South State Corporation: Earnings Growth Outlook Appears Priced In

The merger with CenterState Bank in the mid of this year will increase average earning assets in 2021 compared to 2020. Slow recovery from the pandemic will limit loan growth.

Cost savings from branch consolidation and system conversion will support earnings next year.

The margin will likely contract as fixed-rate loans mature and are replaced by lower-yielding assets.

The prospect of earnings growth appears priced-in as the target price for next year is already quite close to the current market price.

Earnings of South State Corporation (NASDAQ:SSB) will likely improve in the coming quarters due to higher average loan balances following the merger with CenterState Bank. Further, SSB's branch consolidation plans and the conversion of CenterState Bank's systems will drive earnings next year. On the other hand, the margin will likely decline as fixed-rate loans mature, which will limit the earnings growth. Overall, I'm expecting SSB to report earnings of around $5.68 per share in 2021. The June 2021 target price is quite close to the current market price, and the dividend yield is quite low, which makes the stock quite unattractive. Based on the price upside and the dividend yield, I'm adopting a neutral rating on SSB.

Maturing Fixed-Rate Loans to Drag the Margin

SSB's net interest margin ("NIM") declined by 2 basis points in the third quarter on a linked-quarter basis to 3.21%. The NIM will likely continue to decline in the coming quarters because fixed-rate loans will mature and get replaced by lower-yielding loans. As mentioned in the third quarter's conference call, around 55% of total loans were based on fixed rates at the end of the last quarter.

On the other hand, the upcoming maturity of certificates of deposits ("CD") will ease the pressure on NIM. As mentioned in the conference call, around 19% of total CDs will mature in the fourth quarter of 2020, 32% will mature in the first half of 2021, and 26% will mature in the second half of 2021. Altogether, 77% of CDs, or 10% of total deposits, will mature through the end of next year.

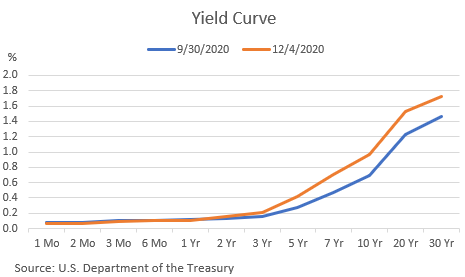

Further, the deployment of excess liquidity into higher-yielding securities will ease the pressure on NIM. According to management's estimates disclosed in the conference call, excess liquidity caused 24 basis points of NIM contraction in the third quarter. At the end of September, SSB had $4.4 billion in cash and cash equivalents as opposed to $3.7 billion in securities. The management hopes to increase investment securities to $4 billion by year-end. Considering that the yield curve has recently steepened compared to the end of the last quarter, the deployment of excess liquidity in the long end of the yield curve will help the NIM going forward. The following chart shows data from the U.S. Treasury Department.

Considering the factors mentioned above, I'm expecting the NIM to decline by 3 basis points in the third quarter. For 2021, I'm expecting the average NIM to be 10 basis points below the average for 2020.

Slow Recovery from the Pandemic to Hurt Commercial Loan Demand

SSB's merger with CenterState Bank Corporation will result in a higher average loan balance next year compared to 2020. The merger with CenterState Bank led to loan growth of 121% quarter over quarter in the second quarter, after which loans declined by 1.1% in the third quarter of 2020. Loans will likely continue to decline in the fourth quarter before recovering next year. The recent worsening of the COVID-19 pandemic will hurt the demand for SSB's target areas, i.e. commercial real estate and commercial and industrial loans.

However, the loan decline will likely be lower in the fourth quarter compared to the third quarter because SSB's loan pipeline has recently improved. The management mentioned in the conference call that the pipeline bottomed at $2.4 billion in August, down from $3.4 billion before the pandemic. The pipeline recovered to $3 billion at the time of the conference call, which was still below the pre-pandemic level. As the commercial loan pipeline is of 90 days, the pipeline will affect loan balance in the fourth quarter of 2020 and the first quarter of 2021. Overall, I'm expecting loans to decline by around 1.0% in the fourth quarter of 2020 on a linked-quarter basis.

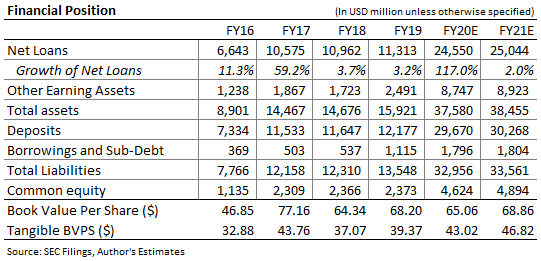

The recovery from the pandemic will likely be slow next year. According to news reports, an expert believes that the COVID-19 vaccine is likely to be in a rationing type of environment well into the spring of next year. As a result, the demand for commercial loans will likely remain low. I'm expecting loans to grow at a low rate of 2.0% in 2021 from the end of 2020. However, the average loan balance will likely be 16% higher in 2021 compared to 2020 because of the CenterState merger. The following table shows my estimates for loans and other balance sheet items.

Branch Consolidation and Merger Synergies to Support Earnings

As mentioned in the third quarter's investor presentation, SSB has around $102.5 million worth of merger-related expenses remaining to incur following its merger with Center State Bank. The merger-related expenses will likely keep non-interest expenses elevated in the coming quarters. However, the management expects to realize some cost savings from the conversion of CenterState Bank's systems in the second quarter of 2021, as mentioned in the conference call.

Additionally, the management plans to cut costs by downsizing its branch network. SSB plans to close 20 branches in the fourth quarter of 2020, which will take its total branches to 285 from the current number of 305. I'm not worried that the branch consolidation will hurt deposits because of the increased digital adoption by bank customers in the country amid the COVID-19 pandemic.

The management mentioned in the conference call that it expects $80 million of cost savings through the merger and branch consolidation. The company has already achieved 12-13% of the $80 million cost savings in the previous quarter. Considering the factors mentioned above, I'm expecting non-interest expense to decline sequentially in the coming quarters, leading to an efficiency ratio of 62.0% in 2021, down from 62.5% in 2019, and an average efficiency ratio of 65.1% from 2015 to 2018.

Expecting Earnings to Increase to $5.68 per Share in 2021

The expected NIM compression will suppress earnings growth next year. On the other hand, the growth in the average loan balance and expense savings will drive the bottom line. Additionally, SSB plans to close the acquisition of Duncan-Williams, Inc., a broker-dealer, in the first quarter of 2021, according to a press release. Duncan-Williams reported revenue of $27 million in 2019, as mentioned in the conference call. Consequently, the acquisition will have a material impact on SSB's non-interest income next year.

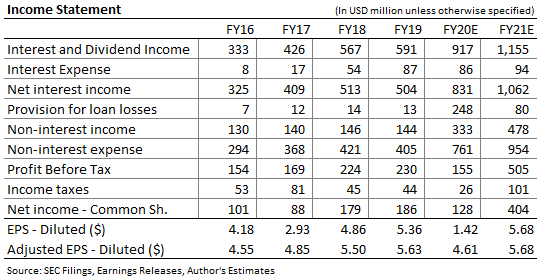

Considering the factors mentioned above, I'm expecting SSB to report earnings of $5.68 per share in 2021. For full-year 2020, I'm expecting SSB to report earnings of $4.61 per share on an adjusted basis. The following table shows my income statement estimates.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to the COVID-19 pandemic. SSB's risk level is currently moderately high because of exposure to the lodging industry, which made up 4.2% of total loans at the end of the last quarter, as mentioned in the presentation. Additionally, restaurants made up 2.2% and retail commercial real estate made up 9.5% of total loans. On the plus side, overall loans with deferrals made up just 2% of total loans at the end of the last quarter, as mentioned in the conference call.

Limited Price Upside Justifies a Neutral Rating

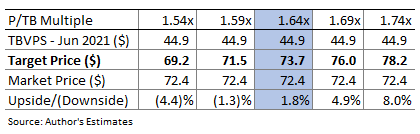

I'm using the historical price-to-tangible book multiple ("P/TB") to value SSB. The stock traded at an average P/TB ratio of 1.64 in 2019 and the first nine months of 2020. Multiplying this P/TB multiple with the forecast tangible book value per share of $44.9 gives a target price of $73.7 for the mid of next year. This price target implies a 1.8% upside from the December 4 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

SSB is also offering a low dividend yield of 2.6%, assuming the company maintains its quarterly dividend at the current level of $0.47 per share. There is little threat of a dividend cut because the earnings and dividend estimates suggest a payout ratio of just 33% for 2021.

Based on the low price upside, unattractive dividend yield, and moderately high risk level, I'm adopting a neutral rating on SSB. The company is on track for earnings growth; however, it is currently trading at a price that I believe makes the stock unattractive for investment.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: This article is not financial advice. Investors are expected to consider their investment objectives and constraints before investing in the stock(s) mentioned in the article.