The Life Insurance Corporation of India (LIC), the biggest domestic institutional investor which is also planning an initial public offering, made a lot of changes in its portfolio in the September quarter this year.

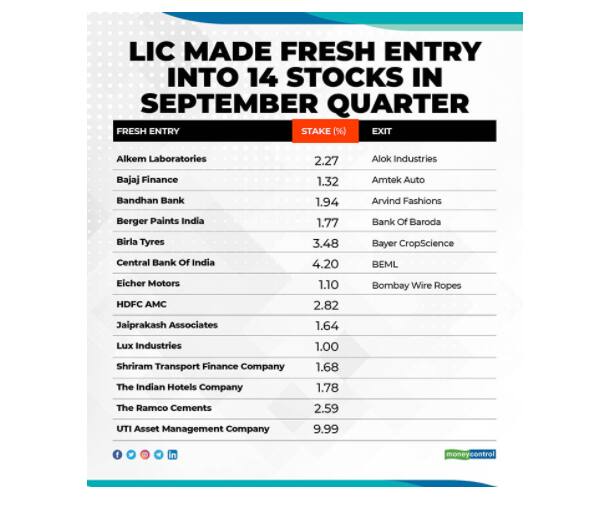

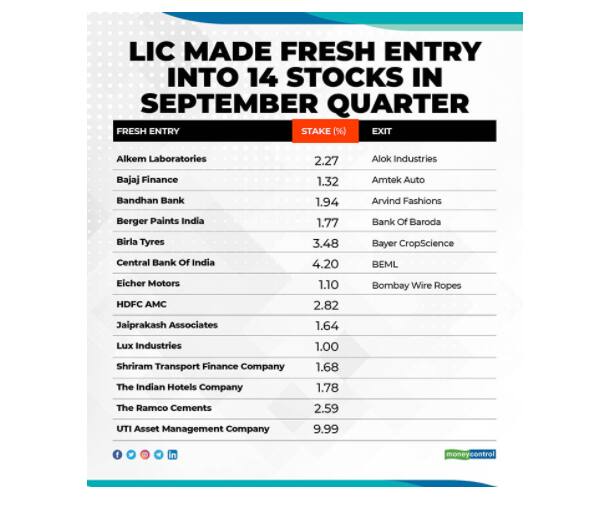

During the quarter gone by, LIC made fresh entry into 14 stocks—Alkem Laboratories, Bajaj Finance, Bandhan Bank, Berger Paints, Birla Tyres, Central Bank Of India, Eicher Motors, HDFC Asset Management Company, Jaiprakash Associates, Lux Industries, Shriram Transport Finance Company, Indian Hotels Company, Ramco Cements and UTI AMC.

"Being the long-term investor, LIC today stands as the largest domestic institutional investor, which is in the mood of IPO preparations and hence it is trimming and reshuffling portfolio stocks by exiting out from low-market capitalisation and invests in quality largecaps, fundamentally strong firms ahead of its planned initial public offering," Prashanth Tapse, AVP Research at Mehta Equities told Moneycontrol.

The 14 stocks have provided a return in the range of 13-605 percent year-to-date (FY21). Birla Tyres was the biggest gainer among, with 605 percent rally followed by Jaiprakash Associates (281 percent return on a very low base) and Bajaj Finance (120 percent).

Of these, LIC acquired a 10 percent stake in UTI AMC through its IPO launched at the end of September. In the rest of stocks, LIC held 1-4.2 percent shareholding.

On the other hand, it exited Alok Industries, Amtek Auto, Arvind Fashions, Bank of Baroda, Bayer CropScience, BEML and Bombay Wire Ropes.

Apart from this, LIC increased stake in 68 companies during the quarter. It includes Amara Raja Batteries, Ashok Leyland, Bajaj Auto, Bata India, Bharat Dynamics, Bharat Forge, Bharti Airtel, Bharti Infratel, Coal India, Colgate-Palmolive, Engineers India, Exide Industries, GAIL (India), Glenmark Pharmaceuticals, Havells India and Sun Pharma.

The data show that LIC increased stake in a majority of largecaps and midcaps during the quarter. Most of these stocks have not fully participated in the run seen from March lows.

The benchmark indices gained 9 percent during the quarter and more than 45 percent from March 23's low. The benchmarks have surged 72 percent from March lows.

Initally, IT and pharma, which didn't see a big impact of lockdown, led the rally but after the September quarter, there has been a major shift, as banking & financials, infrastructure, metals and auto stocks also participated in the run. Overall, broader markets outperformed benchmark indices as the Nifty Midcap index gained 82 percent and smallcap jumped 97 percent from March 23 low.

"The LIC core investment team is building up investment rationale behind LIC's forthcoming IPO as teh quality of assets and investments matter a lot for valuating insurance companies and valuation can be concluded on the basis of market capitalisation as a percentage of the asset under management," Tapse said.

LIC reduced stake in 68 stocks and most of them are midcap and smallcap categories, including ABB Power, ACC, Aditya Birla Capital, Apollo Hospitals Enterprise, Asian Paints, Bank Of India, Bank Of Maharashtra, Century Textiles, Cipla, CRISIL, Dabur India, Dr Reddy's Laboratories, GTL Infrastructure, Gujarat State Petronet, HPCL, Indian Overseas Bank, Infosys, M&M, Maruti Suzuki, MSTC, Oriental Carbon & Chemicals, Spencers Retail and Tamil Nadu Newsprint & Papers.

Another thing to note in the above list is that LIC cut stake in PSU banks and healthcare stocks. Pharma had a strong run-up from March lows following the COVID-19 outbreak, in the case the PSU banks, the decision may have been driven by asset quality concerns.

"LIC has no dearth of funds and therefore could make good amount of money in this fiscal, showing a growth of 30.37 percent (April-September). It has exploited the opportunity in the markets by making considerable value investments, thereby raking in profits," Gaurav Garg, Head of Research at CapitalVia Global Research said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

_2020091018165303jzv.jpg)