XPeng Could Hit The Half-Million-Deliveries-A-Year Mark By December 2021

November deliveries came in strong, but an already-elevated stock was due for a correction.

The delivery figures helped stem market cap losses and reverse momentum.

Extrapolating from delivery growth from July through Nov. 2020, we could see XPeng breach the 500,000-deliveries-a-year mark by Dec. 2021.

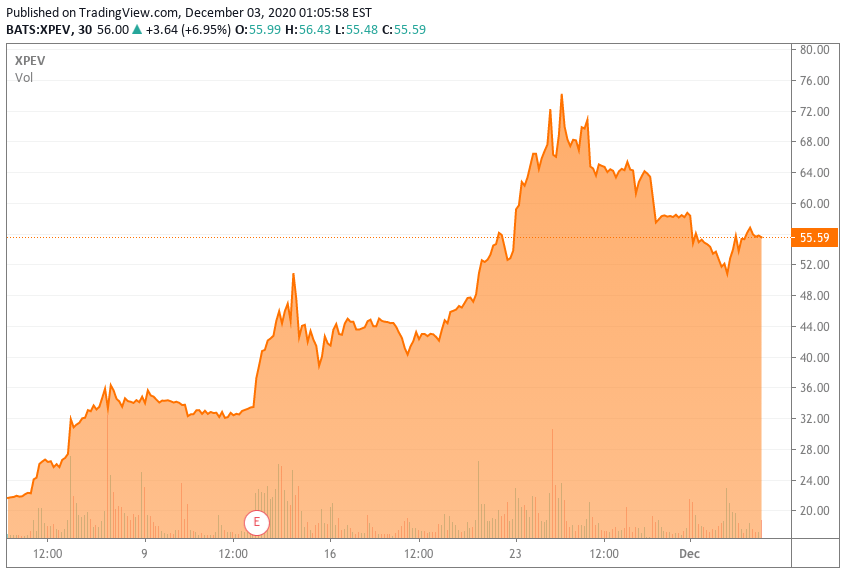

XPeng, Inc. (NYSE:XPEV) has released November delivery figures that show sustained growth through the fourth quarter, but the market didn't react like you'd have expected it to, especially considering the kind of momentum the stock has seen over the past month. To give you some context around this article, I point to my previous piece at the beginning of November. When I submitted the article for publication on Nov. 3, the price was $22.21; by the time it was published on Nov. 6, the stock had already hit $35.43. With a very short amount of time, it rallied hard to nearly $75, but has now settled at around $55 as of this writing.

Source: Seeking Alpha

The sudden surge to $34 and then $50 after the Q3 earnings announcement and subsequently to near $75 speaks to the eagerness of U.S. investors to get in on the China EV game. However, as the crowd moved to invest quickly, it pushed the stock to abnormal levels, forcing a correction, hence the pullback to $50. The stock has since regained some upward momentum.

Thesis: The strong momentum we're currently seeing is likely to crush Q4 guidance of 10,000 deliveries. It should be a lot closer to the 13,300 to 14,400 range, which is great news for anyone investing at the current price.

When I wrote the first article, I believed the stock was undervalued compared to its peers. That was at $22. Today, I look at the risk vs. reward implications for investors looking to get in at the current price, and all I see is strong upside potential.

November Deliveries

To bring you up to speed on developments at XPeng, the latest delivery report shows 4,224 deliveries for November 2020, a 342% increase over the year-ago period. On a YTD basis, the number increased by 87% to 21,341.

While the numbers certainly look impressive and seem to validate the market's confidence, it needs to be seen in perspective. Keep in mind that 2019 was pretty much a down year for the EV market in China after a chunk of subsidies were phased out. Against that backdrop, a 350% YoY increase is not as high as it seems. Nevertheless, it helped arrest the price correction that would have otherwise taken the stock down below $50.

That's an interesting dynamic in itself, and worth going into a little deeper.

The China Stocks Problem

The assumption here is that expectations are very high for Chinese EV companies despite the looming threat of delisting for them and their peers on U.S. exchanges. The latest on that is that Congress unanimously approved legislation yesterday (December 2) to ban Chinese companies from being listed on U.S. bourses if they don't comply with auditing norms within a three-year period.

This puts the decision on the President's shoulders - or his desk, to be precise. If signed into law, it could spell trouble for Chinese companies listed in the U.S.

On the other hand, a "middle-ground" proposal is being put together and will be issued for public comment this month by the SEC. The proposal reportedly shifts oversight responsibility from the PCAOB (Public Company Accounting Oversight Board) to the exchanges themselves; specifically, it will mandate the NYSE and NASDAQ to "require compliance with audit inspections" for new Chinese companies looking to be listed.

For existing companies, there will be a three-year period during which they will be required to comply with the regulatory requirements.

For now, the market is acting like there's no ban planned for the future, but it's a risk that must be kept under consideration until a resolution is reached. On the one hand, it could give the incumbent president a reentry path to the White House in 2024 because he'd be taking a strong stand on a unanimous bipartisan issue as he exits office; on the other, it will make the incoming president's work of resolving the U.S.-China trade imbalance and related issues even harder than they already are.

For the companies themselves, the escape hatch is to list themselves on non-U.S. exchanges that still allow American investors to hold the stock. That's one plausible reason the market isn't reacting to regulatory moves the way one would expect it to.

Looking Ahead

Where does XPeng stand as an investment vehicle for U.S. investors? I covered the positives in my last article so I won't repeat everything here. However, there are certain things I'd like to reiterate.

Q3-20 deliveries stood at 8,578 vehicles when the figures were reported, translating to a 266% increase over the prior period. This was a result of near-consistent strong sequential growth since July 2020, when the company delivered 1,641 P7s. This was followed by August deliveries of 2,655 vehicles, September deliveries totaling 3,478, then 3,040 for October, and now 4,224 for November. Tabulated, it looks like this:

Source: Data from Company Reports

From the data above, we arrive at an average month-over-month sequential growth rate of about 30%. Using that to project Q4 deliveries, we arrive at a figure of approximately 14,400, which would represent a sequential increase of about 68%. The company initially guided much lower - at 10,000 deliveries for Q4 - in its Q3-20 report. However, I believe that's extremely conservative considering that 7,264 deliveries have already been made for Q4-to-date. Using the same 30% assumption for month-over-month growth in deliveries, December deliveries should come in at about 6,100 units for a total quarterly figure of 13,364, which is a lot closer to the initial projection of 14,400 than the company's guidance.

Using the 2019 total G3 deliveries figure of 16,608 units and assuming a December total deliveries figure of roughly 6,000 cars, we could be looking at a 65% YoY growth rate in deliveries between 2019 and 2020.

If the 30% sequential month-over-month growth rate holds through 2021, we could see XPeng breeze past the 500,000-deliveries-a-year mark by the end of Q4-21. Given the strong November delivery numbers, I believe that's a reasonable estimate. If that estimate is anywhere close to accurate, it would mean hitting the 100,000-deliveries-a-month level by November 2021.

Investor's Angle

The financials are rock-solid and margins (gross and vehicle) were in positive territory for Q3. I expect even better numbers in Q4, although there will be some drag from R&D as well as marketing expenditure toward the new model expected to launch in 2021.

I realize my 30% assumption is a little optimistic, but it is more than justified by the moves the company is making to expand its production and its portfolio over the next several years, as I outlined in my previous article. I don't see that figure as being unsustainable.

Nevertheless, for the sake of argument, even if we use a very conservative 20% month-over-month growth rate for deliveries, we're still going to see XPeng breach the 200,000-deliveries-a-year mark by the end of 2021. It's a smaller upside, but an upside nonetheless. Even at that level, we should see the economies of scale kicking in and a chance at sustainable profitability.

Source: XPeng

One particular move I like is that the company's strategy involves using limited-edition models to offset the lower margins for mass-market models. A case in point is the P7 Wing that the company showcased last month at the 2020 Auto Guangzhou event.

This is a financially well-managed company with a sound growth strategy and a proven track record. Seen from that perspective, I believe the stock is still a solid buy at the current price of $56.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.