Reliance Steel & Aluminum: A Value Creation Business

RS serves several high-quality growth industries which are poised to continue growth.

RS, as a company, has a proven history of profit generation even in difficult conditions.

Even the depressed sectors are poised to return to better levels in 2021 as the effects of the pandemic wear off.

Then, there are several possible catalysts that can jumpstart profits beyond expectations.

Reliance Steel & Aluminum (NYSE:RS) is the type of manufacturer that makes for a great long-term hold. The company is positioned in several great categories that will allow it to take advantage of several macroeconomic trends and lead to further growth. This company has proven over the past years and through the pandemic that it is top of class in regard to its ability to create steady profits and increase cash flows. Reliance Steel & Aluminum has some headwinds, however: its energy and aerospace businesses have both been put in a position to underperform due to the pandemic, but these could become catalysts as 2021 unfolds. There are some somewhat lower likelihood events that could jumpstart growth through 2021 even faster. All information from this article is from the company's SEC filings and investors presentations which can be found here.

Diversified Exposure to High Quality Industries

Several of Reliance Steel & Aluminum's customers are in industries that are prospering, even throughout the pandemic. RS sells to automotive customers, primarily light truck and SUV frames. Given historically low gas prices and consumer desires to avoid public transit, this trend is likely to continue into the future. Infrastructure is another sector that RS sells into, and it continues to be resilient. They also sell to the right types of construction for this economy: buildings such as data centers, assisted living centers, and residential construction use RS's products. Reliance Steel & Aluminum also sells to the semiconductor industry, which is in expansion due to increasing demand for semiconductors.

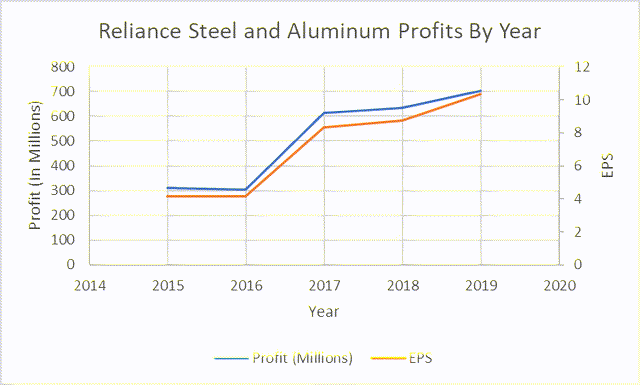

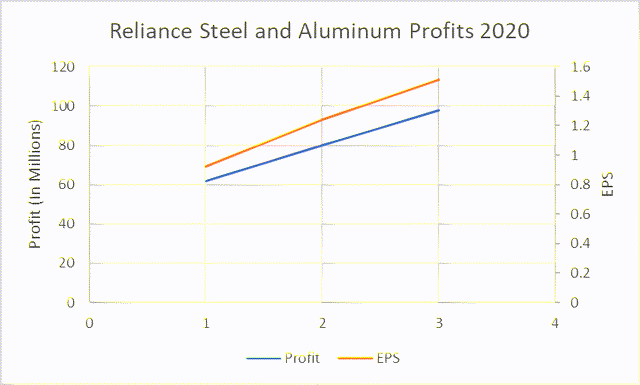

Dependable Profit Generation

One of the most impressive things about Reliance Steel & Aluminum is its consistent ability to create profits. As can be seen from the charts below, RS does a good job creating profits, even in difficult environments. In 2015 and 2016, when several industrials were suffering from a manufacturing recession, RS still maintained significant free cash flow, coming out with larger revenues and profits in 2017, 2018, and 2019. When looking at this year, when companies across the entire economy struggled, RS was still able to profit. This shows just how resilient the business is regardless of economic conditions.

The Opportunities Disguised as Headwinds

RS's energy and aerospace businesses have suffered throughout the year as these industries have faced headwinds. Only about half the aerospace business that RS had was commercial aviation-related, while the other half was defense-related. Pre-pandemic commercial aviation made up about 5% of RS's business, so it was not a terribly hard blow when demand dropped. However, going into 2021, as aerospace recovers, this should result in increased revenue and profits. The energy business has been adversely affected by less drilling from oil companies. Of course, if oil rebounds, this business should see improved conditions and result in increased revenues and profits. However, RS's energy business also includes a growing renewable segment which benefits from solar and wind installations. This energy segment will see long-term benefit regardless of whether oil makes a significant comeback or if renewables hit a large growth spurt.

Other Possible Positives

Most of the things I have outlined in this article are outcomes that have either already happened or are very likely to happen in the future. This section is about some other possible large windfalls for the company that are not necessarily guaranteed. The first big one is a large infrastructure bill in the United States; RS has already said they can increase production as needed. Therefore, a huge increase in demand for RS's products will just be extra revenue and products for the company. As to how much this could mean in revenue depends on the size and scope of the infrastructure bill. The other large windfall can come from M&A which the company is actively looking at due to its strong capital position. Moving forward, as to how many acquisitions the company is going to make is hard to say, but this is another area where large increases can occur in both revenues and profits. The last thing to point out is that to the large amount of cash the company has on hand, they can safely return significant sums of money back to shareholders. The company currently pays a dividend that yields around 2%, and there is no reason to think that they cannot push this higher, especially as we enter more certain times.

Possible Risks

The primary risk that I notice in regards to Reliance Steel & Aluminum has to do primarily with its valuation. The company trades with a PE of around 20, which is pretty high for a typical commodity metal business. However, after digging into the company, it became clear as to why this company is not valued as a typical metals business, and that is because it sells finished value-added products. When taking that correction into account, there still is not a lot of room for error at this price level. To buy RS now, an investor must believe that the company will continue to execute at the level it has previously into the future.

Conclusion

Reliance Steel & Aluminum is positioned for success as we go into 2021. Several of their core markets are booming and will result in increased income for the company. Even some of the more bearish parts of the business can come through this coming year with a large upside. There are a few less certain catalysts that could allow the company to grow revenues and profits at an even faster rate than expected. Reliance Steel & Aluminum is a great company, and for an investor who wants a great industrial, it is a buy.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.