Stating the obvious, 2020 has been a hard year for many companies - the REITs are no exception.

As a result, there has been a rotation away from some of the growthier REIT names and (like the market overall) a rotation into value names.

Data centers don’t exactly check that value box (But should they? More on that later…).

Scroll down to see what we are buying.

Coproduced With Jennifer Fritzsche

As you may know, I'm in the process of writing a new book, The Intelligent REIT Investor (second edition). The book is divided into sixteen chapters and one of the chapters is on the "technology REITs."

Recognizing that cell towers and data centers require more specialization than the traditional property sector (apartments, industrial, retail, etc...), I asked my friend Jennifer Fritzsche to help me.

Jennifer was previously at Wells Fargo (NYSE:WFC) for 25 years and her latest position was as Managing Director of Equity Research where she led an award-winning research team as Senior Analyst covering the Telecommunications Services , Cable, Data Centers and Tower sectors.

Jennifer will be regularly contributing for iREIT and I am thrilled for the opportunity to work with her on guest articles and my new book.

There is an expression that “trees don’t grow to the sky.” This is true... but for the data centers – our message is simple: this tree still has a lot more growing to do before the blue sky is reached!

In the simplest form – think of data centers as physical home for the internet.

These stocks had a strong start to the year – as it was one of the few sectors in REIT land where COVID was more of a tailwind than wind (directly) in the face.

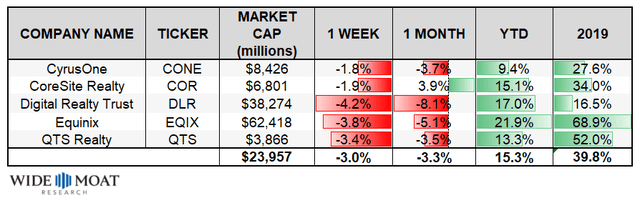

However, recently we have seen a pullback in the stocks – which we believe presents a tremendous buying opportunity. Specifically, despite being the top performer in the REIT group YTD (+23%), the data center sector has seen a ~4.0% decline during the past 30 days.

In the discussion to follow, we discuss why the stocks have been weak as well as 5 reasons why the sector should be a key pillar of any REIT portfolio.

Drivers to Recent Weakness

Stating the obvious, 2020 has been a hard year for many companies - the REITs are no exception.

The Vanguard Real Estate ETF (VNQ) is down 6.8% YTD. However, in recent months, we have seen some institutional investors come in and go down their bargain basement buying list for some of these left for dead REITs.

As a result, there has been a rotation away from some of the growthier REIT names and (like the market overall) a rotation into value names. Data centers don’t exactly check that value box (But should they? More on that later…).

Another driver of the sector’s underperformance has been concern about decelerating rates of growth. The cloud segment (aka “hyperscalers”) is a meaningful customer for the data center REIT group.

Cloud demand tends to be somewhat “lumpy” by nature. It is not atypical to see one year of extremely strong hyperscale demand followed by a slower year – as these cloud companies “digest” the space they have taken down.

Even in ‘normal times’ based on the softness seen from this segment in 2019, 2020 likely would have been an ‘up’ year. But once you mix in the tremendous increase in network demand and traffic in the wake of the COVID-19 pandemic, the cloud players went into “hyper” drive – and the data center segment was the clear beneficiary.

Across the top 10 U.S. markets, leasing from this segment is expected to be in the range of 600 MWs for the first 9 months of 2020 alone. To put this in perspective, this level is ~30-40% over the previous record seen in the full year of 2018!

Given how robust 2020 has been, there is concern that this customer segment will see deceleration in 2021 - not a trend investors like.

While we understand these concerns, we believe investors are missing the overall picture.

Put another way, exiting this sector now is like looking at the tree – without looking at the wide forest growing around it! Why do we say this?

Consider these 5 factors:

Reason #1: Enterprise Coming On Strong

As mentioned, most of the growth in 2020 has come from robust demand from the cloud sector. However, what seems to be hiding in plain sight is the growing demand from the enterprise sector.

In Q3’20, Digital Realty (DLR) and Equinix (EQIX) had very strong Q3 with enterprise demand. DLR had a record new logo addition (130+) in the third quarter alone.

EQIX also spoke to seeing a “diverse funnel” of enterprise deals in Q3 and QTS and CONE made similar comments. Not surprisingly, the COVID pandemic is forcing enterprises to reconsider their IT infrastructure and spending and (like so many other industries today) consider a “digital pivot.”

As a result, we expect the demand from enterprise to continue to build over the coming years as the concept of the “hybrid cloud” is embraced. Think of the hybrid cloud as a combination of both a public cloud solution (on the likes of AWS (NASDAQ:AMZN), Azure (NASDAQ:MSFT), Google (NASDAQ:GOOG) (NASDAQ:GOOGL), etc.) and a private cloud (enterprise owned) facility.

Importantly, enterprise yields and returns are higher than hyperscale yields. Therefore, as enterprise becomes a more meaningful customer segment – it would be accretive to overall yield mix.

Reason #2: Cloud Party Is Getting Bigger – Not Smaller

While we acknowledge that the bar is set very high for comps for US cloud bookings in 2020, it is worth mentioning that the number of hyperscale players has been increasing not shrinking. In 2018 (the last year of cloud strength) – most of the US bookings were driven by Microsoft and Facebook.

Today that growth is much more diversified – coming from 5-10 customers (i.e. Apple (NASDAQ:AAPL), Oracle (NYSE:ORCL), Google, ByteDance (BDNCE) to name a few). Like anything, more customer diversification (and less concentration) is a good thing not bad.

Reason #3: Global Growth Still in Early Innings

The cloud game is getting much more international. Cloud companies have announced expansion of availability zones in key international markets – including much of Europe, Asia, India, LatAm and Canada.

Like we have seen in the US, these hyperscalers are open to leasing space with third-party data center owners vs. building them themselves.

We continue to favor those data centers who have more of a global footprint to capture much of this growth. These include – Equinix, Digital Realty and CyrusOne (CONE).

In the most recent quarter, DLR’s newly acquired European portfolio (driven by the acquisition of InterXion) was the strongest contributor to overall Q3 bookings.

As further evidence of the benefit of global reach – 61% of EQIX’s customers operate in each of their 3 geographic regions (Americas, EMEA and Asia-Pacific). We would expect 2021 and beyond to show accelerating growth trends for many of these international markets.

Reason #4 Consistent Dividend Growth Stories

Data Centers continue to show consistent and steady dividend growth.

The average dividend yield of 2.93% for the public data center REITs. This compares to the total REIT sector’s average yield of 3.7%.

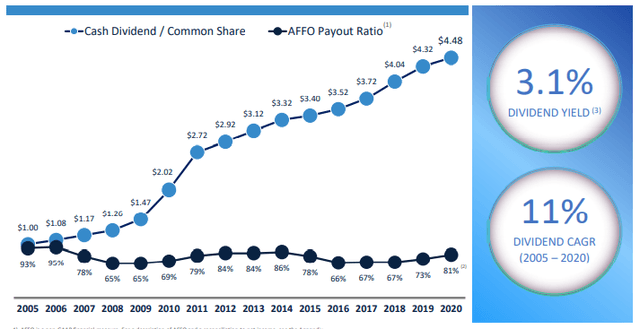

Importantly, however, unlike many of the REIT peers, we believe the data centers have more tangible catalysts to drive this dividend growth than many of their other REIT peers. DLR is perhaps the best example of this dividend consistency.

It has raised its dividend for 14 consecutive years. During this period, DLR’s dividend has seen an 11% CAGR. EQIX’s has increased their dividend 8% each of the last two years.

While capital needs of these companies continue to be high given increasing development and expansion, we believe high single-digit to low double-digit dividend increases are achievable.

Driving this are the low payout ratios (note: EQIX payout ratio is in low 40% range), low interest rate environment, and expanding EBITDA margins (EQIX’s longer term margin goal is ~ 50%). Each of these drivers contributes to higher AFFO – the cash flow from which the dividend is paid.

Reason #5: Data Tsunami - Still Yet to Come Is Significant Tailwind

Last, and perhaps most importantly, is there are still many catalysts still to play out that will be significant drivers to growth longer term. While COVID has been a tremendous tailwind – it seems to have overshadowed all the other tailwinds which we were all focused on pre-pandemic.

These include (but are not limited to) IoT, 5G, and Artificial Intelligence (AI) and the impact they will have on the data center models. Each of these categories will drive more data (some say a “tsunami” in terms of size).

The number of internet-connected devices, autonomous vehicles/augmented reality devices, are expected to grow exponentially over the next few years. These, in addition to the rollout of 5G technology, will dramatically increase the volume of traffic on networks. But this data cannot be supported without a tremendous lift in supporting the infrastructure behind it. Data centers will play a key role here.

Each of these initiatives will require more “edge” deployment. The edge is quickly transitioning from being just a ‘white board’ idea to a tangible infrastructure concept.

This will drive additional buildout of data center buildings in new markets with smaller sized deployments within the data centers themselves. These edge deployment sizes are in the range of 250KW–1 MW. While smaller than the typical bookings seen today, the yields on these projects are higher than the “typical” hyperscale project.

Checks indicate both AWS and Microsoft are expected to be extremely aggressive with these edge rollouts in 2021 and beyond. In order to support the low latency needs of 5G and IoT more edge infrastructure will be critical.

We view this edge as a new source of growth for the data centers. Some of the larger players (namely EQIX and DLR) have already put their toe in the edge water through partnerships or smaller acquisitions. We expect this only to build in 2021 and beyond, adding just more layers to the (already quite thick) moats around these businesses.

Opportunity

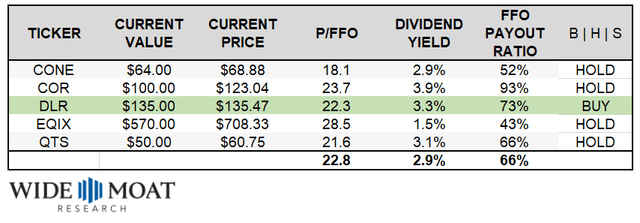

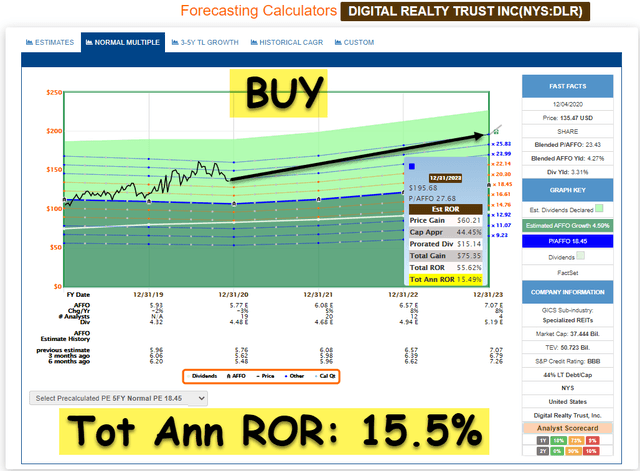

On a valuation basis, data centers are typically measured as a multiple of AFFO. At current levels, the group is trading at 23.0x 2021E AFFOs. This represents a 400-bps discount to highs seen earlier this year (27x P/AFFO).

While this represents a premium to the average of 20x AFFO level, we note that we estimate the data centers to realize roughly 7% to 10% growth in AFFO - well ahead of the REIT average of 3%. In REIT-land it is hard to find stories with as many catalysts. A few days ago we wrote an iREIT on Alpha article in which we explained,

“DLR's 3.28% dividend yield is the highest and it has the longest dividend growth streak (DLR's annual dividend increase streak currently sits at 16 years, CONE's currently sits at 8 years, and EQIX's currently sits at 6 years).

What's more, DLR made big news in late 2019 with its acquisition of Interxion, which was completed in March of 2020. This move adds interesting growth prospects to the DLR thesis, which makes it a compelling stock to consider here, down 14.5% from its recent 52-week high.”

At market close Friday, DLR hit our Fair Value (Buy Below) price of $135.00 so we decided to pull the trigger. More so, we just finished our year-end portfolio rotation for the Durable Income Portfolio, which means we had some dry powder to put back to work.

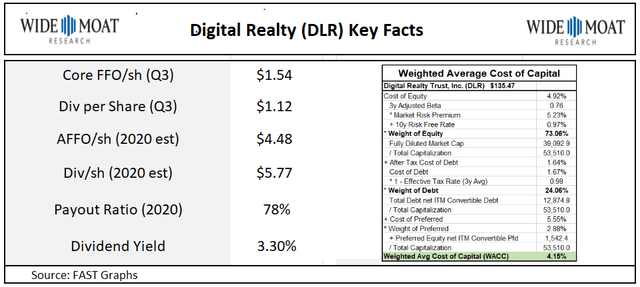

Wide Moat Research/FAST Graphs

As illustrated above, DLR has an impressive WACC (weighted average cost of capital) of 4.15% and this means the company is well-positioned to grow earnings (AFFP/sh) and the dividend. As illustrated below, DLR has an impressive dividend growth history:

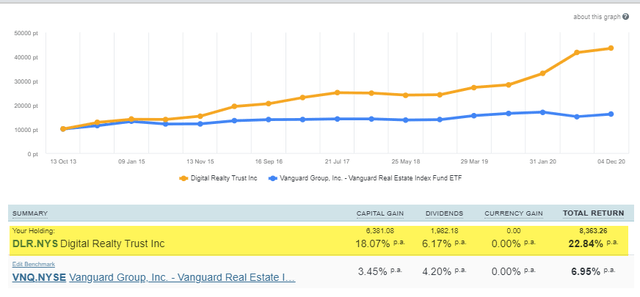

Since 2013, we have accumulated shares in DLR, and as evidenced below, we have benefitted exceptionally well utilizing the “margin of safety” concept – shares have returned an average of 22.8% annually since 2013.

Sharesight

Thus, given the recognizable catalysts (5 referenced above) and current valuation, we are compelled to increase exposure. We recently bought another $5,000 for the Durable Income Portfolio (total dollars invested now $22,878).

FAST Graphs

Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.

The One-Stop Shop For "Everything Income"

We recently added BDC coverage to iREIT on Alpha to complement our broader coverage spectrum that includes equity REITs, mREITs, preferreds, bonds, ETFs, and MLPs. In addition, we added Canadian REIT coverage last week and we just brought on a global analyst. We have ALL of the bases covered...

Join iREIT NOW and get 10% off and get Brad's book for FREE!

* Listen to our Ground Up Podcast * 2-week free trial * free REIT book *

Disclosure: I am/we are long CONE, QTS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.