As we thankfully say goodbye to 2020, it is time to choose healthcare insurance for 2021.

The subsidy is based on the family situation and income.

We look closely at one gold and one bronze plan and make a selection.

Photo of a sunset over Clearwater Beach, Florida from a tenth-floor outdoor hotel bar and grill.

As the sun sets on 2020 (thank goodness), it is time to select a health care plan for 2021.

Introduction

A big factor in early retirement, and discussion point in my articles, is health care costs. Thus far in my monthly updates, I have not been accounting for the health care insurance premiums. The reason for this is that we have been getting insurance through Mrs. Graybeard’s employer. The effect is that it just makes the income appear lower. I was fine with this earlier this year as we anticipated the income would end and we would start with COBRA and I could begin reporting that cost. Now it looks like they will continue to need her assistance well into next year and perhaps beyond.

While this unanticipated situation is good for us, I want the Motorhome Retirement monthly updates to present a realistic picture of the cost to retire early on one’s existing assets and investments. In light of this, I have decided to change how I report income and health insurance costs in the Motorhome Retirement monthly updates. Income and benefits from Mrs. Graybeard’s unexpected employment will be excluded and I will account for health care and health care insurance costs as if we did not have the income and had to buy insurance on the ACA Healthcare Exchange. In this article, I will review plans on the exchange and select one to report throughout 2021.

Estimating subsidies and viewing plans

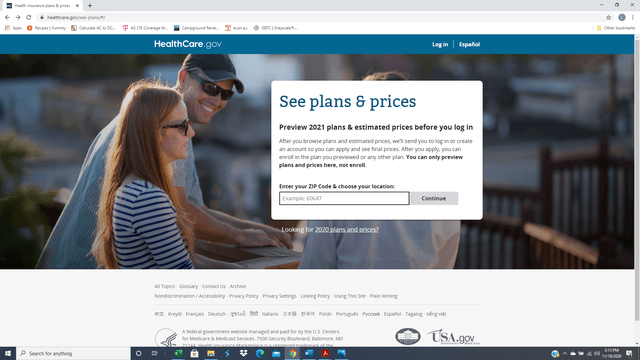

At the ACA website, there is a way to view plans and estimate premiums without enrolling in a plan.

Source: ACA Website

Source: ACA Website

This is the function I used to access the plans that are available to us in our selected domicile location. Once the zip code is entered, the website then asks a number of questions about your household in order to determine your eligibility and potential subsidy before showing the plans. A summary table of the questions is below.

Graybeard | Mrs. Graybeard | |

Zip Code | 33513 | 33513 |

Age | 55 | 55 |

Gender | Male | Female |

Eligible for other insurance(1) | No | No |

Parent(2) | No | No |

Pregnant | No | No |

Tobacco | No | No |

Household income | $60,000 | |

Notes: (1) If you are eligible for other health insurance, you are generally not eligible for the ACA subsidy. The full question asked is: “Eligible for health coverage through a job, Medicare, Medicaid or CHIP.”

(2) The full question is: “Legal parent or guardian of a child under 19 (claimed as a tax dependent).”

Remember, we are not eligible for the ACA health insurance subsidies due to Mrs. Graybeard’s employment coverage. However, we had to answer that question negatively to find the estimated subsidy and view the plans. This is not the enrollment process; this function is provided by the website so that folks can view plans before deciding to enroll.

The website then estimated that we would be eligible for a subsidy of $947 per month based on my input of an income of $60,000.

What if the income is different than projected?

The subsidy amount is based on an estimate of 2021 income. What happens if the estimate is not accurate? There is a “true-up” on the income tax filing for 2021 income based on the actual modified adjusted gross income (MAGI). To calculate MAGI, the ACA starts with the standard Adjusted Gross Income (AGI) on the tax form and adds certain tax-exempt income such as tax-exempt interest, tax-exempt foreign income and tax-exempt social security income. In our case, MAGI will be essentially the same as the AGI. The ACA website explains it here.

To make the true up at the end of the year, I need to know the subsidies for different amounts of income. There is a way to calculate them, but I just quired the website several times to get the amounts. The following table lists the monthly subsidy for different income amounts.

Income | Subsidy | Income | Subsidy |

$50,000 | $1,041 | $63,000 | $922 |

$51,000 | $1,026 | $64,000 | $914 |

$52,000 | $1,012 | $65,000 | $906 |

$53,000 | $1,004 | $66,000 | $897 |

$54,000 | $996 | $67,000 | $889 |

$55,000 | $987 | $68,000 | $881 |

$56,000 | $979 | $68,500 | $877 |

$57,000 | $971 | $68,600 | $876 |

$58,000 | $963 | $68,700 | $875 |

$59,000 | $955 | $68,800 | $874 |

$60,000 | $947 | $68,900 | $874 |

$61,000 | $938 | $68,960 | $873 |

$62,000 | $930 | $68,961 | $0 |

At tax time next year, I will reconcile the difference on the taxes owed for the year. The annual tax bill will be increased or decreased by the difference in the annual amount estimated subsidy and actual subsidy.

The Plans

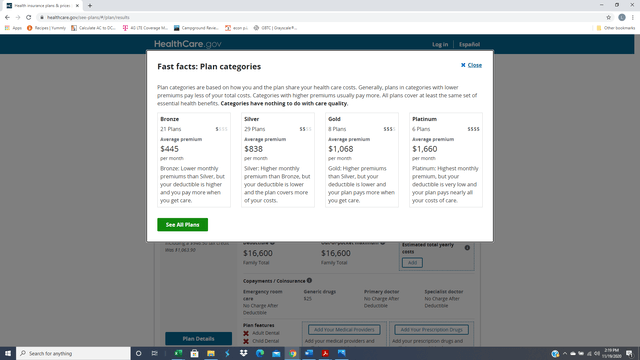

After all the family information and income estimate is entered, the website showed the available plans. There are 64 plans for our selected area, 21 bronze, 29 silver, 8 gold, & 6 platinum.

source: healthcare.gov

source: healthcare.gov

There are a lot of plans to choose from, however there are only two providers, Blue Cross Blue Shield (BCBS) and Ambetter. Because we move around the country, we need a plan with a national provider network. The BCBS plans had that, Ambetter plans did not.

The selection process can get very involved depending on one’s situation. Not only do plans have different premiums, deductibles and out of pocket maximums, they also have different payment schemes for prescriptions, doctor visits, labs, imaging, and hospital services. Lower premium plans tend to have high deductibles and out of pocket maximums and do not start paying until the deductible is met. While higher premium plans generally have copays and smaller, albeit still significant, deductibles and out of pocket maximums. There are a lot of hybrid plans that fall somewhere on the spectrum between the two extremes. I don’t want to make a book out of this exercise so I will look at two plans on opposite ends as one of those is most appropriate for our circumstance and most relevant for a general discussion such as this.

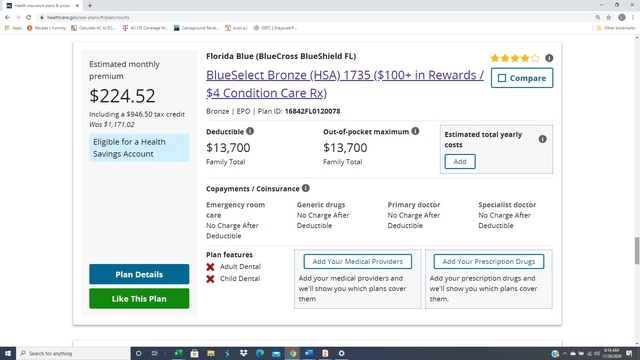

First the lower premium plan. It is a so-called bronze plan. With the estimated subsidy, the premium would be $225 per month. The out of pocket and deductible are the same at $13,700. This plan does not pay anything until the deductible is met. At that point, it pays 100% of in-network eligible medical cost.

source: healthcare.gov

source: healthcare.gov

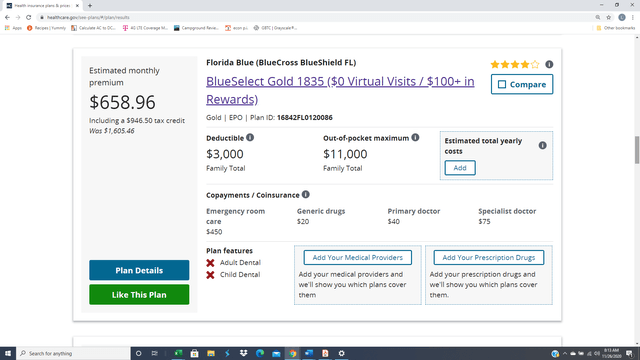

The second plan is a gold plan. The premium after the subsidy is $659 per month. The deductible is $3,000 and the out of pocket maximum is $11,000. It has copays for nearly every category of service, so it pays right from the beginning, even before the deductible is met.

source: healthcare.gov

source: healthcare.gov

The table below summarizes the two plans side-by-side.

Plan | 1735 Bronze | 1835 Gold |

Monthly Premium after subsidy | $225 | $659 |

Deductible | $6,850 | $1,500 |

Family Ded | $13,700 | $3,000 |

OOP max | $6,850 | $5,500 |

Family OOP | $13,700 | $11,000 |

PCP visit | No charge after deductible | $40 |

Specialist | No charge after deductible | $75 |

Imaging | No charge after deductible | $175 |

Labs | No charge after deductible | $20 |

Generic | No charge after deductible | $20 |

Brand – preferred | No charge after deductible | $65 |

Brand - non preferred | No charge after deductible | 50% coinsurance after deductible |

Rx deductible | Included | $0 |

ER | No charge after deductible | $450 |

Inpatient doctor and surgical services | No charge after deductible | No Charge |

Hospital Stay | No charge after deductible | 20% coinsurance after deductible |

The decision

With our medical situation, it is a really a toss up between the two plans. If neither of us has a hospital stay then likely the gold plan works better, however the bronze plan is better if a hospitalization happens. This is because the annual difference in the premium is $5,200 and the out of pocket maximum for the bronze plan is “only” $2,700 more than the gold plan. If we don’t have a hospitalization, it is likely that the gold plan would save us about $3,000. I am going to be optimistic about 2021 and go with the gold plan and try to save a little.

Going forward

Beginning with the January update, I will be reporting medical expenses as if we had the gold plan. I believe this will provide a better representation than our actual of what one would face in early retirement if they didn’t have the employer benefits we have that we did not expect.

I can only post a few photos to articles. To enjoy more photos of our travels, you can visit and follow my new Instagram, motorhome_retirement.

If you enjoyed this article and wish to receive updates on our latest research, click "Follow" next to GrayBeard Retirement at the top of this article.

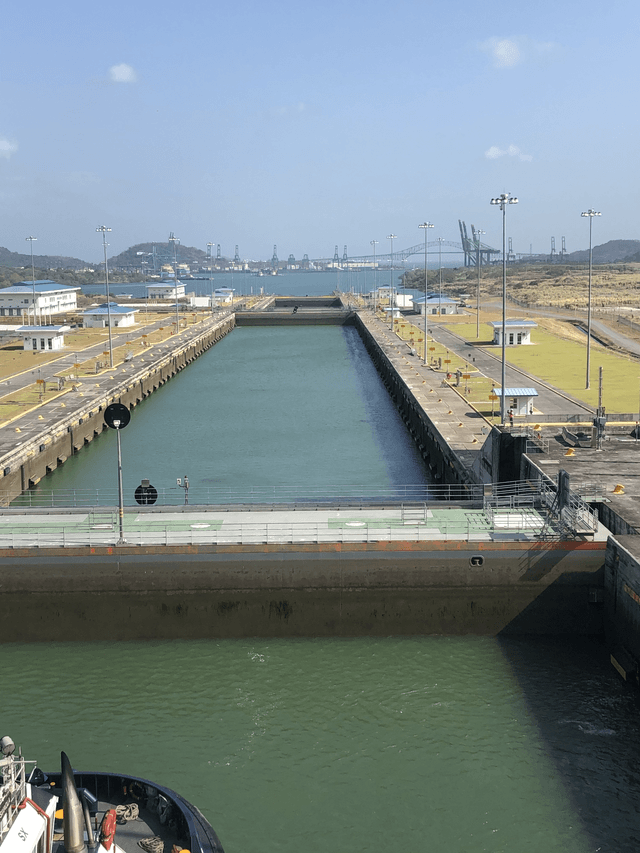

The photo below is from just before we retired. I hope you find it interesting. It is from our trip in February of this year to cruise the Panama Canal. Cruise ships were essentially shut down due to the pandemic about a week after we disembarked in Los Angeles. Here we are entering the first of three locks on the Pacific side of the Panama Canal heading out to the ocean.

.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.