Brigham Minerals: Improving With Oil Prices, But Dilution Still On The Table

The recovery in oil prices has helped propel Brigham Minerals off its summer lows.

Management has led the company through the downtown in very good condition and is now executing its plans to expand aggressively.

The combination of taking on debt and eventually raising new equity to fund this expansion is potential future pressure on valuation.

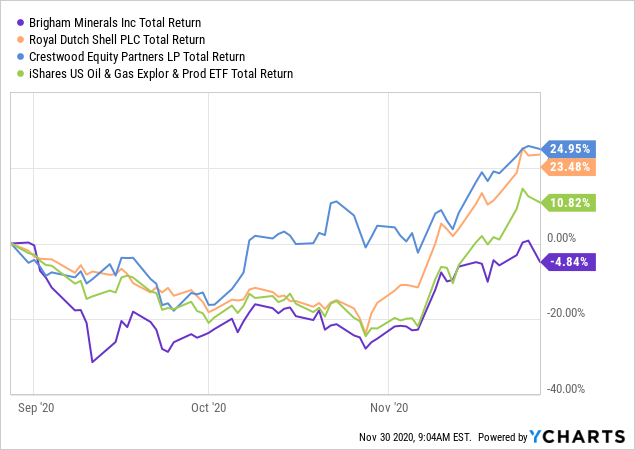

One of the pleasant surprises in my portfolio since August has been the speed of recovery and improved valuations in my oil and gas-related investments. Besides Royal Dutch Shell (RDS.B), which needs no introduction as a super major, I also have smaller interests in the preferred shares of Crestwood Equity Partners (CEQP.PR) as a midstream position, and also in Brigham Minerals (MNRL), which is in the business of managing oil and gas rights for royalties.

Data by YCharts

Data by YCharts

My previous article on Brigham came out on September 14, published just as it was hitting its summer lows and, since then, has seen a dramatic 30% return along with a steep increase in the other energy names in my portfolio as well. Though I was neutral at the time on concerns over the potential of issuing new equity to fund its expansion, clearly, it has so far exceeded expectations without yet selling new shares. This remains a double-edged sword, however, as management clearly still intends to expand, picking up rights over the coming quarters and is planning to use its equity value and some modest debt to fund it.

Understanding The Attraction of Mineral Rights

As a broad investment category, I find there is a lot to like about acquiring and managing mineral rights (in this case, specifically oil and gas rights), particularly from an income standpoint. The companies that buy up the rights own something of value in the eyes of exploration and production companies, who in turn pay both a lease bonus and subsequent royalties on any oil and gas production taken of the acreage leased from the owners. Seeking Alpha contributor Randall Connally has written an excellent overview of the most prominent players, including a thorough comparison of debt levels and debt types. His article will provide very helpful context to anyone not already familiar with the royalty business model.

For some brief context, however, part of the appeal is that Brigham Minerals and its peers bear no direct risk in the sense of the costs of developing sites for production, but rather risk the boom and bust cycle of oil prices upon to which their royalty payments are effectively tied. In a downcycle, if a mineral rights owner is carrying too much debt, the story can have the same ending as the E&P companies, with bankruptcy and reorganization. Blake Williams, Brigham's CFO, even mentioned on the last earnings call that "the only way to screw up a good mineral story is to over lever it. So, that's kind of top of mind for us as we make sure that's always in check."

The good news for investors, on the one hand, is that there is virtually little in the way of traditional capital spending involved, and cash can be returned to shareholders at a fairly high rate relative to the total free cash flow generated. That is far from the only option, of course, as the cash can be used to add new acreage, buy back shares, or otherwise make changes to the capital structure. Traditionally, however, the appeal of the royalty companies has been the high yields.

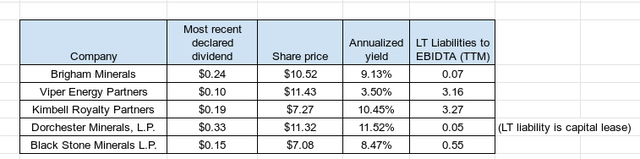

(Image source: author's spreadsheet; data sourced from Seeking Alpha and Google Finance midday 11/30/20)

There is one note, or caveat, to make about the yields here. These companies do not necessarily have a track record of setting a fixed dividend payment that they then maintain for four consecutive quarters and then evaluate for raising or lowering, but dividends can and do change multiple times within the same year based on the company's cash needs at the time, or at least they have during the craziness of 2020. The yields as listed above make an assumption that the most recent declared dividend would be held steady over four quarters, which, in practice, has not been the case. That being said, I still believe it is fair to characterize these as being a "high yield" category of investment.

Is Brigham Best of Breed?

Clearly, these are yielding at the high end, with Viper Energy Partners (VNOM) being the exception, primarily due to the oil market pressures and its relationship as a sort of dropdown company for Diamondback Energy (FANG), which has had its own share of struggles and operates the majority of Viper's acreage. There are those who see Viper as an excellent comeback story, which could pan out beautifully, but it is not the risk profile I am personally looking for. Nevertheless, the linked article from Seeking Alpha's Rida Morwa definitely lays out a thoughtful case for going long Viper now, possibly buying at what could be near the bottom of both yield and value.

As I look at the chart and consider the pros and cons, I definitely come away not thrilled with Viper - the risk of being so deeply tied to one operator, the current low yield, and high leverage ratio are not appealing, even though they intend to de-leverage and possible raise the distribution as conditions improve. Likewise, the leverage with Kimbell (KRP) is concerning, and it does not currently have large scale. As judged on EBITDA, Kimbell generated $51.9 million over the last 12 months, the second smallest on the list. Scale is a similar concern with Dorchester (DMLP), whose EBITDA was $40.8 million, the smallest of all, even though it appears well managed with no real long-term debt. For me, that leaves Black Stone Minerals (BSM) and Brigham as the most appealing options.

I think either one would be a good choice overall - both offer solid income and a low debt profile. Mr. Connally, whose article was referenced earlier, favors Black Stone (although he sees good reasons to like almost all of them). In my view, I like Brigham, although I am not yet adding to my position.

Brigham in Brief

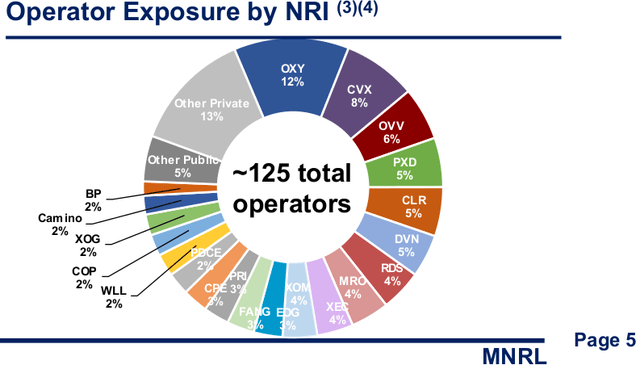

Brigham Minerals entered 2020 without any debt and on the lookout for acquiring more rights. As with the rest of the industry, COVID-19 and global oil shocks sent its value plummeting as the operators stopped running their rigs and pulled back sharply on production, with some operators going under and others combining for more scale in the meantime. Brigham is well diversified in terms of the operators it is working with - as of the end of the third quarter, only Occidental (NYSE:OXY) represented more than 10% of net royalty income, five operators have between 5% and 8%, and more than a dozen more between 2% and 4%.

(Image Source)

For the third quarter, revenue picked up sequentially from $12.5 to $21.6 million, as rigs came back online in several areas and the royalties started flowing again, which is reflected in the dividend getting a nice bump to $0.24 payable this month, up from the previous quarter's $0.14.

However, going forward, the plan set forth by management is to reduce the percentage of overall cash available for distributions back to shareholders, from 95% - 100%, down to 75% or 80%, and redirecting the difference to help fund buying up more rights. In addition to using internally generated cash, Brigham's leadership is quite open about plans to be aggressive at what they believe is a trough in the oil cycle and, therefore, put that clean balance sheet to work. While ending the 3rd quarter with very little debt - $5 million - the plan remains to opportunistically borrow and raise equity in order to bulk up on acreage rights owned.

In terms of debt, there is up to $135 million in borrowing available to the company (actually more was offered, but the company has wisely elected to limit its credit line to this). For comparison's sake, even if Brigham nearly maxes out its available credit - say it borrows $125 million - its debt to EBITDA from the last year would be about 1.7, and obviously, one would expect EBITDA to start going up relatively soon with so much more acreage available to draw from. In other words, even if EBITDA did not go up at all, the leverage figures would not be that bad, and that is including a quarter of EBITDA in Q2 that was truly awful and hopefully not experienced again.

During the third quarter of 2020, Brigham spent $16.2 million on new rights focused in Loving County, Texas, in the heart of the Permian's Delaware Basin. As of November 6, the date of the earnings call, another $17 million in deals for new rights was already underway for the 4th quarter, clearly indicating they are proceeding exactly as they said they were planning to do. With new rights, in theory, will come more volume of production in the years ahead, more lease bonuses, and greater royalties as the sites come under contract and development. Clearly, Brigham thinks the future looks bright enough and the pricing on the rights it wants to own to be attractive enough now to make this expansion a priority.

While I share that sentiment, to me, there remains the "known unknown" that eventually current shareholders will be diluted in pursuit of this expansion. That was known back in September as well, and yet the shares have surged nicely, even if hanging back a little from some of the other oil names in recovery.

Concluding Thoughts

As nobody can predict the timing of when Brigham will decide the company's value (or other factors) will make it appropriate to convert to more equity, I've personally elected to stay on the sidelines until I see more specifically what the plans are for both debt and new capital. While I think management has aligned its interests with those of shareholders and professes to be very aware of the dangers of over-levering, I am content personally to collect my existing dividends and just reinvest those back into my position. The Brigham of 2021 plans to be a bigger player in this space, but the proverbial pipers will need to be paid eventually, and neither the balance sheet nor the share count will be quite as neat and tidy as they are today. By waiting, it could be a better time to evaluate whether Brigham is a reasonable choice for either adding, growing or disposing of from one's portfolio. While I am overall bullish on the company, and am long a small position, I am staying neutral on the shares for now.

Disclosure: I am/we are long MNRL, RDS.B, CEQP.PR. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.