IRL: Investing In Ireland At A Discount

IRL is a CEF focused on Irish securities. While this is a country that faces some important headwinds, I see value in this play.

The fund trades at a discount to NAV in excess of 20%, which is quite substantial.

While not an income play, I view this fund for its growth potential. One of the top holdings is Flutter Entertainment, which has been a big beneficiary of the stay-at-home economy.

Management has authorized a share repurchase program, which could boost the underlying value over the next few quarters.

Main Thesis and Background

The purpose of this article is to evaluate New Ireland Fund (IRL) as an investment option at its current market price. This is a fund I have not covered before, but has come on my radar for a few reasons. One, I am looking for equity exposure outside of the U.S., due to climbing valuations. I see Ireland having a lot of potential going forward, after some notable headwinds are behind us. One, the country is heavily dependent on tourism, and I believe the country will see a boom once Covid-19 vaccines are distributed, as people worldwide are going to be anxious to travel. Two, the country is well-positioned to pull jobs and investment away from the United Kingdom, due to Brexit. The country shares a common language and many other cultural links, and Dublin's rise as a financial center makes it an ideal place to relocate jobs.

Looking at IRL specifically, the fund's current price of $10.06/share is a steep discount from the underlying NAV. This offers investors some value, in a market that is lacking it. Further, one of the fund's top positions is Flutter Entertainment (OTCPK:PDYPF), which is an online gaming company. This is a stock I own and have done quite well with, and believe it will benefit going forward as the world accelerates its shift to e-commerce. Finally, management of IRL has authorized a share repurchase program through 2021. Investors who get in now could front-run some of this buying activity.

Why Am I Looking Outside The US?

To begin, I want to briefly touch on the primary reason why IRL has recently entered my radar. As my readers know, I am partial towards U.S.-focused funds, whether it is in the debt or equity markets. I tend to stay close to home with my investments, although I do occasionally branch out in the other developed markets, namely in Europe and Australia. While my European exposure in the past has primarily centered on the United Kingdom, that jurisdiction has been fraught with challenges stemming from Brexit over the past few years. However, Britain's neighbor to the West, Ireland, also faces some complications from Brexit, but opportunities as well.

With this in mind, Ireland has become an area of focus for me, but it is important to understand this exposure would come at the expense of compounding on my U.S. positions. The rationale behind this simply has to do with the price to buy into U.S. markets right now - in both equities and fixed-income. Despite a challenging economic environment, U.S. equities continue to hit new records on almost a weekly basis it seems. This makes buying in now quite an expensive proposition and, in my opinion, does not accurately reflect the inherent risks in the market at the moment.

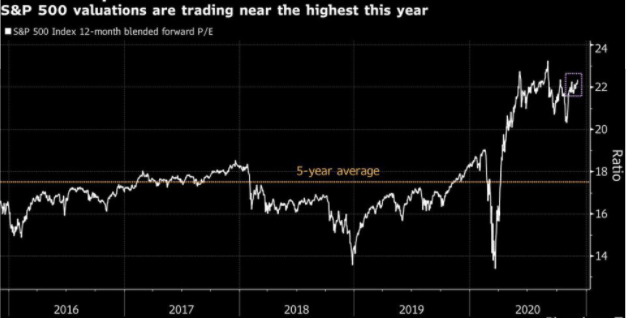

Understanding my logic here is not overly complicated. New Covid-19 cases are surging, millions remain out of work, and the labor force has been shrinking. Yet, stocks are rallying hard, and this rally is not being driven by corporate earnings (if they were, I wouldn't be concerned). For support to this thesis, consider that the S&P forward P/E ratio is near its five-year high:

Source: Yahoo Finance

My point here is simply that I have gotten quite cautious on broad U.S. equities. The market continues to get more disconnected from economic reality, and incredibly reliant on potential stimulus from Congress. While the market's momentum has me reluctant to sell my current long positions, I am likewise reluctant to add new money at this time. As a result, I have to be a selective buyer elsewhere, and IRL has potential to fill this void.

Isn't IRL Expensive Too? Despite The Rally, It's Not

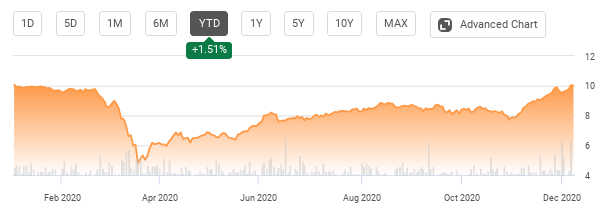

I will now focus on what I like about IRL specifically, aside from the fact it is a non-US equity fund. First, I want to highlight an important consideration, which is valuation. As I noted above, domestic stocks seem quite pricey, but investors would be wise to question the current price for IRL as well. Despite falling hard in the Q1 sell-off, IRL has also surpassed its pre-crisis high. In fact, the fund has edged out a positive gain year-to-date, as shown below:

Source: Seeking Alpha

Considering this, investors may be concerned they are overpaying for IRL as well, and not truly getting much value by moving outside U.S. shores.

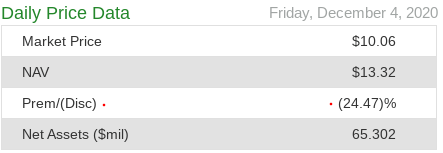

While a fair point, given how low IRL has proved it can trade this calendar year, I am a bit more optimistic on its forward outlook. Yes, the fund sits near a 52-week high, but its underlying value has been holding up extremely well, to the point where its market price actually is quite reasonable. To understand why, consider that IRL's current price, despite being at a high for the calendar year, actually sits at a substantial discount to its NAV, as shown below:

Source: New Ireland Fund

The takeaway here should be apparent. The market price for IRL offers investors a value, given the sheer size of the discount. Of course, this does not guarantee a positive return. The discount could stay in place, or even widen. But I will discuss in the following paragraphs why I believe it will narrow in the months ahead, and see this current valuation as an attractive buy opportunity.

Share Repurchase Program Is A Tailwind

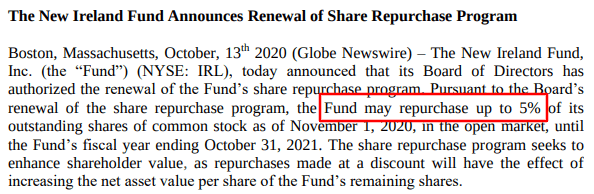

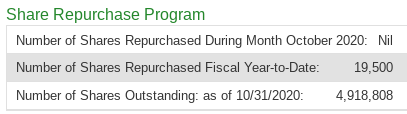

A key point behind my buy thesis is that I believe IRL's discount will narrow in the future. Ultimately, this is very dependent on the state of the Irish economy. However, there is another development that will help narrow IRL's discount, even if the global economy does not rebound as quickly as we would like in 2021. This development is a share repurchase program, which was announced in the middle of October. Specifically, the fund may see repurchasing activity of up to 5% of outstanding shares, as detailed below:

Source: New Ireland Fund Press Release

I view this positively for three reasons. One, it shows management has confidence in the underlying assets in the fund, as it is willing to buy up shares it feels are undervalued. Two, it should improve the NAV of the fund, as cash is going to be used to buy up shares at a discount. Thus, the assets will be purchased for less than they are worth. Three, the program is just getting started, allowing investors to front-run this demand.

In fairness, the program has already begun, as the announcement indicated it would begin on November 1st. However, 5% of total shares outstanding represents roughly 245,000 shares. At present, only 19,500 shares have been repurchased, according to fund data:

Source: New Ireland Fund

My conclusion here is this provides some consistent buying momentum for the fund over the next few quarters. Management may not ultimately purchase 5% of outstanding shares, but it has the potential to, and it has already gotten the program underway in the short term. I view announcements like this very favorably, especially in cases like IRL's where a CEF has a steep discount on the open market. Therefore, I believe getting in ahead of more buying activity should prove to be a profitable play for retail investors.

I Like The Potential For The Top Holdings

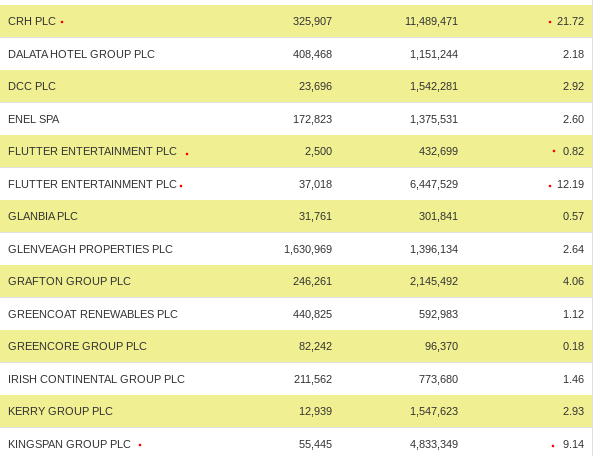

My final thoughts will center on the actual holdings of the fund, with specific attention to the largest by weighting. The outlook on a few select stocks is important when considering IRL because, despite the fund having 36 holdings all together, its performance predominately depends on three key companies. These are CRH plc (CRH), PDYPF, and Kingspan Group plc (OTC:KGSPF), which account for roughly 44% of total fund assets, as shown below:

Source: New Ireland Fund

I see opportunity in these assets, and I will take each in turn.

Starting with PDYPF, which is a stock I own, I believe this exposure is excellent for the fund. One, this stock has been on a roll this year, and has actually benefited from the pandemic, since the return of professional sports. As an online betting/gaming company, PDYPF offers global consumers the ability to wager on classic casino games, poker, and, most importantly, sports. With millions locked down and unable to travel, online gaming has helped fill a void for those used to going to casinos. Further, the sector has been able to grow over the course of the pandemic, capturing new customers who are looking for outlets as they ride out the crisis.

Looking ahead, I continue to like the company, although I will admit the stock is richly priced here. But its inclusion in IRL is generally a positive in my view. Further, the company has major market share in the United Kingdom, Italy, and Australia, as well as a growing presence in America. This means it is not a traditional "Irish" play, and helps diversify the fund's exposure away from the island. Furthermore, the U.S. market is helping to drive the growth right now, as a number of states just authorized sports wagering in their November elections. I highlight some recent examples in the following chart:

| State | Development | Source: |

| Tennessee | Legalized online sports betting on November 1st. Flutter's US sportsbook, branded FanDuel, is already accepting wagers. | WYCB News |

| Michigan | The Joint Committee on Administrative Rules waived the 15 session-day waiting period to approve final online gaming rules. All operators and platform providers, such as FanDuel, still must earn final licensing approval, which can now happen. | South Bend Tribune |

| Colorado | Sports betting was legalized on May 1st, and the results have been impressive. Sports wagering during October set a record for the sixth consecutive month, at over $100 million. According to estimates, the two biggest beneficiaries are DraftKings Inc. (DKNG) and FanDuel, generating 84% of Colorado's sports wagering revenue since betting was legalized. DKNG has 46% of the market, while FanDuel has 38%. | The Gazette |

My thought here is this is a pandemic and a post-pandemic play, as the stock is set up to benefit from how the world is fundamentally changing from Covid-19. Online gaming companies are set to grab more and more market share from brick-and-mortar casinos, and the pandemic has driven an environment that is conducive to this outlook. One, the stay-at-home mentality is drawing in new customers. Two, cash-strapped states are looking for ways to raise new revenue. Three, voters are clearly on-board, as multiple ballot measures passed last month. Four, as more consumers get comfortable betting online in this environment, this will drive a permanent shift in how Americans wager.

While PDYPF is not the only way to capitalize on this trend, I see its inclusion in IRL as an immense positive.

Irish Economy Shows Signs Of Life

Looking beyond the online gaming industry, I will conclude with a look at the state of the broader Irish economy. This is important because the other two main players in IRL are in the construction and building sectors. Specifically, KGSPY, is a building materials company based in Ireland and CRH is in the building materials business, manufacturing and supplying a wide range of products for the construction industry.

On this point, I must manage expectations. Ireland has been hit hard from the pandemic, and faces multiple headwinds going forward. With lockdowns still in effect, Brexit negotiations ongoing that could impact trade between the border, and global tourism shattered, Ireland certainly has its challenges. Therefore, there is a reason why IRL trades at a discount, and I would be remiss if I did not stress the difficult economic climate the country currently faces. With top holdings like CRH and KGSPY exposed to the construction industry, IRL will struggle if economic activity does not return soon.

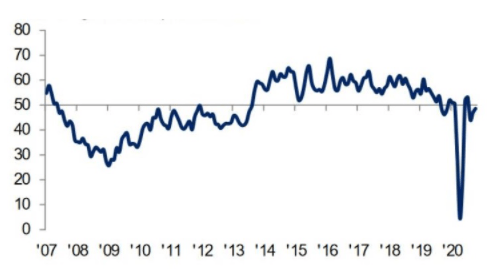

On this point, there is some welcome news in the short term. The Ulster Bank Construction Purchasing Managers’ Index, which measures construction activity and sentiment in Ireland, hit a reading of 48.6 in October, up from 47.0 in September, indicating a rise for the second month in a row. The downside is a reading below 50 indicates contraction, but the point is the figure is moving in the right direction. Importantly, it has recovered sharply from the lows we saw earlier in the year, as illustrated below:

Source: The Construction Index

Furthermore, according to consultancy firm Linesight, recent data shows only 10,023 construction workers remain on Pandemic Unemployment Payments, which is substantially down from 52,118 in May.

My takeaway here is not to say that things are great in Ireland. On the contrary, the country faces enormous challenges. However, I see the tide turning, and IRL offers investors a very cheap way to get exposure to the country before things return to normal.

Bottom-line

For those looking for exposure abroad, I believe IRL has some merit. The fund has a huge discount to NAV, a diverse array of holdings, and will benefit from a share repurchase program that is currently underway. As I remain concerned over the price of U.S. equities, I see value across the pond. Therefore, I am likely to initiate a position in IRL, and I would recommend investors give this fund some consideration at this time.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

Disclosure: I am/we are long PDYPF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I may initiate a long position in IRL over the next 72 hours