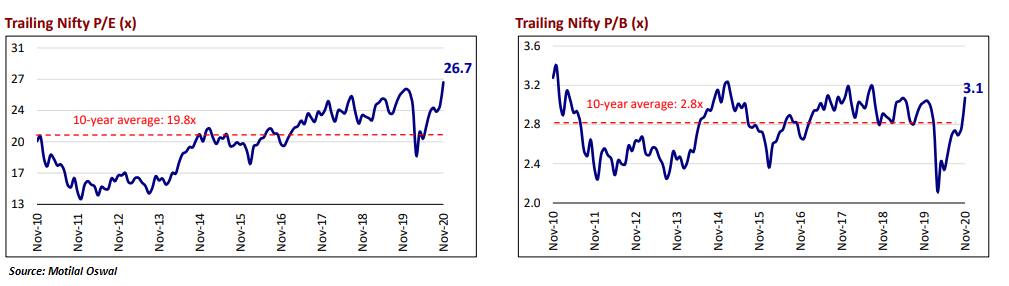

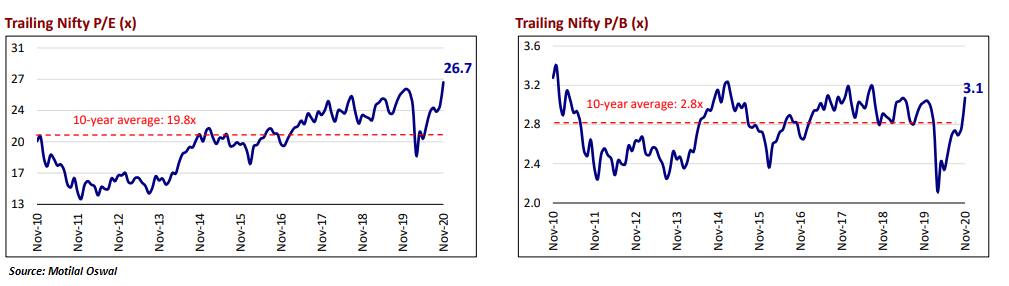

The index’s 12-month trailing P/E of 26.7x is at a 34 percent premium to its long-period average of 19.8x. At 3.1x, its 12-month trailing P/B is also above its historical average of 2.8x, it said.

Five consecutive weeks of gains suggest that some consolidation cannot be ruled out. Experts pencilled in the near-term target at around 13,500-13,600 in December as long as the Nifty holds above 12,800.

Foreign institutional investors (FIIs) that have poured in more than Rs 65000 crore in the cash market of the India equity segment have put in more than Rs 10,000 crore in December, so far. As long as the liquidity trap remains open, the momentum will continue.

“We have witnessed a V-shaped recovery and have witnessed a strong move across sectors and stocks from lower levels over the past 34 weeks. Midcaps and small caps have started to outperform the broader markets and will continue over the next few quarters,” Rajeev Srivastava, Chief Business Officer at Reliance Securities told Moneycontrol.

“But, we would advise to book partial profits to the tune of 25 percent and create some cash to buy in declines and fresh investments should be committed in SIP mode,” he said.

Here is what experts think that the investors should do at current levels:

Sacchitanand Uttekar, DVP–Technical (Equity), Tradebulls Securities

We have been vocal about expectations of some firm headwinds around the 13,590 to 13,756 zone since the beginning of Nifty's journey above 12,000. This is where we may have to re-evaluate the ongoing trend performance.

Hence, we believe that the elevated support band now rests at 12,800 and could shift rapidly higher once the final push towards 13,590-13,756 begins.

The sectoral rotation would remain key for the ongoing major up move to progress well, while the focus stays on quality and megacaps to support from the back while their midcap peers catch up on the left-out rally.

The only caution could be the global numbers of COVID-19, especially from the US and European nations that have again started to see a dramatic spike.

Expert: Umesh Mehta, Head of Research, Samco Group

After the steep decline in March, we began recovering and are now in a long-term bull market, though we are trading in the overbought zone in the short term.

We may witness profit-booking but these small and medium corrections keep on coming. Investors are advised to maintain a bullish outlook in the medium to long term and keep buying on dips. If one is already sitting on cash, then one can re-enter on dips.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

_2020091018165303jzv.jpg)