RQI: Solid Fund For Your REIT Exposure

The recent Semi-Annual Report can give confidence that things are status quo for the fund.

While the fund took a hit during March, along with the rest of the market, the fortunate timing of their rights offering appears to have offset negatives.

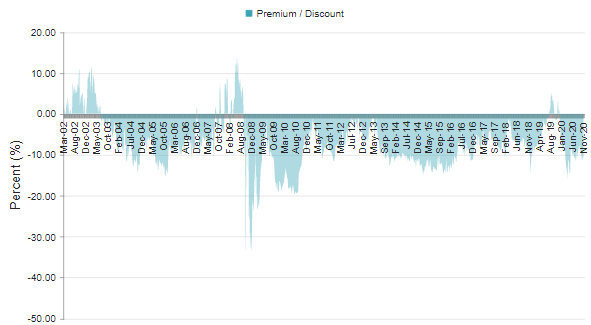

RQI is giving investors a great entry price with a large discount as the economy recovers.

Written by Nick Ackerman, co-produced by Stanford Chemist

Cohen & Steers Quality Income Realty Fund, Inc (RQI) had finished off its rights offering early in the year. They also recently released their Semi-Annual Report showing that they wasted no time putting these assets to work. This is evidenced by showing very little cash at the end of June. Fortunately for the managers there, they were given an incredible opportunity with March's sell-off to take advantage of deeply discounted investments.

(Source)

The rights offering was a bit of a surprise for many Cohen & Steers investors, myself included. They don't have a history of rights offerings. In fact, this was the only one that I could find on RQI itself. As some of you may remember, the rights offering wasn't as successful as the fund would have hoped. This occurred as the discount widened to the floor level that they put in place. Though it hadn't breached it and investors saw shares bought at a subscription price of $14.12 per share. At the same time, the share price was $14.30 on the expiration date.

No one could have really known the full impact of what was about to come just a few weeks later. On February 19th, the broader indexes peaked and began a violent descent lower. In hindsight, investors were given an opportunity to pick up shares at less than half of that price.

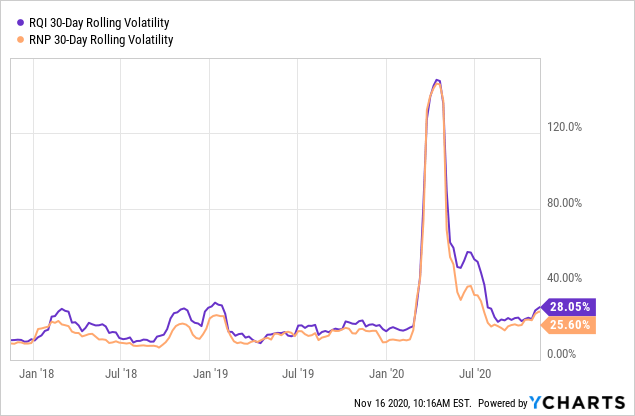

For the Income Lab, we have held RQI and the other REIT fund offered by Cohen & Steers, the Cohen & Steers REIT & Preferred Income Fund (RNP). With RNP, investors have a higher allocation to preferred and RQI is mostly equity - though they have a small allocation to preferreds themselves.

At this moment, we hold both RQI and RNP in our portfolio. This came to be in October when Stanford Chemist sent out a Trade Alert for members. This opportunity presented itself as October presented its own bit of volatility. Though nothing that we witnessed in March. However, an opportunity nonetheless. It was a chance to trim some RNP in favor of RQI due to their discounts widening.

The primary reason for holding on to both positions is that RNP was a rather large position in our Income Generator portfolio in the first place. Also, they are both quite solid funds and offer some greater diversification with a combined position anyway.

The fund last reported that RQI has total managed assets of $2.1 billion. In November alone this number has been driven up quite a bit higher to almost $2.3 billion. C&S didn't report since the end of October, however. Which makes this fund quite a sizeable fund. That RO from earlier in the year also certainly helped as they did mount losses throughout the year. This ultimately put them at about the same level of assets they were on December 31st, 2019.

RQI using leverage does mean that an investor does need to lean as being more of an aggressive investor. The upside is increased, but so is the downside. One interesting point is that even while net assets ultimately stayed flat from December 2019 to the last reported June 2020 - leverage increased. Meaning that they did increase their leverage ratio to 26.37%. They had borrowings of $460 million and this increased to $560 million. At a time when other funds were deleveraging, they were increasing. This ultimately would have proved to be the better outcome as we have seen a slow recovery in the REIT space.

Performance - Long-Term Winner

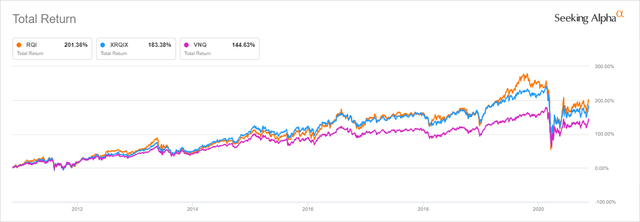

On a YTD basis, RQI is certainly nothing to write home about. This is especially true as we cover a wider variety of funds and you can pick any tech or healthcare fund that has performed much better. However, as a diversified investor over the long term, one has done well with RQI.

Using the Vanguard Real Estate Index Fund ETF (VNQ) as a bit of a benchmark over the last 10 years. We do see that RQI on both a total return price and NAV basis has outperformed. However, that is something else I addressed in my previous coverage of RQI. One could cherry-pick any dates to drive their thesis - I prefer to view these two as completely separate. An investor buying into VNQ and one buying into RQI are likely going to have different reasons for doing so. VNQ you are looking at growth and income - RQI you are more so looking at just the income.

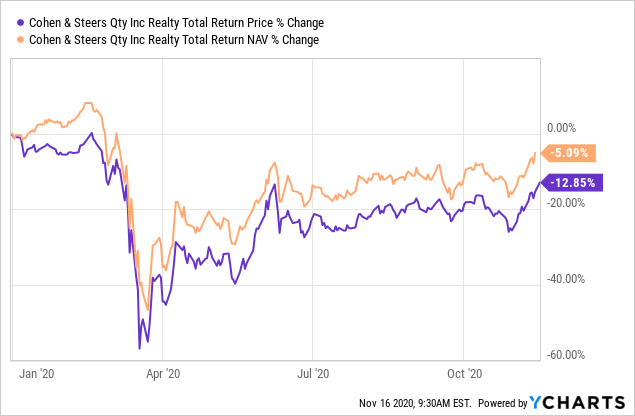

Even on a YTD total-return basis, we are certainly much better off than we previously were in the depths.

The recent optimism is now on the fact that vaccines are starting to show that they are effective. Additionally, now that the U.S. presidential election is mostly out of the way - we have some certainty on that front.

As I've advocated throughout most of this year and in our previous coverage, RQI was and is relatively sheltered from the most volatile REIT sectors. This has to do with their holdings being tied more to the growth area of the market. However, investors didn't care as they sold off assets relentlessly and without question.

The discount has contracted over the last month to 4.76%. At the same time, its 1-year average is 8.48% and 5-year average 7.31%. Not to say it hasn't traded at steep discounts for years previously. Though now is still an interesting time to be looking at REIT exposure.

(Source - CEFConnect)

Distribution - A Healthy 7.87% Yield

Currently, RQI pays shareholders a distribution yield of 7.87%. On the surface that is quite attractive. It is even better when we see that the NAV yield is 7.49%. While that is a bit elevated still after the drop earlier this year - it isn't in the danger zone, I don't believe.

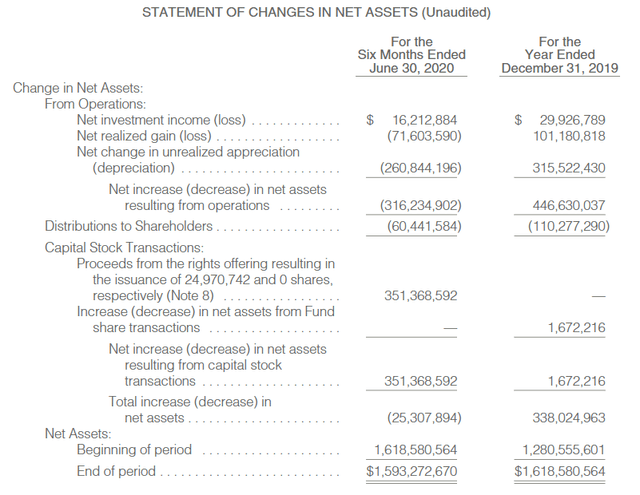

In fact, with the latest numbers thanks to the RO earlier this year - it looks like coverage has basically stayed around the same. Since it is a 6-month report for the period ending June 30th, 2020 - we still have some months reflected that are prior to the increase in assets. However, it still gives us some great insight into what the composition looked like after too.

(Source - Semi-Annual Report)

What we can see is that net investment coverage for the fund was around 27% for all of last year. This year, we only see a slight decline to around 26.5%. That gives us a good barometer on where things can go from here.

In this report, they had very little cash meaning that they put the assets to work promptly. It worked out in having a slight increase in NII if we annualized the 6-month figure. However, this also shows the equivalent impact of how much more the fund will be paying out for the distribution too. So, it is a reliable number and positive in that it is little changed from the previous coverage.

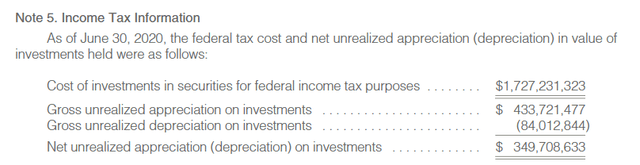

RQI has for years leaned into more growth-oriented REIT investments. So, the low NII coverage might be concerning to some regardless. To help buffer the need for a distribution cut, the fund is sitting on some unrealized appreciation as well. At the end of June, this was around $350 million. Of course, assets have grown since that time too. Being even higher now provides me with greater confidence that the current distribution is sustainable.

(Source - Semi-Annual Report)

Holdings - Resilient 'Growthier' Names

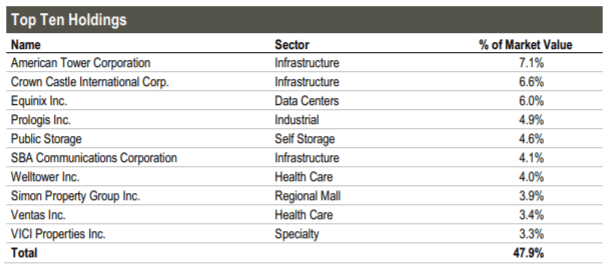

From the last time we covered RQI, the top ten holdings haven't changed all that much. It is still littered with high-quality names, which is exactly what we want to see.

(Source - Fact Sheet)

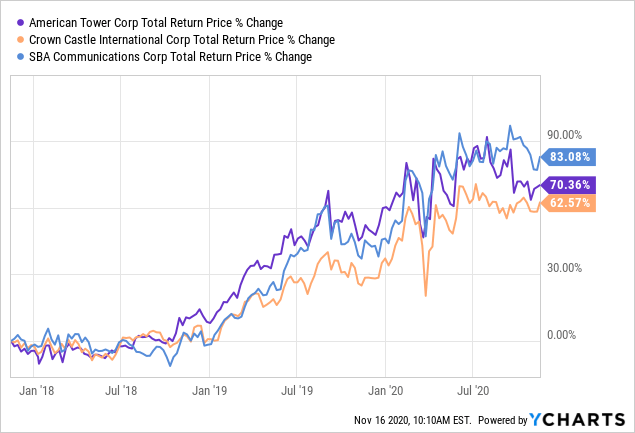

American Tower Corporation (AMT) remains in the top position. However, the allocation did decrease from 10.5% to the latest 7.1%. This wasn't from a large reduction in the percentage allocated to the top ten. As we can see - the top ten represents 47.9% of the portfolio. Previously this was still a high 48.2%. Meaning that the portfolio is rather concentrated in the top half. This has worked out and should continue to do so when you own some of the best.

Another small change is that Crown Castle International Corporation (CCI) has moved up from the fourth largest position to the second now. Both being tower REITs, mean that both companies are rather insulated from the pandemic impact.

Both AMT and CCI posted good earning results in Q3. AMT beat on both FFO and revenue. Revenue was a 3.1% increase year over year. Not bad for what has turned out to be quite a volatile year. For CCI, they missed on revenue but it was still a slight increase from last year of 0.7%. They also beat on FFO. CCI also boosted their dividend by 10.8% since we last touched on the company.

For RQI, we also see that SBA Communications (SBAC) has made an appearance in the top ten list. This is another tower REIT company, though it doesn't appear to get as much attention as the other two, much larger, tower REITs. Though its share price has also been on a wild rally over the last few years along with the larger counterparts. Additionally, they have announced a Q3 where they also reported revenue growth year over year and AFFO growth.

Conclusion

RQI remains one of the top REIT funds for income on the market. Along with RNP, an investor can get solid exposure to some of the 'growthier' areas of the REIT market - at the same time taking advantage of the income that the CEF structure can give. RQI does have the majority of its exposure to equities, but preferreds do represent 11% of their portfolio as well. So it isn't solely equity positions - but one should anticipate more volatility from RQI than in RNP.

At this time, RQI is also still at an attractive entry price. The discount has contracted quite steeply over the last month. REIT exposure is still attractive overall. Additionally, due to how the RO worked out - it would appear that little disruption should come from the volatility of this year. In fact, they were able to increase leverage at a time when others had to decrease. That puts them on much firmer footing as they were able to take advantage of the lows. Of course, leverage comes with its own downside too, that an investor needs to be comfortable with.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

Disclosure: I am/we are long RQI, RNP. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article was first published to members of the CEF/ETF Income Laboratory on November 16th, 2020.